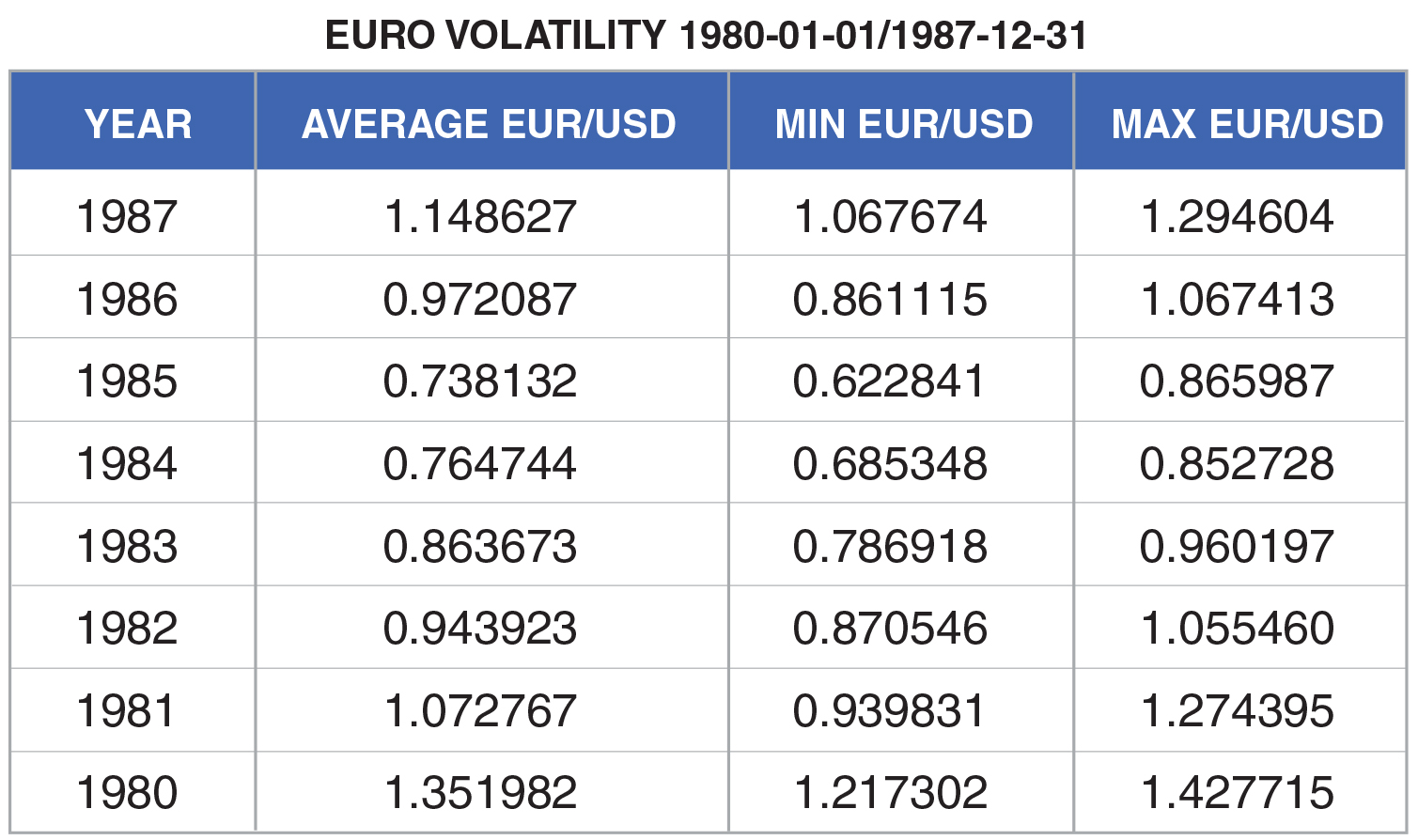

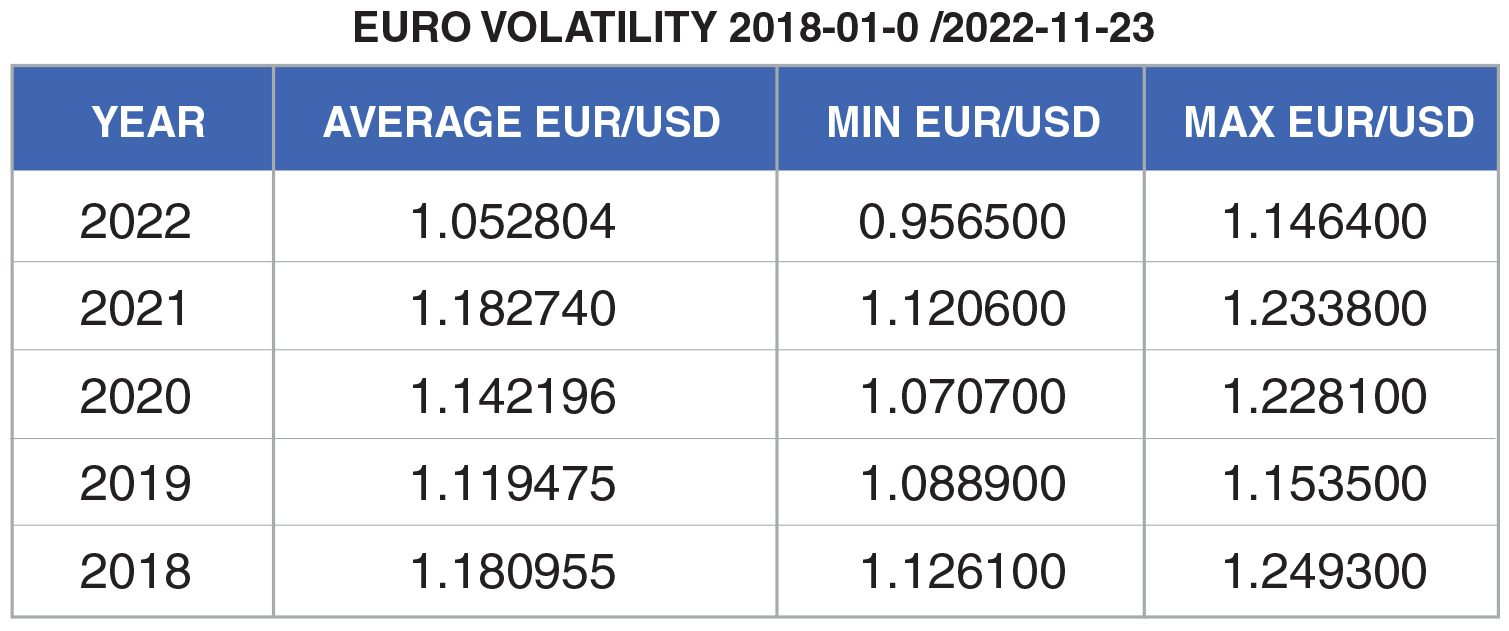

Not since the 1980s have we seen the type of exchange rate volatility in the world’s major currencies that we’ve seen recently. (see volatility charts below for 1980s and recent)

For example, just in the past three months the Euro has fallen 3.46% against the US dollar. Also during that time, the British Pound crashed upon new fiscal policy announcements, falling by 3.6% in a single day. According to Politico, this was the fifth worst one-day fall in the last four decades. It was topped only by market adjustments to COVID-19, a significant episode in the 2009 financial crisis, Black Wednesday (when the pound was forced out of the European Exchange Rate Mechanism) and the Brexit vote in 2016. (https://www.politico.eu/article/british-pound-crashes-to-all-time-low-in-5-charts/)

There are so many reasons for exchange rate fluctuations. For the EU, this follows from the fallout of the Russian invasion of the Ukraine, a slow start to interest rate hikes by the European Central Bank (ECB), persistent inflation, and rising energy costs…to name a few factors. In the UK, the mini-budget announced by Chancellor Kwasi Kwarteng, promising wide sweeping tax cuts shocked financial markets into a tail spin. In the face of rising interest rates, how the UK was going to finance spending was the issue and whether they could reasonably sustain more debt. This of course saw investors fleeing for safer ground in the US dollar.

The Controllers Council asked three experts about the impact of foreign exchange (FX) volatility on US companies and their recommendations for improving FX management:

US interest rate increases have attracted foreign investors not only from the UK and EU, but from around the world, putting even more downward pressure on currencies in countries that can’t meet the same type of premiums the US is offering. For companies buying inventory overseas, a stronger dollar is naturally good. However, for exporters with foreign currency receivables…. not so much.

FX hedging and forecasting:

As any CFO, Controller or Treasury manager knows, foreign exchange risk can play havoc with revenues, margins, budgets and profitability. Predicting foreign exchange movements is pretty near impossible, so most finance executives will enter into some form of forward exchange hedge, not only to potentially minimize the pain of a transaction/translation loss, but to have some basis for understanding what their pricing structures and operating budgets need to be a year in advance.

