Controllers Council recently held a webinar on the 2022 Digital Controller/CFO Study Results – Webcast, sponsored by Trintech.

From high volume transaction matching and streamlining daily operational reconciliations, to automating and managing balance sheet reconciliations, intercompany accounting, journal entries, to governance, risk and compliance – Trintech’s cloud-based solutions help manage all aspects of the financial close process.

The Controllers Council’s webcast panelists included Omar Choucair, CFO at Trintech and David Woodall, Director of Strategic Marketing, R2R and Finance Operations advisory at Trintech. Omar Choucair is a CPA and a CFO of several public companies, a former KPMG alum, and an active contributor to the Forbes Finance Council and before joining Trintech David Woodall was previously with GSK, as a part of the R2R GPO team that built out a roadmap to help drive service improvements from their existing operation model by the use of digital platforms and new processes to drive risk-based approaches and increase the level of automation. David is also a fellow of the Chartered Association of Certified Accountants, the FCCA designation.

During this discussion, Omar and David discussed a number of key takeaways from the report including why CFOs/Controllers have a bigger role in technology adoption and where companies are in their automation journey. If you are interested in learning more, view the full webinar archive video here.

Takeaway 1: An increasing need for the Digital CFO/Controller

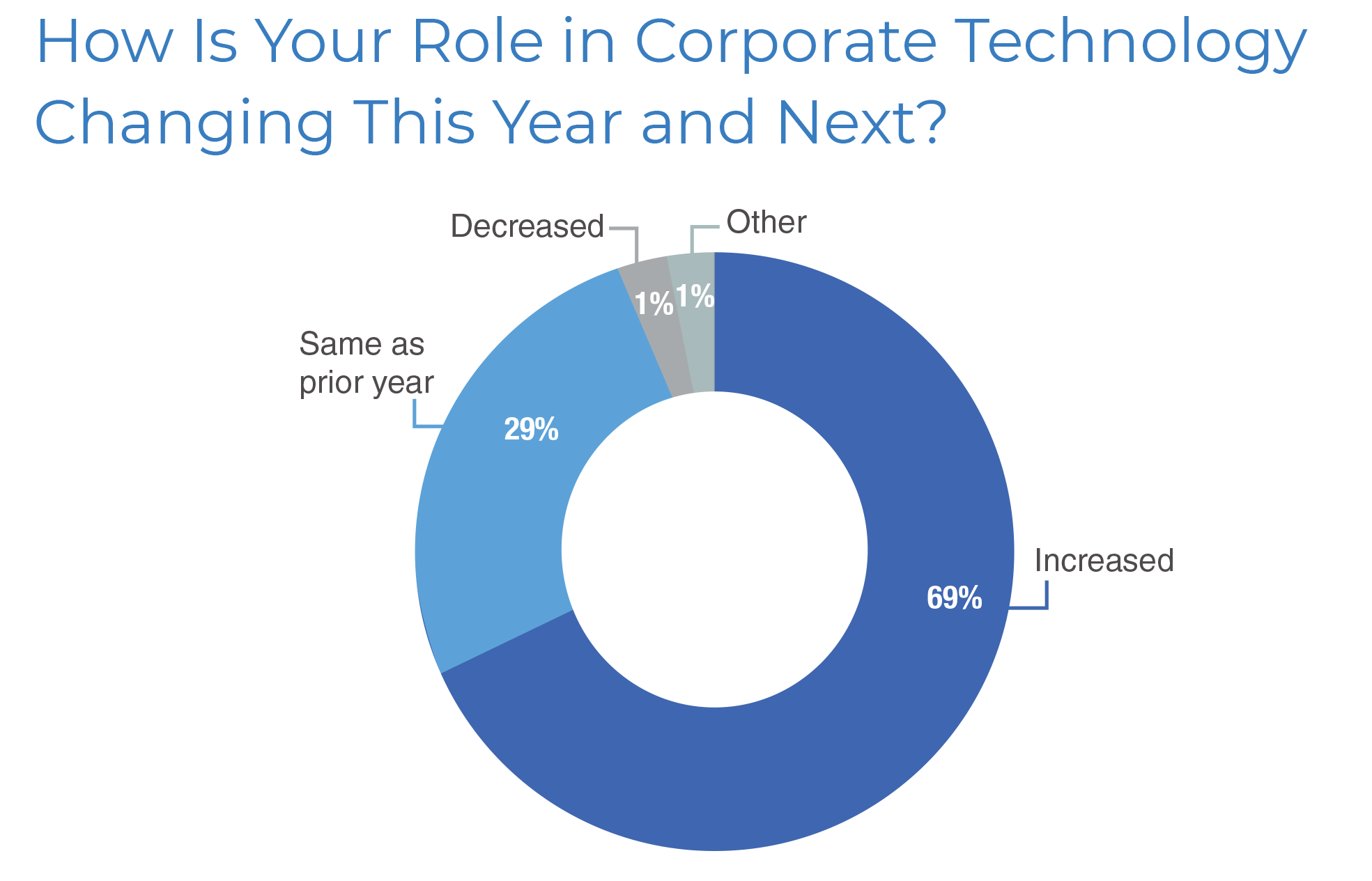

The survey asked respondents this question to better understand how their roles have changed in the past year, and what they expect for the next year. A majority (69%) of respondents said their corporate technology role had increased significantly in the last 12 months, while 29% consider their role in corporate technology to have remained the same. Less than 1% stated that their roles were decreasing.

“I think the return on investment has become clear for Controllers and CFOs, and I think the quality of the applications have obviously increased and there’s a larger breadth of applications that companies can use,” said Omar.

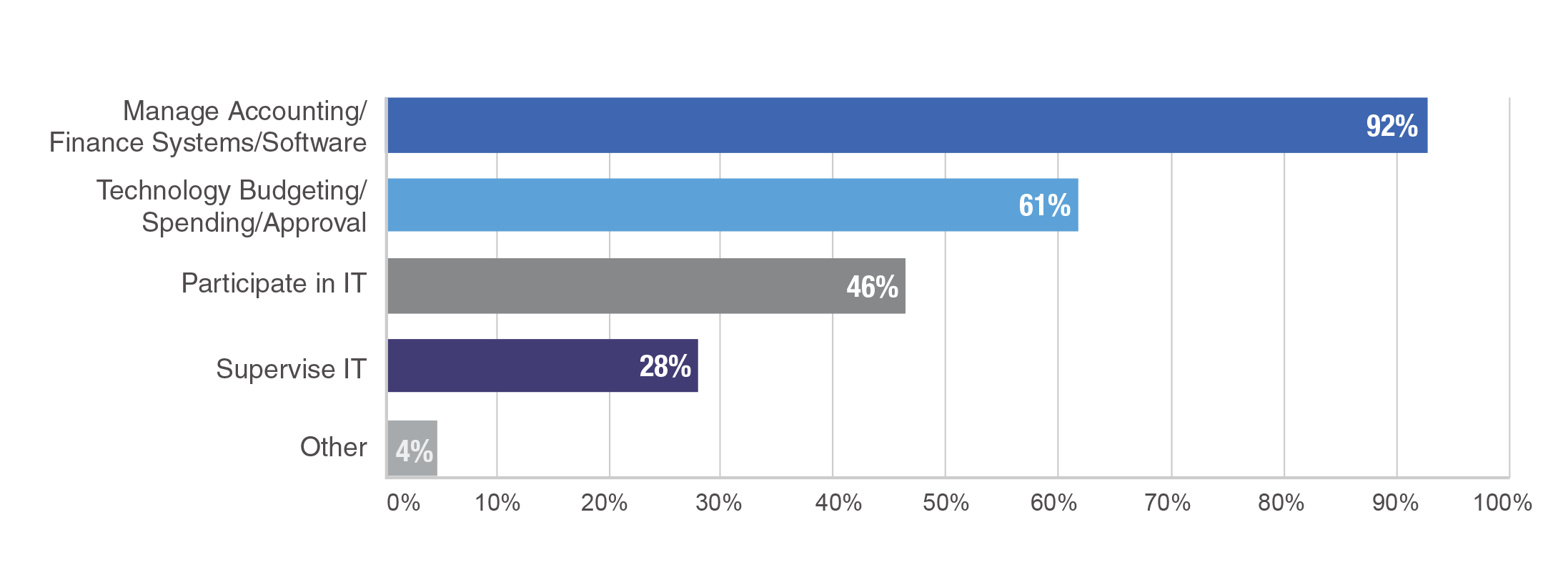

The goal of surveying corporate technology responsibilities was to identify broad “buckets” of Controller and CFO technology roles. As we saw in last year’s survey, most respondents (92%) said they are responsible for managing Finance & Accounting (F&A) systems, software, and related processes.

