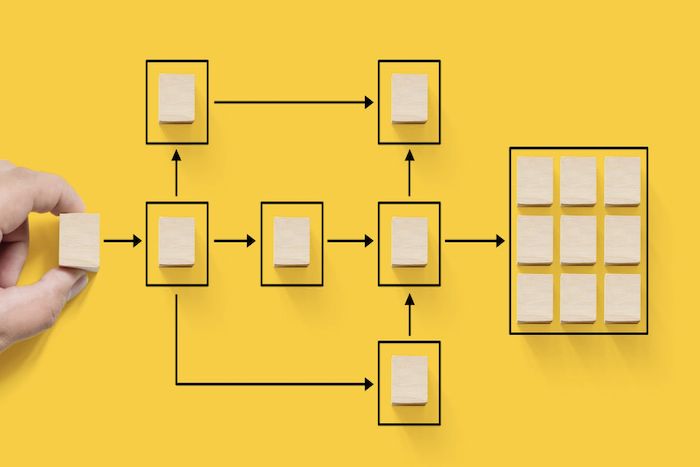

In most mid- and large-sized companies, processes are often broken up into pieces and handled by different teams or professionals. For instance, the record-to-report process would start with a bookkeeper posting entries that are reviewed and reported by an accountant and controlled by a controller. The multiple handover points in the process create risks of errors, especially if the process is mostly manual. This is a struggle that many finance teams can recognize.

We find similar challenges in most finance and accounting processes—not least in the order-to-cash process. There are many causes underlying these challenges and it would be easy to blame Sales, for instance, for not following procedure. However, we will find most of the challenges when we look at the part of the processes fully owned by Finance, e.g., invoice-to-cash (I2C).

This is one of the core transactional financial processes with the most sub-teams involved. It’s also a root cause of headaches for finance directors, CFOs, and business leaders. The pain only grows if the process is done manually. The first logical step would be to automate the process, but how do you best do that?

The Automated I2C Process

Errors can occur all over in the I2C process—like issuing a wrong invoice, failing to do proper cash application, mishandling customers’ credit limits, and upsetting customers through improper dispute handling. And the trickiest part? Managing the tasks between the teams to ensure proper handover points and that nothing slips through cracks.

That’s why you should automate the process and move all the tasks to one platform. Not only will it improve the process, but it will also raise accountability among everyone involved. Most importantly, it will free up time to analyze the numbers and develop insights about customer behavior that can be used for sales and marketing activities, as an example. Let’s qualify these benefits even further:

- Cash Application: reduce unapplied cash by up to 99% and manual effort by up to 85%

- Credit & Risk Management: automate credit limits based on your risk policy

- Collections Management: free up 25% of your team’s time and reduce overall DSO (days sales outstanding) significantly

- Dispute & Deductions Management: process deductions at the point of payment and automatically post in the GL

- Team & Task Management: monitor and analyze user performance and gain the ability to quickly reassign tasks

As if this wasn’t enough, you can start to turn all the data produced from your automated process into insights about customer behavior that can fuel cash forecasts, help you understand if extended payment terms have a healthy ROI, and enable business partnering with commercial teams. What’s not to like?

Are You Ready to Start Automating AR?

One key concern for most companies when they consider starting an automation process is that it can seem like a daunting task. Where do I begin, and will I ever see ROI on my investment?

The great part about automating a process like accounts receivable is that you’ll be able to see the impact relatively fast. Some companies even get their money back in as little as four months. Of course, it depends on many factors, and while the ideal is to get everything on the same platform, you can easily break the automation project into pieces and automate each part first before you bring it all together.

The best part about automating your accounts receivable process is not the process improvements, but the increased team engagement. Everyone gets frustrated working with a highly manual and often broken process. Fix these issues and teams will feel they can spend more time on meaningful work and contribute to the value creation in the company. It’s a true win-win situation. How far have you come in automating your accounts receivable process and what’s stopping you from going further?

Learn more about how to raise the bar on accounts receivable automation with BlackLine.