Parts of our economy is declining which would indicate that we are in an inflation, but the key metrics is business hiring. The US economy is sticking to a soft landing. Investopedia states that soft landing is a cyclical slowdown in economic growth that avoids recession. Below you will learn how companies are now cross-training their employees to avoid layoffs.

As reported by Wall Street Journal on July 29th, 2023, by Ruth Simon and Sarah Chaney Cambon.

How the U.S. Economy Is Sticking the Soft Landing

To see what an economic soft landing looks like, search no further than business hiring.

Parts of the economy are cooling, just as the Federal Reserve would like to see to combat inflation. Freight railroads, for instance, are seeing shipping volumes decline. Construction firms are cutting back on equipment purchases. A vending-machine company’s customers are negotiating prices downward.

Yet the key to a measured, inflation-busting slowdown that doesn’t sink the economy lies in whether companies hold on to workers or lay them off. And the answer, in an economy that otherwise can send repeated mixed signals, is clear: They are making a priority of keeping workers. Apple, for one, is avoiding layoffs despite economic uncertainty.

All those retained workers, in turn, are spending their paychecks, albeit more slowly. So, the economy appears to be steadily cooling, while averting the long-anticipated recession.

Fresh economic data this week reinforced optimism that inflation can fall without the U.S. suffering a recession. Economic output accelerated in recent months on the back of solid consumer spending. Inflation cooled to 3% in June, according to the Fed’s preferred gauge. And wage growth, while still elevated, slowed, the Labor Department said Friday.

U.S. stock indexes were up on Friday. The Dow Jones Industrial Average and S&P 500 Index have risen for three straight weeks, with the broader index closing Friday at its highest value since April 2022.

“We’ve seen so far the beginnings of disinflation without any real costs in the labor market. And that’s a really good thing,” Fed Chairman Jerome Powell said Wednesday after the central bank decided to raise interest rates to a 22-year high.

He said his “base case” is that inflation can move back to the Fed’s 2% target “without the kind of really significant downturn that results in high levels of job losses.”

Companies cross-train workers and tap technology

Many economists, financiers and business owners predicted the opposite: that inflation and high interest rates would prompt companies to fire workers, the newly unemployed would stop spending and the economy would spiral downward.

The desire to hold on to workers, if at all possible, is a change from 2007-09 and 2020, when steep layoffs were more commonplace, and the U.S. economy moved into a recession.

Starting three years ago, VendingONE of Los Angeles slashed its 37-person workforce by more than 50% in response to the pandemic. As sales recovered, it increased head count to 25.

Now, even though business has softened, and customers are citing recession fears to renegotiate contracts, the vending-machine company is keeping employees by cross-training them and using technology to cut costs.

It started using software to schedule drivers to service machines that need filling or repairs, allowing drivers to spend less time on the road. VendingONE also is restructuring purchase agreements and using technology to adjust restock levels, reducing waste.

“We are trying to become more efficient to avoid laying off staff, if possible,” said owner Barry Rosenberg. Holding on to the workers it has is particularly important given the company’s slimmer head count, he said.

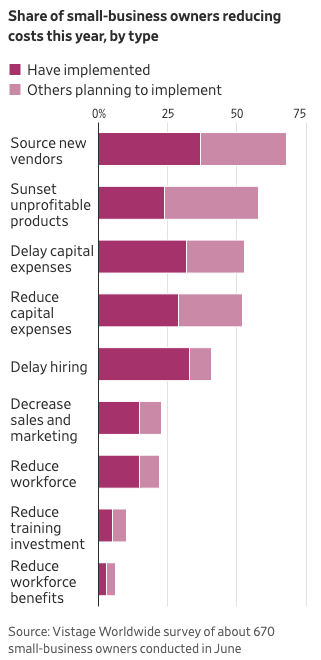

VendingONE isn’t an exception. Only 7% of small-business owners intend to reduce their workforce this year, according to the survey of roughly 670 entrepreneurs conducted for The Wall Street Journal by Vistage Worldwide, a business-coaching and peer-advisory firm. Small-business owners tend to be reluctant to lay off workers, in part because of their close ties to employees. Many say they still face hiring challenges.

