Controllers Council recently held a Roundtable Panel Discussion on the hot topic of Managing Finance and Accounting in the Great Resignation, sponsored by Oracle NetSuite.

The panel featured four panelists: Brenna Albert, John Baule, Jennifer Pinder, and Bob Lindeman. Neil Brown, Controllers Council Executive Director moderated.

Brenna Albert, EVP and corporate controller at Cresco Labs, a vertically integrated cannabis and medical marijuana company that went public in 2018. Brenna was recently recognized as the Controllers Council 2021 National Controller of the Year.

John Baule, CEO of FutureView Systems and former CFO for 35+ years, and a regional finance director for Bristol Myers Squibb with two New York Stock Exchange IPOs under his belt. FutureView Systems is a software solution for ERP data extraction, integration, and automation along with turnkey financial planning testing analysis tool.

Jennifer Pinder who’s controller of Watchdog USA, a real estate project management service, and formerly a controller at REEF Technology.

Finally, Bob Lindeman is managing director of The Overture Group, an executive search and compensation consulting firm specializing in corporate finance. He’s a former partner of top 10 accounting firm RSM McGladrey, now RSM.

Following are key highlights to the Roundtable panel discussion. If you are interested in learning more, download the full webinar here.

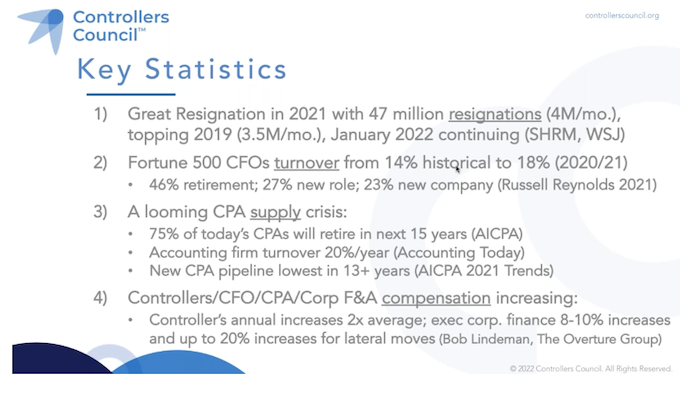

Brown kicked off the panel with some key statistics from 2020 to 2022.

Next, Brown posed a number of questions to the panel starting with the Roundtable title;

What have you experienced as Controllers/CFOs/CEOs with the Great Resignation?

Brenna Albert: When we started out, Cresco Labs had about five people in finance, and now we’ve got about 120 people. The controllership organization is quite large. A part of that reason is because we’re lacking certain automation that maybe more mature companies have. What we’re seeing is that folks who we brought in because of their entrepreneurial mindset, high risers, ambitious folks. So, they can potentially go to a company where, “Hey, things are automated. We don’t need to build everything from scratch.” Which really… Focusing on keeping on folks engaged and helping them kind of see the light at the end of the tunnel with automation coming down the pipeline and the maturation of our company. But certainly, we’re not immune. I mean, we’re kind of a cool industry, right? You think we can easily attract new talent, but it has been quite challenging. We’ve experienced some turnover; we’ve done some reorgs to kind of help elevate folks. We have a lot of promotions that we’ve done as the needs of the business have grown over the last four years. Being a post-startup, we had a fun environment and then the pandemic, right? We’re mostly working from home even now so we’ve experienced more turnover since the pandemic began, and particularly I would say in the last few months with the Great Resignation.

John Baule: For my firm where we provide financial services, FP&A services and sometimes interim CFO services, it’s actually worked really well because what you find is searches for CFOs, we tend to work with a lot of companies that are in that $20 to $120 million range.

Jennifer Pinder: From my experience and finance professionals, I feel that burnout and frustration are the two main drivers for the Great Resignation. Many organizations had to pivot during the past two years to remain viable, they had to adapt services or change staffing, and these always seem to have a trickle-down effect that fully lands in finance. Finance often ends up having to backfill these and often it’s also low value tasks that they’re having to take on their already full plates so the professionals.

