A study on Corporate Controllers and CFOs evolving responsibilities for technology was launched in the 2nd half of 2021 by the Controllers Council. The objective of the study was to identity how Controllers, CFOs and their accounting/finance departments are changing and adapting to the “Digital Revolution”. This national survey was conducted with more than 300 respondents participating across North America.

The results of the study were previewed during a September 21 webcast with Controllers Council Board Chair, Lindy Antonelli, moderating a roundtable discussion of the results with three subject matter experts (SMEs): Omar Choucair, CFO of Trintech, a leading financial close software company; Ted Weitzel, CFO and former Controller of G2, Steelbrick, and Big Machines; and James (JJ) Walker, Corporate Controller of Trintech.

The premise of the study was that Corporate Controllers and CFOs are taking on more responsibilities for technology including automating back-office systems, managing spend, implementing finance automation systems including AI/ML/RPA/IoT, and participating in or leading digital transformation initiatives. Let’s take a look at some of the questions and answers from the study:

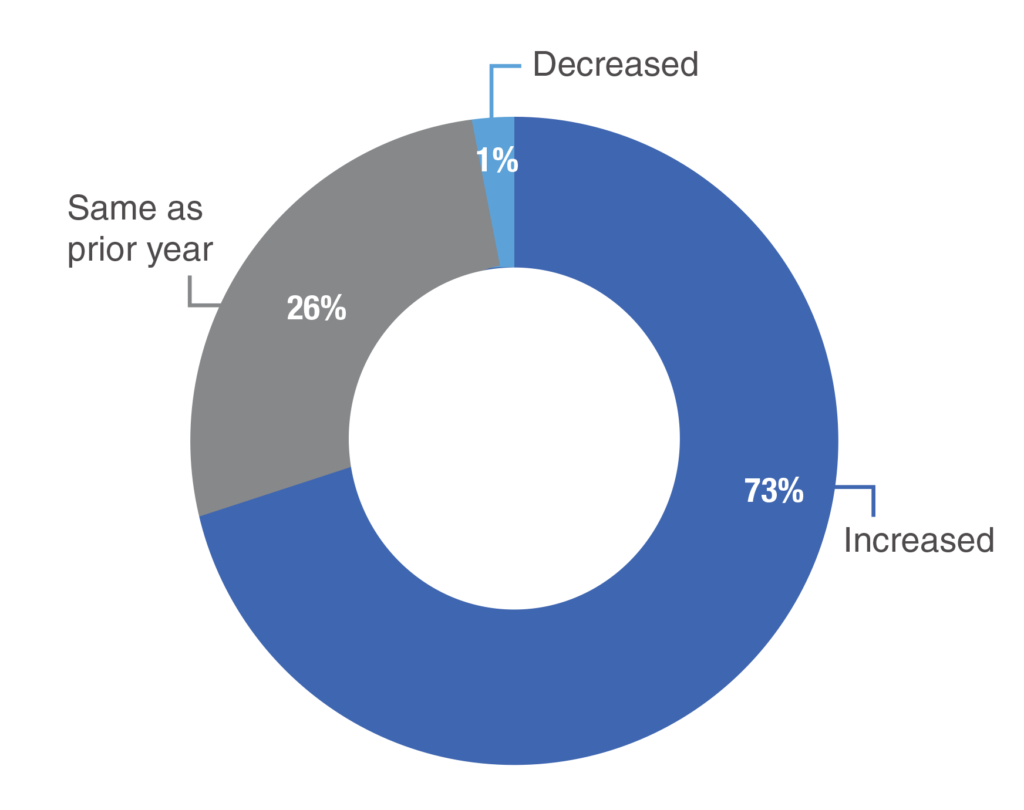

How is your role in Corporate Technology changing?

The first question was the broadest regarding overall changing roles for corporate technology, not just accounting/finance technology. A significant majority 73% have increased responsibilities, followed by 26% not changing, and only 1% decreasing, per the chart below.

