Accounting: Business critical work with shrinking resources.

Accountants and controllers have a far-reaching and consequential job — they’re responsible for many moving parts at a business, and they have a duty to keep things running smoothly, in policy, and within budgets.

But pressure on controllers continues to build. Federal, state, and local tax compliance is a constant obligation; reporting and visibility are their day-to-day purview; the close process is a continuous undertaking; and now for the last several months, accounting leaders have been working through the ongoing accountant shortage.

The mandate of doing more with less.

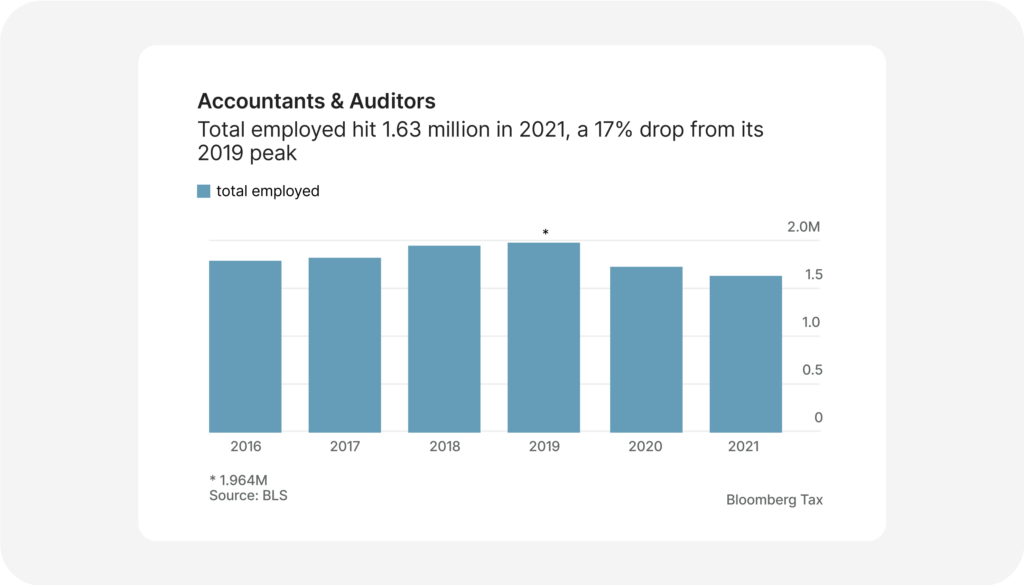

Demand for accounting services remains high, but for the past several years, there have been fewer accountants to meet the growing need. The total number of employed accountants and auditors declined 17% from a peak of nearly 2 million in 2019 to just 1.63 million in 2021 (see fig. 1).

Fig. 1: Resignations, retirements, and fewer accounting graduates drive the accountant shortage. Source: Bloomberg Tax

