Qikiqtaaluk Corporation (“QC”), located in Nunavut Canada, is a diversified development corporation with interests in multiple sectors including fisheries, mining, commercial and industrial properties, land development, clean energy, and several others. As a “Birthright Inuit Development Corporation”, QC is owned and operated by an indigenous Inuit Association in Nunavut, Canada. The Association protects the land claim rights for the entire Qikiqtani Region, (which, to put it in perspective, is more than double the size of California).

Proceeds from its 32 subsidiaries and joint venture for-profit businesses accrue by means of capital reinvestment, maximizing Inuit training and employment and providing an annual dividend to its ultimate owner, the Qikiqtani Inuit Association.

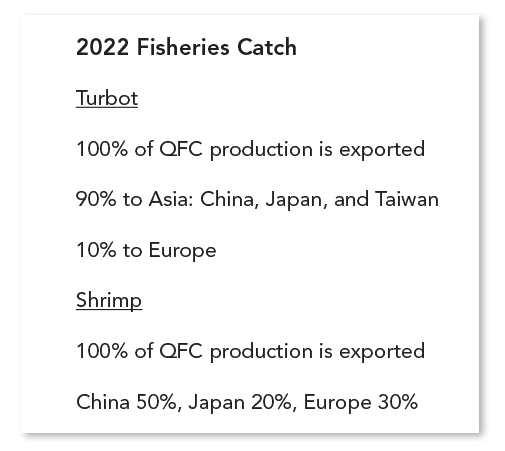

Qikiqtaaluk Fisheries Corporation (QFC) is the largest and most profitable business for QC with $40 million USD of annual revenues. The QC brand is one of the most recognized in the major markets for both cold-water shrimp and turbot. In 2018, QC purchased the common shares of its 49% minority shareholder. As a result company management was taken over by QFC .

Upon assuming all management of the fishing operations, QFC entered into an agreement with Denmark based Sirena Seafoods, one of the major marketers worldwide for both shrimp and turbot. Sirena purchases QFCs catch, paying 80% upon delivery and the remainder within 60-90 days.

This new marketing agreement has reduced Qikiqtaaluk Fisheries Corporation’s inventory and storage costs, its products are now sold deeper into global markets, and, in most cases cutting out the middleman. Where once it could take up to eight months to get paid for one catch, the company would now clear the majority of their receivables almost in real time.

This free cash flow facilitated an aggressive investment strategy that included Qikiqtaaluk Fisheries Corporation purchasing a new factory freezer fishing vessel, with an estimated cost of more than $85 million USD.

In the town of Iqaluit, ( aka “place of many fish”) where QC has its headquarters, winter temperatures range between -30 and -41 Fahrenheit, with record lows of -66 with the wind chill. The town sits at the end of Frobisher Bay on Baffin Island, the easternmost region in Nunavut and can only be reached by sea and air. There are no roads linking it to the rest of Canada or the communities within the region, and geographically it’s closer to Greenland than to Ottawa, the Canadian capital.

In January 2021 QC hired Ali Sarfaraz, BSc, CPA, CGA, FCCA as their new Corporate Controller. With extensive experience in both large conglomerates and smaller private companies, Ali would be second in command to the CFO.

Ali is responsible for accounting, financial reporting, coordination of annual audit, financial planning and analysis, supervision of payroll functions and financial management for QC and all of its subsidiary companies. Ali’s major achievements for the last two years include successfully standardizing QC’s payroll process and implementing a new payroll program.

Before Ali came on board, QC had four different payroll periods, and everything was done manually. Ali standardized payments to bi-weekly across the company, and installed a payroll software solution that has automated the once time-consuming manual process. “It was a simple fix, but took six months to implement with the right training and software,” he says.

Ali also revamped the formula for how their fishermen got paid, based on a share settlement plan where they would receive a percentage of revenue from the catch. “Now, the men would understand exactly how much they would be paid and were paid consistently at the end of each fishing trip” he says.

“That was a win-win situation for us. We typically need between 25 and 30 experienced people to be with us throughout the year. Once we developed the payment plan and put everything in black and white after every trip, we were able to keep 60 dedicated fishermen, instead of rotating between 90 and 100. In other words, we now have a reliability factor, where the men have a sense of attachment and feel that they are fairly compensated.”

Yet payroll was not the only problem. “When I joined, even our chart of accounts and the day-to-day accounting was not standardized. Most of the department managers and the board used to see the financials for the group only at a annual shareholder meetings.”

Ali would commence replacing their 20 year-old accounting systems and processes with state of the art accounting and resource management technology. “Before we started upgrading our old technology, we were basically running blind,” he says. “The medium to long-term planning was not there and there was no oversight of the numbers.” There was also lot of paperwork, he adds.

Ali is now in charge of selecting an ERP system, which promises another leap in QC’s ability to provide meaningful information to QC business leaders and the board. The system will replace the outdated financial management processes and systems to facilitate growth and provide company executives and mangers with best practices in financial reporting. When the project is finished, says Ali, “QC financial management will be best-in-class and will be supported by state of the art technology tailored to the company’s unique circumstances.”

With a total overhaul of QCs corporate finance function, the company is poised to expand their operations and grow the revenues so important to the welfare of the entire Qikiqtani region, and this remote, indigenous community.

Relevant Resources:

Meet the Controller/CFO Interview Series

Neil Brown is Executive Director of the Controllers Council, author and a professional association manager. Neil is CEO of the Chief Executives Council, COO of the Operations Council, VP Partnerships for IT Executives Council, and Chief Marketing Officer of Modern Marketing Partners. Neil started his career as a Brand Manager, then promoted to CMO. Brown has provided marketing services to leading Fortune 500 and start-ups, along with board and volunteer roles with non-profits. Neil is a frequent speaker, author and contributor to Advertising Age, Marketing News, Adweek magazine and many others. He is author of two books including “Breakthrough Branding: Brand Naming Tips & Trade Secrets”, and “Tools of the Trade: Modern Marketing for Construction Brands”. Brown earned an MBA from Northern Illinois University, and a BS-Marketing Cum Laude from Southern Illinois University.