As the person responsible for steering the organization, managing many of the finance and accounting functions, and ultimately keeping the company moving in the right direction, the controllership position has remained one of the most vital people responsible for a company’s short- and long-term financial health. From close to cash flow to internal and regulatory controls, the controller’s job is rarely an easy one. So why is it such an underrepresented and uncelebrated job?

Is There Too Much Focus on the CFO?

Marketing materials focus on the CFO, media companies are built on targeting this person, and you’re generally going to see a finance chief’s name on your company’s leadership page. Controllers Magazine? Not sure that’s a thing. Heck, until May 2020, there wasn’t even a place for controllers to discuss, network, and find community—despite a dozen focused on the CFO post.

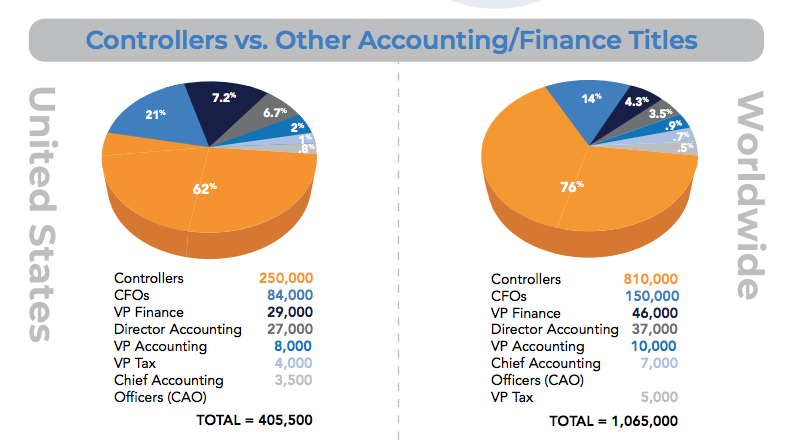

But that’s the problem—CFOs aren’t that common. In fact, for the approximately 150,000 CFOs worldwide, you’re going to find a whole lot more controllers, 810,000 according to recent estimates.

So why hasn’t the controller gotten the love that he or she deserves? Who is this person, and why wasn’t there a community for the controller until recently? Today, we’re breaking down the statistics and highlighting why this leading role needs a place built for them.

Who is the Controller?

A role that has continued to evolve throughout the years according to a survey by Dimensional Research and FloQast, controllers have more on their plate.

The Traditional Role: Still Vital, Yet Diminishing

Often the highest person still holding a CPA license, Controllers still play a key role in control and compliance, you’re still in charge of the basics:

- Maintain all the necessary reporting to the banks and backup system reports

- Maintain the company bank balance and remain cognizant of outstanding checks

- Approve invoices that need to be paid

- Read and review any documentation attached to checks for approval and accuracy sake

- Follow up with customers that are over 45 days old

- Make sure all financial statements and tables are correct and precise

- Make sure that the owner of the company receives the company bank statement unopened

- Reconcile all bank statements and monthly financial reports

- Prepare monthly sales and use tax returns

- Prepare projections annually and update monthly with actual figures

- The controller must coordinate with the auditors and be prepared to surrender documentation if called upon

- Coordinate with the tax division of the company and prepare any schedules required for tax returns

- Maintain the renewals on company insurance

But a Growing focus on the Strategic

That said, many of the above-mentioned roles take less time than ever. Automation, delegation, and improved technology have helped you reduce the time spent on traditional roles, with many reporting an increased focus on leadership.

No longer a stereotypical number cruncher, 95 percent of controllers say that their role has become increasingly important and strategic, and over two-thirds characterize the controller as a “risk manager” versus a “number cruncher.”

That said, there are a variety of roles controllers need to embrace—especially considering the expanding role of the department. With your CFO making moves to focus on capital markets, equity and debt financing, and externally communicating to the market, your department has taken on new responsibilities as well.

Nearly 40% of leaders admit the finance department is becoming more accountable for the business’ success, and because of this, finance has become increasingly important in other departments’ decisions.

