What Is ESG?

Environmental, social, and governance (ESG) criteria are a set of standards for a company’s behavior used by socially conscious investors and consumers to screen potential investments or business deals.

As a concept, sustainability is easy to understand. We all want to live safely and well, and we want to reward businesses that commit to basic human values. But turning those concepts into day-to-day reality is anything but simple, and in fact presents a growing range of challenges to the world’s businesses.

Those challenges, as framed by bodies such as the World Economic Forum and the SEC, involve creating measurable, meaningful data and reporting around the ESG efforts put forth by organizations and industries worldwide.

The problem: ESG measurement is a fast-moving target, with continuously evolving standards and frameworks. Businesses will be challenged to keep up as disclosure demands become more stringent in the future.

Still, there’s value in proactively taking hold of ESG reporting, and many business leaders feel that accounting and the CFO are ideally positioned to handle the task.

A recent Accenture survey pointed out that 68% of executives said the ultimate ownership around ESG should lie with finance.

And in How CFOs Can Manage Sustainability Risks and Find Long-term Value, Deloitte notes, “at the intersection of sustainability and financial performance, the CFO is in the best position to define and communicate how a company’s management of ESG risks contributes to value creation.”

According to BlackLine’s Vin Messina, CPA and finance technology expert, “at the end of the day, ESG is really a set of standards, or criteria, that investors can use to make decisions about investing, and other stakeholders can use to evaluate the health of a business. Taking the lead with ESG is really about collecting and reporting on metrics, and that’s what accounting is all about.”

Still, taking the lead may or may not be an enviable position, considering the many challenges that will come from the evolving demands of ESG reporting and the increasing scrutiny of companies’ stakeholders.

Weighing the Risks of Disregarding ESG

The risks of falling behind on ESG initiatives can be significant—and they can be obvious or hidden.

Obvious risks range from running afoul of the SEC or other standards bodies as reporting criteria evolve. This can potentially result in massive fines or higher insurance payments for businesses that fall behind. Another one could be lowered interest by investors that can result in reduced market value. That’s because investors are pressing more than ever for visibility, and action, into ESG concerns.

In Investors Push Companies For Specific ESG Actions, news and research organization Pension & Investments pointed out that “as the 2022 proxy season got underway in early spring, shareholders had filed 20% more ESG resolutions than the previous year.”

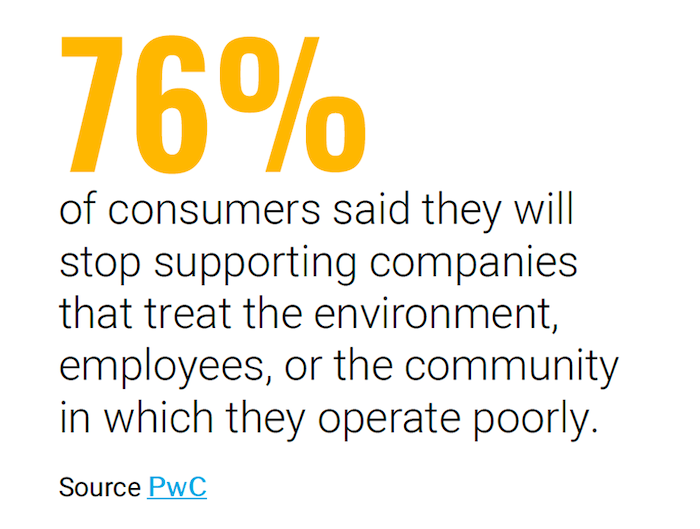

Other risks may not be so obvious. Employees, business partners, and even customers are more likely to base their employment, partnering, or buying decisions on a company’s reputational characteristics.

Deloitte gives these examples:

- A beverage company loses access to water due to local water scarcity or loss of social license to operate in surrounding communities

- A technology company fails to listen to its highly skilled labor force; employee turnover increases and the company loses its competitive advantage

- A consumer products company faces brand and reputation damage and consumer backlash for instances of human rights violations in its supply chain

The Rewards of Paying Attention to ESG

The Rewards of Paying Attention to ESG

But just as business might be punished, directly or indirectly, for ESG infractions, taking effective action on ESG initiatives and reporting effectively to stakeholders can bring benefits to forward-looking organizations.

“One way that organizations known for high ESG preparedness are benefiting has to do with lowered total cost of capital. And that’s not just ‘good feelings,’ it’s real money.”

Vin Messina

Banking giant HBSC agrees. In How An ESG Strategy Can Help Put Your Business Ahead Of the Pack, the company’s global head of sustainable finance Martin Richards says, “we’re seeing both access to capital and pricing of capital being driven by sustainability strategies.

“In the general credit market, we’re seeing equity being focused in this direction, and in the public bond market we’re seeing a definite discount on pricing for green bonds.”

Depending on their industry and business model, companies can benefit in other ways, too, by bringing in more efficient service vehicles, for example, or recycling waste products back into manufacturing processes.

