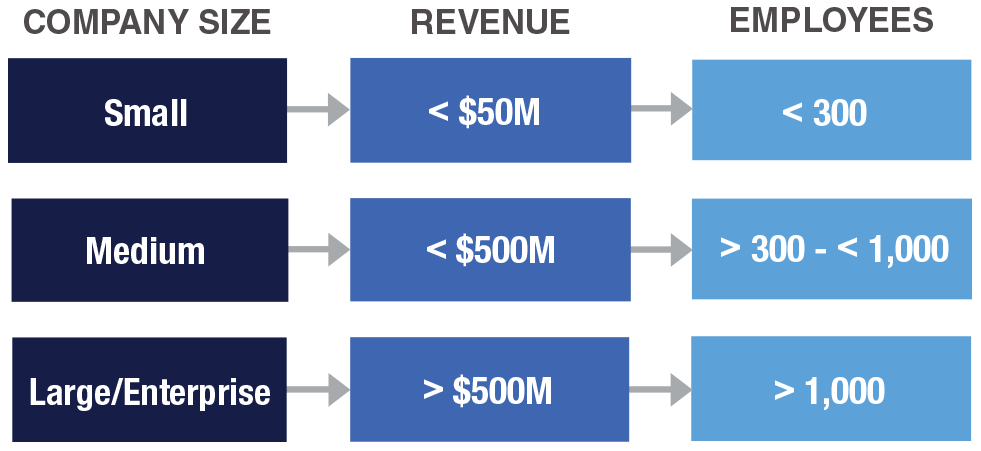

Corporate Finance and Accounting (F&A) organizational structures differ based on company size, public vs. private, industry, and other factors. That said, company size might be the biggest determinant, but definitions of small, medium and large or enterprise organizations vary widely. For our purposes, let’s use some broad definitions and approximations for company size, followed by details on F&A organization structure, titles and staffing levels for different sizes within each broad category. Finally, companies can employ “captive” staff, or outsource specific functions or complete departments. Often, a combination or hybrid of captive and outsourcing is used.