61% are responsible for technology budgeting, spending, and approval, 46% are participating in IT, software, and related technology, and 28% are supervising IT, software, and related technology.

“I think we’re going to have to see technology again as the route to try and solve some of our key challenges, and I think we’ve got some real practical examples today. A lot of the role that we play within finance is to make sure that we are getting that accurate, timely data out,” stated David. “Again, historically, the accuracy was important for reporting, but I think today the accuracy is now being able to feed other processes within finance, and in particular, financial planning.”

Takeaway 2: Total Automation is slow to catch on

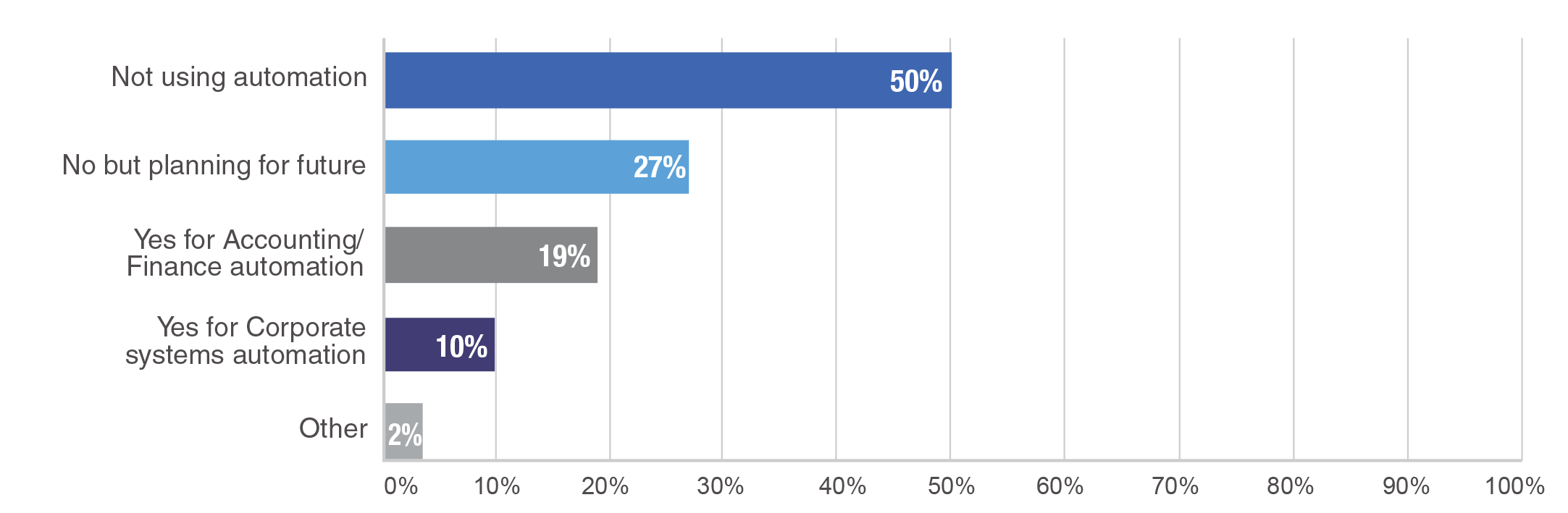

Despite much promise and media attention, automation is still not widely adopted, but there are indications of adoption and planning that should drive future automation initiatives.

It is encouraging to see that there is a group of Controllers/CFOs that are indeed “early adopters” of automation with 19% using for F&A and 27% planning to use it (46% combined) and another 10% using automation for corporate processes. However, that still leaves the other side of the story where 50% say they are not using automation or planning to use it.

“If your business is processing a high-volume of transactions, then F&A leaders should use automation. If there’s a lot of volume that’s running through the system, whether it’s credit cards or retail or just volume, I think it makes a lot of sense,” stated Omar.

“You’ve got to have a strong foundation in your automated digital journey before you really start to adopt this, because I think companies have jumped into this a few years ago, especially robotic process automation (RPA), and have found it not to be successful for several reasons,” said David. “It’s not necessarily because the technology is not right, it’s just the approach.”

