We recently had experts from Quicken and Bill.com join us for an informative discussion on the benefits of an AP automation solution, and what features finance teams should consider when selecting one. The webinar was titled Buying an AP Automation Solution and featured Gary Hornbeek, CFO at Quicken, and Mark Gervase, Director of Product Marketing at Bill.com.

If you missed it, we have covered some of the top highlights below.

Why AP Automation?

Well, it is all about pain. The whole space around AP automation has become hot. Maybe a global pandemic has something to do with it and having to go remote and do things digitally.

Automation is all about transforming to be:

- Fast and automated

- Paperless in the cloud

- Mobile, audit trails and reminders

- Digital payments with a click

- Automated sync with GL for easy reconciliations

Why Now?

The reason to automate now is about agility. Every business has these unique workflow needs now that may need to change more often than we’re used to in the past. There is an incredible focus on cash flow. We are certainly seeing growth again in the economy. Your business may be growing by the number of vendors, transactions, or locations. Your company could be pivoting, changing direction, or your process is changing (go from remote to back in the office to semi-remote). One thing that is probably on your mind is staffing and talent. We were finding that it was tough to find good talent pre-pandemic; now, it is becoming even more challenging. Businesses are starting to be all their finance work in-house.

What are Peers Doing?

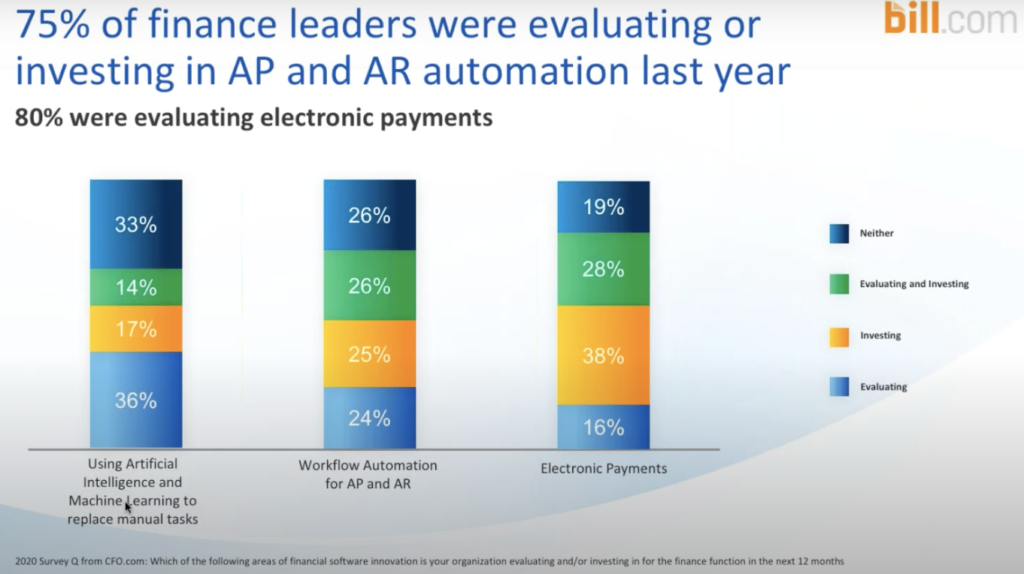

Bill.com did some research and surveyed CFOs and finance leaders across the country. One of the questions we ask them is which of the following areas of financial software innovation is your organization evaluating or investing in over the next 12 months.

75% of finance leaders were evaluating or investing in AP and AR automation last year. This is the trend.

Many of your peers have realized the importance of AP and AR to the business, to automate, to go digital.