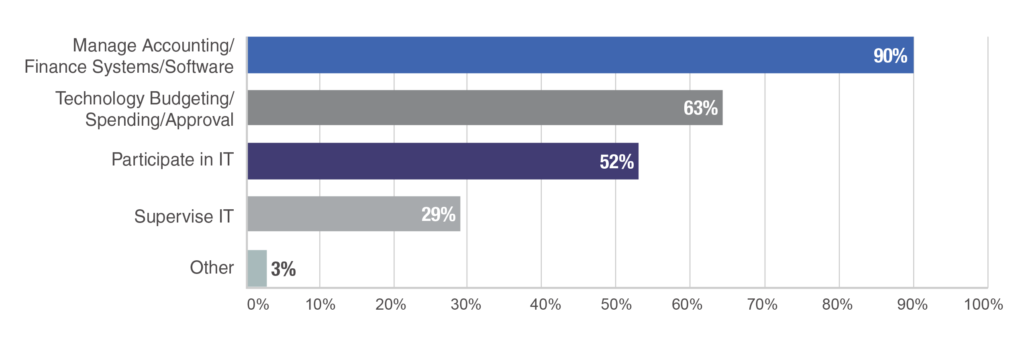

What Corporate Technologies are you responsible for?

Question 2 focused on responsibilities for various types of corporate technology. Intuitively, 90% of Controllers/CFOs are responsible for managing Accounting/Finance systems or software, and 63% have Budgeting and Spending responsibilities. Noteworthy is that a majority (52%) of Controllers/CFOs participate in IT as well, and a significant number (29%) also supervise IT.

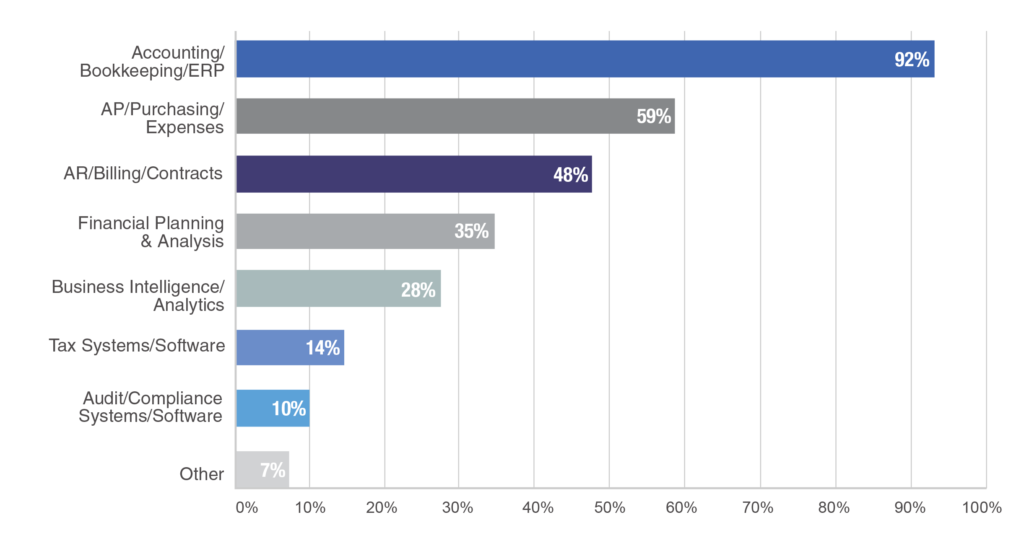

What Accounting/Finance systems or software has your org implemented?

Question 3 drills down to the Accounting/Finance systems or software that have been implemented? Not surprising, 92% have implemented some type of Accounting/Bookkeeping/ERP, followed by 59% implementing AP/Procurement/Expense Management, and 48% implementing AR/Billing/Contracts. FP&A is implemented by 35%, followed by Business Intelligence/Analytics at 28%, Tax systems at 14% and Audit/Compliance systems at 10%, per chart below.

