We recently had experts from insightsoftware join us for an informative discussion on how to start exercising control over your planning to drive business growth. The webinar was titled Best Way to Plan for Growth During Market Volatility and featured Josh Schauer, Director of Finance at insightsoftware, and Tim Caudill, Director of Solutions Engineering at insightsoftware.

If you missed it, we have covered some of the top highlights below.

Top 2021 Finance Trends

What are the top challenges and areas to prioritize for the finance department in 2021? Josh shared some great insights from the 2021 Financial Trends Survey by Hanover Research including:

- 54% of organizations aren’t able to fully execute their financial planning and analysis responsibilities

- 49% of organizations aren’t able to execute key responsibilities due to manual and time-consuming processes

- 29% of organizations say they lack the resources needed to execute key responsibilities

- 21% of organizations say they can’t readily access required data

- 31% lack time to spend on analysis

- 28% have challenges adopting new technology

With the challenges outlined above, about 1/3 of financial decision-makers describe upcoming departmental priorities as balancing growth with profit, enabling flexible and timely decisions and increasing working capital. Also:

- 28% prioritize new budget and planning software

- 21% prioritize the automation of current responsibilities and tasks.

In order to exercise control over your budgeting and planning with this shift in priorities, it’s important to understand that spreadsheet-based planning processes will no longer cut it. According to the presenters:

Manual planning processes take too long and are difficult to control: missed opportunities to tighten costs or grow revenue – due to long cycle times.

Planning is fragmented and lacks transparency: business inefficiencies and manual data errors through fragmentation.

Lack flexibility for strategic analysis to model different scenarios: missed opportunities for strategic growth.

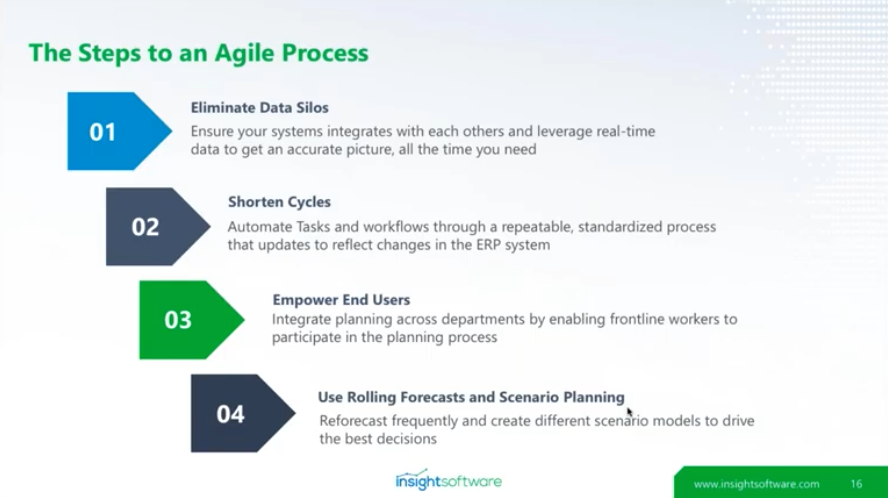

The Importance of an Agile, Continuous Approach

Agile forecasting is the ability to look at where your company stands in near real-time and also be able to predict where your company will be in 6, 12 or 24 months down the road. As a result, spreadsheet-based planning inhibits the ability to create an agile, continuous approach within your organization.

Being able to implement an effective agile approach means three things:

- Frequency and Direction: organizations need to reforecast profit and revenue often, while also be able to forecast a year ahead with confidence.

- Accuracy: to be able to drive the organization in the right direction, profit and revenue forecasts need to +/- 5% accurate.

- Adjustability: companies need to be able to make adjustment to their plan quickly and accurately when needed.

How LINX Implemented an Effective and Efficient Reporting and Forecasting Process

How can you put all this information into action?

The presenters shared an interesting case study covering how the London Internet Exchange (LINX) has been able to eliminate errors and inaccuracies in their reporting and forecasting processes, spend less time on manual budgeting tasks, and quickly analyze data from multiple systems.

Like many of the trends covered in the webinar, LINX was challenged with:

- Relying on homemade Excel static spreadsheets resulting in manual, error-prone budgeting, planning and reporting

- Difficult follow-up process

- A time-consuming consolidation process meant the finance team didn’t have the time to analyze the results

LINX started using Bizview for budgeting, financial reporting, as well as rolling two- and five-year forecasts as part of a continuous planning process. Now they have access to dashboards and KPI analysis, including both financial and non-financial data. The result? Fewer errors and less time spent on manual budgeting tasks.

View the full case study here.

Watch the Full Webcast to Learn More

As executives push for weekly or even daily reports and forecasts, finance teams struggle to make sense of massive data volumes, often lacking the tools necessary to quickly access accurate data and extract insights. The result? Your best people spend too much time on repetitive, manual processes rather than driving value. Watch this on-demand webinar and start exercising control over your planning to drive business growth. Click here to watch now.

Don’t miss out on any of our upcoming events! View upcoming webinars and recordings of past webinars on our events page: https://controllerscouncil.org/events/.