Controllers Council recently held a webinar on the Corporate Finance Upskilling/Reskilling – Study, sponsored by Sage Intacct.

Webcast panelists included Judy Romano, CFO of Sage North America, and Russ Porter, CFO of the Institute of Management Accountants (IMA). Following are highlights of this discussion.

The Corporate Finance Upskilling/Reskilling – Study was driven by macro-trends including the pandemic and remote hybrid working environments, coupled with the Great Resignation and Accounting/CPA shortages, which have forced corporate finance and accounting departments to adapt. The objective of this important study was to identify how controllers, CFOs, and their departments, and staffs are adapting to these trends.

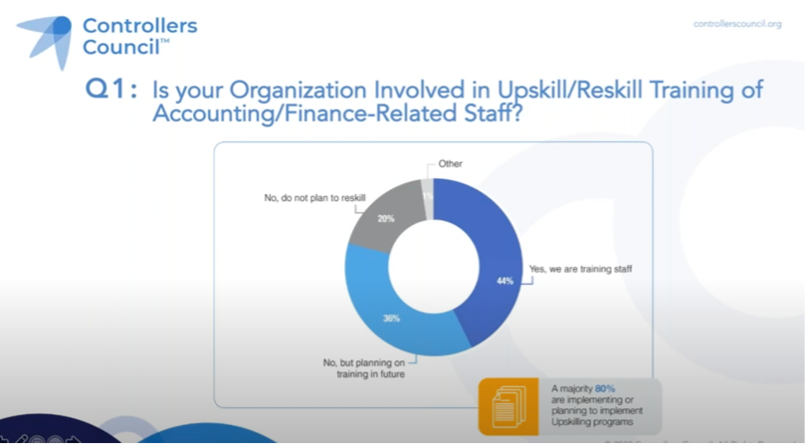

The results identified that many organizations are rapidly implementing new systems and automation processes that require training or upskilling/reskilling as the new norm. The national survey was conducted from February to April of 2022 with more than 200 respondents participating across North America. The key takeaways are, large majority, 80% of organizations are upskilling or reskilling staffs. Many to address remote and hybrid work models.

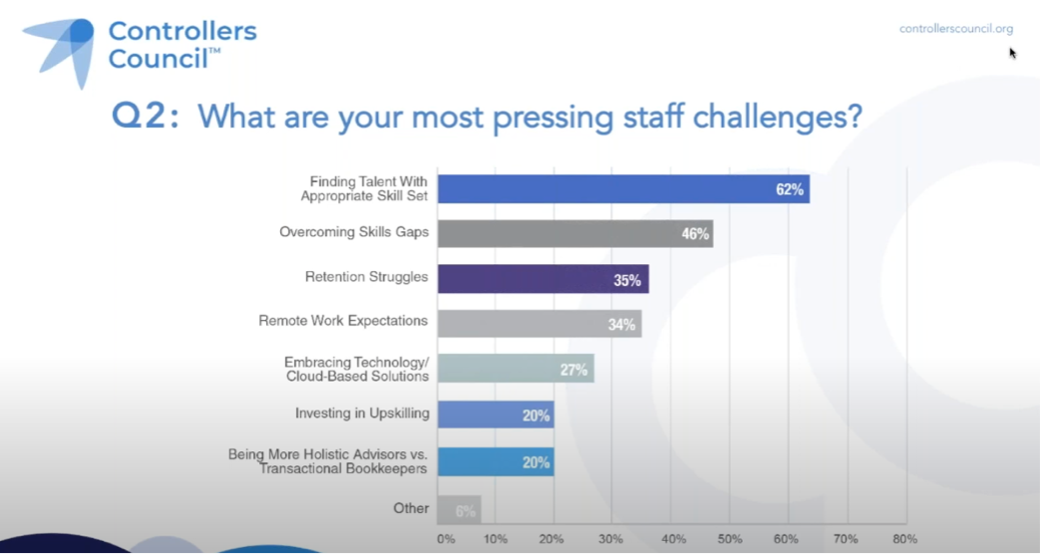

The Great Resignation and accounting CPA talent shortages create challenges in recruiting, training, retention, and remote work expectations. And have the result of driving increased wages, executives spending more time on hiring related tasks, but also upskilling and training their staffs, our study itself, and investing in automation. They’re also using more contract and outsourced staff.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

