Controllers Council recently held a panel discussion on Transforming Accounts Receivable with AI: Use Cases & Insights, sponsored by Esker.

Esker is a global cloud platform built to unlock strategic value for finance, procurement, and customer service professionals and strengthen collaboration between companies by automating the cash conversion cycle. Founded in 1985, Esker operates in North America, Latin America, Europe, and Asia Pacific with global headquarters in Lyon, France, and US headquarters in Madison, Wisconsin.

Our expert panelist was Dale Phillips, business development manager at Esker. With over 30 years of experience in technology industries, Dale is a true veteran of the digital revolution from telecommunications to cloud-based solutions. He’s mastered a diverse array of technologies.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

AI in Accounts Receivable

How is AI used?

Payment predictions: In automated solutions, predictive analytics forecast when payments will likely arrive. This is based on previous invoices, payments history and other customer data — improving efficiency with collections automation and visibility over incoming cash and AR performance.

Recommendations: Prescriptive analytics help your AR team facilitate better decision-making and accelerate the entire invoice to cash cycle.

Data extraction: AI can be used to automatically capture data from all AR documents to carry out AR processes (e.g., routing the document, matching a payment to an invoice, creating a claim, etc.). This takes the burden off the AR team and optimizes your invoice-to-cash automation efficiency.

Content analysis: Leveraging tools like GenAI can speed up the processing of customer communication by suggesting responses and summarizing lengthy conversation threads. AR teams also benefit from chatbot assistance, enabling them to quickly search for data, generate reports and create graphs.

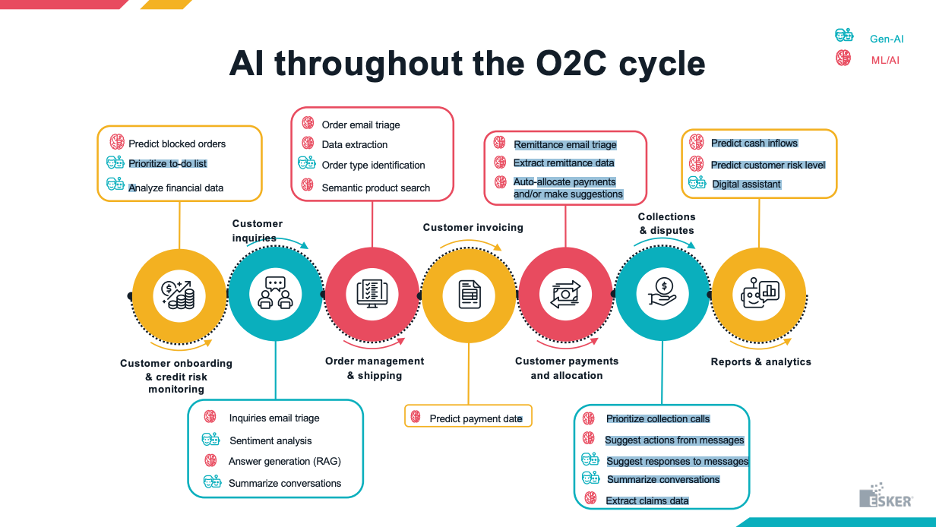

AI throughout the O2C cycle

These are just examples of how AI is put to work within the different AR modules, such as credit risk, customer inquiries, order management, customer invoicing, customer payments, collections, and reports.

AI in Credit Management

In credit management, there’s two sides of the coins in terms of a solution or just in terms of operations and credit management. Part of it’s about onboarding new customers, being able to assess the credit worthiness, establish a credit limit and put them into the system. And then once they’re a customer in the system, it’s about keeping up with the credit risk from that customer. So, one benefit of AI is the ability to be much faster and more accurate with the credit reviews.

We move from reviews to alerts. Credit departments face ongoing large volumes of customer reviews daily, you know, whether that’s customers with blocked orders, credit limits exceeded, credit score alerts coming out, that type of thing. So, the benefit of AI in this scenario is the system prioritizes and sends the alerts to the credit manager that are based on the credit manager’s priorities.

We’ll move then from alerts to suggestions. So, credit term suggestions, obviously AI analyzes customer data and transaction history to recommend optimal repayment terms. It can also, from a perspective of credit scoring and risk management, the AI uses credit risk indicators, which analyzes factors like risk category, exposure, credit limit and internal credit scores to make suggestions.

And then finally, credit worthiness reviews. Let the AI set up the annual credit worthiness review. Now, based on parameters, you can either, you got a choice. You can either have the AI tee up the review and drop it into a queue for an analyst to review, a specialist to review, or you could let the AI approve it.

