Controllers Council recently held a webinar on the Corporate Finance & Accounting Talent: Study Preview and Panel Discussion.

The objective of the study was to identify how controllers, CFOs, and related executives are managing finance and accounting or F&A talent along with such challenges as talent and skill shortages, hybrid and remote work environments, rapidly changing macroeconomics, staff turnover and more. A national survey was conducted from May to July of this year.

Subject matter experts for this webinar included John Liacone, managing director and a co-founder of the Overture Group, a recruiting and compensation firm with a Controller/CFO practices. John is also a public accounting alum from RSM. Controllers Council Board Chair, Lindy Antonelli moderated the session. Lindy is Partner in the Technology Practice at Armanino, a Top 20 CPA and consulting firm.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

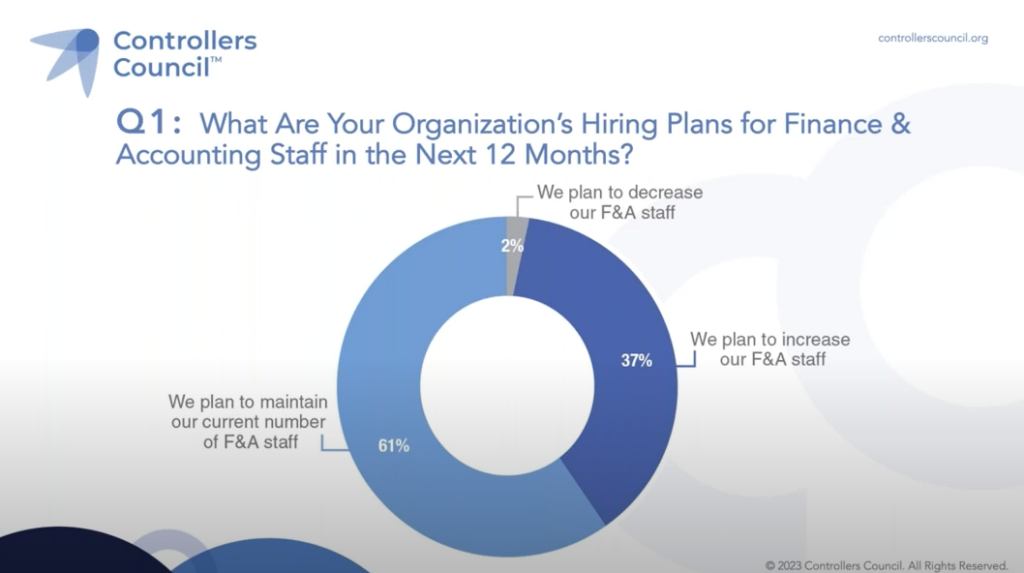

What are your organization’s hiring plans for finance & account staff in the next 12 months?

Lindy: Regarding hiring plans, only 2% intend to decrease F&A staff, with 30% increasing staff and 61% maintaining staff.

John: I specialize in executive recruiting at the controller, CFO levels and VP levels. And I’ve been doing this for about 30 years now. The survey data that you see is really consistent what we’re also seeing with our clients. Most of our clients, they’ll add roles if need be. And the reason I say that is there’s been a lot of turnover. It’s still a very hot job market for finance and accounting professionals, we see a lot of our clients taking a step back once people give their notice in leap to really look at their org structures. And a lot of organizational structures have been not looked at or neglected, and they’ll find that what skill gaps are there? So those are a lot of the clients that are adding roles.

And again, turnover still higher than what we would normally see in a regular market. It’s a hot job market. It’s slowing down from the ’20 to ’22 numbers. We’re seeing some slow down, but it’s still very, very hot.