Takeaway 1: Significant majority, 80% of organizations are upskilling or reskilling staffs

Judy Romano: Upskilling and reskilling is no longer an option. It’s something that we all should do, individuals as colleagues, and also as organizations. We don’t have the luxury to be left behind. We must have our colleagues upskill, so that they could have the required skills to remain relevant in this competitive market.

Russ Porter: 80% of organizations are upskilling and reskilling, but that means that 20% are not planning, or are not currently upskilling and reskilling their staffs. I think that could be a huge mistake for those organizations. And I hope some of the takeaways out of this will reinforce the value of that upskilling and reskilling of our F&A employees.

Takeaway 2: The Great Resignation and accounting CPA talent shortages create challenges in recruiting, training, retention, and remote work expectations

Russ Porter: Recruiting talent with the skills needed, not a surprise that comes out on top. We’re in an environment where there’s a real competition for top talent employees, where companies need to be out there, and they need to be differentiating themselves in new and different ways.

And in ways they haven’t had to in the past. So not surprised that takes number one. And then as I said, because it’s an employee’s market for hiring and talent, keeping people on the staff is a very quick number two. Because there is so much opportunity out there for quality finance and accounting professionals.

Judy Romano: I think on the retaining talent side, we have to have a multi-pronged approach. Not only the money that attracts the talent to us or keep the talent with us. But it’s also, what are we doing on upskilling? What are the job rotations opportunities we offer? The other, getting involved with the community, and the culture.

So there’s so many other ways that we could also have an impact on talent remaining with the organization. And we have to think about those, because money is not all that is required. Our bottom line will be pressed if we just address these challenges with, retaining talent challenges with money.

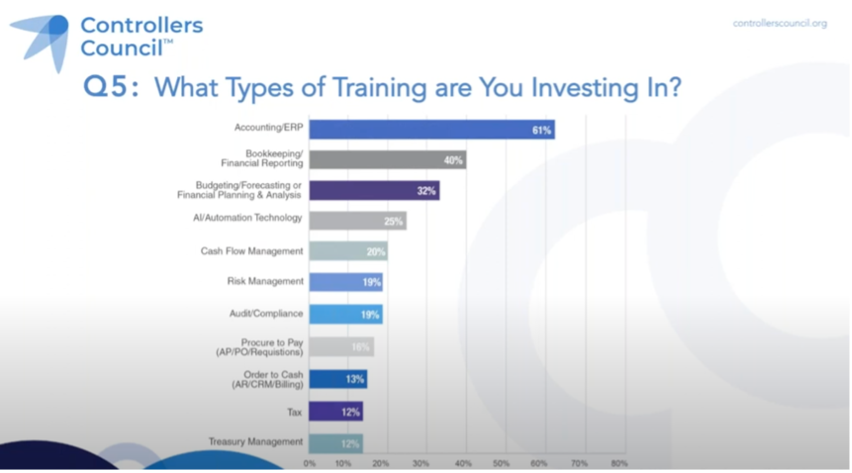

Takeaway 3: 61% of training that we’re talking about includes accounting and ERP systems as the number one type of training

Judy Romano: I would love to continue seeing the trend for more technology removing the mundane task. So that, again, they come to me. The accountants are also finance business partners. They need to understand their numbers, and checking them, et cetera. So as technology advances, and the ERP systems they’re using allow them for more time to be spent on analysis. That’s a great investment for the company, and a great career opportunity for the colleague.

Russ Porter: I would love to see investments in AI and machine learning, and process, full process-oriented, like procure to pay, order to cash. A lot of those skills, and a lot of that training is about raising the capabilities of the organization. As opposed to training that teaches people how to do the job the way it’s done today.

