Controllers Council recently held a webinar on The Data-Driven CFO: Refocusing on the KPIs That Matter, sponsored by Oracle NetSuite.

Oracle NetSuite is a cloud-based business management platform used by more than 28,000 organizations across the globe. NetSuite seamlessly integrates financial planning, AR, AP, RevRack, tax management, and other core accounting functions with real time financial visibility to improve financial performance. Learn more at netsuite.com and request a free product tour.

Our expert speaker D. Scott Beaver, senior product marketing manager for Oracle NetSuite. Scott has a nearly 20 years marketing experience, so he is a career marketer and he’s had experience in a number of different types of organizations from startups to large enterprises.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

How to Define Metrics

when you begin to define the metrics for your business, the very first thing you need to do is start with the end in mind. Another favorite book, The Seven Habits of Highly Effective People. Begin with the end in mind. So, what is my intended result? If I’m going to measure something, why am I measuring it, and how is it going to contribute to the success of my business, my department, what have you, or even my own job? So, start there with my intended result and a target number ideally.

Then number two is to understand that there are other measures that I might want to use. So, once you define the results you want, you should be able to come up with a list of a lot of potential other measures that you could use to track performance against each one of the results you’ve identified. Again, if you’re interested in learning more about potential metrics, I highly suggest you pick up a copy of the Balanced Scorecard. And I also recommend the American Productivity and Quality Center apqc.org.

So, after you understand there’s alternative measures, then you need to select the right measurements for each objective. You’ve got this long list of things you could use to measure your performance against results, but what are the right ones. It’s what gets measured gets managed. And it’s now time to really narrow down all those potential measures that you’ve identified in the previous steps and select just those that feel like are best reveal how strategic performance is improving, whether it’s worsening or staying the same.

Once you’ve done those first three steps, the next step is to define the composite indices that’s needed. And what I mean by that is you may have several KPIs that relate to a specific outcome. There are a lot of different ways of looking at profitability for instance. Obviously, there’s gross net margin, but you may want to look at product lines or categories just as an example.

Then, you need to set very specific targets and thresholds for performance. I know what my intended results are, I’ve come up with all different sorts of ways of measuring those results, measuring my performance against those outcomes. Now I’ve got to make sure I set targets. So, it’s not enough just to measure. You’ve got to say, here’s what I’m going for, here’s the thresholds, here’s the minimum performance I’m willing to accept. Here’s my ideal target, et cetera. So, make sure you set those targets and thresholds.

And then finally you need to define, document, and communicate what those selected performance measures are.

Metric Categories

Now there are a lot of different categories of metrics that you should consider and again, it’s going to vary by company, which ones you use, but these are the most common categories:

- Financial Efficiency

- Cash Flow & Liquidity

- Departmental Performance

- Asset Utilization

- Capitalization/Solvency

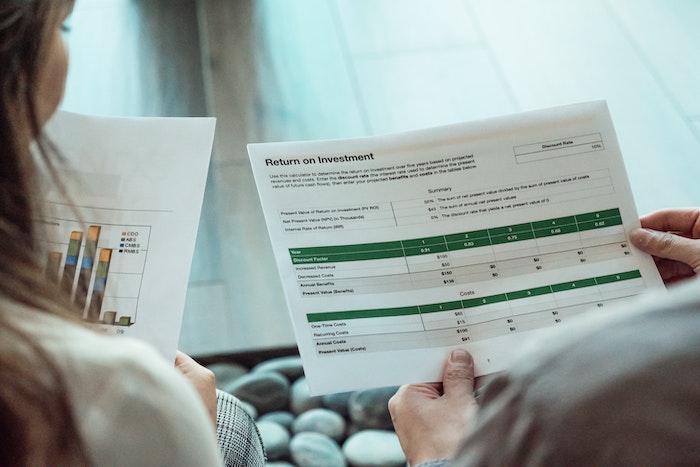

- Return on Investment (ROI)

- Market Performance (if publicly traded)

Financial Metrics Every CFO Should Track

NetSuite, this isn’t a sales pitch, but they do have a research group within our company that speaks to CFOs, controllers, senior accounting personnel, across our over 32,000 customers. So, several times a year they’ll do research on what’s happening, what the different trends are/ and this is from one of our more recent papers on business metrics. The things that are most important to most CFOs, controllers out there are going to be operating cash flow, metrics around accounts receivable, working capital, obviously gross margin is always important, current AP, and then my net profit.

12 Key Financial Metrics

Here are 12 critical financial metrics that every CFO or controller should be aware of:

- Gross Profit Ratio

- Net Profit Ratio

- Return on Assets (ROA)

- Return on Working Capital

- Current Ratio

- Quick Ratio

- Days Cash on Hand

- Receivables Turnover

- Days Sales Outstanding (DSO)

- AP Turnover Ratio

- Interest Coverage Ratio

- Cash Generating Power Ratio

Finance Department Performance Metrics

Here are 6 finance department performance metrics:

- Days to Close: How long does it take your business to close? The last report says on average it takes companies that are the best performing the top performing companies on this metric about four and a half days to close. And the worst performing companies are taking 10 days or more.

- Headcount Ratio: That’s the ratio of accounting staff to your overall staff.

- Transactions Processed per Person: What does it cost me to process and pay an accounts receivable, or what does it cost me to generate and send a customer invoice and to close that out?

- Cost per Transaction: What does it cost me to process and pay an accounts receivable, or what does it cost me to generate and send a customer invoice and to close that out?

- Reporting Error Rate: This is sometimes a manual calculation, but how often do I find errors in my primary financial reports before obviously sending them out, particularly if you’re a public company, that should be error free.

- Time Allocation: Looking at how they allocate their time to the sort of administrative activities versus things like data entry versus adding value by analyzing data to look for trends, et cetera.

To view the complete webcast panel discussion, link to the video archive here.

ABOUT THE SPONSOR:

Oracle NetSuite is a cloud-based business management platform used by more than 28,000 organizations across the globe. NetSuite seamlessly integrates financial planning, accounts receivable, accounts payable, revenue recognition, tax management and other core accounting functions with real-time financial visibility to improve financial performance. To learn more, please visit www.netsuite.com to request a free product tour.