Controllers Council recently held a webinar on Finance Operations Teams – From Cost Centers to Revenue Generators, sponsored by Gaviti.

Gaviti is accounts receivable enablement solutions, helping companies accelerate AR collections through workflow automation. Our guest presenter was Bruce Zivan, Vice President Sales, Gaviti. Bruce’s first encounter with accounts receivable and corporate finance operations came as a small business owner in the United States. Prior to Gaviti, Bruce held lead sales roles with several companies, which brought technology solutions to improve processes in a variety of industries.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

The Past: Accounting – Financial Reporting, Audits

Number one, in the past, you had an accounting department, which was responsible for financial reporting and auditing. They just kept records and they took the records, and made reports, and those reports were for audits. And this is also looking back, right, this role if you still were doing it’s just historical reporting of what happened in the last month, in the last quarter, in the last year.

Now/The Future: FP&A – Forecast. Projection, Planning

The future, which is now, is FP&A, financial planning and analysis. Being able to look at the numbers in a different way, in a more proactive way, and be able to give actual, accurate forecasts of what should be happening in the next month and in the next quarter, so that the company can plan and run their business in a more proactive manner.

Standard Financial Operations Team

Got accounts receivable, got accounts payable, accounts payable team is responsible for the basic, paying the vendors and making sure the payroll is run as well. They’re doing the basic operation of and accounts payable team. Accounts receivable team, again, running day-to-day activities, sending out the bills, sending out the invoices, and running processes to collect from the clients. That is the present that’s what’s going on in many organizations right now.

What Is a Financial Leader in 2022 Doing?

We understand that financial operations teams are mitigating risks, but on one side it’s not taking risks on the other side, it’s taking some risks, and opening the mind to some different ideas.

Non-Strategic Leader

You’re generating your default reports, what you need to show to the auditors at the end of the quarter, at the end of the year, those are the reports you’re generating. You’re reactive to ongoing business processes, meaning you basically look at the processes and you say to yourself, okay, well, that’s the way it is, people don’t pay their bills. So, people will continue to not pay their bills. That’s something we must just deal with. You stick with the existing tools and processes. You’re using Excel, great tool, but you’re just kind of sticking to the Excel, you’re sticking to your calculations, you’re sticking to your standard report analysis operation.

So that non-strategic leader, and his or her team has operational value for sure. Because they are providing the information, but there’s no effect on the bottom line. The bottom line remains the same, because they’re just calculating numbers and reacting to existing situations, and not actually becoming proactive to have an impact on that bottom line.

Strategic Leader

A strategic leader is that person who is enabling business decisions. And they’re enabling business decisions based on utilizing up to date 2022 tools that are on the market and available to positively impact the bottom line, and to give the team the tools to put some thought into making decisions about how to run the business. We’re talking about reports that are going to give the company, and the auditors, and the C-suite, the opportunity to make smart decisions about how to pay themselves better. How to impact their own bottom line? And how to impact the company’s bottom line? You’re talking about being proactive, right? With existing processes, optimizing those processes. Can we do this better? Can we run AP better? Can we run AR better? And looking for ways to do that, that are going to positively affect the bottom line, and allow for proactive business decisions. And on the operation side, introducing those new tools, and improving those processes. And that is what we call revenue generating activities. Bottom line, it’s positively affecting the bottom line.

How To Generate Revenue

The right technology will generate revenue. An efficient payables team equals a smaller team, equals a less costly team, equals less fraud, and less late payment fines.

Payroll

Payroll was probably one of the first, if not the first, areas of the finance operations to be positively affected by technology, and to become a place where the company had to take action to protect the bottom line. And when I say, protecting the bottom line, is, as running payroll became more and more complex with deductions for this and that, each state, its different laws, each state, its different rules, different pay rates, benefits, et cetera.

Companies were forced to move from running it on ledger sheets to Excel, and quickly to an outsource provider. This is when, at least for small businesses, companies like ADP, and Paychecks, among many I’m sure, came into being, because the companies just couldn’t do it anymore.

