As we put a wrap on what was an incredibly dynamic and busy year, the last thing that most controllers and finance teams want to think about is sales tax. But know that 2024 was busy when it comes to sales tax law changes, and it is worth recapping just a few of the bigger moves that we saw this year.

It has been 6 years since the landmark South Dakota v. Wayfair decision created the concept of economic nexus. And in the years since, there has been an incredible amount of change for online sellers. Several states made notable adjustments to their sales tax frameworks, especially in areas like SaaS taxation and economic nexus requirements.

As we approach 2025, these shifts are setting the stage for further legislative changes. Let’s dive into 2024’s key developments and explore what might be coming next.

SaaS Taxation Expands in 2024

One of the most significant developments of 2024 was the growing number of states extending sales tax to software as a service (SaaS) and other digital products.

Louisiana and Vermont were standouts, implementing comprehensive legislation that brought various digital products into the tax fold.

Key Changes in Louisiana

H.B. 8 expanded sales and use tax to include digital products like:

- Digital audiovisual works

- Digital audio works

- Digital books

- Digital codes, applications, and games

- Digital periodicals and discussion forums

The law also applies sales tax to “any otherwise taxable tangible personal property transferred electronically,” including maintenance, updates, and support.

Additionally, H.B. 10 increased Louisiana’s state sales and use tax rate to 5% from 4.45%, effective January 1st.

Key Changes in Vermont

Vermont also implemented sales tax on SaaS and certain digital goods, aligning with the trend of taxing subscription-based services. This legislation reflects a broader push to modernize state tax codes to include the digital economy.

H.B. 887 expanded the definition of “tangible personal property” to include remotely accessed prewritten software as of July 1st. Up until this point, SaaS had been exempt under a 2015 exemption.

If you are selling SaaS to customers in Vermont, and you have nexus, either physical or economic, you now need to charge sales tax. In Vermont, economic nexus means having $100,000/year in sales or 200 transactions within a 12-month period.

Implications:

While these shifts generate significant revenue, they create new challenges for businesses that need to account for SaaS taxation in states like Louisiana and Vermont. Companies will need to ensure compliance with these regulations, especially if their transactions include any of the listed digital goods or services.

Jurisdictions are Looking for Additional Revenue

While Louisiana and Vermont are the latest states to enact a state-level tax on SaaS, others are signaling their intentions to follow suit. Virginia, in particular, is a good example of a state that is looking to generate additional revenues with new taxes on software and digital goods.

Virginia’s Discussions on Digital Product Taxation

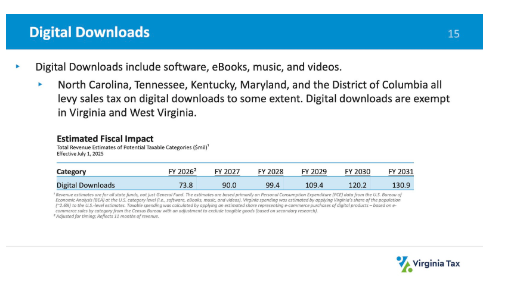

Although Virginia lawmakers ultimately excluded SaaS and digital downloads from the revamped 2024 budget, the topic remains under active consideration. In October 2024, Virginia’s Joint Subcommittee on Tax Policy discussed the potential fiscal impacts of taxing digital downloads:

- $73.8 million in revenue projected for 2026

- $130.9 million by 2031

Implications:

Governor Youngkin’s push to “modernize” the tax code suggests that SaaS and digital products could be on the table for taxation in the near future. Businesses operating in Virginia should prepare for potential legislative shifts by monitoring updates closely and ensuring their tax compliance strategies can accommodate these changes.

And It Isn’t Just the States

In December, Chicago passed their new budget, and in order to fill a $1 billion deficit, the city decided to increase its tax on “cloud computing,” which includes software and digital products.

Chicago is an interesting city in that it is one of the few that tax cloud computing and software under what is known as the Personal Property Lease Transaction Tax. While Illinois, at a state level, doesn’t tax SaaS, for example. The tax rate increased from 9% to 11%.

Simplification of Economic Nexus Thresholds

In 2024, some states simplified their economic nexus rules by eliminating transaction thresholds, making compliance slightly less complex for remote sellers. Tracking nexus thresholds and exposure has always been challenging, especially for ecommerce businesses.

Wyoming, North Carolina, and Indiana were among the states leading this trend.

Key Changes:

Wyoming (HB0197), North Carolina (House Bill 228), and Indiana (Senate Bill 228) all removed their 200-transaction thresholds, replacing them with a straightforward $100,000 sales threshold.

Implications:

For remote sellers, these changes simplify compliance by eliminating the need to track transaction volumes. However, the dynamic nature of sales tax laws still presents challenges for maintaining administrative compliance across multiple states. Businesses must remain agile and equipped to adapt to such legislative changes in real-time.

Looking Ahead to 2025

As states look to close perceived “tax loopholes” and generate incremental revenue, more jurisdictions may follow Louisiana’s lead in taxing digital products and services. With a growing reliance on subscription-based business models, the SaaS sector will likely continue to be a focal point for policymakers.

Key Predictions for 2025:

-

- Expansion of SaaS Taxation: More states may introduce legislation to tax SaaS and digital products. States like Virginia, which are already discussing this, could take action in the coming year.

- Streamlined Nexus Compliance: Additional states might simplify economic nexus thresholds, removing transaction-based criteria and focusing solely on sales revenue thresholds.

- Increased Compliance Complexity: As new laws emerge, businesses will face increased administrative burdens to stay compliant across diverse state regulations.

- New Software and Tools for Compliance: The sales tax compliance tooling space is changing, and a number of startups are building innovative and new solutions for getting compliant, staying compliant, and automating some of the more mundane tasks.

Final Thoughts

2024 marked a pivotal year in sales tax evolution, with notable changes in SaaS taxation and nexus requirements. As we look to 2025, businesses must remain proactive in understanding and adapting to these changes. Whether it’s navigating new SaaS tax laws or streamlining compliance with economic nexus thresholds, staying ahead of the curve will be crucial for success.

Nate Matherson is the Head of Growth at Numeral, an all-in-one solution for sales tax compliance. Before joining Numeral, Nate started 2x venture-backed startups: YC W16 and S21.