We recently had experts from Euler Hermes for an informative discussion on how to navigate the storm to ensure your business is protected.

The webinar was titled Economic Trends: Navigate the Insolvency Storm and featured Dan North, Chief Economist, and Justin Seedorf, Regional Vice President from Euler Hermes.

If you missed it, we have covered some of the top highlights below.

The Hangover of 2020 – Lack of Jobs, Expensive Policies

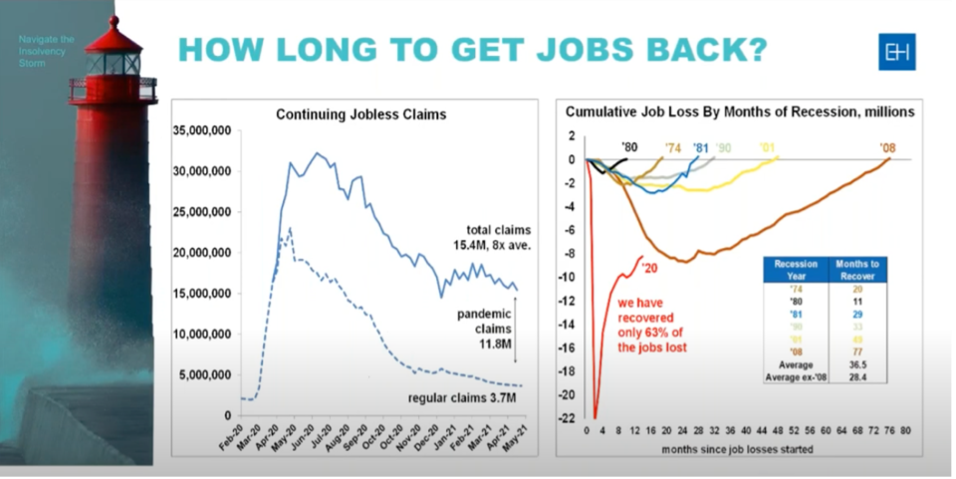

Economists like to talk about things like Gross Domestic Product (GDP). GDP measures everything produced by the economy. If you a person on the street, you don’t care about GDP; you care about having a job. Right now, there are a ton of jobs missing.

The solid blue line are the people still on unemployment, but a lot has to do with these programs that are going to fade away in September 2021. The massive job losses will take until 2023 to recover.

Is Stimulus Good?

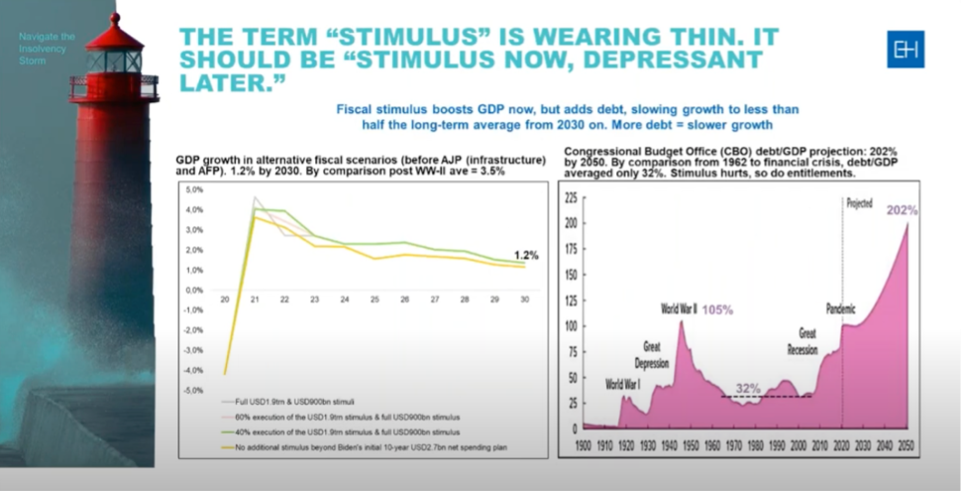

Stimulus boosts GDP now, but it adds debt and slows growth. How much debt is too much debt? To compare how much debt is too much, take how much debt you have compared to your income. Both of these charts do not include the American Job Plan that is infrastructure and they do not include the American Family Plan. Government response helped in the short term, but slows growth in the long term.