Takeaway 3: Controllers/CFOs continue to drive Digital Transformation

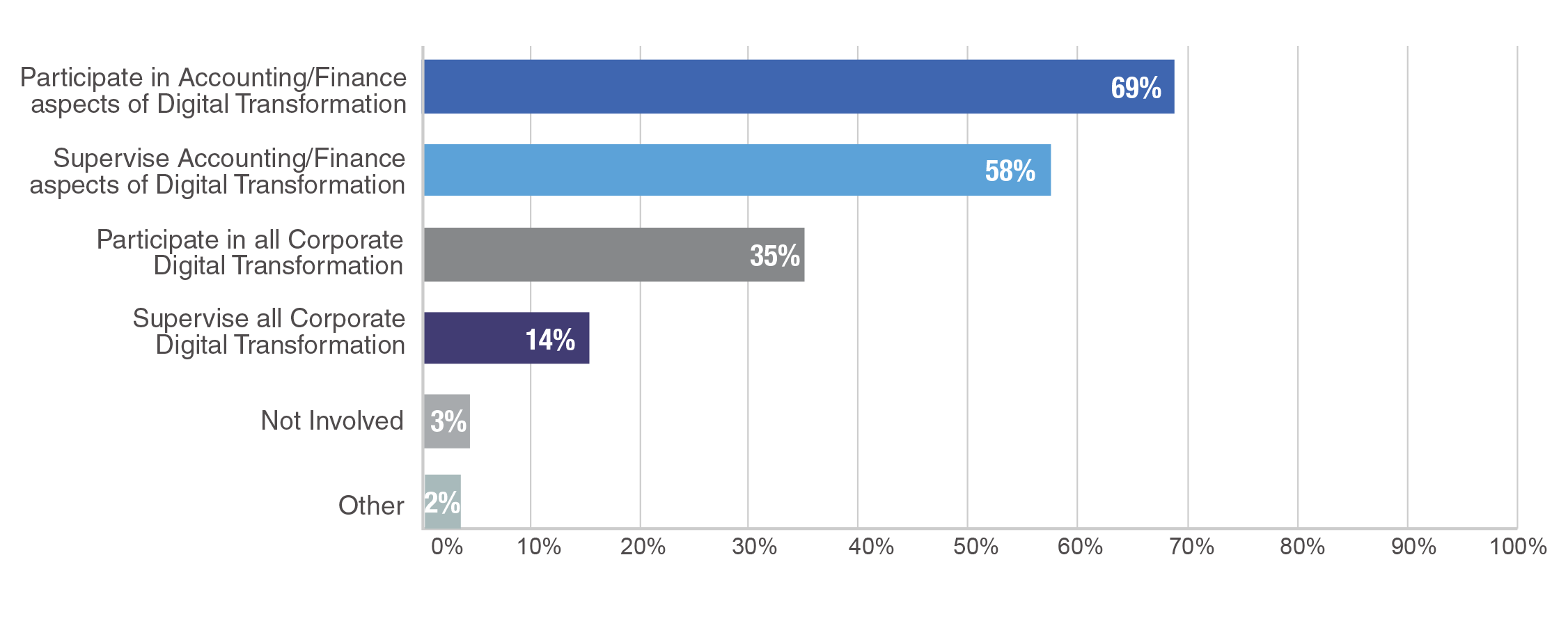

As with the 2021 study, the last question in our study addressed the trending topic of Digital Transformation. Controllers/CFOs continue to drive Digital Transformation in F&A, with almost 70% participating in Finance & Accounting (F&A) Digital Transformation and 58% supervising it; while 35% also participate in Corporate-wide Digital Transformation and 14% supervise all of it.

To view the complete webcast panel discussion, click here.

To download/read/print the 2022 Digital Controller/CFO Study Results Report, click here.

ABOUT THE SPONSOR:

Trintech provides cloud-based software solutions that standardize and automate key processes in the financial close including, high volume transaction matching, balance sheet reconciliations, intercompany accounting, journal entries, close management tasks, disclosure reporting and governance, risk and compliance.

Over 3,500 clients worldwide – including the majority of the Fortune 100 – rely on the company’s solutions to continuously improve the efficiency, reliability, and strategic insights of their financial operations. For more information, visit Trintech.com.