Controllers Council recently held a Webinar Discussion on the hot topic of Automate or Stagnate – The Case for Advanced Tech in the Finance Back Office, sponsored by Auditoria.AI

Nick Ezzo, VP of Marketing and Elaine Nowak, Director Product Marketing at Auditoria.AI, explained the challenges in the back office and what advanced technology can solve these problems today.

Challenges in the Finance Back Office

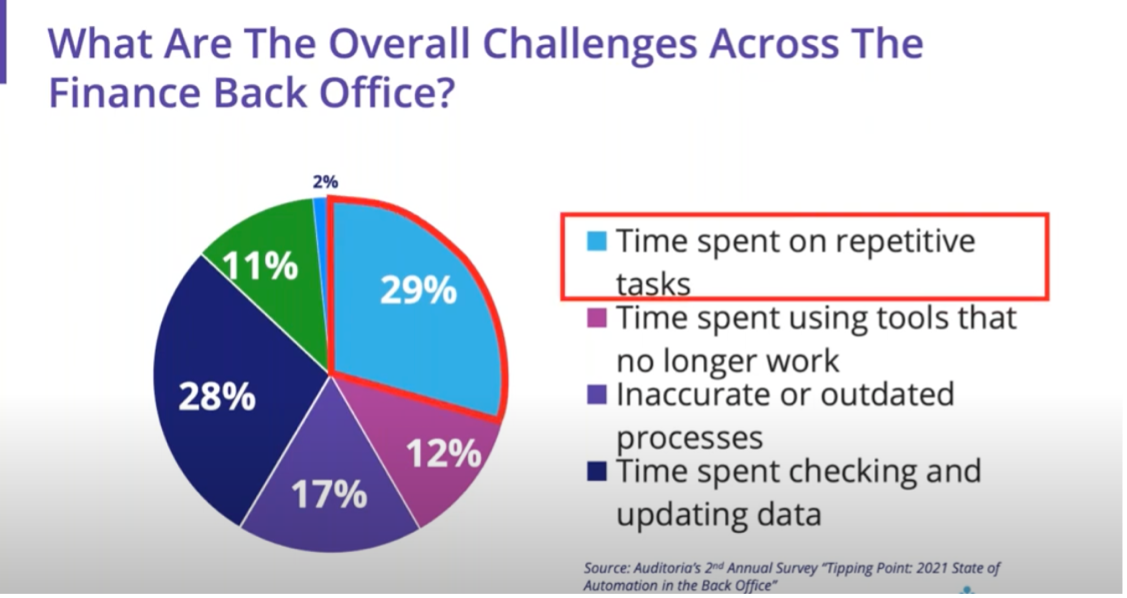

To start off, Nick and Elaine asked what are the overall challenges across the finance back office? As you can see below, the overall challenge is time spent on repetitive tasks.