Do we really need more stimulus programs?

But the Outlook is Quite Strong

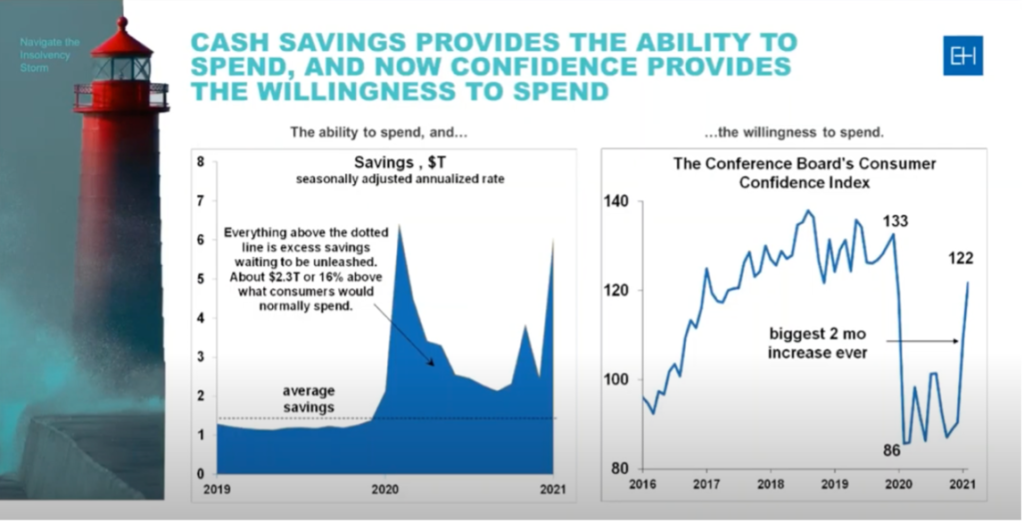

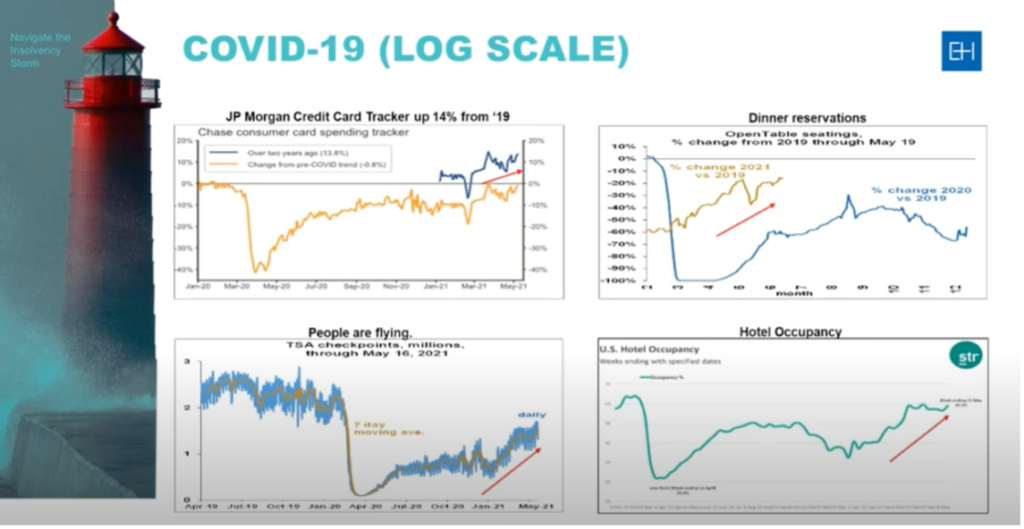

The chart below shows what has happened in result of all the stimulus programs.

The stimulus programs gave consumers the ability to spend AND save. Consumers now have consumer confidence. Based on this chart below, consumers are already spending their money.