AI in Cash Application

AI-powered Remittance Management

AI can analyze inbound data from multiple sources to identify associations between payments and open invoices.

You’ve got a bank file, a BAI-2 file, for instance, it’s coming from the bank. That payment information is coming into the system. Your remits a lot of times aren’t in that payment file from the bank. They come in by email. That’s another channel. So those remits are inbound emails and the information there could be either in the body of that email or in the attachment. And you need the AI to be able to read it wherever it is and extract that data wherever it lives in that email.

Then from there, the payment data is automatically potentially downloaded from customer portals. Some customers manually still do that. Others, we can automate that so we can download that.

Automated Allocation & Suggestions

AI-powered Invoice Matching: AI-powered solutions extract data from the payment files (customer name, invoice number, PO, etc.) to identify payer and potential matching customers and invoices and auto-learns from user validations.

Real-time Computation: The solution computes in real-time multiple combinations of payment amounts and related open items amounts, including potential rules (discounts, overpayments, etc.).

Smart Suggestions: When multiple allocations are possible, AI acts as a digital assistant to ingeniously help the user make the allocation.

AI in Collections Management

With collections management, the first thing is analyzing payment performance. It’s about delivering payment predictions based on invoice status and customer payment behavior.

Then in terms of determining customer risk levels needs to be dynamic. If trends are moving in the wrong direction, the team needs to be alerted. The AI can assess the risk levels based on payment predictions and by comparing current and past payment behavior. Now you’ve got three different risk levels in there. It could be normal, it could be high, or it could be critical. And so based on the AI, what it sees, it can dynamically change those risk levels.

Then there’s the priority call suggestions. And again, this is one of the biggest things as we talk with folks is helping their people to be ready and organized, understanding where they’re going to get the most out of their efforts every day in terms of working in collections. And AI can take preset parameters that are built in as you go and that you can change as you evolve, right, as things change. And then the system will dynamically build the to-do lists for each of the collectors and call out any of the special risk levels that they should be paying attention to.

Then you’ve got predicted payment deferments. So hey, sometimes you don’t want to have to pick up the phone. Why spend the time if you really shouldn’t have to? So the AI can see that the customer is going to likely pay within the next three days and it can automatically defer the contact point, pushing it out. And if the payment comes in, great. If it doesn’t come in, then it puts it back in the queue to be followed up with.

The last one is predicting incoming cash. So that’s collections forecasting. And the AI calculates and can predict incoming cash by looking at different payment scenarios. It can look at overall payment predictions, predictions for cash from promises to pay or from scheduled payments for the next 30, 60, 90, or 120 days to deliver insights on future cash flows. And this predictions piece, this is becoming more and more important for our customers, is the ability to predict further future actions.

AI in Claims & Deductions

A claims and deduction solution that’s automated like this, first of all, allows connecting with any of needed stakeholders, and then also organizes all the supporting documentation, the notes, and all of the approval workflows into one area. The AI keeps the process rolling along by matching things like short payments to the supporting documentation and captures customer information, the amount, related invoice number, et cetera, to have all the data the approver will need to make a call on the validity of the claim or the deduction. Or again, depending on the level, if they don’t have the approval level, you have workflows built in that are going to allow that information, everything to forward to the next approver to be able to ultimately approve or deny the claim.

Benefits of AI in AR

Reduce credit risk

- How AI helps: Evaluates customer creditworthiness and flags high-risk accounts

- Benefits: Minimizes bad debt and ensures informed decision-making about extending credit

Improve DSO and collect cash faster

- How AI helps: Predicts customer behavior, predicts payment patterns, ranks overdue accounts by risk level and invoice age, helping AR teams focus on accounts with the highest impact

- Benefits: Maximizes efficiency in collections efforts, shortening the time to recover outstanding amounts

Save time in daily activities

- How AI helps: Automates repetitive tasks, enhances accuracy and allows AR teams to focus more on strategic decision-making and less on administrative duties

Prevent late payments and avoid blocked orders

- How AI helps: Predictive payment analysis, automated payment reminders, enhanced customer communication, dispute resolution automation

Predict cash inflows

- How AI helps: Analyzes historical data, customer behavior insights, credit risk analysis, real-time alerts and updates

To learn more about these strategies, download full webinar here.

ABOUT THE SPONSOR:

Esker is a global cloud platform built to unlock strategic value for finance, procurement, and customer service professionals and strengthen collaboration between companies by automating the cash conversion cycle. Founded in 1985, Esker operates in North America, Latin America, Europe, and Asia Pacific with global headquarters in Lyon, France, and US headquarters in Madison, Wisconsin. Visit https://www.esker.com/ to learn more.