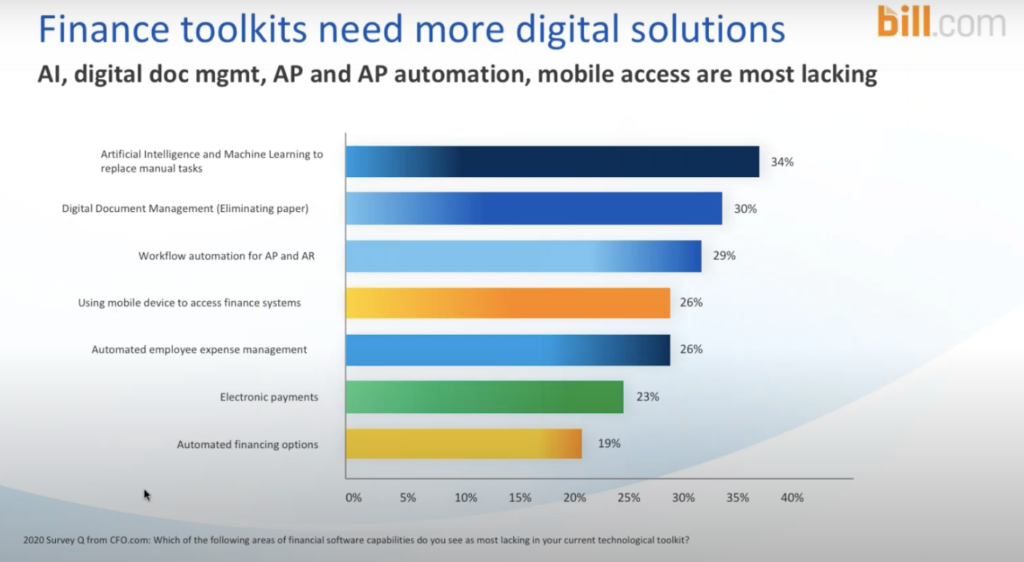

One more data point for you: Bill.com asked “which of the following area of financial software capabilities do you see as most lacking in your current tech toolkit?” The responses were all about digital capabilities and the most common answer was lacking in artificial intelligence (AI) and machine learning (ML) to replace manual tasks.

The trend here is all about being able to go digital, be flexible, and be agile.

How to get Started

There is a recognition that there is some pain around accounts payable and you go on to Google to search “where do I even start.”

To solve this pain, you are going to have to make a ROI case to someone higher up about investing in new software.

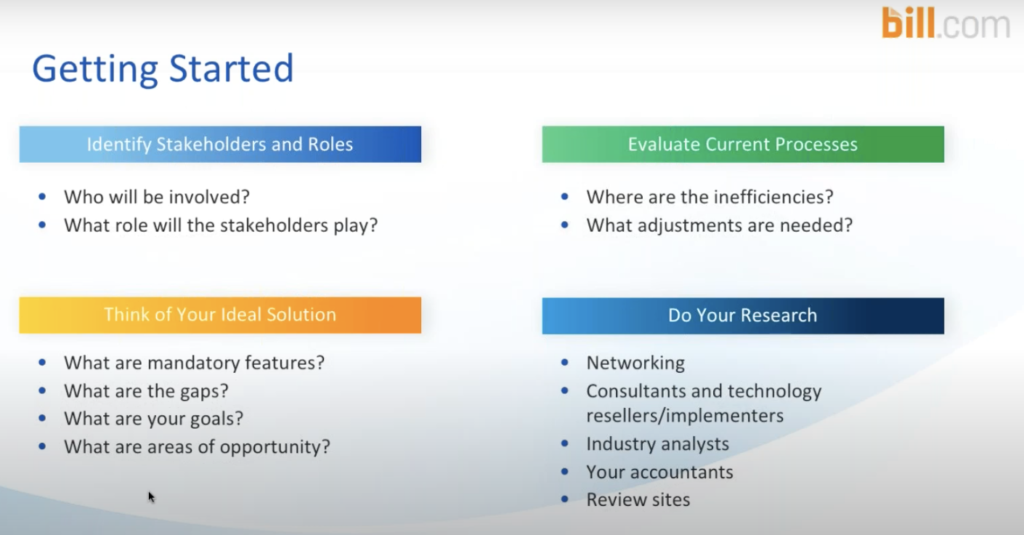

Evaluate Current Process

When you evaluate your current process, you know quite well that you have some pain. Evaluate those pain points.

Identify Stakeholders and Roles

When they identify the stakeholders, they will try to justify the ROI. Some questions that may be thought about are

- Can I save time with my accounts payable group?