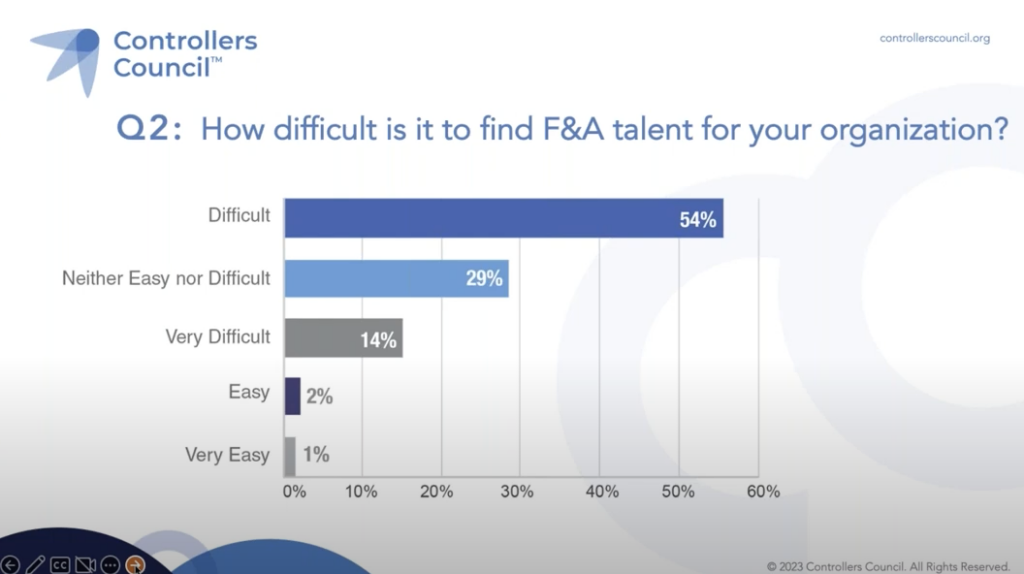

How difficult is it to find F&A talent for your organization?

Lindy: 68% of respondents find it difficult to hire and retain F&A staff, with 27 neutral on the sentiment and only 3% stating easy to hire and retain.

John: When I have conversations with business owners and/or CEOs or presidents, one of the top three issues when I ask what are some of the issues you’re having in your organization? It’s always staffing and recruiting, right? Hiring talent, attracting talent. It’s always one of the top three issues. But I think the survey results for this question are very consistent of what we’re seeing. They find it neither difficult or easy or difficult, it’s because of the talent shortage. But a lot of companies are very good at what they do, whether it’s a product or a service that they’re developing. But what they failed to do, which makes it more difficult, is really understanding what their employer brand is. And the companies that find it easier to find talent have that identified so they’re attracting new talent. Also, they’re creating opportunities. People leave, but also it makes it easier if you have opportunities to attract the talent inside your organization.

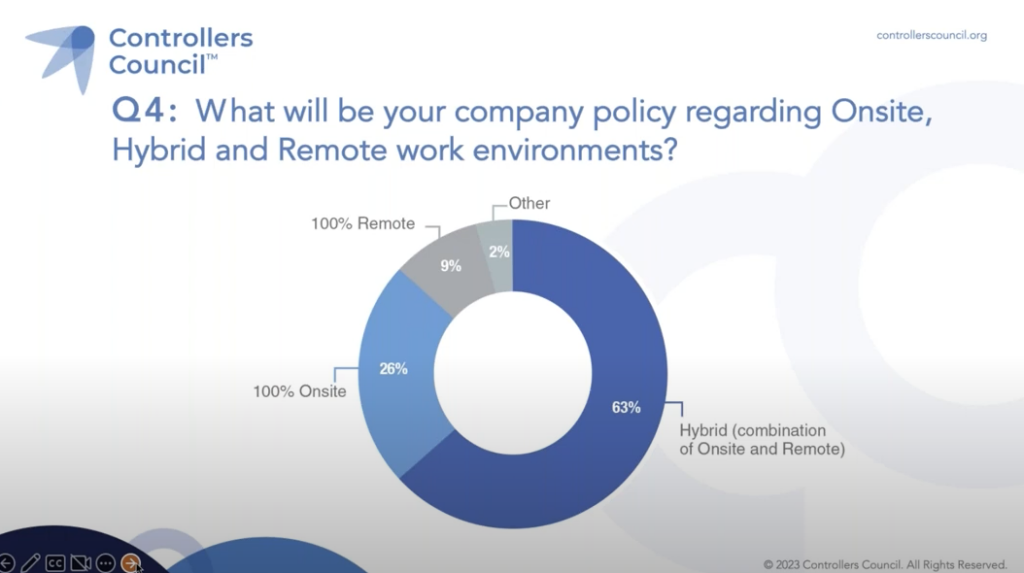

What will be your company policy regarding onsite, hybrid and remote work environments?

Lindy: Regarding work environments and return to office mandates or RTO, a majority, 63% will offer some hybrid combination of onsite and remote options. 26% will transition to full onsite and only 9% will offer full remote.

John: First off, this is the million-dollar question. If I had the answer and I can go in and help clients, I do that all day long. But it is all over the board. It’s all over the board in terms of what our clientele is doing, what we’re seeing, a lot of companies that are 100% on site, those tend to be our manufacturers and they’ve been essential services since the start of the pandemic. But when you start getting the services, professional services, technology, that’s a lot of times where the hybrid roles kind of come in. And depending on the role too. A lot of administrative roles in all industries, I’m seeing more hybrid, three days in the office, two days at home. This is a great attraction and retention tool. This is what candidates are looking for.