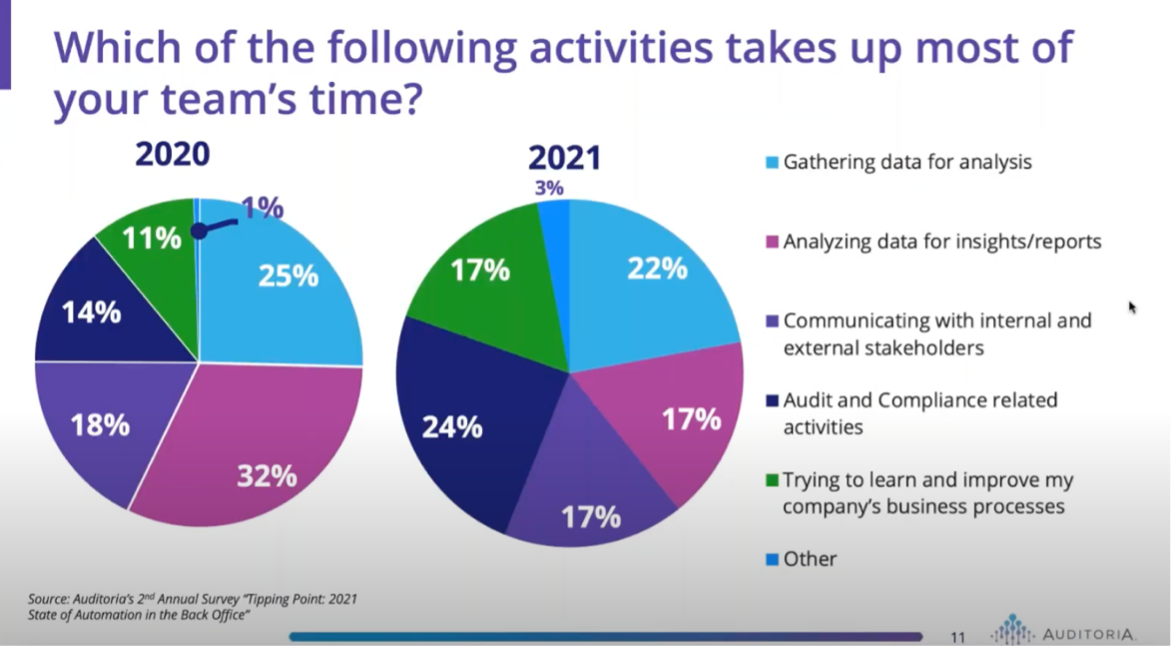

Then, Nick and Elaine asked which of the following activities takes up most of your team’s time? As you can see below, the activity that takes up most of your team’s time is gathering data for analysis.

38% of people said that one of the top priorities is investing in new technology in the coming year, but also the reduction of repetitive tasks and manual tasks is extremely important. If manual and repetitive tasks are off peoples’ plate, then they can focus on higher level business objectives.

Reduce Stress in AP and AR

The stresses in the back office include lack of visibility, manual tasks, lack of standardization, compliance and auditing, lack of required skills, constant deadlines, and fear of being replaced. These stresses can get boring and not rewarding, and people want a job that is impactful and not just inputting data from one place to another.

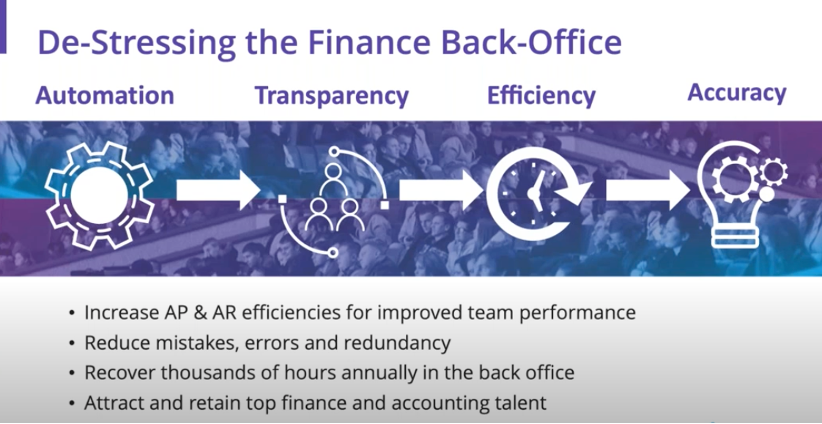

One way to reduce stress is by putting automation in place. The benefits you can gain by automating repetitive manual redundant processes give you a better visibility int your AP and AR activities.

Another way is technology. Technology allows you to resolve disputes much more quickly, which leads to a better customer satisfaction. This is going to give your team the ability to make smarter, faster, and more precise decisions. Putting technology into place also increases your accuracy.

Technology Trends: Next-Level Process Automation

Next-Level Technology and Automation allow us to focus on four things:

- Improve the decision making and the quality of the conversations between your internal and external stakeholders, like your customers and your vendors

