AICPA recently released a plan to accelerate talent pipeline solutions. Below you will learn about the challenges and how to build a pipeline for future CPAs.

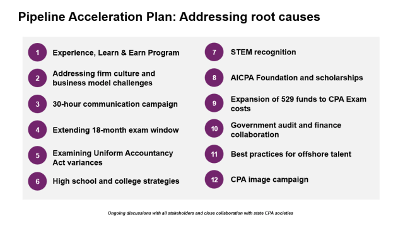

Addressing Root Causes of Pipeline Challenges

The accounting profession is grappling with a talent shortage. Meaningful, quick action is needed. That action must be anchored in data that identifies root causes and measures the impact of new and existing efforts.

In its role as a national convener of stakeholders, the AICPA is creating opportunities for dialogue and collaboration to address the underlying challenges and build the pipeline of future CPAs. Together with state CPA societies, accounting firms, academia, state boards of accountancy, the National Association of State Boards of Accountancy (NASBA), the Center for Audit Quality (CAQ) and others, we can make a difference.

Considerable attention, discussion, investment, and research is being focused on a range of initiatives at each stage of the CPA pipeline — from the CAQ-led Accounting+ student awareness campaign to CPA Evolution and the launch of the new CPA Exam in January 2024.

In collaboration with stakeholders, the AICPA has identified initiatives that address the following key areas:

- Awareness: Increasing awareness about the accounting profession and promoting the benefits of a career in accounting

- Improved perceptions: Dispelling outdated perceptions and leveraging updated, positive messaging that can help the profession resonate with today’s students

- Training and education: Providing high-quality accounting education and training opportunities

- Firm culture and business models: Equipping firms with the tools to offer competitive salaries and benefits, as well as career advancement opportunities and compelling work

- Diversity, equity, and inclusion: Attracting and retaining a broader range of talent

- Partnering with educational institutions: Affiliating with colleges and universities to offer internships, scholarships, and other programs to attract individuals to the profession, help defray costs, and assist students in developing the skills needed to succeed as a CPA.

As part of building this larger, cohesive effort, the AICPA is partnering with stakeholders to implement activities in the near, medium, and long term that address certain root causes of pipeline issues. This plan should be viewed as one set of priority initiatives but not as an exhaustive look at all pipeline efforts. The title of the plan has changed to reflect the expansion beyond the eight initiatives that were introduced earlier this year as a starting point for input and discussion. Certain additions and expansions to the plan have been made based on recent feedback and are outlined in this version of the plan.

The intent of the plan is to identify ways to integrate the changing needs of new recruits and young professionals; increase flexibility and accessibility in the licensure pathway; and drive awareness of the wide range of career pathways within the profession in ways that result in a more robust supply of new CPAs.

What follows is an overview of the plan, which will continue to evolve and expand as existing milestones are met and new initiatives are added.

To help delineate the likely time horizon for each initiative, near-term items expected to be completed in 2023 are labeled in green; mid-term items expected to be completed in 2024 are labeled in blue, and long-term items to be implemented beyond 2024 are labeled in orange.

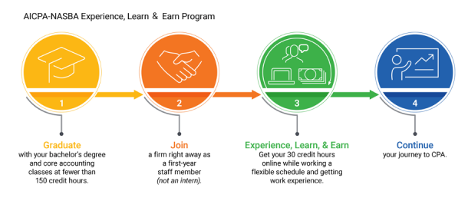

Experience, Learn & Earn (ELE) Program

Providing a route for students who need the means and a plan to earn 150 credit hours

The Experience, Learn & Earn Program blends paid work experience and online courses for the final stretch of credit hours and focuses on licensure.

The AICPA and NASBA program is designed for students who have completed between 120 and 150 college credit hours and core accounting courses. The program is not an internship or an apprenticeship. The graduates are paid first-year staff with a reduced workload and time to complete academic courses.

As a participant in the program, a student will:

- Graduate with their bachelor’s degree and core accounting classes at fewer than 150 credit hours

- Join a firm right away as a paid first-year staff member

- Get up to 30 credit hours through online courses in areas relevant to their careers at the firm while working a flexible schedule and getting paid work experience

- Complete their credit hours and continue their journey to CPA.

Goals of the program include increasing accessibility to accounting and making entry into the profession more affordable for a diverse pool of candidates. The cost of a college education remains a major factor in student decision-making and is an undeniable component of the pipeline. ELE’s online learning will be priced at or below the average cost of a community college credit. The projected cost for the full 30 credit hours is approximately $4,500 or $150 per credit hour. Students who need fewer than 30 credits are able to tailor the program accordingly.

Students in the program will earn the credits while in a flexible, paid position at the firm, helping to further offset the cost of the education. Participants will not be awarded a master’s degree through the program.

ELE will launch as a pilot in fall 2023 with up to 1,000 students. Outreach to firms to secure pilot participation is underway.

There will be one university partner for the pilot phase. A request for proposals will be issued in summer 2023 for universities interested in joining the program after the pilot. This approach is designed to accelerate the launch of the pilot phase while allowing interested universities time for discussions and due diligence for subsequent participation.

A key principle of the program is that it is scalable to work for firms of all sizes. Firms can tailor the experience to fit their needs. For example, a firm may not want its participants to take courses during busy season and instead would allocate time for coursework during other parts of the year.

An advisory group of leaders from state societies and state boards of accountancy is helping to shape ELE state outreach and materials.

Addressing Firm Culture and Business Model Challenges

Focusing on attractiveness of the culture and work

The CPA pipeline decline is the result of many factors, ranging from lower college enrollment and higher costs to the expense of exam preparation and the disconnect of starting salaries from new market realities. The AICPA is calling on all stakeholders to address the forces deterring students from pursuing a CPA career. In our research and in discussions with stakeholders and students, we heard a common theme emerge that has elevated the focus on firm culture and business models among the calls to action.

How firms are structured and operate plays a significant role in the accounting ecosystem and, ultimately, affects the pipeline. To help position firms for success, AICPA’s Private Companies Practice Section (PCPS) is developing a “Transforming Your Business Model” toolkit designed to help firms challenge the status quo in how they approach significant topics, such as:

- Strategy

- Compensation for staff and partners

- What services they provide

- Identifying their ideal clients

- How they staff engagements

- Developing career paths for all team members that provide a sense of belonging and purpose

- Offering flexibility to integrate work and life.

This ongoing resource development project will have an overall focus on culture within firms that will attract, retain, and develop talent to ensure the success of the profession. Resources will highlight firms of all sizes that are changing their way of doing business to reflect a changing landscape in the profession.

More broadly, the AICPA and other stakeholders are convening conversations with firms through town halls, forums, and other venues about talent trends and business model shifts.

How Controllers Council Supports Accountant and CPA Shortages

The mission of the Controllers Council is to build awareness about the Controllership and related corporate accounting and finance career opportunities, which often starts with a CPA and public accounting experience.

The Controllers Council supports the AICPA, CPA societies, active and aspiring CPAs with a dynamic community and platform of more than 100,000 Controllers, CFOs and corporate controllers, accounting and finance professionals focused on best practices, information and resources, career development and CPE training, recognition, and networking. Membership has many features and benefits to propel your career and expertise, and to be an active participant in our exciting community. Discuss topics like today’s job market and more in our private member forum. Become a member today.

Additional Talent Resources

Financial Controllers: The Hottest Job of the Decade

The Continued CPA and Accountant Shortage in 2023