Accountants and finance professionals are familiar with long days and nights spent each month trying to close the books. Manual processes, errors, and lack of knowledge due to staff turnover often drive inefficiencies in financial reporting.

In fact, it’s not uncommon for accountants to work well over 50 hours per week during the monthly close period, far exceeding the workload of their peers.

While progress has been made to develop new technology and software designed to reduce the time spent on the monthly close process, many companies have lagged in adopting these innovative close solutions. Instead, their time is spent putting out fires, meeting ongoing deadlines, or being pulled into special projects like implementing new ERP software.

In the 2022 Financial Close Benchmark Survey by Trintech, which surveyed 160+ finance professionals around the globe in the first half of 2022, a full two-thirds of organizations surveyed indicated that they want to reduce the monthly close period, but don’t have the time to put the processes and solutions in place that would enable them to do so. In this article, we will share some additional insights from the survey.

What Are the Biggest Challenges Facing Finance Teams Today?

52% of finance professionals cited that meeting close and reporting deadlines was the biggest challenge they faced. Lack of automation adoption and relying on old manual processes hinders the ability of finance teams to reduce the number of days in their monthly close process.

Those who work in a remote or hybrid environment often find it even more complicated since they have to rely on emails or chat software and Zoom calls to resolve issues with their colleagues, rather than using a solution that drives visibility into the process and collaboration in the workflow.

Sadly, 45% of finance professionals aren’t fully confident in the numbers reported during the monthly close. Doubt over the financials can lead to increased risk for an organization, resulting in internal and external problems.

Investors rely on a company’s financial reporting to understand the successes and failures of the business. In contrast, executives rely on reporting to plan for working capital needs and budget for upcoming expenditures. Incorrect financials can lead to bad decisions, affecting the entire company and its investors.

What Is Preventing an Efficient Financial Close Process?