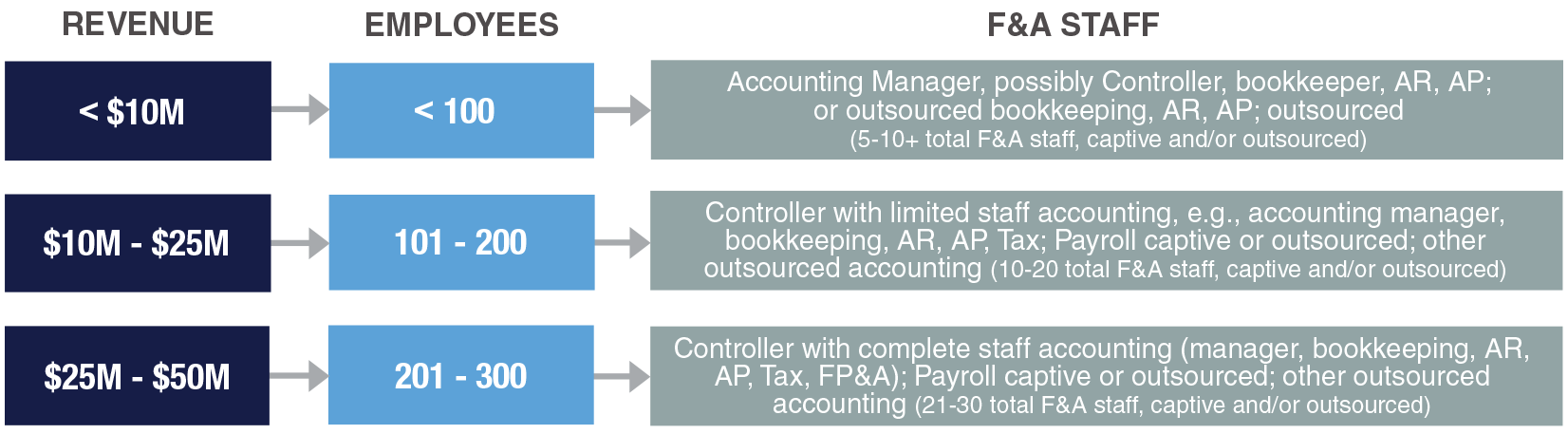

Small Business F&A Organization Structures

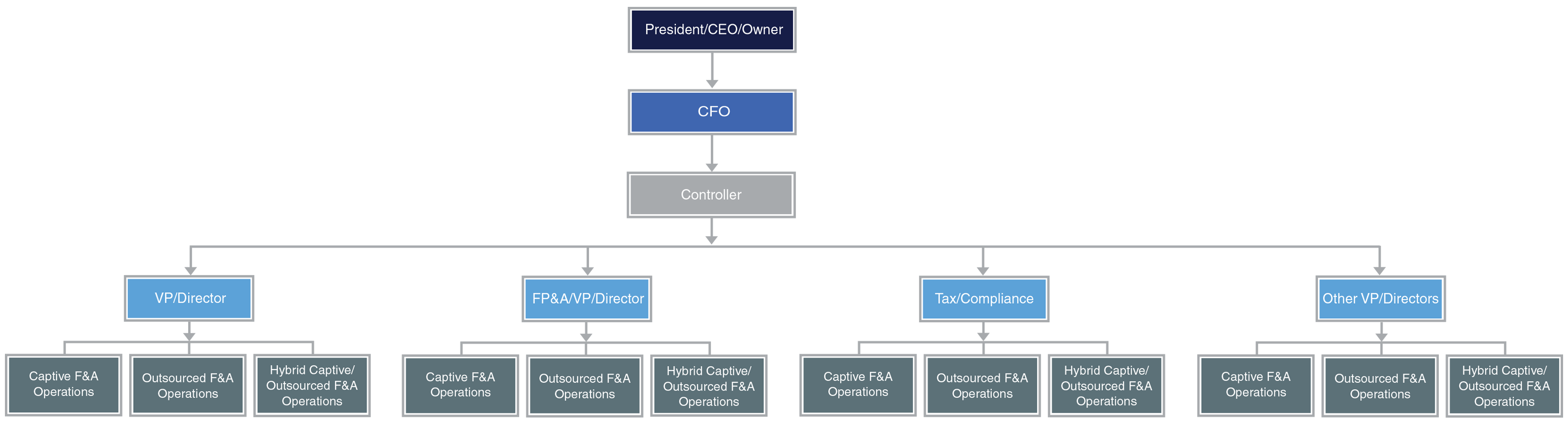

Following are three sizes of companies within the Small Business category, along with typical F&A structures for each. A startup or very small business, e.g., less than $10M annual revenue might outsource bookkeeping and accounting, and not have a staff financial controller until scaling to, e.g., 50 employees in size. Likewise, very Small Businesses are more likely to outsource such accounting functions as tax, payroll, and more. While Small Businesses tend to be privately held, there are exceptions including small but fast-growing Pre-IPO startups that might have both a Controller and CFO or VP Finance. As startups and very small businesses scale, so do F&A staff. Finally, privately held small businesses will tend toward smaller staffs, while Pre-IPO or Public companies may have additional F&A staff specialists for internal audit, compliance, SOX, etc.