Accounts Payable (AP)

You want to make your AP operation as efficient as possible, because AP is no longer just about cutting checks to pay invoices. It’s about protecting yourself from having payments redirected, and the fraud involved there. It’s about keeping tabs on your vendors, and you want to be number one, a good vendor. You want to be a good vendor, and you want your vendors to be good vendors. And you do that by running an efficient accounts payable operation, when you have your accounts payable operation in order, you can negotiate better, because you know what you can do to get better terms from your vendors, because you know looking forward with the operations tools that you’ve brought to bear on the business what kind of cash you’re going to have looking forward in the next month, in the next quarter, in the next year.

Current Financial Situation

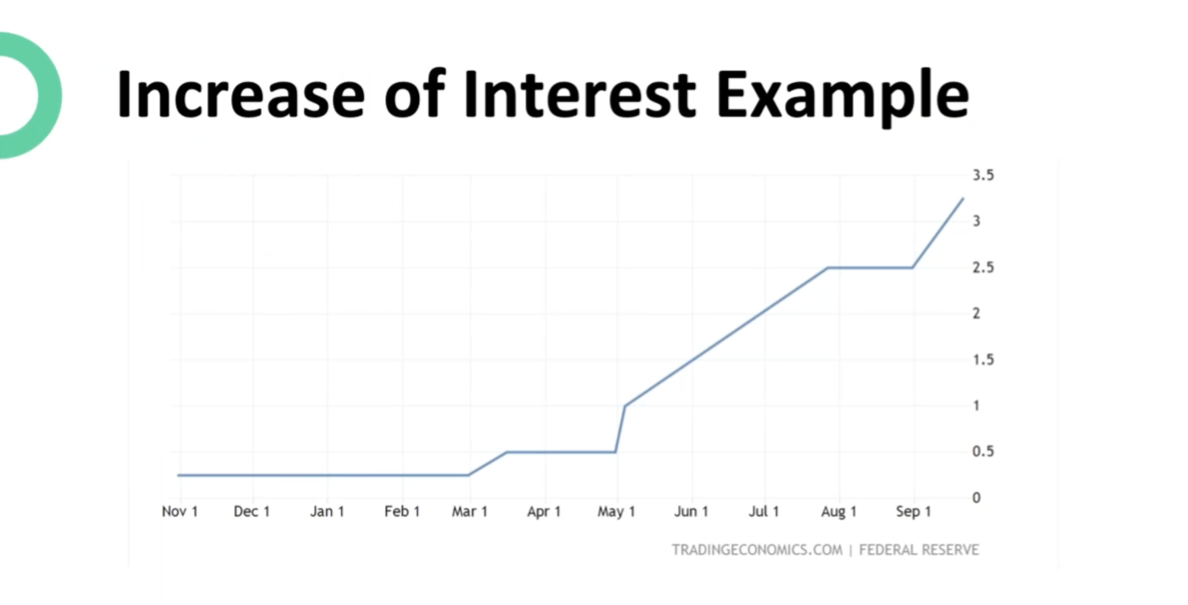

Number one, high interest rates, your day’s sales outstanding becomes more and more important, because you don’t want your customers treating you like a bank. You don’t want them sitting on your money to earn interest rate in their bank account. You want that money in your bank account earning interest. So, every day, you’re late, you might be paying interest to keep the operation running in the same direction. Every day you have that money in the bank, you’re earning interest on it and not paying interest for the operational costs. Loans are very expensive; lines of credit are very expensive. Below is an example to show you the interest rate increase.

The rates are going up, and this is crucial. This is crucial for you and your businesses to get on top of the receivables and get that money in faster. So how can you improve even in a couple of weeks? The process is in the financial operations. Number one, and we’re talking on the receivable side here, identify your top 10 debtors, who has the most outstanding debt? Review your credit terms, make sure you understand by customer what terms you’re offering, and see if you can improve them.

To view the complete webcast, download full webinar here.

ABOUT THE SPONSOR:

Gaviti is a platform for collections teams that enables SMEs to get more of their invoices paid faster. Our solution optimizes the complete collections process, from automating highly personalized dunning emails to perfecting task management.

Collections teams and their leadership will find payments forecasting, risk scoring, and actionable insights to enhance collections performance over time. Your in-house collections team will collaborate in the centralized workspace available to all stakeholders.

Gaviti is ERP agnostic allowing SMEs to start optimizing within one billing cycle.