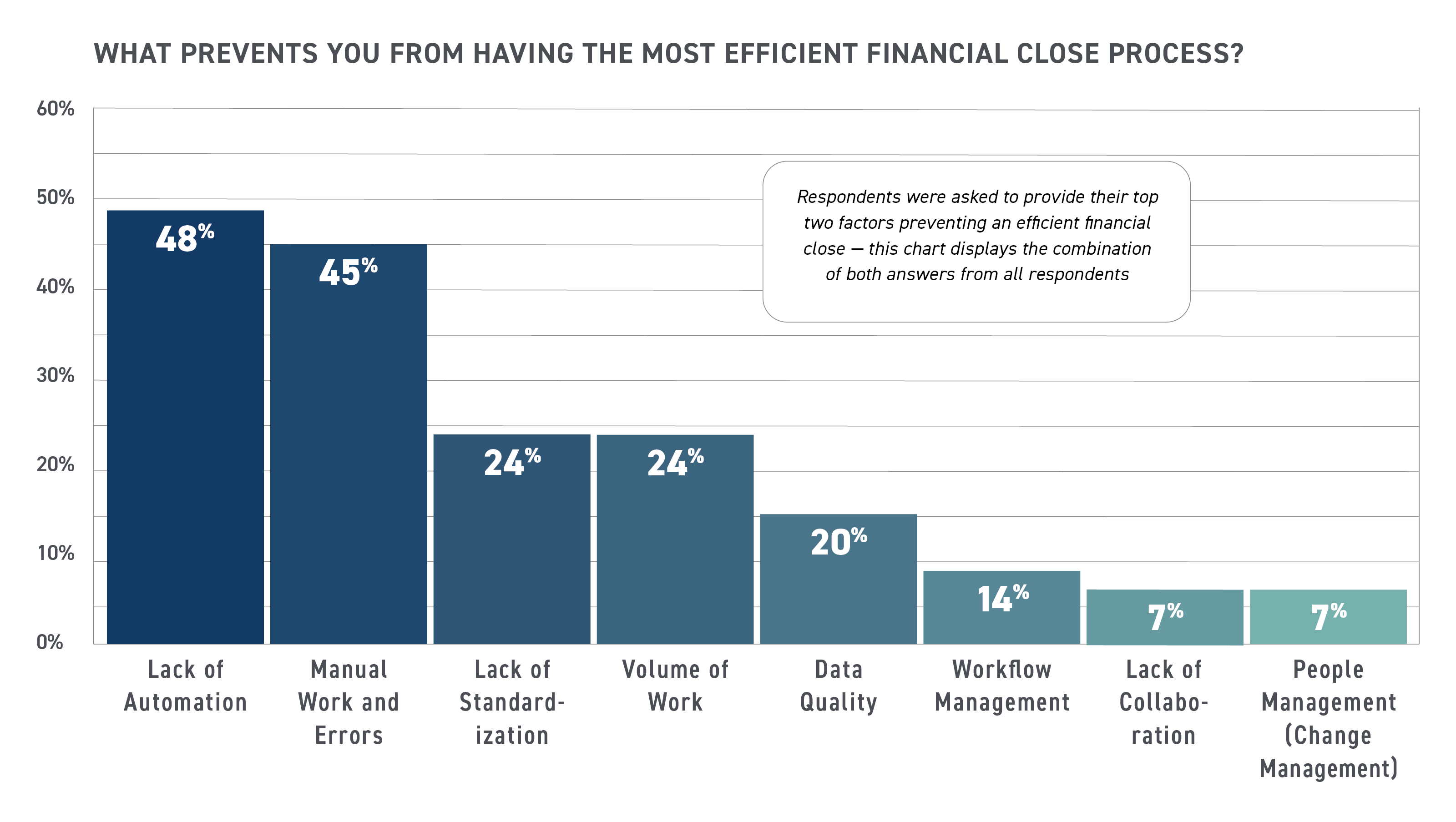

In the survey, 48% of respondents cited a lack of automation as a hindrance to an effective close. A further 45% identified manual work and errors as a significant issue.