Neil Brown: What’s happening with compensation?

Bob Lindeman: With respect to controllers, probably four- or five-years age, we started seeing the increases of base salaries for controllers, running at about 2X the national average for managers and executives. Managers and executives were really running around 3%, and it really started pre-pandemic. They were running about twice that amount, and that’s continued through the great pandemic. Also, what we’ve seen is when people and for people in their current roles, were people switching. Normally pre-pandemic, you would see people leaving for maybe 3, 5, 10% for a lateral move, no promotion, controller to controller. What we’re seeing now is 8 to 10% increases on average, and sometimes as high as 20% for lateral moves. That gives an indication how hot the market really is for controllers.

Neil Brown: What are Best Practices for Staff/Executive Retention?

Bob Lindeman: Retention goes hand in hand with compensation, but one of the reasons you are seeing a drop in retention is the remote working. You can live in one state, but work for a company in another state for more compensation.

Controllers’ base salaries are running at about 2X the national average for managers and executives. You are now seeing more long-term incentive plans for C-level, especially for retention value.

The number one reason why people leave a company is because they have a bad boss, which ties into a toxic or not-so-great culture. To fix this, you can get that boss coaching, or you need to take them out of this role.

The second thing is you need to make sure that your culture supports your strategy.

You can have your employees take a retention interview which is 5 or 6 questions about the work environment, such as “what would make you leave,” “what would make you stay,” and “what would make your job more rewarding.”

Another thing you can have your employees take is an engagement survey. This allows you to make sure your turnover is low, and employees are engaged.

The keys to retention are training, compensation, and communication.

Neil Brown: What are best practices for Staff Training?

Jennifer Pinder: One of the best practices is you should set your team up for success. Your employees need the tools to get the job done. They want to work on rewarding tasks.

A lot of the times, training is more concepts than questions. People are willing and able to get the answers themselves if you just give them the right tools.

Bob Lindeman: Remember, “If you really want to retain people, make sure that you’re helping them build their resume.”

Neil Brown: What are best practices for Staff Recruitment?

Brenna Albert: A lot of staff recruitment is done on Crystal Network, LinkedIn Outreach, internal recruiting teams, and external recruiting firms.

Bob Lindeman: When recruiting:

- Think outside the box

- Look for employees with strong capabilities in your market

- Don’t forget employee and board referrals

- Don’t overlook networking groups, professional groups, and job groups

Neil Brown: What are best practices Staff Performance or Compensation Reviews?

John Baule: Performance reviews used to be a one-way street. Think of them more of a performance partnership, a discussion, “How can I make you a better… How can you achieve whatever your respective ambitions are?” Then two, really separating out what the ambitions of that individual are in the role. What do they want out of it?

Jennifer Pinder: A performance review is now more of an opportunity for two-way feedback, and it has become a valuable opportunity. It’s so important as leaders that we are thoughtful about soliciting that feedback.

The great resignation is happening in corporate Finance and Accounting departments across all company types and sizes. From Controllers and CFOs to accounting and finance staff, the great resignation is taking place. Statistics show large numbers of retirements, and a shortage of experienced and new CPAs. Each trend driving up compensation and causing more turnover.

Corporate Finance Panelists All Spending More Time on HR/Talent

Managing corporate Finance and Accounting has never been more challenging. Achieving success will require best practices in retention, training, compensation, recruitment and more. Technology certainly has a role in attracting and retaining top talent. As does understanding how your peers manage these tumultuous times.

To learn more, view the full Roundtable Panel discussion here.

ABOUT THE SPONSOR:

Oracle NetSuite is a cloud-based business management platform used by more than 28,000 organizations across the globe. NetSuite seamlessly integrates financial planning, accounts receivable, accounts payable, revenue recognition, tax management and other core accounting functions with real-time financial visibility to improve financial performance. To learn more, please visit www.netsuite.com to request a free product tour.