Controllers Council recently held a panel discussion on 5 Trends Finance Leaders Need to Know in 2024, sponsored by AvidXchange.

AvidXchange is a leader in automating invoice, payment and AP processes. A FinTech unicorn, AvidXchange processes more than 215 billion transactions annually with 1600 employees, 6,000 customers, and 225 system integrations. Important notice, material portions of this webinar are based on AvidXchange’s White Paper 2024, Anticipating Tomorrow’s Trends.

Our expert panelists are Rhonda Greene and Tyler Stubbs. Rhonda Greene is a certified accounts payable solutions consultant, APSC, and a principal solutions consultant for AvidXchange. Rhonda brings more than 25 years of experience to help companies streamline AP. Tyler Stubbs is a solution consultant for AvidXchange. He joined AvidXchange in 2017.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

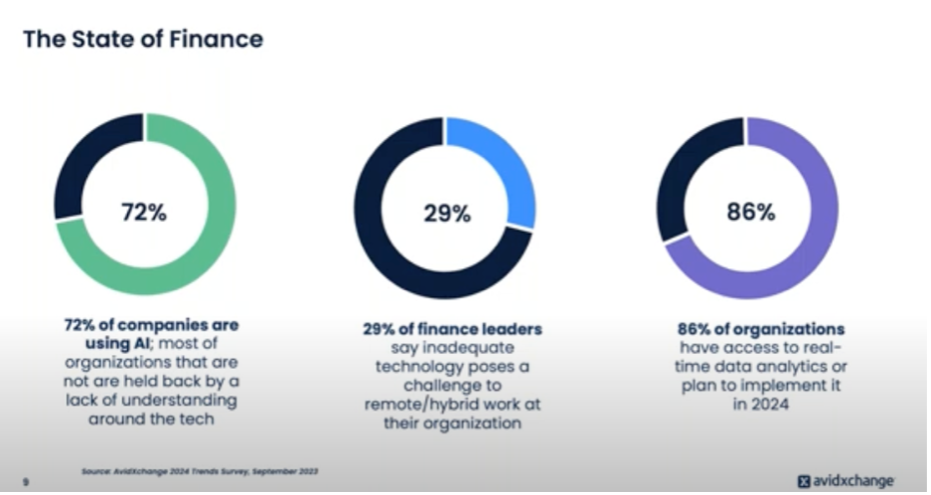

The State of Finance

When we’re talking about accounts payable, that’s typically a team or a department that historically couldn’t work from home because there were so many paper invoices and of course cutting so many paper checks. But with COVID, that pushed us in this direction, and it’s worked. Companies are embracing it. And then finally, analytics and power decision-making. Finance teams consider access to real-time data analytics as imperative.

66% of finance leaders work in departments with access to that real-time data analytics. So, when we look at, again, some of our poll results or our survey results, 72% of companies are using AI and most of the organizations that we polled said that are not, are held back at all by a lack of understanding around the tech. So that’s good news. 29% of finance leaders say inadequate technology poses a challenge to the remote hybrid work at their organization. And then 86% of organizations have access to real-time data analytics or plan to implement it in 2024.