Source: Trintech’s 2022 Global Financial Close Benchmark Report

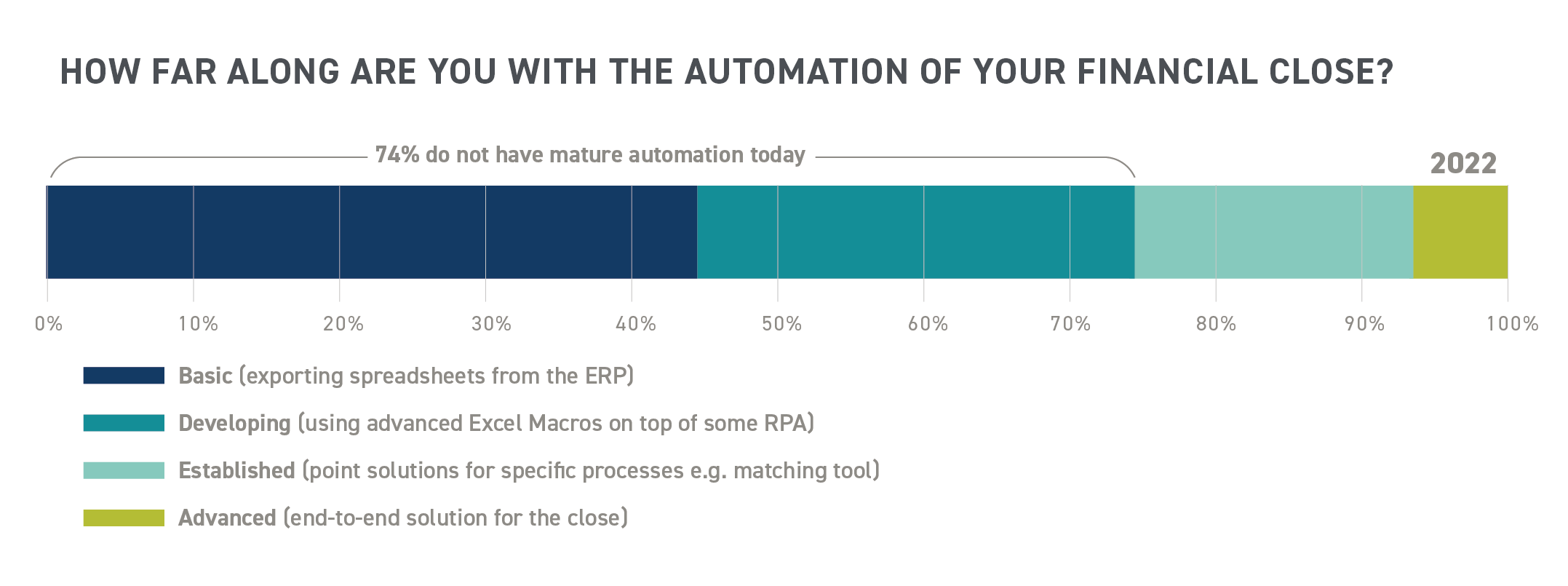

While many finance professionals recognize the source of the problems, 74% indicated that they still don’t have standardized processes and purpose-built automation solutions in place.

What will it take to change? Efforts must be made to understand today’s automation technology and leverage it to optimize the close process.

Without more efficient operations, talented team members will move away from companies that rely on ineffective and inefficient manual processes reliant on spreadsheets in favor of more strategic roles at companies leveraging technology that allows them to add value to their existing skill sets.

What Areas Are Driving Increased Risk to Organizations?

A sweeping 74% of organizations cited talent acquisition and retention as the most significant risk to their company over the next year.

Retirements and movement of finance and accounting professionals to roles where they have the opportunity to provide more value are leading to strain in many companies.

To retain and attract talent, finance teams need to take action to leverage financial close automation in their organization’s accounting processes. This reduces the time spent on tedious and repetitive tasks that could be automated, such as balancing reconciliations and high-volume transaction matching that is still done in spreadsheets across many companies today.

By automating these types of processes and freeing up time in the month, finance and accounting professionals will have time to grow their skills and engage with other departments in a more strategic partner role.

How Many Companies Have Automated Parts of the Monthly Close Process?

Few companies have been able to achieve the automation that they want. Less than 10% of companies are advanced and have reached best-in-class status, leveraging an end-to-end financial close automation solution that allows for a quicker close period.

Source: Trintech’s 2022 Global Financial Close Benchmark Report

Of those surveyed, 74% of organizations are still entirely reliant on basic or developing automation procedures, such as exporting spreadsheets from the ERP or using advanced Excel Macros on top of some RPA to help with specific items. This laggard adoption will eventually put these companies at risk as they lose ground to companies modernizing their processes and speeding up the time to provide insights to the business.

