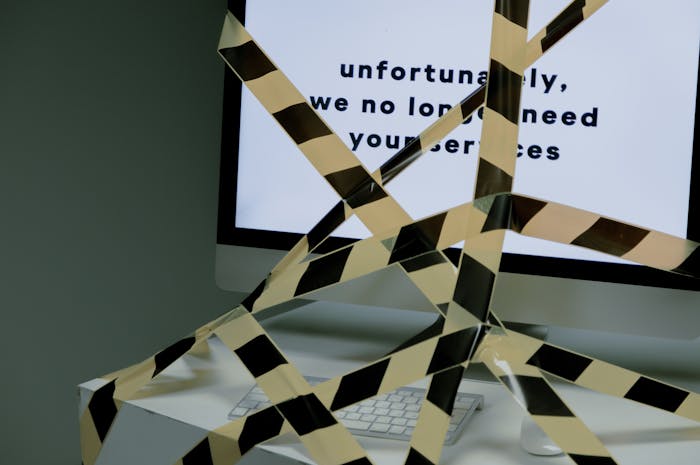

The current tech layoffs continue to pile up in 2025. The mid-year total was roughly 72,000 layoffs spread across 150 companies. What started as isolated hiring freezes rapidly escalated into widespread layoffs, which are impacting organizations of all sizes.

While most of the conversations about the layoffs have focused on the impact on engineering and product development roles, finance departments have also felt the repercussions.

As a finance leader, you need to get your team ready for the ripple effects of these changes and the challenges they will present. Here’s a look at the road ahead, as well as opportunities you may be able to seize in the aftermath.

The Ripple Effect

While most tech layoffs have originated in product or engineering departments, your finance team may still feel the secondary effects. Here are a few examples:

- Budget Reallocation: Cutting R&D costs may increase compliance or operational expenses

- Workforce Planning: Adjusting forecasts amid headcount changes requires flexible modeling

- Revenue Recognition Challenges: Subscription churn and contract changes could prevent you from meeting revenue goals

- Systems Cost Shifts: Cloud or software subscription costs can fluctuate unexpectedly based on workforce size or usage levels

The specific ripple effects your business faces will vary based on the sector you operate in, the size of the workforce, and the level of autonomy of your IT department.

FP&A Pressures and Resource Rebalancing

When layoffs hit, finance departments are expected to do more with less. Controllers may suddenly find that team members they relied on are now departing, and this can lead to an increased workload. The reorganization period can be particularly challenging as outgoing employees’ work is reassigned. Common impacts include:

- FP&A Burnout: Teams must revise budgets and forecasts across multiple departments, sometimes with incomplete data

- Increased Scenario Modeling: Finance departments need advanced modeling capabilities to adjust to staffing changes

- Delayed Close Cycles: Turnover or hiring freezes can lengthen financial close periods

Additionally, your finance team must adjust to changing headcounts and department structures. This means adjusting user access, permissions, and data ownership in key systems.

Lessons for Controllers and Finance Leaders

Here are some key tips that you can use to navigate the road ahead:

- Use a range of scenarios to model the financial impact of workforce changes

- Adopt rolling forecasts and user-based budgeting to better accommodate changes

- Collaborate closely with HR, legal, and IT to stay agile

- Automate key processes such as payroll reconciliation and invoice approvals

The reality is that your finance team is going to be doing more with less. Consequently, you need to proactively identify opportunities to save time or reduce manual effort. Automating redundant tasks and addressing areas prone to errors can decrease the burden on your team while offsetting the productivity losses associated with layoffs.

Aligning Finance With Business Strategy

Layoffs can serve as a cue to adjust other aspects of business strategy, such as pivoting to new markets or revitalizing demand for core products. As a finance leader, you have the responsibility to ensure that financial models align with the organization’s new direction. You can do this by:

- Analyzing gross and net margin changes from reduced headcount or modified strategies

- Preserving liquidity by delaying discretionary spending

- Pausing or scaling back capital expenditures

You should also be prepared to discuss these changes with stakeholders, especially when composing investor communications.

Long-Term Finance Planning in a Post-Layoff Environment

Beyond crisis response, finance leaders must prepare for medium and long-term stabilization. Here are a few ways you can contribute to the stability of your organization:

- Collaborate with HR on future hiring strategies and compensation planning

- Lean into upskilling so you can achieve more with leaner teams and lower headcounts

- Consolidate redundant software licenses to save money and slash wasteful spending

Many firms are also using AI-driven workforce planning tools to get more done with smaller teams. Consider investing in similar solutions to model productivity changes and absenteeism trends.

What to Watch For in the Back Half of 2025

Unfortunately, the tech sector probably hasn’t seen the last of these staffing shakeups. As artificial intelligence becomes more sophisticated and the economy remains unpredictable, businesses will likely face a slow rebound. While this could lead to some light rehiring toward the end of the year, more layoffs are also likely.

Your finance team should prepare for all of these changes by:

- Conducting quarterly workforce cost audits to identify savings opportunities

- Preparing updated liquidity and runway forecasts monthly

- Benchmarking severance, retention, and benefits costs against industry norms

- Monitoring workforce trends and building mitigation strategies

Additionally, explore opportunities to adopt AI-powered tools for both finance and workforce analytics. The right combination of technologies and proactive responses can help you weather these storms while keeping your business on track to achieve its 2025 performance goals.