- Can I cut from x AP clerks to y AP clerks?

The stakeholders in total are far greater than just the accounting department. It is all business people involved in the spending.

Think of Your Ideal Solution

When you think of your ideal solution, which specific things do you most want to solve.

Do Your Research

When you do your research, explore and talk to other people about a solution to fix the pain points.

Quickens’ Experience

Quicken was a part of Intuit, then we were sold to a private equity company. Quicken had to quickly implement our own systems. Quicken wanted to use NetSuite as GL and Bill.com integrates with NetSuite.

Don’t view it as the AP processors time; focus on how much time the controller, the CFO, and the other executives will save in the process.

What to look for in an AP Automation Solution

Gets the Basics Right

It does have to easily invoice capture and code. The workflows allow you to see everything on your invoice and who approved it.

Connects With Your Tech Stack

AP automation solution works with what you use today and what you might use tomorrow.

Reduce Errors and Risks

AP automation solution has app security, payment security and data protection, but it also allows you to have separation of duties and internal controls.

Saves Time

It is easy to use. There are trainings and support. You have cloud and mobile access. It will reduce manual work.

Delivers Analytics

Some questions answered are:

- What needs attention?

- What’s coming up?

- What’s done?

The Bill.com Approach

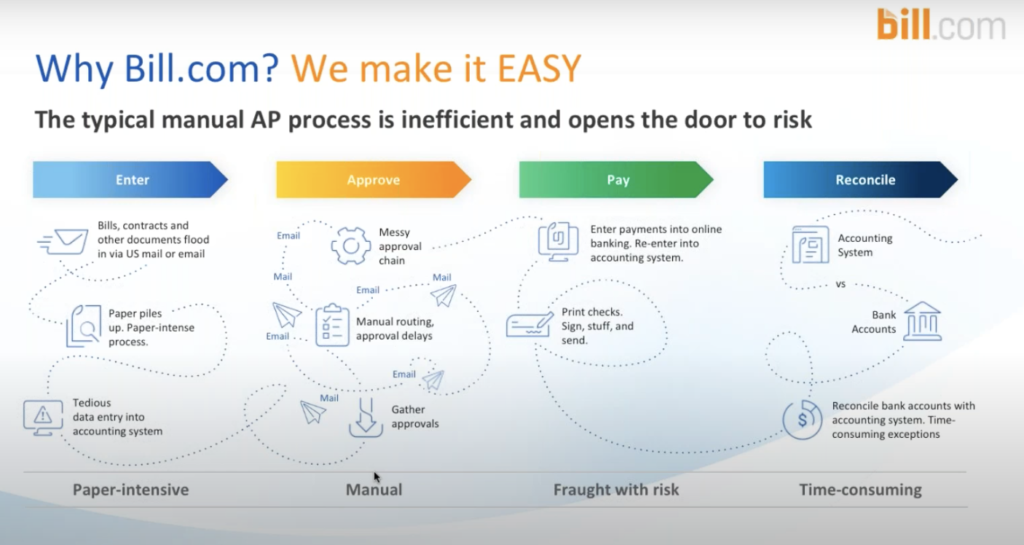

The whole purpose of Bill.com is because of the typical manual ap process.

The Bill.com approach has 4 easy steps. The first step is capture POs and invoices to allow your company to go paperless. The second step is view and approve bills online from any device to allow your company to be automated. The third step is pay with a click to allow your company to be flexible. The fourth step is to reconcile.

Want the Full Webcast to Learn More?

We’ve all wasted time entering the same data into multiple systems, such as an AP sub-ledger, an online bank account, a reconciliation spreadsheet, and then the general ledger. Automated AP solutions can help you avoid these scenarios. Whether you’re already familiar with the AP automation solutions available or you’re in the beginning stages of your search for a better option, watch this on-demand webinar to gain insights on how to move forward. Click here to watch now.

Don’t miss out on any of our upcoming events! View upcoming webinars and recordings of past webinars on our events page: https://controllerscouncil.org/events/