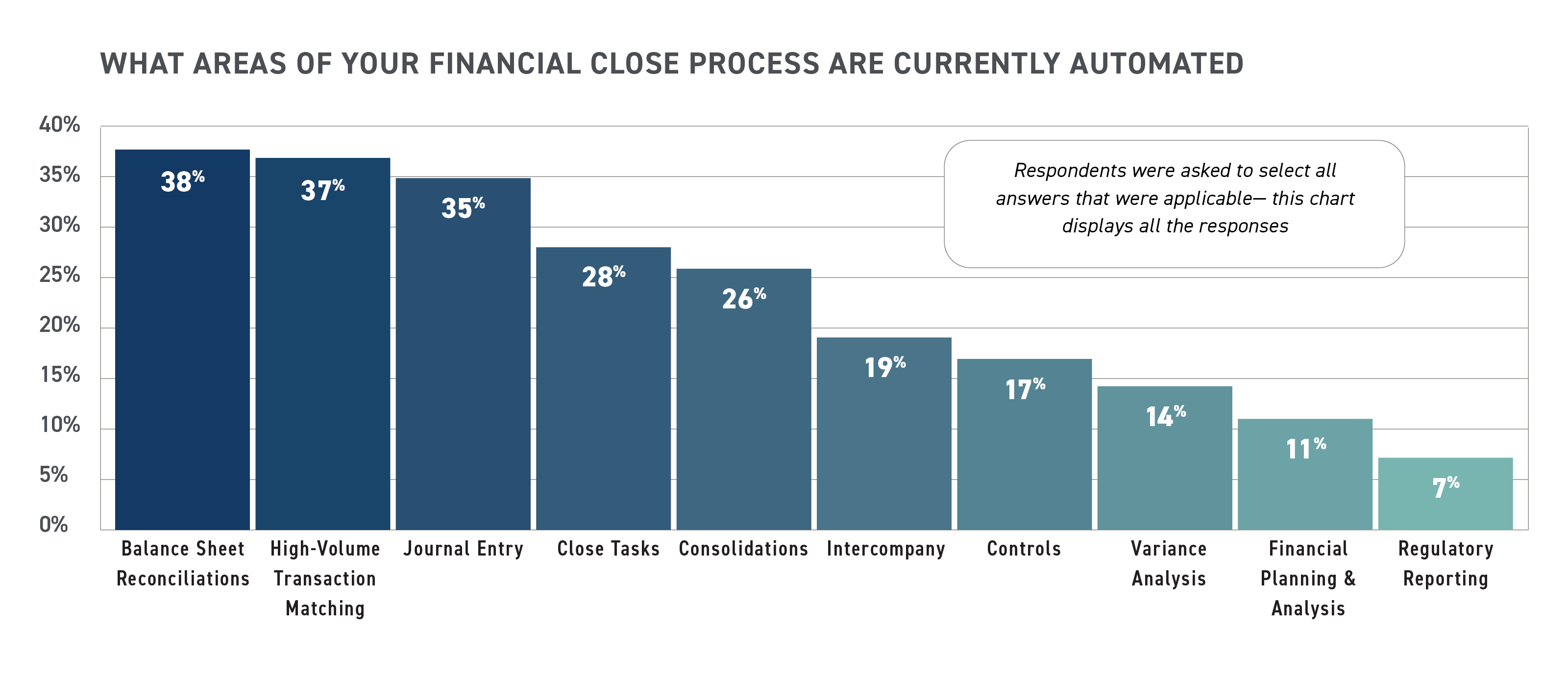

When asked about what part of the financial close process they have automated, there is still a very low adoption rate of solutions that automate balance sheet reconciliations and high-volume transaction matching (38% and 37% respectively), even though these solutions have been around now for more than a decade. In fact, 42% of companies said they still use mostly manual efforts for the overall financial close process but have short-term goals of implementing new tools to speed up the time spent on manual processes.

Source: Trintech’s 2022 Global Financial Close Benchmark Report

What’s Preventing Automation of Monthly Close?

Finance and accounting professionals often are tasked with numerous responsibilities outside of the monthly close process. These responsibilities, combined with the challenges many companies are experiencing from a reduced workforce, take away from time that could be spent implementing a financial close automation solution.

For instance, 61% of organizations indicated that prioritization of other projects — such as ERP implementation — reduced the time available to implement new financial close automation tools.

Other organizations cited lack of standardized processes across the accounting team and simple unawareness as hindrances in automating monthly close procedures.

Of those who have automated processes within the monthly close, balance sheet reconciliations and high-volume transaction matching were slightly higher than other areas, and is a common place to start, since this is usually where the biggest pain point is within the organization.

Final Thoughts on Monthly Close Automation

Clearly, there is room for improvement within most companies’ financial close processes.

Companies who want to retain their employees and further develop their skill sets must move away from manual, ineffective processes and prioritize efforts to leverage technology and modernize the financial close process. Download a full copy of the report on monthly close automation here.

BONUS: Check out our on-demand webinar, How Demand for Business-Critical Insights and a Challenging Labor Market are Accelerating Corporate Finance Automation, where experts from The Hackett Group and Trintech dive even further into the results of this survey.