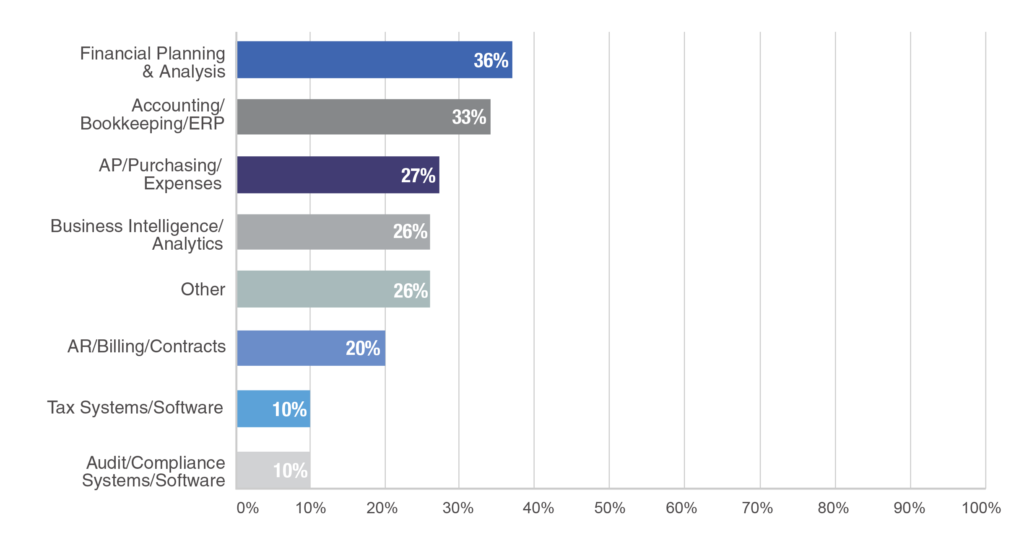

What Accounting/Finance systems/software is your org planning or evaluating?

Question 4 is still accounting/finance systems or software related but focused on planning or evaluating the solutions. Very interesting that FP&A leads all systems/software (planning or evaluating) at 36%, followed by Accounting/Bookkeeping/ERP at 33%, AP at 27%, closely followed by BI/Analytics at 26%, and AR at 20%.

The data from this chart sparked a question from the webinar audience about how financial close automation software can free up human capital. Omar Choucair, CFO of Trintech, James (JJ) Walker, Corporate Controller of Trintech, and Ted Weitzel, CFO and former Controller of G2, Steelbrick, and Big Machines, discussed their thoughts on this question. See what they each had to say below:

JJ Walker:

Financial close automation reduces the number of errors that can be made, which means you don’t have to have as many people looking for errors, which ultimately streamlines the process. Another thing that we use a lot here at Trintech is an analytics tool that’s built into our software so we can see, in real time, where the bottlenecks are on the close process. So, we can just keep an analysis of that, go in and see if we can shift things around or maybe make things work a little bit more efficiently.

Omar Choucair:

If there’s one thing that controllers and CFOs need to really focus on is having accurate financial information and speed is important. The past 12-14 months have shined a spotlight on speed and accuracy, and what we’ve seen in our business and what we’ve seen with our customers is the need to streamline inefficient manual processes and putting the the right tools and processes in place to help companies do that. In our mind, that’s really important.

Ted Weitzel:

I’ve used a few close management solutions and I think the number one benefit is time to close and the number of resources that you free up by having a shorter close, a shorter, more accurate close. You think about potentially having a team of four to five people who are getting a day or two back in their month. What does that do to the ability of your finance team to really affect change in your organization? That’s quicker answers on commissions, that’s quicker board responses, it’s quicker delivery of metrics to the rest of the team. It’s the ability for your team to really enable the rest of the organization to move on and take the rest of the month then to figure out how to solve the problems that maybe you’ve brought to the surface. So, yes, close software is amazing.

