From the sales team to operations to finance, everybody’s been talking about digital transformation. Whether it’s clear if they know what this truly means is another thing. One of those nebulous terms that became popular in recent years, digital transformation is a process that allows businesses the freedom to manage change, increase productivity, and extract more value from technology investments.

The problem and the question? Where should you begin? It’s a question many ask, and something with many answers. But if you’re like us and like to follow the advice of Deloitte, the best answer to this question may be the thing that you’ve been putting off for years or decades—ERP.

This according to a recent article titled ERP Transformation Vision and the Roadmap for the Finance Function, an article that looks at the state of the finance function and discusses how ERP might be the one thing that can help bring together your activities. From helping you keep up with a changing landscape to organizing your initiatives, ERP gives leaders information and insights at a time when they need it most.

The Changing Landscape in Business and Finance

Like many finance leaders today, you may be thinking about how digital transformation might enable new finance capabilities and drive better business insights.

At the same time, COVID-19 may be prompting your IT organization to consider new enterprise resource planning (ERP) systems that can simplify system architecture, reduce costs, and make current infrastructure easier to manage and more agile.

The last year has presented businesses with challenges. But with any challenge comes an opportunity—to handle it better than your competition. In this, finance and business leaders have learned that change is the key to forward progress. This gives finance an opportunity to secure its position as a business partner by focusing on the following:

- The Need for Real Time Insights: Business leaders see increased value from rapid and real time insights. Finance has the keys to this, and needs the right tools to deliver.

- The Push to Upskill: Accounting and corporate finance departments face a talent crisis and a skills gap while being expected to do more with less. The right tools deliver new capabilities and help to upskill.

- Sustainable Growth: Organizations need to answer more questions about their finances, driven by shareholder demands for sustainable growth.

How ERP Connects the Dots

Chances are, your finance team is routinely pulled in multiple directions, each with competing needs and stakeholders. Particularly in this context, an ERP-enabled finance transformation journey requires a clearly defined and communicated strategy, beginning with both a vision and a road map.

How can you approach this? It starts with defining the vision, determining the steps forward, and ultimately connecting the dots.

Defining the Finance Vision

Finance exists to drive the business forward. By enabling key decisions, finance can find its place in the shifting and transforming business.

The finance vision is a set of choices and goals that articulate and align Finance’s aspirations for how the function serves and partners with the organization. The vision becomes the “North Star” for the ERP-enabled finance transformation.

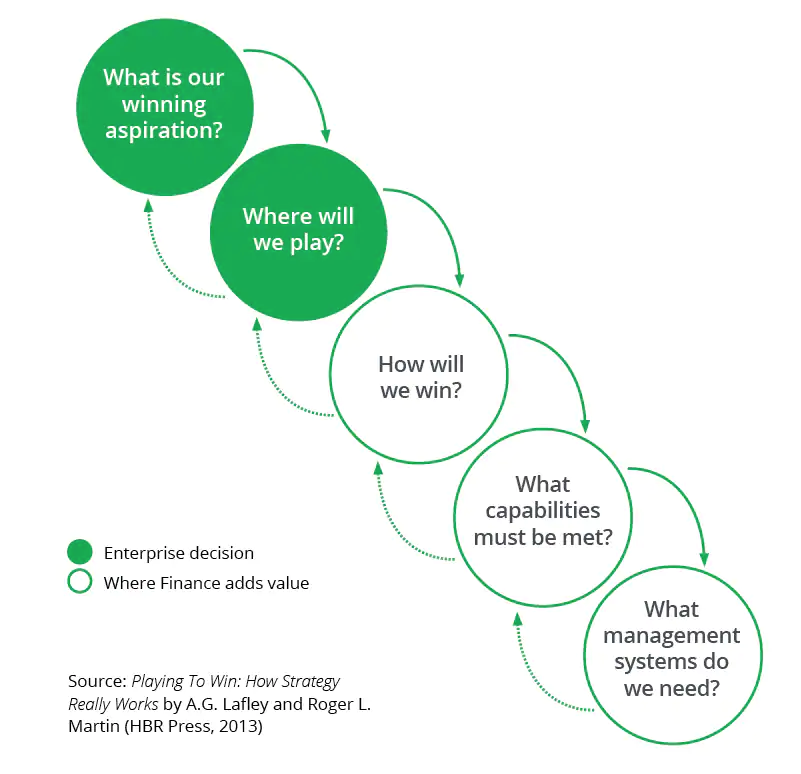

In something it calls the Strategic Choice Cascade, Deloitte looks to connect enterprise decisions with the areas that finance adds value:

Building a Roadmap

With a vision in tow, businesses need to determine how they are getting there. This is where the finance transformation roadmap comes into play:

The finance transformation road map is a practical articulation of the vision—a prioritized, aligned, and sequenced list of initiatives that addresses people, process, and technology enablers. The following steps are required to build the road map:

- Partner with IT, procurement, supply chain, commercial, and other key stakeholders to assess current-state capabilities, tools, and the desired future state.

- Identify required initiatives across the people, process, and technology pillars to achieve the finance vision for future-state capabilities.

- Evaluate the role of ERP and other systems and tools in enabling the finance transformation.

- Finalize a list of key initiatives and ongoing or competing priorities; for each initiative, identify resources, milestones, timing, dependencies, and risks.

Value, Process, Technology, and People

To enable access to long-term value, companies need to commit to change, and both finance and the business need to ask themselves about the following areas:

- Value: How does Finance maintain momentum and achieve wins during a multiyear, ERP-enabled transformation (e.g., quick wins and pilots)?

- Process: What level of process redesign and standardization is required prior to implementing the new ERP?

- Technology: What is the data strategy, including the corresponding data requirements to enable the desired reporting capabilities?

- People: How will current employees need to be retooled so that they can effectively partner with the business in a digitally enabled finance organization? Where is the work delivered now, and where will it, or could it, be delivered?

Learn More: The Controller’s Guide to Becoming a Digital Transformation Champion In 2021

Transformation has a lot of value, but knowing where to start is the key. Luckily, we have an upcoming webinar to help you determine your goal and your role in this.

COVID-19 has accelerated the pace of digital transformation globally. The trend is being seen in the finance and A/R world as well, with almost 80% executives across industries looking to fast track their digital strategy in the aftermath of this crisis.

For financial controllers, this is the perfect opportunity to evolve from being the historian of the company, to being the bridge between compliance and strategic leadership. Cortney Herington, Director of Digital Transformation at HighRadius, and former Director of Finance and Operations at Coca-Cola Bottlers will deep dive into strategies to manage workforce and leadership expectations, promote a culture of continuous improvement and deploy the right technology for the finance department, as we move into 2021. Join us on January 26 for this highly informative webcast on the role of the controller. Click here to learn more.

Additional Resources

Nine Questions Controllers Need to Ask Potential ERP Partners

How Controllers Can Understand ERP Success: Three Stages Used to Define an ERP Project