Pierce Kohls, CFO of Tente Casters US, a German headquarter manufacturer serving the global medical equipment, furniture and automotive sectors, buys most of his supplies from their facilities in Germany and keeps a very close eye on the Euro these days. “We’ve really reached the limit of increasing the prices of our product, so I have to be very careful to manage input costs. Since much of their supply is purchased in Euros, he adds, he hedges that currency with a 12 to 24 month forward contract. “I typically hedge 50% of my exposure,” Kohl says. “So, if I were buying Euros for February 2024, I typically would buy half of my needs 18-24 months out, and the other half 12-18 months out. That’s another thing I do to help mitigate currency fluctuations.” Kohls also uses sophisticated Business Intelligence technology to tell the whole FX volatility story. With reports built into their BI system, Kohls can easily access information on how their margins have changed with a change in the price of the Euro, down to the specific customer, sector and specific product.

FX exposure and buying or selling a company

When it comes to buying or selling a company, foreign exchange exposures can have a significant impact on valuations, explains Dr. Howard Johnson, Managing Director at Kroll Corporate Finance, a global consultancy firm. For example, operating FX risk will be embedded in the costs of goods sold, and, if a company is an importer, goes right to profit margins. Many companies under-manage their foreign exchange exposure, he adds, leaving themselves open to both realized and unrealized foreign exchange losses, which will impact earnings per share and other profit measures. For US exporters, if their receivables are foreign currency denominated, they’re likely booking more unrealized exchange losses due to the strength of the US dollar, he notes. When it comes to the valuation of a company, any unhedged unrealized loss is considered an expected future reduction in cash flow which may or may not reverse itself. In addition, when it comes to accessing capital, says Johnson, the way company’s manage foreign exchange could impact their financial covenants. Many of the banks will consider unrealized exchange losses on FX contacts as a liability that factors that into a company’s borrowing base, Johnson explains. He strongly recommends that the CFO or controller look at their bank covenants to see how things like debt to EBITDA are defined and whether debt includes unrealized losses on foreign exchange contracts. Finally, he adds, if a US based multinational has a foreign denominated subsidiary that’s located in Europe, the sub is likely depressing earnings right now and that can show up as a real loss to the US parent.

The broader FX impacts on US companies:

It’s not just the financial management of foreign exchange that company executives need to think about, says Dr. Donald Lessard, MIT Sloan professor of international management. Treasurers and finance managers also need to understand the potential impacts of a change in currency values on the competitive landscape and other aspects of business risk, he says. “Let’s assume that you’re in a sector where your competitor suddenly has 20% lower costs relative to what they were a year ago. That will have strategic implications for your company, perhaps even shifting production to that region if possible. It’s a question of where you operate, where they operate, the effective currency of your revenues, and what the effective currencies of your costs are,” he comments.

Top FX Recommendations from our experts:

- Pay attention to operational as well as transaction risks associated with FX currency volatility.

- Best-in- class FX management includes building the capacity to understand FX volatility exposure by product, sector and customer.

- Re-examine your bank covenants in relation to unrealized losses on FX contracts.

- Understand the impact of currency fluctuations on your competitive landscape and factor those into your strategic decision making.

Source: FXtop.com

Source: FXtop.com

Relevant Resources:

Volatile Exchange Rates Can Put Operations at Risk (Harvard Business Review)

How International Inflation and Currency Fluctuations Affect Todays Businesses (inflationdata.com)

How Do Exchange Rates Affect a Business? (Market Business News)

Why Is The Euro Falling? Here Are Four Factors Driving The Currency’s Slide (ibtimes.com)

Neil Brown is Executive Director of the Controllers Council, author and a professional association manager. Neil is CEO of the Chief Executives Council, COO of the Operations Council, VP Partnerships for IT Executives Council, and Chief Marketing Officer of Modern Marketing Partners. Neil started his career as a Brand Manager, then promoted to CMO. Brown has provided marketing services to leading Fortune 500 and start-ups, along with board and volunteer roles with non-profits. Neil is a frequent speaker, author and contributor to Advertising Age, Marketing News, Adweek magazine and many others. He is author of two books including “Breakthrough Branding: Brand Naming Tips & Trade Secrets”, and “Tools of the Trade: Modern Marketing for Construction Brands”. Brown earned an MBA from Northern Illinois University, and a BS-Marketing Cum Laude from Southern Illinois University.