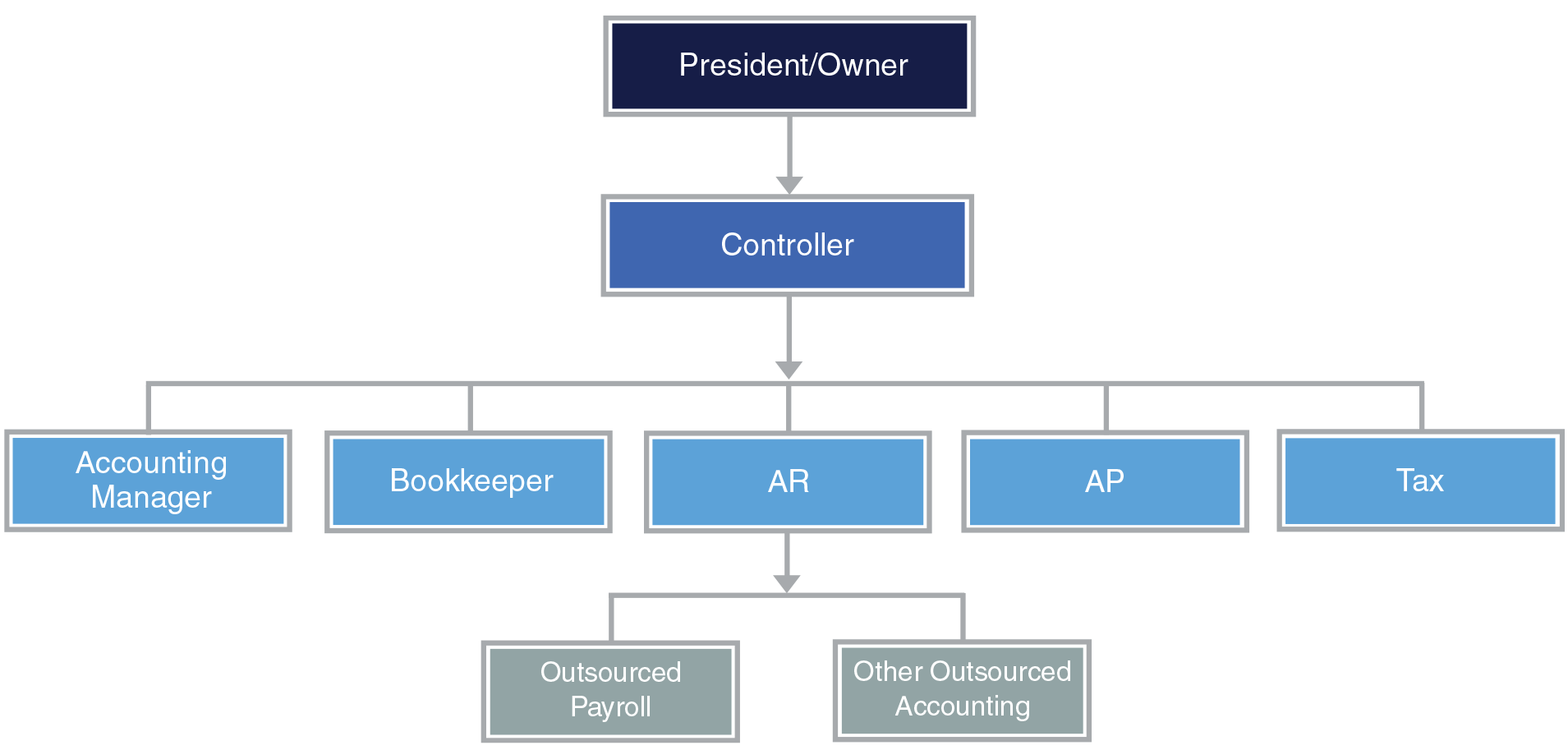

Typical F&A Organization Structures for Small Businesses

Small Business F&A Org Chart

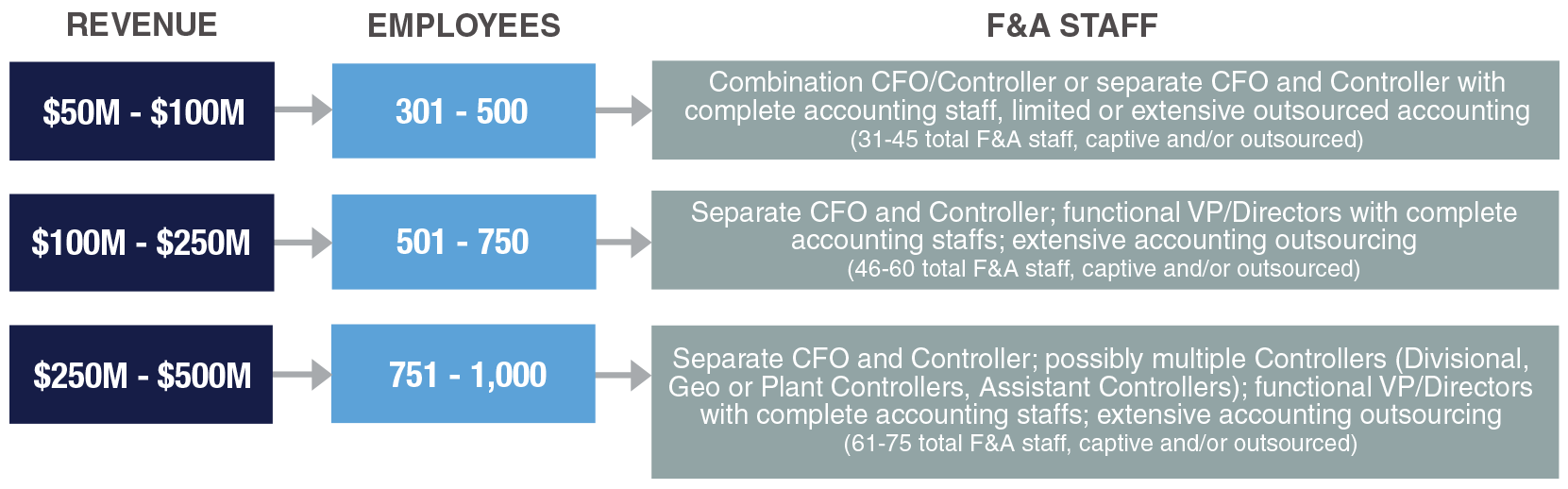

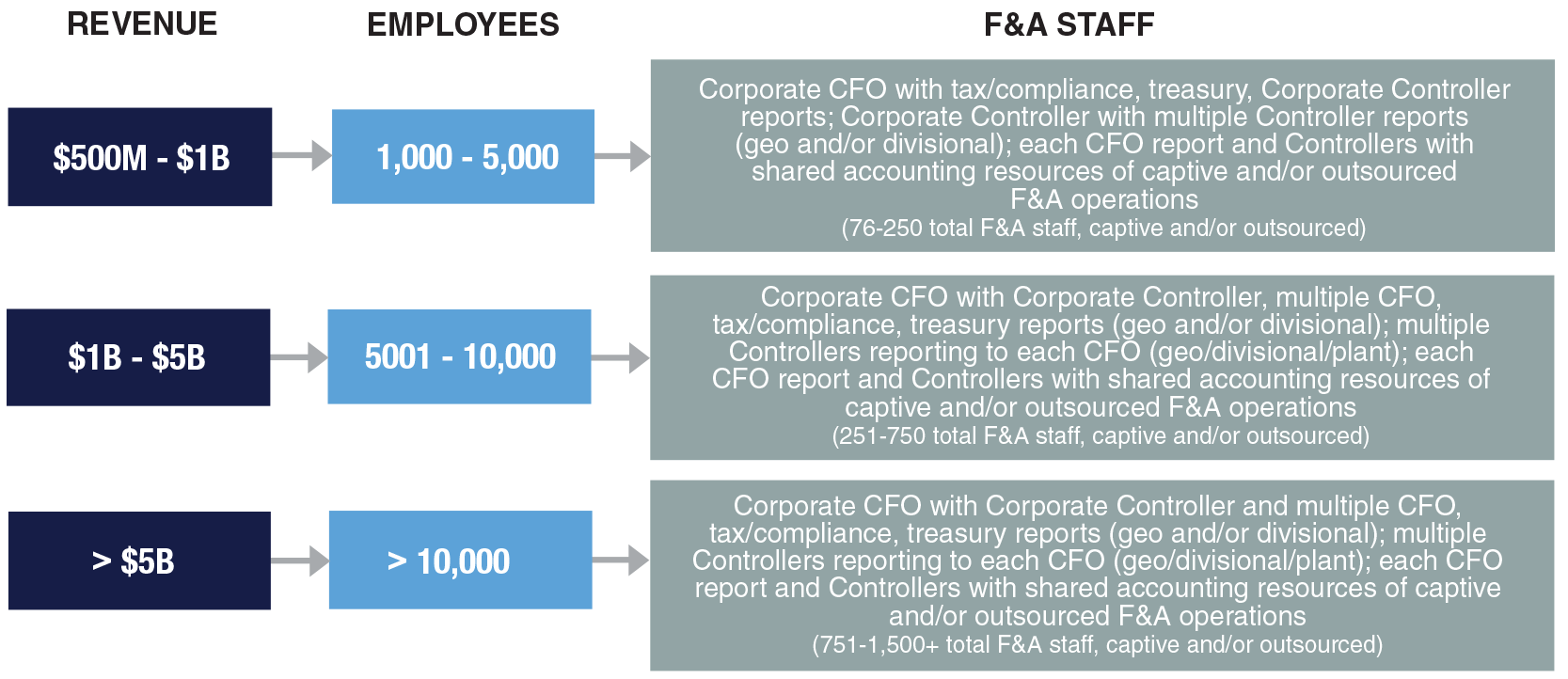

Medium-Size Business F&A Organization Structures

Following are three sizes of companies within the Medium-Size Business category, along with typical F&A structures for each. As businesses grow to medium-size thresholds, Finance & Accounting organization structures become more complex with more likelihood of either a combination Controller/CFO, or a Controller reporting to a CFO or VP Finance, along with complete accounting staffs, with or without outsourced accounting. Medium-size business will tend to be privately held but could be Pre-IPO or Public as they grow bigger. Public or Pre-IPO businesses will have additional F&A staff specialists for internal audit, compliance, SOX, etc.