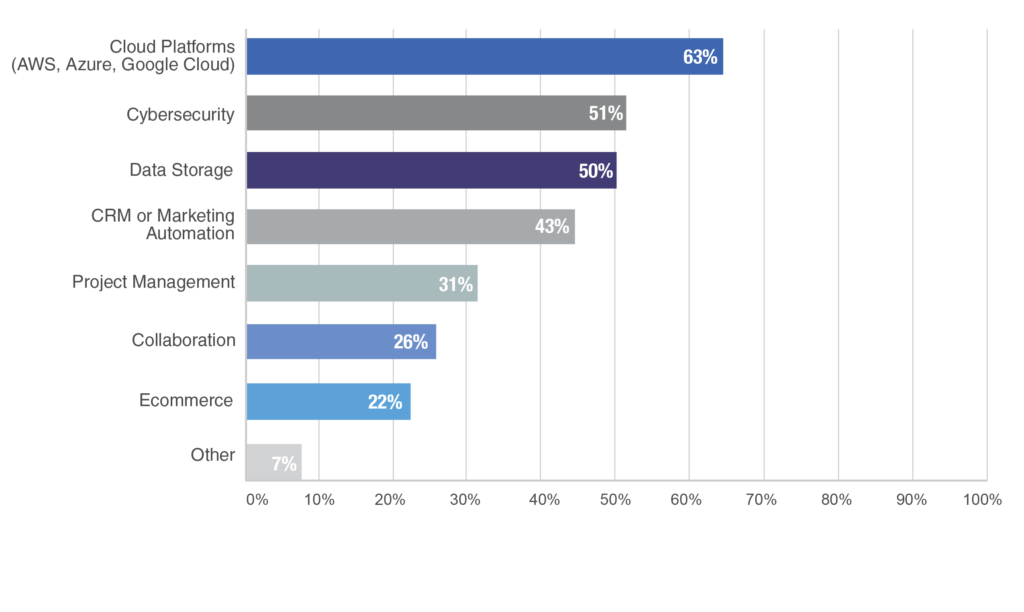

What Corporate systems or software has your org implemented?

Question 5 focused on implementation of Corporate systems that are non-Accounting/Finance-related. Interestingly, Cloud Platforms led all at 63%, followed by Cybersecurity at 51%, and Data Storage at 50%. CRM or Marketing Automation rounded out this top tier at 43%. Project Management was implemented by 31%, followed by Collaboration and Ecommerce.

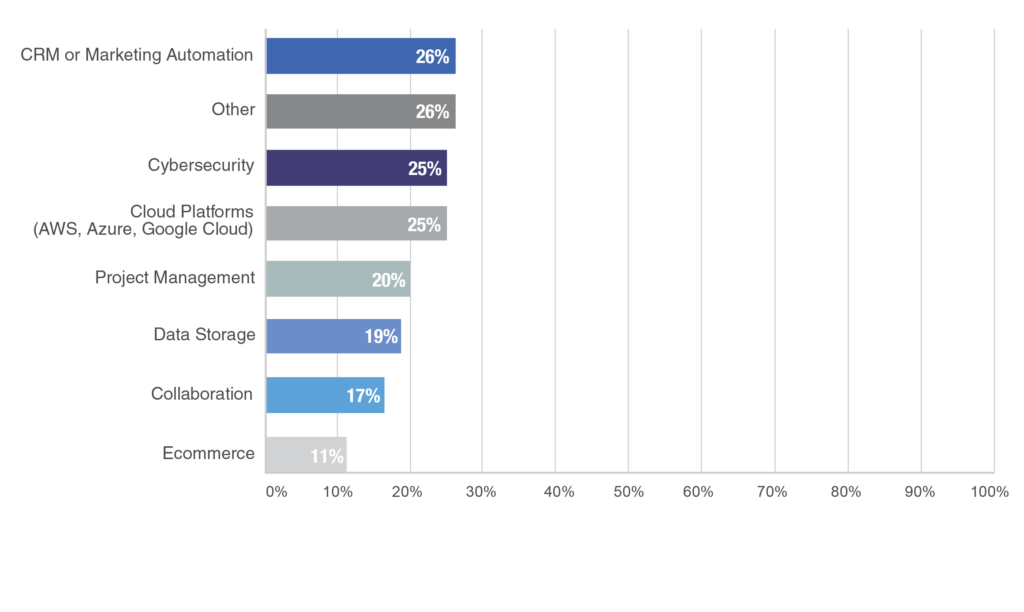

What Corporate systems or software is your org planning or evaluating?

Question 6 is still about Corporate systems that are non-Accounting/Finance related (vs. accounting/finance systems) but is focused on planning or evaluation of these solutions (vs. already implemented). 26% of organizations are considering a CRM followed by responses that were tied between Cybersecurity and Cloud Platforms at 25%. Project Management and Data Storage are planned by 20% and 19% respectively with Collaboration and Ecommerce at 17% and 11%.

