Finance transformation at Aetion®: Telling the story – not just the numbers

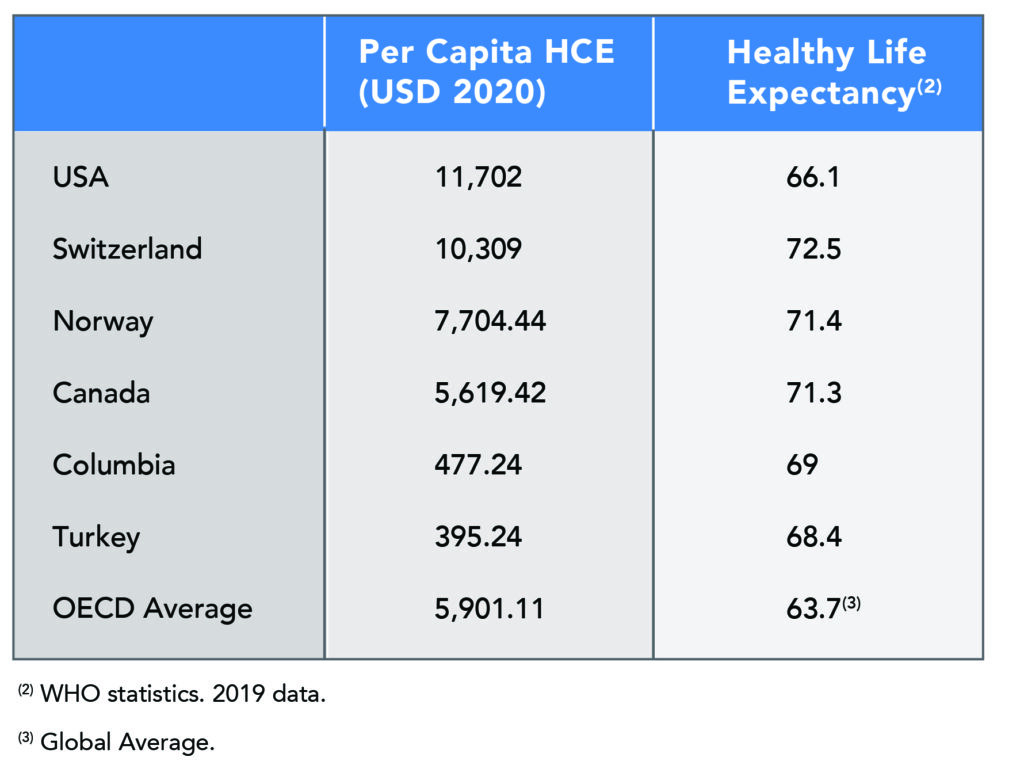

Almost double the OECD average, the US health care system is the most expensive, and among the most complicated in the world. There is a large variety of group health insurance plans offered privately and publicly, and individual health care costs and the type of healthcare people have access to are subject to the kind of insurance they have. In 2020, according to the latest comparative statistics produced by the World Bank, per capita spend on health in the US totalled $11,702, versus the OECD average of $5,901.11.[1] Yet Americans are often worse off health-wise, than countries with the lowest per capita health care expenditures.

Fast growth and finance transformation in the digital health sector:

Aetion, a high growth health care data analytics company attempts to address this imbalance, not only in the US, but in other countries around the world where population health can be improved by data led insights. Founded in 2013 by Jeremy Rassen, Sc.D. and Sebastian Schneeweiss, M.D., Sc.D., two Harvard Medical School professors, the goal was to provide a better way to evaluate and use real world evidence in health research and expand its use and adoption to improve health outcomes. In 2022, Aetion was named among The Digital Health 150, representing the 150 most promising private digital health companies out of a pool of 13,000.[4]

The name: Aetion (“ay-tee-on”) is adapted from the Greek word for causality, which in statistics, refers to the relationship between two events.

