Controllers Council recently held a panel discussion on ESG 101: Practical Approaches for Navigating Compliance, Controls, and Sustainability Reporting, sponsored by Visual Lease.

Visual Lease is the number one lease optimization solution provider, trusted by over 1500 organizations worldwide to ensure compliance with lease accounting standards, meet ESG reporting needs and leverage lease portfolios for strategic, financial, and operational outcomes.

Our expert panelist is Katie Meeker, a seasoned marketing professional with over 13 years of experience in B two B and software as a service industry. Katie joined Visual Lease in January of this year as director of product marketing and creative services. Having led the product launch for VL’s ESG Steward, she’s acutely aware of the pressures the Office of Finance is facing when it comes to preparation and execution of environmental reporting.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

What is ESG?

ESG is a framework and it’s been used by investors, regulators, and businesses to really evaluate and measure the sustainability and the ethical impact of a company’s operations and its practices. And it stands for environmental, social and governance.

This first pillar environmental really focuses on a company’s sustainability risks and impacts, and it tends to include factors such as a company’s carbon emissions, energy efficiency, waste management, water usage, and overall environmental sustainability.

This next piece, the social aspect of ESG, tends to deal with the company’s impact on people both internal and external to the business. This can include employee treatment and wellbeing, diversity, equity and inclusion, labor practices, community engagement, human rights, product safety and more. And evaluating that social dimension really helps assess a company’s commitment to responsible and ethical business practices.

And then lastly, the governance piece. This refers to really the system of rules, of practices and processes by which a company is directed and controlled by. This aspect of ESG examines the company’s leadership structure, board composition, executive compensation, transparency, ethics, and compliance with laws and regulations. And good governance, of course is seen as essential for preventing corporate misconduct and really making sure that a company is managed in the best interest of all its stakeholders.

What’s Measured in Sustainability Report?

In sustainability reporting, we think about the materiality in a broad sense. It’s not just the financial information to address the needs of investors, but non-financial factors that are material to the performance of the business. The upcoming European Sustainability Reporting Standards or the ESRS, they’ll be officially requiring double materiality assessment and reporting practices from companies in the EU, including some European subsidiaries of U.S. companies.

According to double materiality, businesses must consider both what’s material to society or the planet, and then also how the business impacts the environment and the community. So that would be our inside out and then how the business is affected by sustainability issues. And that would be our outside in reporting, what’s material to the business and a lot of the popular sustainability reporting guidelines such as GRI or the SASB.

How To Measure Environmental Impact

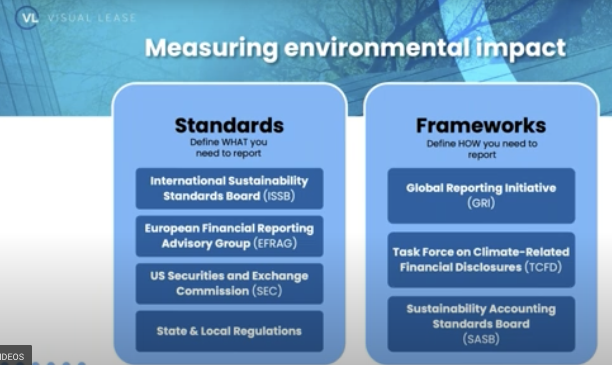

The standards define who must report and what you need to report on. Now outside of the U.S., the first standards have been released mostly with phased implementation starting in 2024. And the standards are swiftly becoming more and more aligned. ISSB or the International Standard, they just announced there’s the summer. It’s designed to really be the global baseline for all their jurisdictions to build from. Now in the United States, we have a patchwork of state and local laws. The SEC is expected to release their official guidance as soon as next month (November 2023).

Now if we think about frameworks, the frameworks define how you need to report. These are reporting methodologies, and the most popular frameworks are really the ones that you see on the screen. The SASB, GRI and the TCFD. Now, each framework defines material topics and materiality thresholds, and it provides guidance to disclose the impact of those topics and how they’re being managed. And there’s even guidance specific to certain industries.

Updates on the Regulatory Landscape

It’s been quite a busy summer and early fall in the ESG universe. Below you will see the recent global sustainability regulations landscape:

How to get Started in Sustainability Reporting

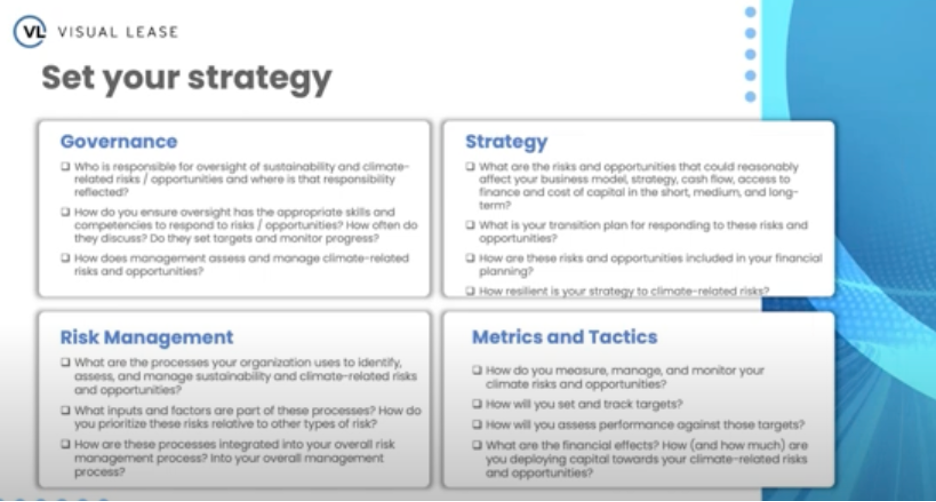

First, you set your strategy:

Then, you will establish your task force. Your task force will include the executive sponsor, reporting owners, functional owners, and system owners.

Next, you will establish a baseline, which is to measure your current impact on the environment. It’s hard to know where to invest if you don’t know where you are now, when determining what to track, it’s helpful to look really in three areas:

- What’s in your control?

- What are your competitors reporting?

- What’s required?

Finally, you will apply industry guidance in real life.

To view the complete webcast, download full webinar here.

ABOUT THE SPONSOR:

Visual Lease, the #1 lease optimization software provider, empowers organizations to leverage their lease portfolio as a strategic asset. Our platform is uniquely designed to meet the needs of every team that interacts with a company’s lease portfolio to reduce risk, drive confident and sustained lease accounting compliance, and provide the visibility required to make agile business decisions. Informed by nearly three decades of experience, our solutions help companies easily sustain compliance with FASB, IFRS and GASB lease accounting standards and implement proper lease controls to improve the financial, legal, and operational performance of their leases. Our award-winning software is used by 1,000+ organizations to manage 500,000+ real estate, equipment, and other leased assets globally. For more information, visit visuallease.com.