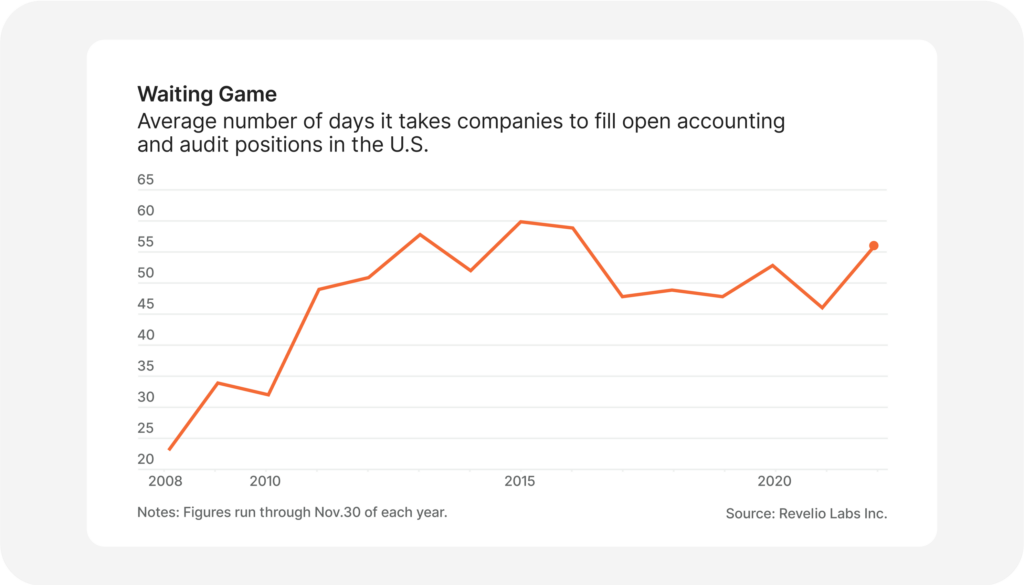

Aside from career accountants retiring and fewer graduates entering the profession, there’s the third obstacle of training time associated with new hires. It is already taking longer for businesses to fill open positions — as long as 56 days on average in 2022 (see fig. 2) — but once those accounting and audit positions are filled, it can take just as long, if not longer, to train those new hires on your systems and procedures. The longer it takes for an employee to join your accounting team and begin adding value, the greater the additional strain on the organization.

Fig. 2: Filling open accounting roles is taking longer and becoming more difficult as the shortage continues. Source: WSJ

What does all of this mean for CFOs and other finance leaders? For some, it means offering higher salaries and bigger bonuses — greater spending on the employees they hire to entice the best talent. For others, it means turning to temporary workers, outsourced help, or interns. For just about everyone, it involves attempting to do more with less, and everything that entails.

Fortunately, there are solutions to this shortage within view that we can consider; we identify and define three of them in this paper.

The three levers you can pull to address the shortage.

To overcome these challenges, there is an age-old formula for the three ways to approach a solution: people, process, and systems. This framework boils down to the same three questions for every organization: who is doing the work, how are they doing it, and what tools are they using to get it done?

Asking these three questions can help accounting teams identify actionable ways to do more with less, which is especially important in a macroeconomic context like the one we find ourselves in now. Higher interest rates are making it more expensive to borrow and raise money, inflation is making goods and services pricier, and as we’ve already discussed above, finding individuals to do the work is getting more difficult in a constrained labor market.

Below, we go into depth on each pillar and how they can be deployed effectively within an organization to meet some of your biggest challenges.

People: the first line of defense.

Leaders often look to their people as their first resource to solve a problem. You’ve built a team of smart, dynamic problem solvers, and you can focus on ways to use them more strategically to cover the gap in accounting staff.

Here are some people-related ways to solve the shortage and the pros and cons of each:

1. Tapping your current team.

The people you have are a powerful resource to draw from. Talented finance employees can find creative ways of working, discover cost savings, and collaborate to build effective solutions.

In the case of the accountant shortage, though, overutilizing your existing team can have its limits. The lack of trained accountants could pose risks of audits, late filings, accounting errors, and possible SEC fines — and if you struggle to find new finance employees to fill the gaps, you may be forced to run a decentralized finance function. You end up asking every single person in the company to correctly select the right code for each expense and to make sure they’re staying in policy on their own. If someone takes a client to lunch, for example, it’s now their job to ensure they categorize it properly.

Your accountants and auditors don’t always have to be your first line of defense, but if they aren’t, certain aspects of their work shifts to other employees in the organization who may not necessarily be trained on the risks and requirements of ensuring compliance.

2. Outsourcing.

In early March of 2023, Brex hosted a roundtable discussion among finance leaders from a variety of companies, and one of the challenges we heard most frequently was that many teams are still using manual processes, and were forced to turn to outsourcing to meet all of their needs.

Outsourcing can be a helpful solution for a situation like an accountant shortage. In some instances, it can be less expensive than hiring new workers. It’s also a quick fix that brings in new capacity right away without the ramp-up needed for training new hires.

However, outsourcing also has its risks. First and foremost, you have less control over an outsourced team, and they may be less responsive to your needs if they have multiple clients. Sharing company financial data to a third party also increases the number of people who transmit and review the books, which could introduce security and compliance complexities.

3. Hiring new employees.

If you have a new product, company initiative, or greater volume, the first question you’re likely to ask is, “Can I get headcount for this?” But as we noted above, that’s easier said than done given the current labor shortage. The real question is, when or if you get that eventual “no,” how do you handle it?

The next question you have to ask yourself ends up being, “Are my processes and systems perfect and I just need a body? Or is this a brand new scope of work that can’t be absorbed by the existing team?” Throwing a new hire at the problem may be a quick and dynamic solution that alleviates some pressure from the rest of the team, but it may not always be the best course of action.

New headcount is expensive for a business — labor costs can account for as much as 70% of total business costs, including employee wages, benefits, payroll, and other related taxes — and that cost is only going to increase as the macro environment shifts and inflation continues. Plus, the time to train new employees then comes into play, as we covered previously.