Telling the underlying story to private equity investors:

With the changes in US health care delivery brought about by the COVID pandemic, the company grew exponentially and the finance function needed to evolve along with it. For the finance department, the challenge would not only be to deliver the numbers to its multiple equity partners, but to tell the story of the company in real time and customer by customer. In April of 2022, Aetion hired Jessica Allen as their new VP of Finance to do just that.

As many finance and accounting executives are only too aware, making sure the financials of the company are transparent, accurate and meaningful for investors is their number one priority. For Jessica, being able to articulate the company’s story would mean diving deep into the levers that were responsible for revenue growth. “I really wanted to build something that was driver-based and linked to being able to tell the underlying story,” she says. “It’s critically important to find alignment with your equity partners and being able to provide them with not just the numbers, but the strategic insights they’re looking for is key.” They need to understand the drivers of profitable growth, the type of investments that will support that, the unit economics and scalability, the variance analysis the economic trade offs and influences behind strategic decision making, as well as the important KPIs, she adds.

Team led transformation:

For Jessica, this would first mean building her team. “The team is at the core of any finance transformation,” she says. They need to have the core financial management and reporting skills, as well as the ability to communicate effectively with a broad range of stakeholders and understand how business decisions are made, she adds. “I think companies are really hungry for the insights that can come from corporate finance professionals, so there’s a high demand for the ones that can really bring that to the table.”

Once in place Jessica would have the necessary support to carry out several transformation projects. To date, finance has implemented operational reporting, rolling forecasts, as well as product line, segment and customer analysis. “Having that view at a customer segment level enables us to make targeted decisions about where we’re spending our time and where we want to invest for growth,” she says. “It helps us understand what we can do to change the cost structure around how we service our customers and segments.” Since Jessica took on the role of VP, finance has also automated certain reports that have helped reduce the month end time to close by one third. Going forward, they will continue to automate with the addition of new ERP and reporting software and AP automation.

The outcomes of these initiatives thus far have been measurable in terms of strategic planning and aligning with their equity partners, she says. It has also enabled important discussions. “It’s fantastic to be able to articulate what the revenue growth levers are across all the different teams and segments.”

“The parallels between finance and a data driven company are striking,” she adds. “There are similarities in how we ultimately think. One of our anchoring thoughts at Aetion as a company is that the best innovation you can make is a better decision. Not only does that apply to how data science helps drive healthcare decisions, but that theme can be applied to financial reporting too – how finance can really help provide a powerful lens into company decisions.”

Top tips for finance and accounting professionals:

- Always look for challenging opportunities. The health-tech industry is fast growing and a fascinating sector.

- A critical part of evaluating a role that you want to pursue is to look at the company’s leaders and their equity partners – who you’ll really be working for.

- If we put in place the right financial management processes and technology, we as finance leaders are equipped to answer any questions. Find the insights and the story behind the company.

- Be aware of the coming finance automation technology and how it can lend support to your company and your career. That will continue to set talent apart in the future.

Relevant Resources:

Controller Spotlight: Ali Safaraz

Meet the Controller/CFO Interview Series

[1] https://data.worldbank.org/indicator/SH.XPD.CHEX.PC.CD?locations=OE

[2] WHO statistics. 2019 data.

[3] Global Average.

[4] https://www.cbinsights.com/research/report/digital-health-startups-redefining-healthcare-2022/

Neil Brown is Executive Director of the Controllers Council, author and a professional association manager. Neil is CEO of the Chief Executives Council, COO of the Operations Council, VP Partnerships for IT Executives Council, and Chief Marketing Officer of Modern Marketing Partners. Neil started his career as a Brand Manager, then promoted to CMO. Brown has provided marketing services to leading Fortune 500 and start-ups, along with board and volunteer roles with non-profits. Neil is a frequent speaker, author and contributor to Advertising Age, Marketing News, Adweek magazine and many others. He is author of two books including “Breakthrough Branding: Brand Naming Tips & Trade Secrets”, and “Tools of the Trade: Modern Marketing for Construction Brands”. Brown earned an MBA from Northern Illinois University, and a BS-Marketing Cum Laude from Southern Illinois University.