Controllers Council recently held a webinar panel discussion on Controllers Roadmap to Build a Best-in-Class Finance Team, sponsored by HighRadius.

Our guest speaker was Morris Kupfer, VP of Finance at HighRadius, reporting to the office of the CFO at HighRadius at global headquarters in Houston, Texas. Morris holds a JD, an MBA, and a BA and served in several operations and finance roles.

Following are key highlights to this discussion. If you are interested in learning more, view the full webinar archive video here.

Controllers Under the Lens

Controller’s functions have really expanded over the years. You become a right-hand person to the CFO, or the CAO, or to the executive team. They rely on you to not just close your books, but to have a very high-level detailed explanation or analysis for all the global or consolidated financials, especially if you’re a global company.

Roadblocks we are seeing:

- Drowning in data but starving for information: So, the data is not stopping, we’re moving forward as the global digitization and transformation in data, that’s inevitable and that won’t stop. So, there’s tons of data.

- Scaling resources and the siloed workforce: you have the need to added resources is in part because you have so much data that’s coming into you and there’s additional requirements and regulations from FASB for example.

- Disconnected systems: The world’s moving forward, whether you like it or not in a digitization world. So, your technology capabilities must keep up. As simple as supporting a metric, which I thought it was interesting. And the next is on AR processes.

67% improvement when you look at manual accounts receivable processes versus automation. And if you kind of pause and think about that, if you’re currently operating on the manual AR collections process, it saves you 67 more percent time to collect your past dues. And that’s a material impact to company’s working capital operations and best practice.

Controller’s Growth Outlook for 2022

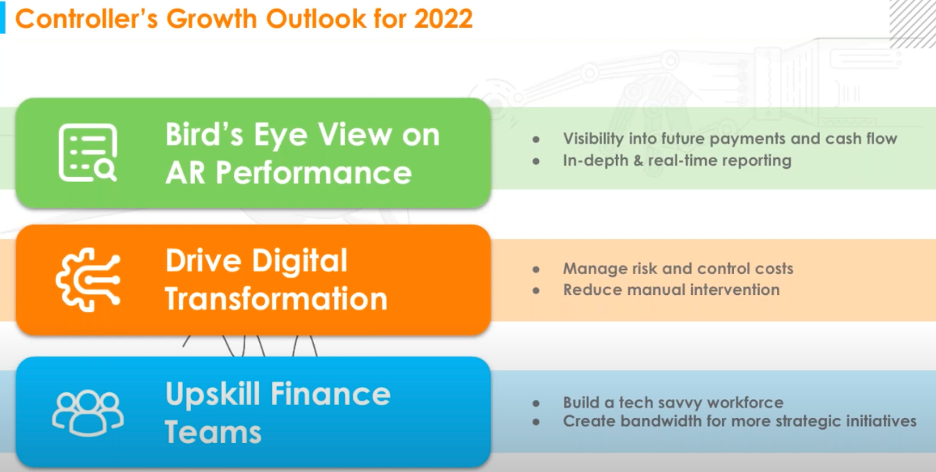

So, when you look at the controller’s growth outlook for 2022, there again, controller position is no longer solely focused on number punching. You’re the right-hand person, you need to have a high-level priority for what the CFO and your executives are going to be looking at.

Below shows you what the 2022 outlook is for controllers.

