Each month the Controllers Council Conversations series features insights from some of the top thought leaders in accounting and finance on an important and trending topic.

This month we asked our members: What is your top priority for 2022? Here are some of the top responses:

“Automation, automation, automation! Companies should invest in technologies for various reasons, some of which are 1) more time to focus on strategic work, 2) reduce redundancies, 3) increase efficiencies, and 4) limit the request for additional headcount to process manual work.” – Dany Saade, Controller, One Concern

“As an engineering and consulting firm, our revenue decreased slightly over the past year as some contracts were put on hold and there are not many projects beginning. Luckily, and skillfully, we kept our expenses down. Therefore, our priority for 2022 is revenue growth.” – Richard Bernier, Controller, The Balmoral Group

“I have come to learn from my own experience that leaders should create flexible business models that react quickly and resolutely if conditions around them do not go as planned. The best leaders can and should capitalize aggressively on opportunities as they emerge, even if they are considered to be unconventional.”

“In facing what a global pandemic can do to any sized business, there are several factors that I have decided to implement and place as top priorities moving into 2022: Digital Transformation, Rebuilding Team and Culture, and Creating a New Business Model for Growth.”

“Artificial intelligence and machine learning are finally having the impact many predicted. Automation tools are plentiful, and CFOs and their teams ought to embrace them.”

“Without a strong culture, the survival of any company is precarious, at best. Companies that evolve, innovate, and adapt will be well-positioned to succeed. Those that keep their heads down and hope to ride out the storm are unlikely to survive.”

“In short, and to sum it all up from the words of a former employer of mine, “You can fight change and lose. You can accept change and survive. Or you can lead change and prosper.” (Governor Michael Leavitt) -Mark Chapman, Accounting Director, Beehive Insurance Agency

It’s no surprise that common themes amongst our respondents included both automation and digital transformation.

Priority #1: Automation

Financial automation has been well understood and adopted amongst many global mid-market organizations. The Global Financial Close Benchmark Report from Trintech found that 78% of mid-market organizations have only implemented basic or developing financial automation, meaning a majority of their financial close processes were still carried out with manual methods and legacy tools. The acceleration of automation initiatives, triggered by the pandemic, has prompted finance executives to rethink their existing manual processes and augment them with financial close software.

By not automating, companies risk falling behind competitors, inaccurate financial data, workflow inefficiencies and bottlenecks, losing top talent, and more.

To learn more about automation, check out our recent webinar: How Automation Can Solve Your Reconciliation Challenges. You will learn:

- The top challenges organizations face by manually reconciling accounts in Excel

- How an automated solution can provide greater standardization, visibility, and control over your balance sheet reconciliations

- ROI you can achieve from automating your balance sheet reconciliations

Priority #2: Digital Transformation

In 2021, Controllers and CFOs continued to take on more responsibilities for technology. There isn’t one priority, but many. They’re tasked with managing finance back-office systems, automation, and implementing new software. Today, Controllers and CFOs are participating or leading corporate IT and digital transformation initiatives for their organizations.

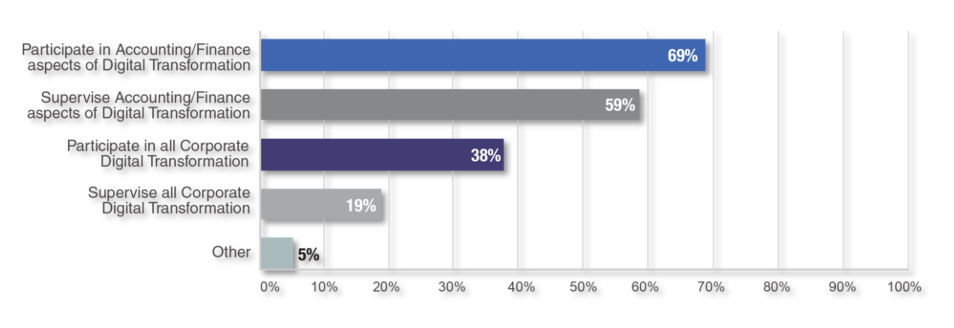

According to our 2021 Digital Controller/CFO study, a majority (69%) of respondents participate in Accounting/Finance aspects of Digital Transformation, while (59%) actually Supervise Accounting/Finance aspects of Digital Transformation. In addition, 38% of respondents participate in Corporate Digital transformation, while 19% actually supervise Corporate Digital transformation.

Cleary, corporate Controllers and CFOs are evolving to become Digital Controllers and CFOs. This evolution certainly started prior to the global pandemic, but was accelerated by remote work environments, along with seismic business change and uncertainty. This trend will only continue in 2022.

To take a deeper dive into why new expectations for the Office of Finance are highlighting the importance of financial transformation initiatives, register for our next webinar coming up December 16th.

Controllers Council thanks all of our members and subscribers who took the time to participate in this month’s discussion. Be sure to participate in our December discussion here.