Finance plays a critical role in ensuring organizations continue to thrive. Free up your finance team’s time to carry out more complex and valuable analysis while building knowledge of financial performance across the company.

This year has been critical for many organizations as people transition to working from home, we experienced firsthand how quickly the working environment and economy can change and in turn, how businesses had to adapt.

Why Traditional Finance Processes are not Sustainable

If you work on your business’s finance team, you’ll likely have a hectic workload at the month’s end. For many organizations, the monthly static financial reporting process continues to be arduous, especially if it’s still performed manually.

It’s a time-consuming process and relies mostly on transferring data from the Enterprise Resource Planning (ERP) system (sometimes multiple) into spreadsheets, with lots of switching back and forth.

The process is slow because every adjustment to the numbers makes the spreadsheet-based reports instantly out-of-date, forcing the regular creation of new versions.

Financial data can no longer be siloed in business – the finance team needs to utilize technology to help create the reports so they can free up their time to educate the rest of the company about the actual numbers. People across the business should understand the numbers so they can better serve customers or address inefficiencies in production or warehousing.

Financial Reporting

Companies need to be more responsive and adapt to changes in the market. When markets shift, businesses must act quickly, but people need access to up-to-date data to inform decisions.

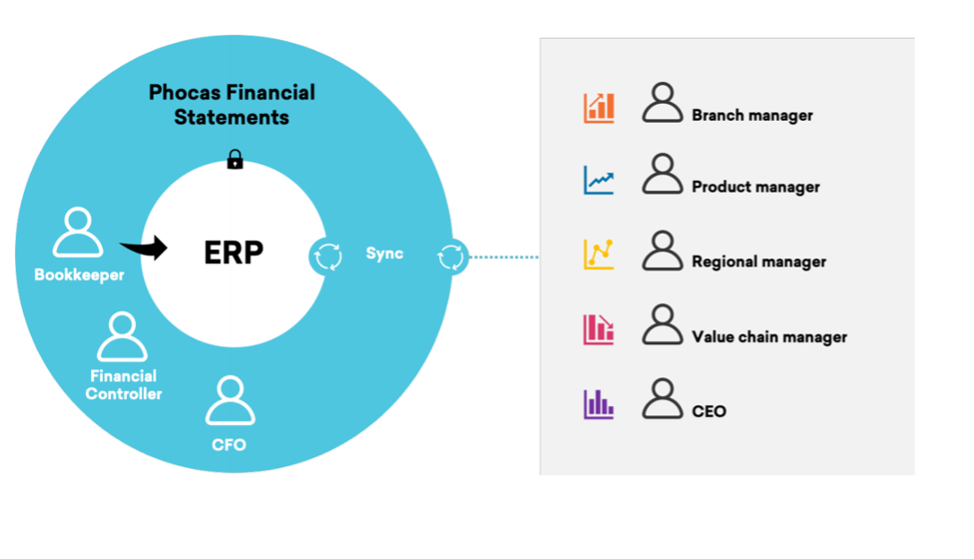

Businesses can use software to consolidate all data into a single source of truth, so that everyone can make decisions quicker and more accurately. Financial data needs to be in that mix because everyone needs to operate with consistent, finished numbers. A modern approach to financial reporting involves an inclusive model where finance still controls the data within the ERP.

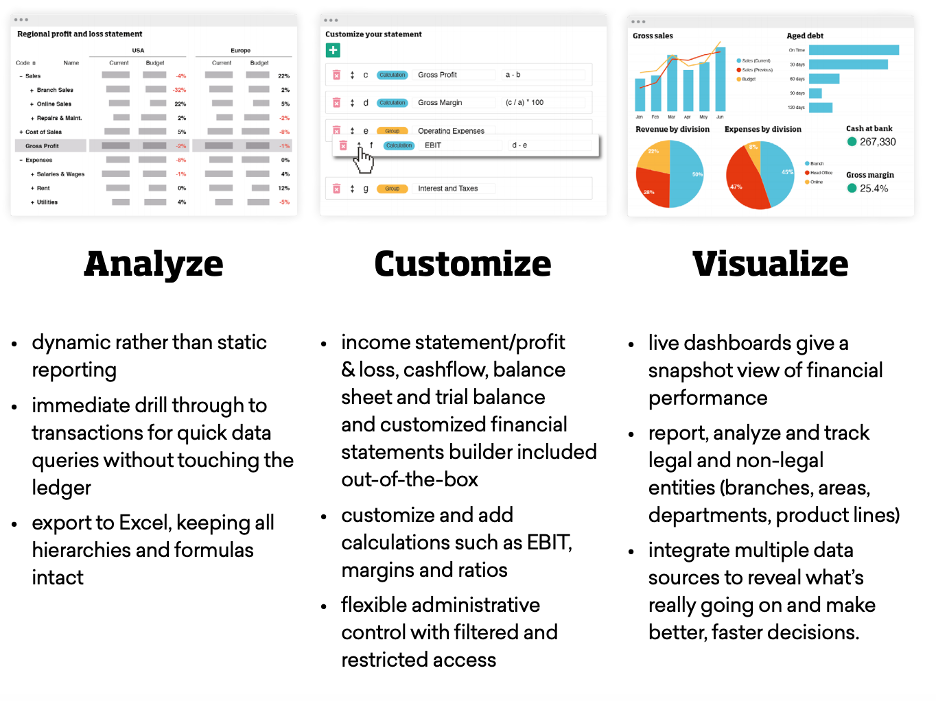

Analyze, Customize, Visualize

It all starts with analyzing the data in the financial statement.

The idea is to empower the user and ultimately make them more accountable for the business units they control.

Where do Excel Sheets Fit In?

Ubiquitous tool is not always fit-for-purpose, especially when preparing month-end statements. You’ll be aware of the common pitfalls of Excel around data integrity, formula errors, user errors and data becoming corrupted. What the Phocas solution has concentrated on is removing the limitations of Excel and using the power of the data analytics solution to carry out data consolidation, analysis and customization, so the preparation of the financial statements is straightforward and replicated quickly and efficiently.

Security and Control

The in-built, user permissions allow the finance team to govern the level of detail each user sees and to control their ability to see sensitive data.

ERP data is usually tightly guarded which is why finance has siloed it and restricted access.

For a long time, the financial numbers were the domain of the accounting team.

By using software that enables sharing profit, loss and variance with other departments means more people can engage and invest in the development of a team’s performance. To learn more about the future of financial analysis, check out this eBook.