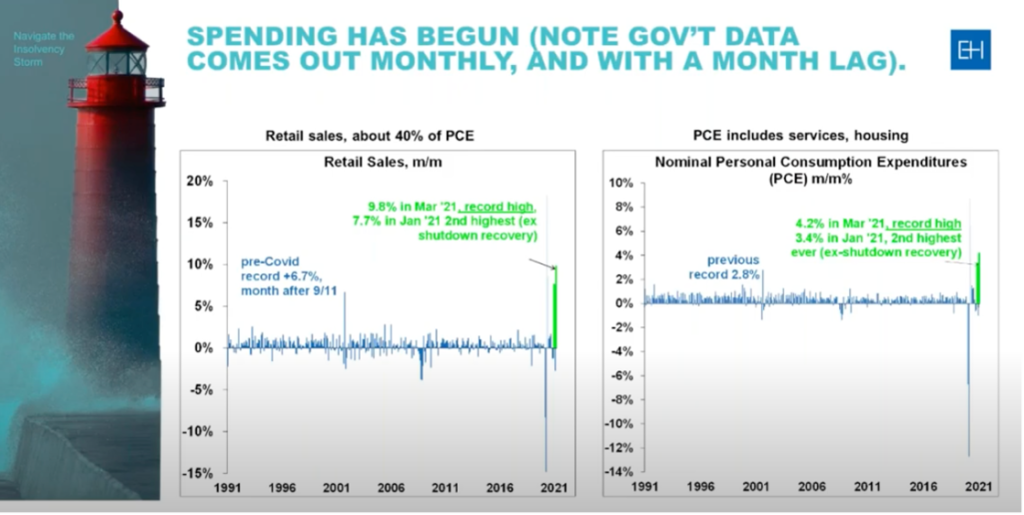

Every month, there is an increase in retail sales. In 2020, we had this giant shutdown that has led to a giant recovery. This chart below shows that consumers are spending their money.

The expectations for 2021 is for GDP to grow at a strong 6.3% pace. But we do need to keep an eye on COVID. The biggest risk right now is more COVID.

Poll Question

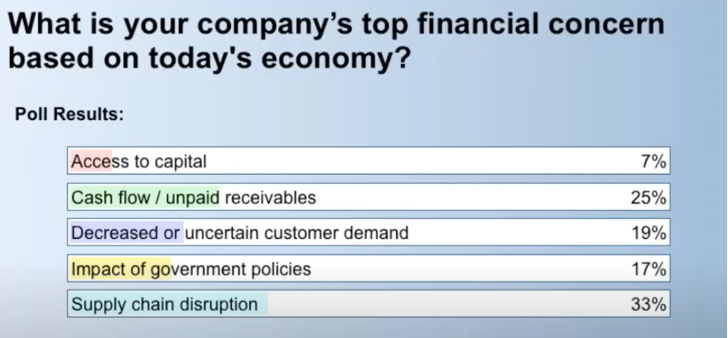

What is your Company’s Top Financial Concern based on Today’s Economy?

Supply chain disruption is number 1. Based on this result, Dan North, Chief Economist, was not shocked because the supply chain is the biggest problem for everyone right now. Supply chain disruption is not going to get cleared up any time soon.

Is your Industry at Risk?

It is by no surprise that there are elevated concerns for so many industries at this time.

Customer Insolvencies and Payment Risks

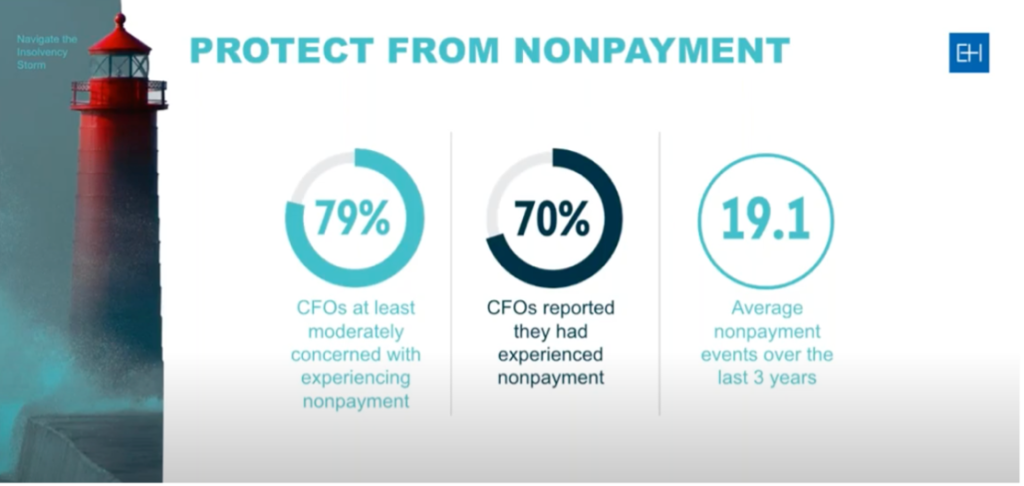

Credit risk management should not be a one-time event. You should be constantly moderating your customers, based on the risks of the customer and the customers needs. If you were ever shocked by your customer filing bankruptcy, it was because your credit management needs improvement.