Depending on their industry and business model, companies can benefit in other ways, too, by bringing in more efficient service vehicles, for example, or recycling waste products back into manufacturing processes.

“And of course, there’s recruiting and retaining employees,” says Messina. “Pursuing and publicizing a strong ESG commitment can be effective in finding and keeping employees who care about conscientious employers—those are good people to have in the building, for sure.”

Facing the Need for ESG Accounting Leadership

Benefits aside, the organizational challenges facing newly-minted ESG working groups will be daunting.

At a high level, often there is a general lack of confidence within the organization concerning management’s ability to meet ESG requirements. In its 2022 ESG Reporting Survey covering North America, Europe, and APAC, ESG reporting experts Workiva said that 66% of senior decision makers feel that their organizations are unprepared to meet their ESG goals and regulatory reporting mandates. Further, 72% said they don’t feel confident in the data currently being reported to stakeholders.

A lower-level challenge involves the day-to-day business of satisfying specific disclosure and reporting demands. As an example, a multinational law firm that advises on ESG law pointed to an SEC risk alert for investment advisors and funds offering ESG products and services. The SEC found, among other things, inadequate controls for maintaining and monitoring ESG directives and portfolio management practices inconsistent with disclosures in some client-facing documents.

“Whoever takes the lead of an ESG working group will have to deal with these types of challenges, and many more,” says Messina. “For instance, the ESG contingent will have to be good at rallying business partners and executives to commit to specific roadmaps, while at the same time keeping a tight rein on controls and reporting.

“That’s why accounting is well-suited to take the lead. The CFO is used to working with C-level executives on strategic planning, and knows how to communicate with investors and other stakeholders. And accountants are no strangers to working with controls, aligning to standards, understanding risk, maintaining data accuracy and timely reporting, and partnering with colleagues throughout the business.”

Forming An ESG Leadership Strategy

Different companies will have wide varieties of specific issues to deal with, but in general, Messina advocates a four-point strategy for coping with the fast-growing responsibilities of ESG leadership.

The ESG leader should:

Build a close connection with uppermost leadership. An ESG strategy will demand a full commitment from the business, so it’s imperative to work closely with the CEO and other C-level executives, and to engage the board of directors as well. Deloitte recommends giving ESG a permanent spot on the board agenda and making sure that the board understand the relevant regulatory requirements and has access to the internal ESG data it needs to make strategic decisions.

Assemble a robust ESG working group. An effective working group will draw members from operations and business units as well as accounting and finance. The ESG leader’s job will be to evaluate and enhance, if necessary, the skills and resources needed to work on a myriad of tasks, from gathering and codifying data from across the company to tracking regulatory developments and monitoring competitors’ ESG efforts.

Another working-group function, risk evaluation, will work closely with accounting and finance to verify and update ESG-related data. Accuracy is key here. According to Accenture’s Measuring Sustainability, Creating Value report, 78% of global finance leaders were seeking to understand the financial risk of sustainability to their companies, but only 47% had defined key metrics and data sources for their reporting.

Partner with IT to maximize technology efficiencies. There’s no better time than now to extend the partnership between accounting and IT because new technology will be urgently needed to expedite the transition to successful ESG monitoring and reporting. For instance, accounting may be able to help IT evaluate performance of the emerging families of sustainability management software or services, and both accounting and IT should look into how they might make use of independent benchmarking services to assess the quality of the organization’s ESG data collection, monitoring, and management processes.

As the challenges become more complex, businesses should remember that the move to cope with ESG is not so different from other business enterprises, says Messina.

“It’s about a brand, about internal costs of capital, control mechanisms, and about business performance. It’s not just a random social consequence.

“At the end of the day, ESG success can bring about a competitive advantage for those organizations that do take it seriously. This is why companies should look first at the accounting/CFO function to take the lead in ESG management, because there’s nothing more serious than balancing the books and reporting to investors.”

Vin Messina

How Accounting Technology Can Help with ESG Reporting

Many accounting groups will face their own challenges as they gear up to take on their new roles in ESG management. For one, they’ll have to find extra capacity to add tasks, such as building new ESG reporting models, to their already hectic workloads.

Cloud-based F&A process automation can help open up capacity by reducing the time needed for mundane tasks such as ticking and tying numbers in a financial statement or tracking down paper documentation that may have been lost or destroyed. Also, these systems store financial data and documentation in the cloud, so they are accessible at any time of day to authorized accountants, controllers, or CFOs who may be working remotely or in different offices.

“This also makes it easier for auditors to access the data and documents they need remotely,” says Messina. “This saves time for everyone, and helps reduce travel, which can reduce a company’s environmental footprint.”

Importantly, many companies find it easier to hire and retain accountants who are motivated to take on strategic work and avoid the tedium of manual bookkeeping, Messina notes. “And these are just the types of people who will be in demand to help businesses succeed with their ESG programs.”

Watch this free on demand webinar Driving Sustainability From the Finance Seat to learn more about this emerging topic .