Companies of all sizes are hiring at a slower pace than last year, but still added an average of 278,000 jobs a month through June. Layoffs in most industries remain rare, and the unemployment rate is near a half-century low.

Investors are betting that the Fed has raised interest rates for the last time this year, but what matters is what Fed Chair Jerome Powell says. We break down the latest FOMC statement and Powell’s news conference to explain what’s next for markets. Photo: Sarah Silbiger

U.S. consumers are less likely to make large spending cutbacks if they can keep their jobs, said Erik Lundh, a principal economist at the Conference Board. And with consumer outlays accounting for two-thirds of economic activity, that could minimize the economic blow from higher interest rates.

“In part, it is this tightness in the labor market that should probably prevent the economy from falling into a more acute, longer-lasting recession,” Lundh said.

At the start of the year, many economists had expected the Fed’s aggressive rate-raising campaign to spark a recession by now. That hasn’t happened, though many forecasters predict cooling in the second half of the year.

Slowing small-business spending

Broadly, business investment rose strongly this spring, spurred by a surge in federal spending on chip-manufacturing plants and electric-vehicle factories, as well as expensive aircraft purchases. Some economists expect that was a temporary bump.

Broadly, business investment rose strongly this spring, spurred by a surge in federal spending on chip-manufacturing plants and electric-vehicle factories, as well as expensive aircraft purchases. Some economists expect that was a temporary bump.

More than two-thirds of small-business owners surveyed by Vistage in June said they had taken one or more steps to cut costs in the previous six months, and nearly that share said they plan future reductions. Tactics include sourcing new suppliers, delaying hiring, delaying, or reducing capital expenses and sunsetting unprofitable products and services.

Those strategies are allowing companies to brace for a further slowdown without cutting jobs, and to prepare for an economic bounce back.

“The mind-set a number of years ago was laying people off was painful and they knew it was going to be painful getting them to come back,” said Ethan Karp, chief executive of Magnet, a nonprofit providing technical assistance to manufacturers in northeast Ohio. “Now, there’s a lot of sentiment that it’s painful to lay them off and darn near impossible to replace them.”

Larry Anderson, chief executive of Anderson Construction in Camarillo, Calif., is battening down the hatches as some of the commercial construction firm’s customers delay projects amid higher interest rates.

He is scaling back equipment purchases and putting a hold on new hiring, while making investments to improve efficiency, such as a tool-tracking system.

“I’m thinking we are either in a recession or heading into a recession,” he said. Home Depot is no longer buzzing with early-morning customers, he added.

Anderson is looking for ways to keep his 30 employees busy even if business slows.

“We are trying to hang onto all the people we have,” he said. “We will do whatever it takes to not cut. It’s much more expensive to lay people off and then train them.”

Apple’s CEO: ‘I view layoffs as a last-resort’

Apple has avoided mass job cuts embroiling the tech industry. The iPhone maker is managing costs tightly and curtailing hiring in certain areas, while adding in others, Chief Executive Tim Cook said earlier this year.

“I view layoffs as a last-resort kind of thing,” Cook said. “You can never say never. We want to manage costs in other ways to the degree that we can.”

Freight railroads have retained workers this year despite declines in shipping volumes, a reversal from the old practices. Railroad operators made deep cuts during the pandemic and then struggled to rehire when traffic bounced back. One result, executives said, was erratic service; railroad operators lost out on additional revenue because they didn’t have enough train crews to meet demand.

Orbitform, a Jackson, Mich., maker of assembly equipment, is retaining staff but is taking a hard look at its telephone service and other vendors; it is increasing inventory when that leads to lower per-unit costs.

Jake Sponsler, president of Orbitform, says he is hesitant to add employees and instead looks to manage increased workloads. That includes outsourcing some standard operations when orders rise and keeping more profitable custom work in house.

“[It’s] so we are comfortable through a bit of a slowdown and so we have the ability to expand quickly once things do pick back up,” Sponsler said.

Additional Economic Resources

Inflation vs. Recession: What are CFOs Biggest Concerns for 2023?

Building Resilience: How Controllers/CFOs Can Foster a Growth Mindset in Recessionary Times