Controllers Council recently held a panel discussion on How to Modernize Revenue Accounting, sponsored by ZUORA.

Zuora, Inc. (NYSE: ZUO) provides a leading monetization suite for modern businesses across all industries. Zuora serves an intelligent hub that monetizes and orchestrates the complete quote to cash and revenue recognition process at scale.

Our expert panelists are Winston Hait, Matt Dobson, and Rachel Noel. Winston Hait is Director of Product Marketing at Zuora. Matt Dobson is SVP & Chief Accounting Officer at Zuora. And Rachel Noel is Director of Revenue Accounting at Zuora.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

Background

Matt: I started at Zuora about three years ago and when I started our close process took more than 15 days. We’re a public company, so really focused on quarter closes and that 15 days was business days. The team was working weekends, lots of late nights, and that really drove a lot of staff turnover. And in my experience, I worked in revenue at another software company, it’s hard to get good people on the revenue team. You’re hiring a lot of people that are coming out of public accounting. They have good experience, and they don’t want to spend the entire month closing. They don’t want to be doing that kind of detailed work, checking spreadsheets. They really want to be partnering with the business. And because of our longer process, I think it really drove some staff turnover.

In May of 2021, we were kind of in a situation where we had deal structures that weren’t supported by our revenue system. We had a ton of customizations that we had built over time. Anything we wanted to do, it needed a customization, or we needed to make sure it worked in the system.

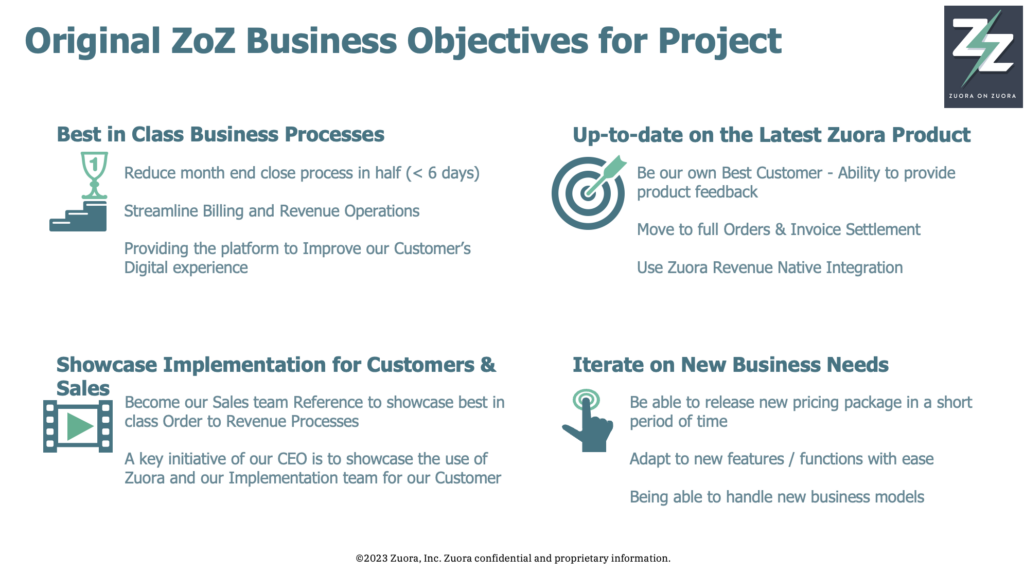

Winston: The first goal was we wanted to reduce our close to six days or less and we managed to achieve that because we’re now at a five-day close and we’ll go into that a little bit later. We also streamlined our billing and revenue operations. Now data flows seamlessly between the two modules and makes it a lot easier during the close process. On the up to date on the latest Zuora products, we wanted to be our own best customer and provide feedback to the product team. That’s happening now.

The Phased Approach to a Successful Implementation

Phase 1: The first phase we had was more of a soft launch. So, what we did was we went live, but we had a limited number of transactions on the new system. And what this did is it really enabled our teams to get more use to using the new system before we committed to having all our transactions on it. And then a few months later, we did a full cutover. At that point we took all our contracts that were active as of our quarter cutoff and we moved them onto the new system and then we were fully on the new system from there on out. And what this did was it made it so that we no longer had to run in parallel and we were able to reap the benefits of just being on one system for all our transactions.

Phase 2: Then a few months later, we did a hard launch. At that point we took all our contracts that were active as of our quarter cutoff and we moved them onto the new system and then we were fully on the new system from there on out. And what this did was it made it so that we no longer had to run in parallel and we were able to reap the benefits of just being on one system for all our transactions.

Policy Changes Enabled Through Implementation

Matt: It’s not just implementing a new tool, it’s looking at the processes, looking at things that maybe didn’t work as well the first time around. I’m sure a lot of companies when they adopted 606 made certain decisions that they maybe wanted to revisit. And for us, the re-implementation was a chance to revisit those decisions and look at some of the things we were doing and look at ways to simplify. And I think the one key to that is you really need to have a system in place you can rely on to do that, right? Because you want to make sure that you can rely on the information coming out of it and that allows you to get a little bit more aggressive in your reviews and other things.

So, when we did our implementation, we looked at some of the revenue grouping rules we had, we looked at some of the time periods in which we linked contracts and we made some changes that allowed us to reduce our revenue allocations, which obviously is a little simpler for the revenue team. It also helps to make things a little bit more predictable on our side. We worked with our auditors to get that through. We changed the way we handled concessions on the services side. We looked at different scopes and simplified the process. So that was like a less burdensome process for the team and that really was one of the items that helped us a lot. And we removed the customer deposit reconciliation account, simplified the reconciliations.

The other thing we looked at was you look at we have a predictable revenue business. That’s one of the things we like. That’s a subscription business. Those contracts you sign at the end of the quarter, they may start the next quarter, they may start this quarter, but really, they only have a few days of revenue impact if that.

I think the real focus here is the implementation allowed us to make these changes. These were things we’ve thought about before, but we didn’t have the systems to support it and once we made that change, we were able to do that, and I think it also made a big progress for the team. Most of the things on here aren’t things they love doing. The team’s spending a lot more time doing different analysis and reporting and things that we can action as opposed to just checking contracts and closing.

Lessons Learned

- Stay up to date with latest products/stack

- Adopt best practices (For example: Zuora as an A/R Subledger)

- Changes in policy and processes are okay and sometimes good

- Big bang projects are not always the best approach, look for phasing options

- Executive sponsorship and alignment with stakeholders is critical

- Good revenue people are hard to find

To view the complete webcast, download full webinar here.

ABOUT THE SPONSOR:

Zuora, Inc. (NYSE: ZUO) provides a leading monetization suite for modern businesses across all industries. Zuora serves an intelligent hub that monetizes and orchestrates the complete quote to cash and revenue recognition process at scale. Through industry-leading technology and expertise, Zuora helps more than 1,000 companies around the world, including Caterpillar, General Motors, Penske Media, Siemens and Zoom, nurture and monetize, direct and digital customer relationships. Headquartered in Silicon Valley, Zuora operates offices around the world in the Americas, EMEA, and APAC. To learn more about Zuora monetization suite, please visit Zuora.com.