In 2020, there was one major corporate insolvency every 21 hours. Many of those corporations had to file based on their customers actions. Unpredictability is the new norm.

Just because life is slowly turning to normal, there is still a huge impact on companies due to the lockdown.

Protect for Nonpayment

Before COVID, late payment and default payment were on the raise. As a business, we have to find ways to reduce these problems.

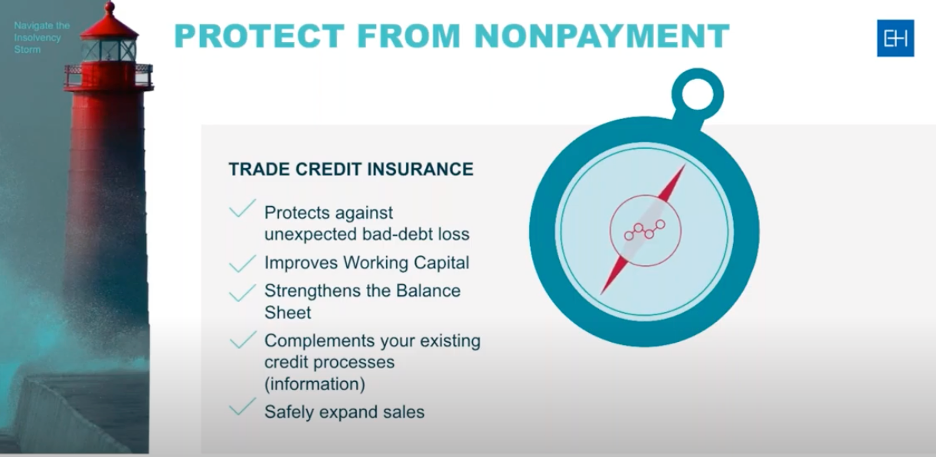

The most necessary tool a company can utilize is credit insurance. Credit insurance can benefit your company in many ways. See the chart below.

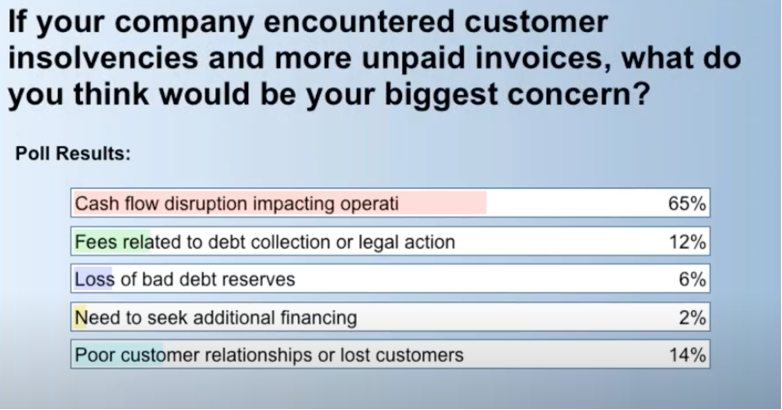

Poll Question

If your company encountered customer insolvencies and more unpaid invoices, what do you think would be your biggest concern?

Cash flow is the blood flow of a business.

Want the Full Webcast to Learn More?

The United States has seen an extraordinary surge in insolvencies. The shockwaves of the unexpected COVID-19 crisis have left many businesses across various industries struggling, uncertain how to stay afloat through the treacherous conditions.

What does this rise in insolvencies mean for your business? Which industries should you watch out for? Learn how to navigate the storm to ensure your business is protected in this webinar.

Don’t miss out on any of our upcoming events! View upcoming webinars and recordings of past webinars on our events page: https://controllerscouncil.org/events/