Controllers Council Releases New Infographic Highlighting Importance of the Controller

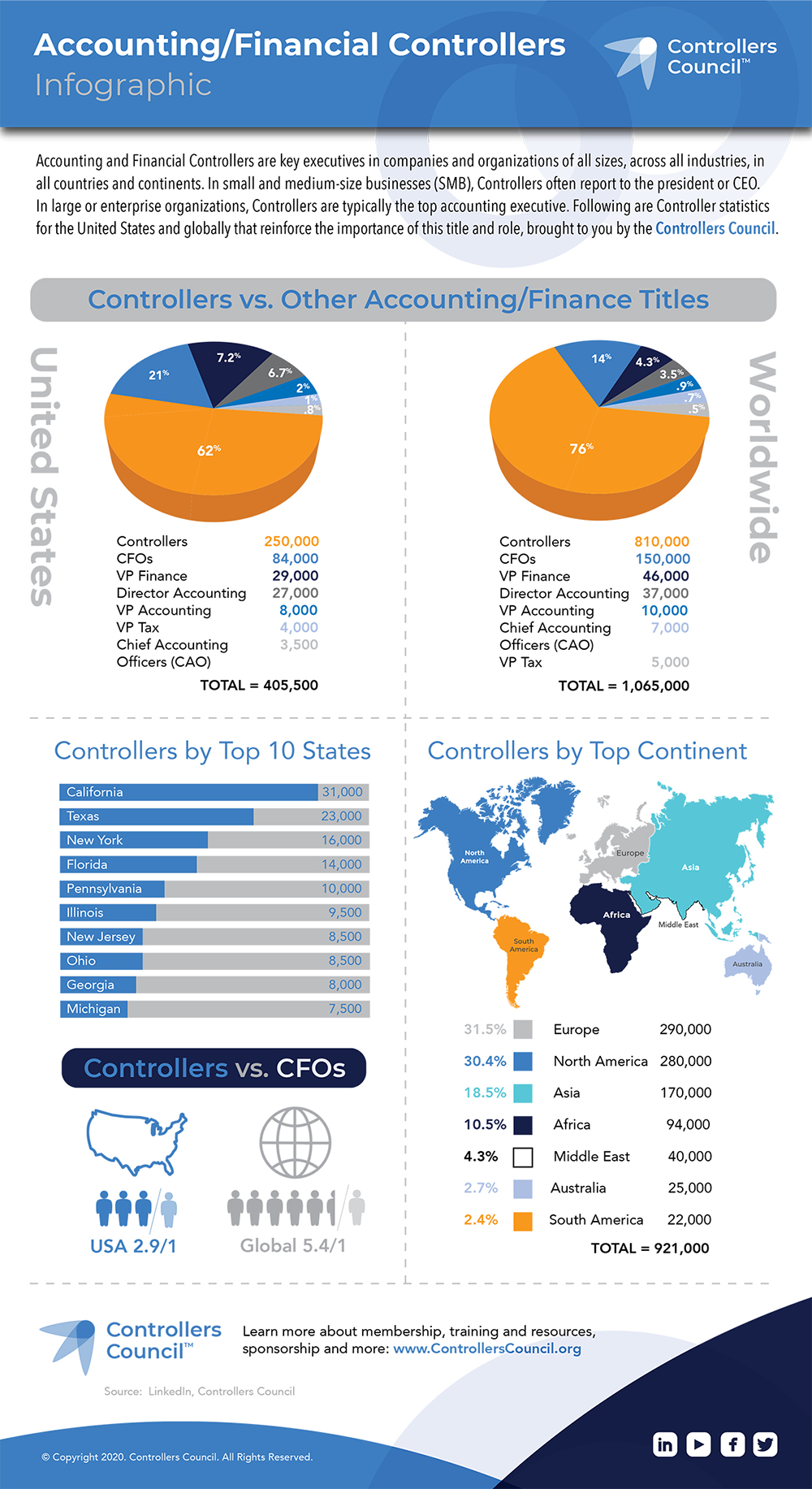

As the soon-to-be leading voice for the controller, we’re excited to release a new infographic documenting just how extensive the controller role is and discussing why 810,000 businesses employing controllers aren’t wrong about this vital role. Our new infographic looks at the common demographics of those in the finance role and has found that controllers make up 62% of finance leaders in the US and 76% worldwide.

Read our infographic below to see just how many controllers exist and read our blog titled five reasons controllers need a community to learn more.

Join the Controllers Council

Controllers Council is a national community and platform of Controllers, Accounting and Finance professionals focused on accounting best practices, information and resources, recognition and networking. Both individual and corporate memberships are available. Membership has many features and benefits to propel your career and expertise, and to be an active participant in our exciting community. Questions? Contact Controllers Council via email or call Neil Brown, Executive Director at 312-869-2180. Click here to join.