And a lot of training I see, especially on the ERP side, it’s how do we get done the process we’re running today? How do we work within our existing ERP system? How are those going to link into other elements of our IT landscape?

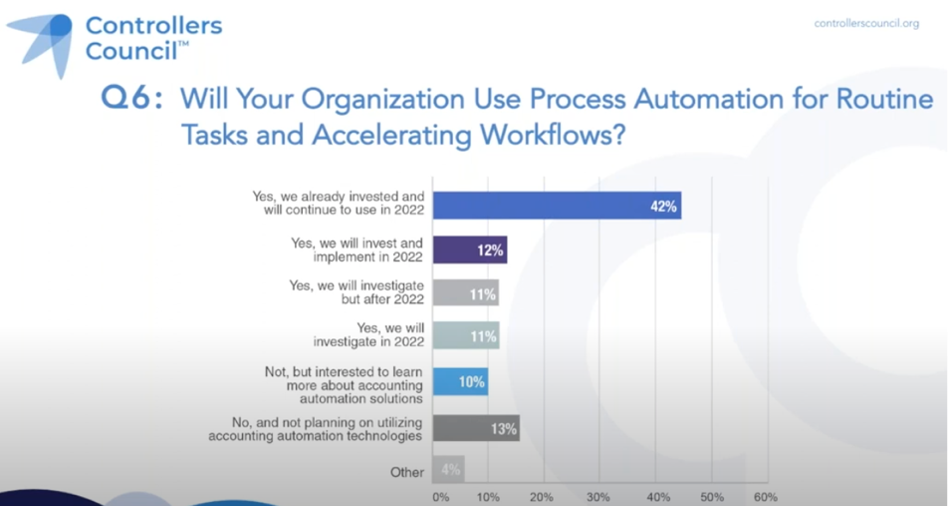

Takeaway 4: 42% of respondents implemented automation, and another 44% are either planning to invest, or investigating

Russ Porter: A lot of CFOs and controllers are looking at automation because it is a way to drive efficiency with any organization.

I’m interested in those bottom two sections, interested to learn, not interested to learn. I picture those as maybe being smaller organizations who might be looking at automation and saying, “It’s not worth it. I can’t justify necessarily the investment, because I’m a small enough finance organization that I can’t save money by releasing a staff member.” Because activity is only a small part of their job.

Automation is great for a discussion of efficiency in larger organizations. In smaller organizations, it’s more about effectiveness. If I don’t have to have somebody spending two hours a day reconciling my accounts receivable. Instead, they’re analyzing to make recommendations to management about where we should be investing next. That’s a huge change in how my finance organization is perceived by the rest of the company. And also the increased value, that shift we always talk about, from low value to high value skills. It can happen in small organizations too.

Judy Romano: Maybe just one add to Russ about the efficiency. I would also say it increases accuracy. So they all go hand in hand, right? So reducing errors, et cetera. I mean, just errors, it will help us avoid redoing work and again, create efficiency for the broader organization. And maybe retain our credibility with the business leaders.

To view the complete webcast panel discussion, click here.

To download/read/print the Corporate Finance Upskilling/Reskilling Study Report, click here.

ABOUT THE SPONSOR:

Sage Intacct gives leaders of digital-savvy, intelligent organizations the visibility and agility to make the right data-driven decisions at the right time to steer their organizations and people to growth and recovery. As the innovation and customer satisfaction leader with over 20 years of experience as a native cloud financial management system, Sage Intacct is the only solution to earn the top score in Gartner’s Cloud Core Financial Management Suites Lower Midsize Enterprise Use Case for 4 years in a row, is the first and only preferred provider of the AICPA and is ranked #1 in customer satisfaction by G2. Tightly integrated with budgeting and planning and paired with HR and people software, Sage Intacct enables digital transformation through continuous accounting, continuous trust, and continuous insight.