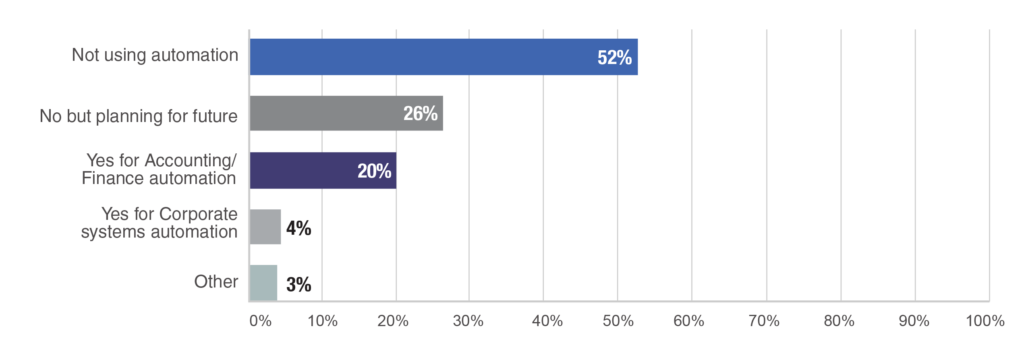

Are you involved in Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), or Internet of Things (IoT) initiatives?

The “Automation” question witnessed a majority (52%) are not using automation, followed by 26% who are not using automation but planning to do so in the future, and 20% not using automation for accounting/finance applications. Encouraging to see the sum of “not using but planning to do so in the future” and “using for accounting/finance” is nearly half of the responses, which means actual change vs. talk of change is finally starting to take place. Finally, only 4% were using automation for corporate systems.

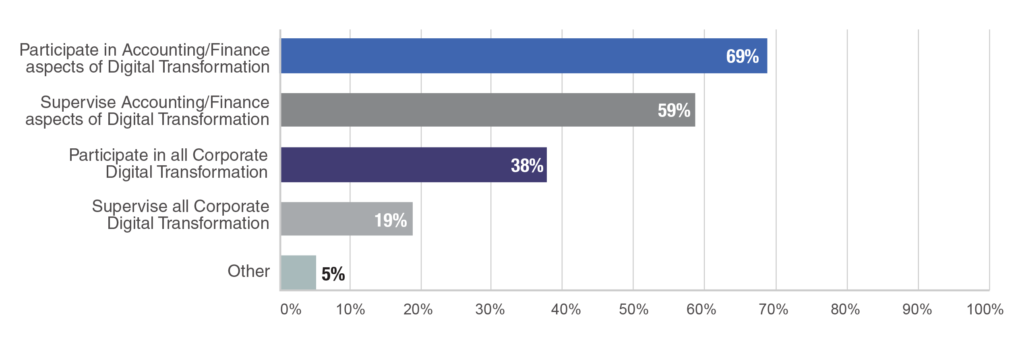

What is your role in Digital Transformation?

The last question we want to highlight was on the trending topic of Digital Transformation. A huge majority (69%) of respondents participate in Accounting/Finance aspects of Digital Transformation, while another majority (59%) actually Supervise Accounting/Finance aspects of Digital Transformation. In addition, a substantial 38% of respondents participate in Corporate Digital transformation. And finally, 19% actually Supervise Corporate Digital transformation.

Cleary, corporate Controllers and CFOs are evolving to become Digital Controllers and CFOs. This evolution certainly started prior to the global pandemic, but was accelerated by remote work environments, along with seismic business change and uncertainty.

In our next article we will look at more of the roundtable discussion from the webcast where Omar Choucair, Ted Weitzel, James (JJ) Walker, shared insights into what the numbers from the study mean for the future of the Office of Finance, and what Controllers and CFOs should be thinking about as they begin planning for next year.

About our Study Sponsor

Trintech provides cloud-based software solutions that standardize and automate key processes in the financial close including, high volume transaction matching, balance sheet reconciliations, intercompany accounting, journal entries, close management tasks, disclosure reporting and governance, risk and compliance.

Over 3,500 clients worldwide – including the majority of the Fortune 100 – rely on Trintech’s solutions to continuously improve the efficiency, reliability, and strategic insights of their financial operations.