Intelligent Automation Tools

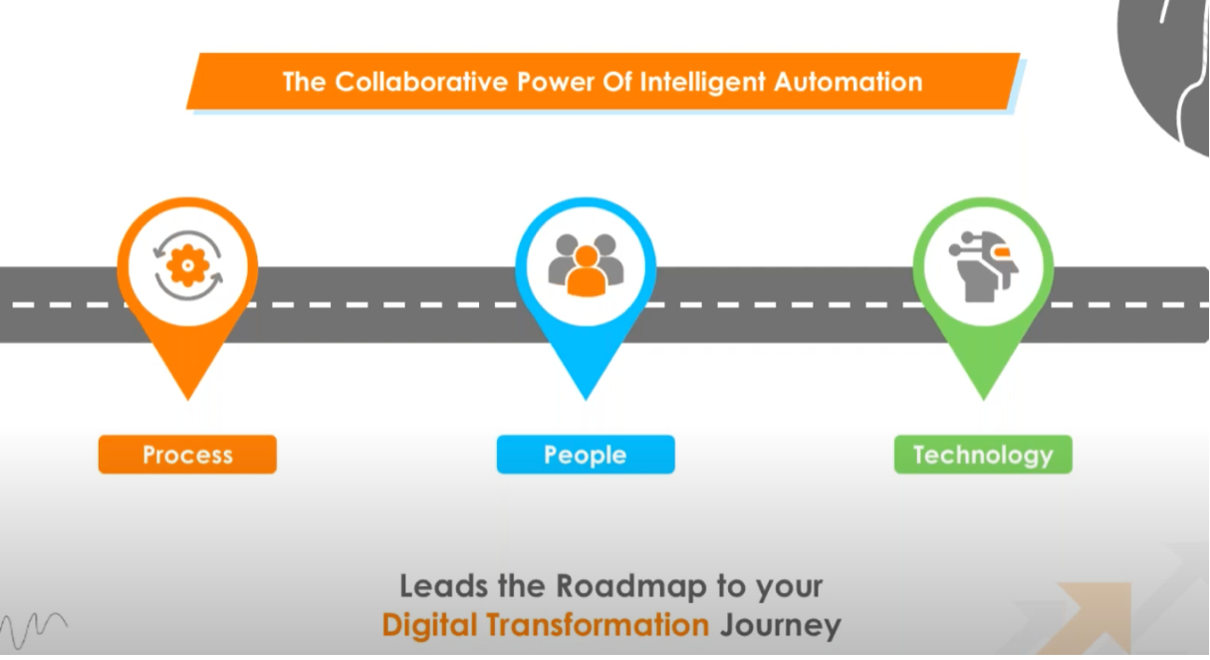

Intelligent automation, in the end of the day there is more data in the past two years than 5,000 years and that’s not stopping. There’s so much data inflows. How do you manage that data without automation? If you rely on a manual process, we all love Excel, we all love sticky notes, but it doesn’t work. That’s not a long term or viable solution, frankly. So, below is the collaborative power of intelligent automation.

What does this mean? How do you successfully pivot to intelligent automation for AR space? Step one, if you don’t know what’s broken, then how do you fix it? And maybe it’s broken, maybe it’s not, but you need to understand the process. Number two is the people, that you must have the right people, the right motivation, and the right skillset. And the last one is technology. When you put it all together, you need the technology to support your people and your process. You need these three together on your transformation journey.

The Process (Insight)

- Customer payment trends

- Track key accounts receivable metrics

- Visibility into cash forecasts

- Simplified workflows and streamlined approvals

- Automated worklist creation for analysts

- Automated and dynamic dunning

- Unified systems for seamless collaboration

- Centralized data repertory as a single source of truth

- Intelligent automation (RPA + AI) to reduce manual and repetitive finance tasks

Benchmarking Manual Versus Automation

Technology really comes into play for the four areas of the order-to-cash process.

Onboarding

Manual onboarding takes 3 days, as automated takes 2 days. How can you onboard new customers 33% faster? Number one is capture complete credit data with a ready-to-use online credit application template. Number two is automated emails for bank and trade reference validation. Number three is automated customer correspondence for credit acceptance or denial.

Invoicing

Manual invoicing takes 3 days, as automated takes 2 days. How can you lower invoicing time by 33%? Number one is create a self-service customer portal to view invoices easily. Number two is streamline collaboration between internal teams. Number three is introduce a single portal that includes all relevant backups.

Average Days Delinquent (ADD)

Manual ADD takes 10 days, as automated ADD takes 4 days. How to lowers ADD by 60%? Number one is send proactive reminders to customers before the payment due date. Number two is prioritize collections process based on risk categories. Number three is self-service customer portal to view invoices and make payments.

Automatic Remittance Posting Matching Rate

Manual cash posting is 35%, as automated is 75%. How to achieve 2X hands-free cash posting? Number one is auto aggregation of remittance from multiple sources. Number two is automated payments to remittance matching and exception handling.

To learn more, view the full discussion here.

ABOUT THE SPONSOR:

HighRadius is a Fintech enterprise Software-as-a-Service (SaaS) company which leverages Artificial Intelligence-based Autonomous Systems to help companies automate Accounts Receivable and Treasury processes. The HighRadius® Integrated Receivables platform reduces cycle times in your order-to-cash process by automating receivables and payments processes across credit, electronic billing and payment processing, cash application,deductions, and collections.To learn more, please visit www.highradius.com