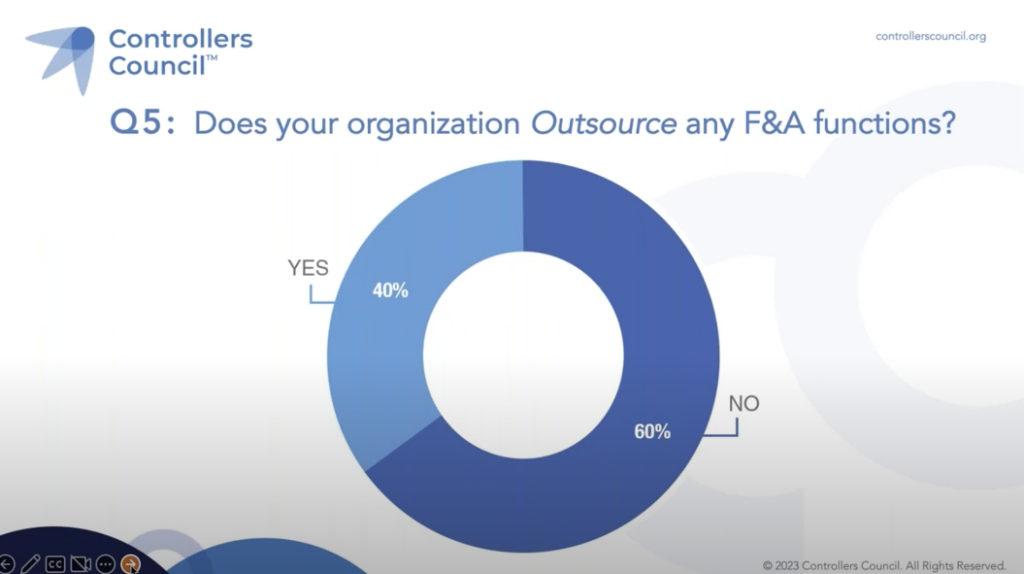

Does your organization outsource any F&A functions?

Lindy: While most respondents, 60% do not outsource F&A, a significant 40% do outsource and 18% will increase F&A outsourcing in the future.

John: I really think it depends on the size of the organization. A lot of my smaller organizations outsource more functions. Most people outsource tax because they don’t have a lot of tax departments. The larger companies do, but you still always looking for that outside counsel. But if you’re more of a transactional with very high transactions, sometime the billing, the AP, the AR, they’ll outsource. But it depends on the size. A lot of my larger clients, they don’t outsource anything except the tax and audit.

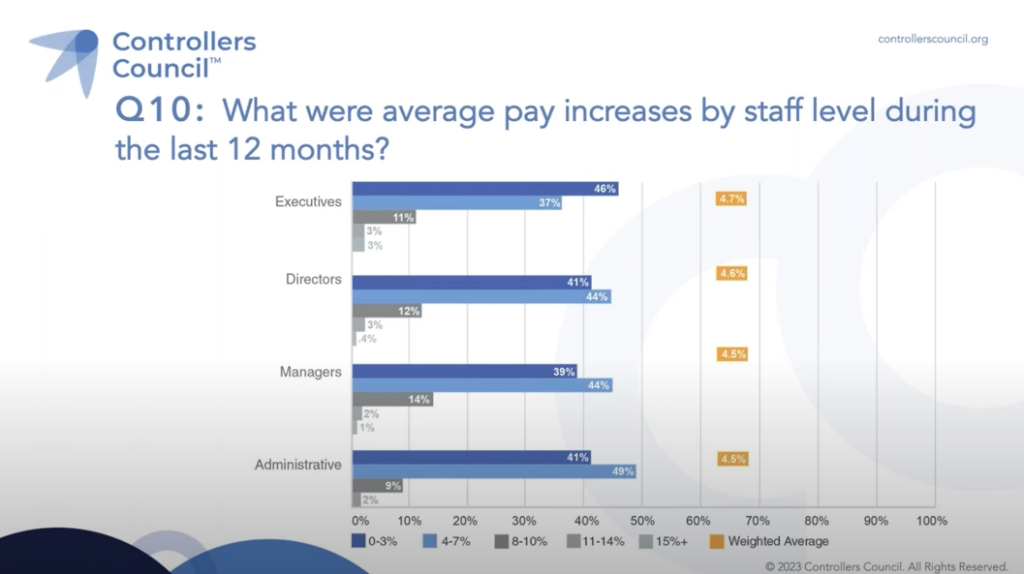

What were average pay increases by staff level during the last 12 months?

Lindy: Overall, F&A pay increases average 4.5% in the last year with the executive category leading with an average of 4.7%, followed by directors at 4.6% managers and administrative at 4.5%.

John: I’m most informed from the manager level and above and we’ve seen a 4% to 7% increase in the last 12 months. But you have to remember that’s internally, that’s your internal pay increase and that’s only base pay. But we’re also seeing our folks looking at their annual incentive programs. For them to compete on a larger basis for their managers and executives, they’re looking at their long-term incentive pay as well, such as phantom stock, stock appreciation rights programs, things like different types. But those numbers, I could tell you the pay increases, sometimes people leave for a pay increase. And again, it’s starting to level up, but especially at the controller level, my god, they were getting 15 to 30% increases to make a move.

To view the complete webcast panel discussion, click here.

To download/read/print the Corporate Finance & Accounting Talent Study Results Report, click here.