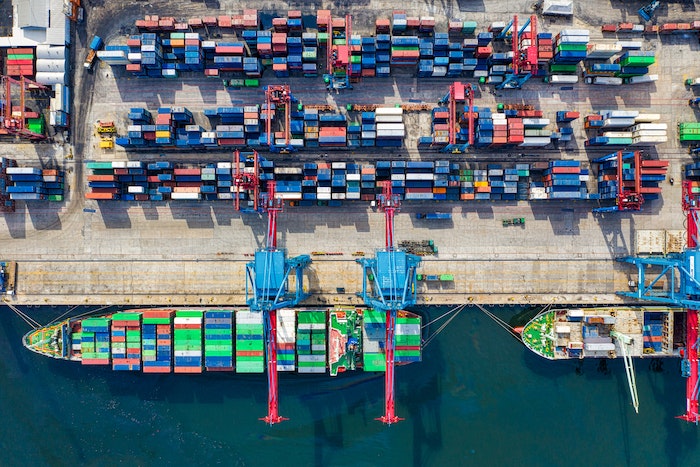

While 2023 saw long-anticipated improvements in the global supply chain, many companies are still experiencing major disruptions in their operation and distribution networks.

Financial executives can play an important role in mitigating supply chain risk. By working with supply chain teams, they can identify these risks and create a more resilient logistics network.

Gain End-to-End Visibility over Complex Systems

Despite the word “chain,” most supply lines are non-linear systems. The typical supply chain relies on a complex series of supply partners and logistics providers scattered around the globe.

Managing this network demands a digital-first approach. Finance executives and controllers can rely on digital tools to provide end-to-end visibility of the entire process. As a result, supply teams gain fast, accurate data about the state of the supply chain and can make decisions about alternative solutions.

And now that artificial intelligence is transforming the logistics industry, many companies can leverage AI-powered software to examine their systems and identify points of potential risk.

Leverage Data for Predictive Analysis

Many supply chain disruptions are out of your control. But you can leverage data to predict delays and disruptions. The most advanced software can even account for geopolitical data or weather patterns to anticipate supply disruptions.

For example, if you have a large shipment of inventory coming in from Asia but there is a major storm brewing in the Pacific Ocean, your software can alert you to potential delays.

By leveraging this sort of data, finance executives can pivot to alternative options and alert their own supply teams and customers to an expected delay.

Create New Supply Chain Models

Ongoing concerns about the supply chain have prompted many companies to adapt to new supply chain models to mitigate risk. Finance executives and CFOs can create alternative options to manage their supply chain to reduce their exposure to risk.

One common method is to simply diversify your supply chain. Finance executives can research alternative suppliers — ideally from different geographic locations — which can reduce the risk of sourcing inventory from any one vendor.

Controllers might also look into suppliers that rely on diverse transportation and material conveyance methods to further reduce risk. Similarly, financial leaders can negotiate for better contracts that protect businesses against losses caused by supply chain disruptions.

Forecast Future Inventory Needs

One of the best ways to manage supply chain risk is to anticipate inventory needs before they become urgent.

Finance executives and other managerial personnel will have unique access to sales records and other historical data. This allows companies to predict future inventory needs and order in advance to prevent bottlenecks from cyclical demand cycles.

Again, digital software can be valuable in analyzing historic sales trends. AI-powered tools can likewise identify sales cycles and optimize your procurement process to prevent excess inventory while also ensuring that you maintain stock of what you need.

Pursue the Right Contracts

Some suppliers offer contracts with risk mitigation strategies already in place. Financial executives and controllers can therefore play a role in finding vendors who offer surety of supply and price, which protects your company from disruptions and price volatility due to unforeseen events.

Other vendors and suppliers use just-in-time consumption models which minimize the need to maintain large quantities of inventory and make the supply chain process more efficient.

These contracts can provide greater security for the business itself, but the pricing controls also provide value for the customer. The right contract can protect businesses from price fluctuations, allowing consumers to enjoy stable, predictable prices.

Collaborate with Procurement Specialists

Finance executives can also work to develop partnerships with procurement specialists and inventory managers. Even though your company data may be digitized, these other professionals can provide insights that financial executives might not notice on their own.

By collaborating across departments, organizations can achieve greater efficiency and work together for a common objective. These interdepartmental collaborations also provide the opportunity for executive leaders to learn from those with “boots on the ground,” which can contribute to better leadership decisions by others in the C-suite.

Finance executives can encourage other collaborations as well. For instance, controllers and CFOs might work to build partnerships between procurement specialists and marketing teams. That way, your marketers can communicate with customers to mitigate dissatisfaction with shipping times or item availability caused by supply chain disruptions.

When Will the Supply Chain Improve?

By most reports, supply chain issues are becoming rarer. But this may actually reflect the ability of top companies to adapt to the instability of their global supply networks. And regardless of when or how the supply chain crisis resolves, businesses will still need to maintain agility to navigate their greatest challenges.

Finance executives will continue to play a part in creating a culture of collaboration and transparency so that companies can thrive regardless of external conditions.

Additional Resources

Disrupted or Resilient? Key Takeaways for Supply Chain Leaders

Cutting Costs Without Cutting Quality: Strategies for Corporate Accounting and Finance