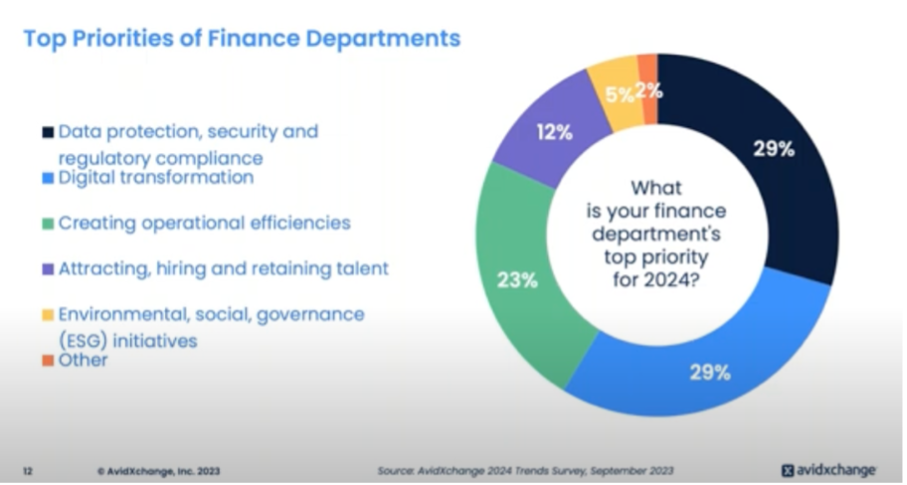

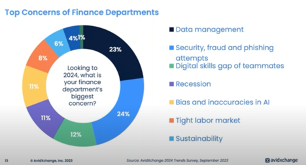

Top Priorities and Challenges of Finance Leaders

AvidXchange conducted a survey of 500 finance executives at middle market companies in September of this year to understand their priorities and concerns as they’re planning for 2024. The top priorities and concerns really mirror each other with the top three being number one, data protection, security, and regulatory compliance. Number two is digital transformation. Number three is creating operational efficiencies. So, as you can see, that one and two are very closely tied together and I think they kind of go hand in hand. Because as people work more toward a digital transformation, protecting their data and security in general is top of mind. And some of the things that were also still top of mind is creating operational efficiencies, which I think should always drive departments and businesses as we’re thinking about better ways to do things.

Now let’s investigate the top concerns. The number one again was security with fraud and phishing attempts. Unfortunately, as security has gotten more robust, so have the scammers and unfortunately fraud and phishing are running rampant. The second concern was data management, and the third was digital skills gap of teammates. And I have heard that occasionally where some companies are hesitant to move more toward technology because they are afraid that some of their teammates don’t have the skills needed.

2024 Finance Trends

1. AI Supercharges Productivity

We asked, “Is your organization currently using AI technology in your finance department?” And 72% of finance leaders told us that their department is currently using some form of AI. In 2024, we can expect to see even more widespread adoption of AI and finance as businesses are looking for ways to create those efficiencies and to augment team performance and really at the end of the day, improve their bottom line. However, finance leaders need to be aware of the associated risks like inaccuracies and bias, which highlight the importance of training teammates on how to use these new technologies to minimize errors.

2. Remote and Hybrid Work Options Drive Company Growth

65% of finance leaders work in a department with a hybrid model, working anywhere from one to four days in the office per week.

What is your finance department’s current work location policy? In our survey we were told that only 15% work remotely, five days a week. 25% said that they have a hybrid model with one to two days in the office per week and 40% or the majority have a hybrid model with three to four days in the office per week and 20% said that they’re still having to go in all five days.

But again, this is really giving employees the opportunity to have more of a work-life balance. And we found out, during the pandemic, that we could make it work if the communication was there and that we stayed engaged with our teams. I hear more and more when I’m out talking to customers that they’re really embracing it, they’re liking it. It’s causing them to even value their position and their company more that they work for.

Companies that offer remote and hybrid work policies are at an advantage when it comes to hiring in today’s tight labor market. Remote companies are not limited to recruiting local residents. They can attract the best talent from across the globe and that in and of itself is huge.

3. Analytics Empower Decision-Making

we asked the question, “How is your accounts payable team using data analytics?” And 75% told us that they’re analyzing invoice data, 67% said that they’re measuring invoice and payment workflows, while 60% said that they’re tracking purchasing patterns. This really helps them make more informed decisions. Also, it helps them identify fraud much quicker. It also enables them to catch and reduce errors and they’re also pinpointing opportunities to grow the business.

I can’t say enough good things about data analytics and BI in general and how it has really changed the way that we work.

4. Fraud Concerns Escalate

When we talk about fraud concerns escalating, 64% of financial leaders say their company has strengthened security measures in 2023. So we asked, “What did you do? What have you done? Have you done anything?” And of course, 64% said that they’re planning to. 20% said, “No, but we plan on doing it next year.” 10% said, “No, but we’re thinking about it. We’re interested in it.” And 6% said, “No, we’re not interested.” Which really kind of confuses me because I would think that the fraud concerns, again when we’re talking about phishing and other schemes as they’re escalating, I would think fraud would be on top of mind for financial leaders. While most companies that we surveyed said that they bolstered security measures this year, organizations must remain vigilant and aware of threat actors constantly evolving tactics.

5. Suppliers Expect Real-Time Payments

Vendors and suppliers are starting to expect real-time payments because that’s really been on the news a lot lately with the right now payments, the real-time payments. So, we ask, which payment method did your organization use most often to pay your vendors in 2023? And 49% told us that it was real-time payments with 21% of them using this method most often.

While traditional payment methods can take several days to clear, real-time payments are settled instantly and typically within seconds. Suppliers are preferring this method because it helps them obviously speed up cashflow and gives them increased visibility of their payment statuses.

To view the complete webcast, download full webinar here.

ABOUT THE SPONSOR:

AvidXchange is a leading provider of accounts payable (“AP”) automation software and payment solutions for middle market businesses and their suppliers. AvidXchange’s software-as-a-service-based, end-to-end software and payment platform digitizes and automates the AP workflows for more than 7,000 businesses and it has made payments to more than 700,000 supplier customers of its buyers over the past five years.