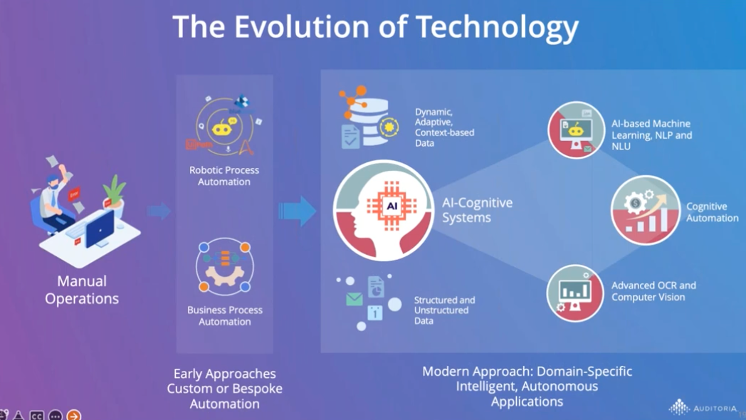

- Achieve significant savings with both time and money using advanced technology, like RPA, computer vision, natural language processing and speech technology

- Build those digital capabilities for the finest team of the future

- Take advantage of the new technologies to really reduce the cost and optimize performance, which is what the CFO and the controller care very much about

Future of Corporate Finance

It’s not enough to just put technology in place, you have to talk about the people that are using that technology. It’s going to be an interesting thing to see now, because this changing workforce that we have, that means that we’re going to have up to four generations.

Skill Sets

One of the top priorities is talent management. After recruiting and then keeping your employees in place, it’s, what is the skillset for the office of the CFO? That the CFO office is less tactical and more strategic. And CFOs need to make the case for either hiring employees that have those skills or retraining their current employees to become true business and data analysts.

One of the key things is you want to have is data savviness, the ability to process data and extract relevant information, and then translate all this analysis that you’re able to do now into actionable plans. Then you have to look for people that have strong relationship management skill, honed interpersonal skills. And you also have to be open, approachable, collaborative, all those things that will make it important for being able to embrace technology. It’s also important to have a strategic mindset, someone who develops strategic frameworks, that has a vision of where they want to be, so they can be forward thinking and future thinking. Then you have to have some business acumen. Understand key drivers, what are the outcomes you’re trying to achieve? And what are the drivers that are going to influence that outcome? If you can find one person who has all these skills, then that is incredible.

Technology to Elevate the Role of Financial Professionals

If you don’t get behind technology, you’re going to get left behind.

The first thing you should is think about moving your accounting system to the cloud. It’s not the end of the world if you have an on-premise accounting system, we work with them all day long too, but there is a modern category of cloud-based financial management systems or ERP systems.

So, these systems communicate via something called application programming interfaces or APIs. These are just ways for third parties like Auditoria to write data in and out of your ERP system, instead of uploading and downloading like CSV files, we can communicate directly with your accounting software. The cloud and the innovative architecture are important.

Look at the processes in your back office, is it a lift and shift versus a complete transformation? Are we throwing everything out or are we just tweaking around the edges? You have to do that on your own through your own processes.

You got to think about your team. The characteristics of that finance team of the future was discussed previous in this post, that perfect finance person that has all those, the creativity, the analytics, the left brain, the right brain. Once you’ve put automation in place, guess what, a lot of the routine mundane stuff that they used to do is being done automatically while you sleep or while you’re on your lunch break.

And then lastly, capitalize on the opportunity. Most CFOs change out their ERP system once in their career maybe twice, it’s a painful process, people don’t like to do it. And so, as you’re rethinking and reimagining your technology platform, the team that you want in the future, use this as an opportunity to really capitalize on it, and use it to maximize the efficiency in your back office.

Key Takeaways

- Many of the challenges, such as repetitive work, manual tasks and repeated follow up could be resolved by implementing automation.

- The future of corporate back-office is automation that provides better decision making, improved interactions, significant savings in time and money.

- Transparency, efficiency, and accuracy delivered through automation will recover thousands of hours annually in the back office.

- Develop and hire the right skill sets, focusing on technology, creative thinking, and agile culture.

- Explore the most advanced technology to achieve the greatest impact with the quickest ROI

- Get started with practical next steps

To learn more, view the full Webinar discussion here.

ABOUT THE SPONSOR:

Auditoria is an AI-driven SaaS automation company for corporate finance that automates back-office business processes involving tasks, analytics, and responses in Vendor Management, Accounts Receivables, Planning and Audit. By leveraging natural language processing, artificial intelligence, and machine learning, Auditoria’s platform removes friction and repetition from mundane tasks while also automating complex functions, such as predictive analytical forecasting. Give your finance teams superpowers at Auditoria.ai.