When you add all this up, people are an incredibly powerful resource to draw from when you have a challenge and are one of the foundational pillars of any successful business. But people alone can’t solve every problem — especially when a shortage of people is the problem.

Process: how to do what you’re already doing — but better.

The next lever for doing more with less is process, or how people get work done. Good process helps to optimize the way employees work, making them more efficient and reducing redundancy in their tasks.

At Brex, our accounting leaders take the following factors into account when making decisions about process:

1. Focus on processes that matter.

Don’t waste time on process for process’s sake. In our own accounting function, we perform risk and materiality assessments so we know exactly what to focus on. As Brex controller Kevin Moore says, “We have to battle our natures as accountants or auditors where we say ‘It has to reconcile to the penny,’ and then you’re working 150% of your capacity and you’re burning yourself out.” Part of this focus means knowing the right granularity of data that the rest of the business needs to make the best decisions.

2. Consider your stakeholders.

It’s important to orient your processes around what will have the most impact on decision-makers’ abilities to steer the business. “The one thing that I learned coming to Brex and being in the industry for the last four years is that I really have a much better understanding of who the stakeholders of the financial information are: management,” says Erik Zhou, Chief Accounting Officer at Brex. “Figuring out what’s going on with their business, where are we succeeding, where are we failing, where should we invest more, and needing the data to inform the right decisions for the company.”

3. Get the timing right.

Is there too much work in too short of a period of time? We take precautions to “flatten the spike,” or reduce peak workload times, such as by holding interim audits for example. After every month-end, the first two weeks of the following month is crunch time — the window when finance teams are making sure the record is correct. Instead of waiting until the end of the month, we do the work to flatten the spike before crunch time gets too crunchy. “As we’ve carved up our general ledger and looked at all the business processes we have out there,” Kevin adds, “I’m looking at certain things and asking if it really makes sense to do 100% of our work right at the month end, or are there tasks we can pull forward a week or so just so that it isn’t this mad scramble at the end of the month where I’m doing all of my accounting.”

4. Automate processes where possible.

As part of flattening the spike, we employ the principle of continuous close: using automation to ensure the books are up to date at any point in the month. This ties into the tremendous benefits of systems, which we’ll talk about in our next section.

Process automation can help employees work better by reducing uncertainty and streamlining their day-to-day work. Plus, having good process in place can help make the profession more desirable for college grads to go into, because they can be confident they won’t end up at a company where they’ll be asked to work long hours reconciling expenses every month.

However, good process only goes so far. A company could have the best processes in the world and still lack the right people or technology to take full advantage of them. That’s where great systems come in to put all the pieces in place.

Systems: the glue that keeps everything together.

Technology is the ultimate supercharger — people can use technology to implement processes, but technology can also replace people entirely in situations where automation comes into play. With the right systems in place, everything comes together to enable businesses to grow and scale.

Of course, as a SaaS company, we at Brex have a vested interest in how great systems can enable people and businesses to achieve great things. We built Brex Empower to be a unified spend platform that automates processes and creates a closed-loop system that alleviates the accounting burden. We’re confident in our tools because we practice what we preach — we use our own technology to manage our travel and expenses.

The key considerations you’ll have to keep in mind before choosing a new SaaS solution include:

- What is the cost of the system compared to the cost of headcount?

- What’s the need you’re solving for and can it be addressed through other means?

- What does system implementation and ongoing administration look like?

- When is the right time to switch systems, or when is the right time to switch from a manual process to an automated one?

Overcome the accounting shortage with the right tools and a forward-thinking mindset.

Whether the shortage of accountants and auditors is a short-term or long-term problem, controllers have an opportunity to turn a current challenge into a prolonged net benefit. The investment in a unified spend platform that streamlines and automates many workflows — including accounting — can enable the long-term efficiency of your company’s spend management, but it also reflects a spirit and perspective that’s centered on growth and scale in the face of considerable odds.

At Brex, we’ve created a leading all-in-one solution that empowers employees anywhere to make better financial decisions.

With Brex Empower, you can:

- Free up your team with an unparalleled set of automatic classifications and enable continuous reconciliation by automatically syncing your Brex data across systems in real time.

- Create a better experience for your teams and build a cultural shift that lifts finance and accounting up as strategic partners rather than receipt chasers.

- Drive 100% compliance with built-in expense policies, auto-generated receipts, and automated reminders.

- Save time by proactively approving spend (vs. chasing it later) so employees stay compliant without excess oversight.

Visit brex.com to learn more.