Typical F&A Organization Structures for Medium-Size Businesses

Medium-Size Business F&A Org Chart

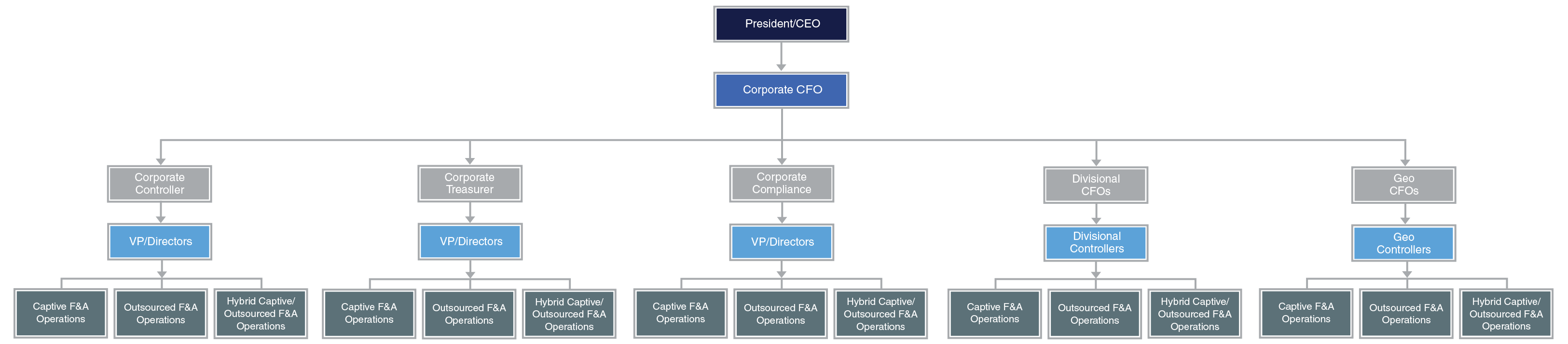

Large/Enterprise-Size Business F&A Organization Structures

Following are three sizes of companies within the Large or Enterprise Business category, along with typical F&A structures for each. As businesses grow to Large or Enterprise in size, Finance & Accounting (F&A) organization structures become large and complex. Large or Enterprise businesses have the greatest likelihood of being public vs. private, and multi-national. As a result, some F&A operations tend to be regional to leverage expertise in local and regional tax regulations, compliance, etc. Enterprise F&A operations can be captive, business process outsourced (BPO), or a hybrid of both depending on the process/subprocess area. Per Mike Polaha, SVP of Finance Solutions and Technology at BlackLine, if and when a F&A process automation scales, the decision to staff or outsource can change as skills required for manual input are replaced with skills required for automation oversight.

Typical F&A Organization Structures for Large/Enterprise-Size Businesses

Large/Enterprise-Size Business F&A Org Chart

The Future is Bright for Corporate F&A

Corporate finance and accounting organization structures vary widely by size, public vs. private, geographical locations, industry sectors, and more. Macro-trends including the global pandemic and corresponding hybrid and remote work environments coupled with accounting and CPA shortages and the “Great Resignation” have impacted F&A “org” structures with mass adoption of process automation, software technologies, and the ability to outsource or use contract staffing to address skill gaps. As a result, long-term trends could witness shrinking F&A operations, and increased demand for F&A technology, data, and analytics specialists.

With this backdrop, the roles and responsibilities of CFOs, Controllers and other corporate F&A executives will continue to grow in importance and market-demand, leading to increased compensation and more opportunities for promotion.

Relevant Resources:

Financial Controller: The Hottest Job of the Decade

The Growing Shortage of Accountants and CPAs

Corporate Finance Upskilling/Reskilling Study Report

The Digital Controller/CFO Study Report

Neil Brown is Executive Director of the Controllers Council, author and a professional association manager. Neil is CEO of the Chief Executives Council, COO of the Operations Council, VP Partnerships for IT Executives Council, and Chief Marketing Officer of Modern Marketing Partners. Neil started his career as a Brand Manager, then promoted to CMO. Brown has provided marketing services to leading Fortune 500 and start-ups, along with board and volunteer roles with non-profits. Neil is a frequent speaker, author and contributor to Advertising Age, Marketing News, Adweek magazine and many others. He is author of two books including “Breakthrough Branding: Brand Naming Tips & Trade Secrets”, and “Tools of the Trade: Modern Marketing for Construction Brands”. Brown earned an MBA from Northern Illinois University, and a BS-Marketing Cum Laude from Southern Illinois University.