Our partner community, the AI Leaders Council, recently released the 2026 Corporate AI Outlook Study, examining how organizations across North America are adopting and scaling artificial intelligence. While the study spans multiple executive roles, the findings carry direct implications for CFOs and Controllers who are increasingly responsible for evaluating ROI, managing risk, and ensuring financial discipline around AI investment.

As AI adoption moves beyond experimentation, finance leaders are being asked to move from observation to ownership. This shift is reshaping how AI initiatives are funded, governed, and measured.

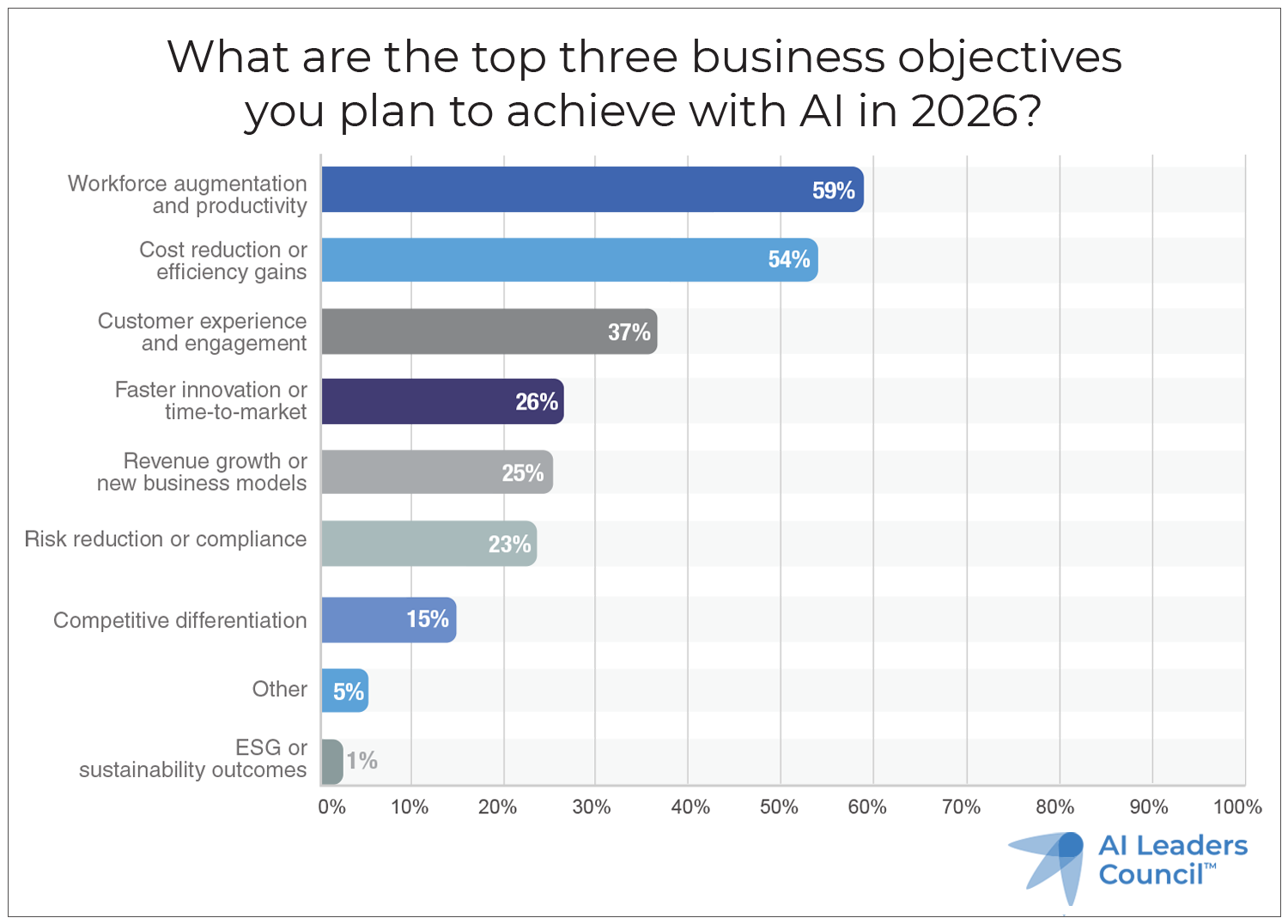

Productivity and efficiency now drive AI objectives

One of the clearest signals from the study is that workforce productivity and cost efficiency are the top business objectives organizations expect AI to support in 2026. Revenue growth and new business models appear further down the priority list.

For finance leaders, this reflects a practical mindset. AI initiatives are being evaluated based on their ability to improve operating leverage, reduce manual effort, and support better decision-making rather than speculative growth narratives.

Controllers and CFOs are increasingly expected to validate these outcomes by tying AI initiatives to financial performance indicators such as labor utilization, process cycle time, and cost-to-serve metrics.

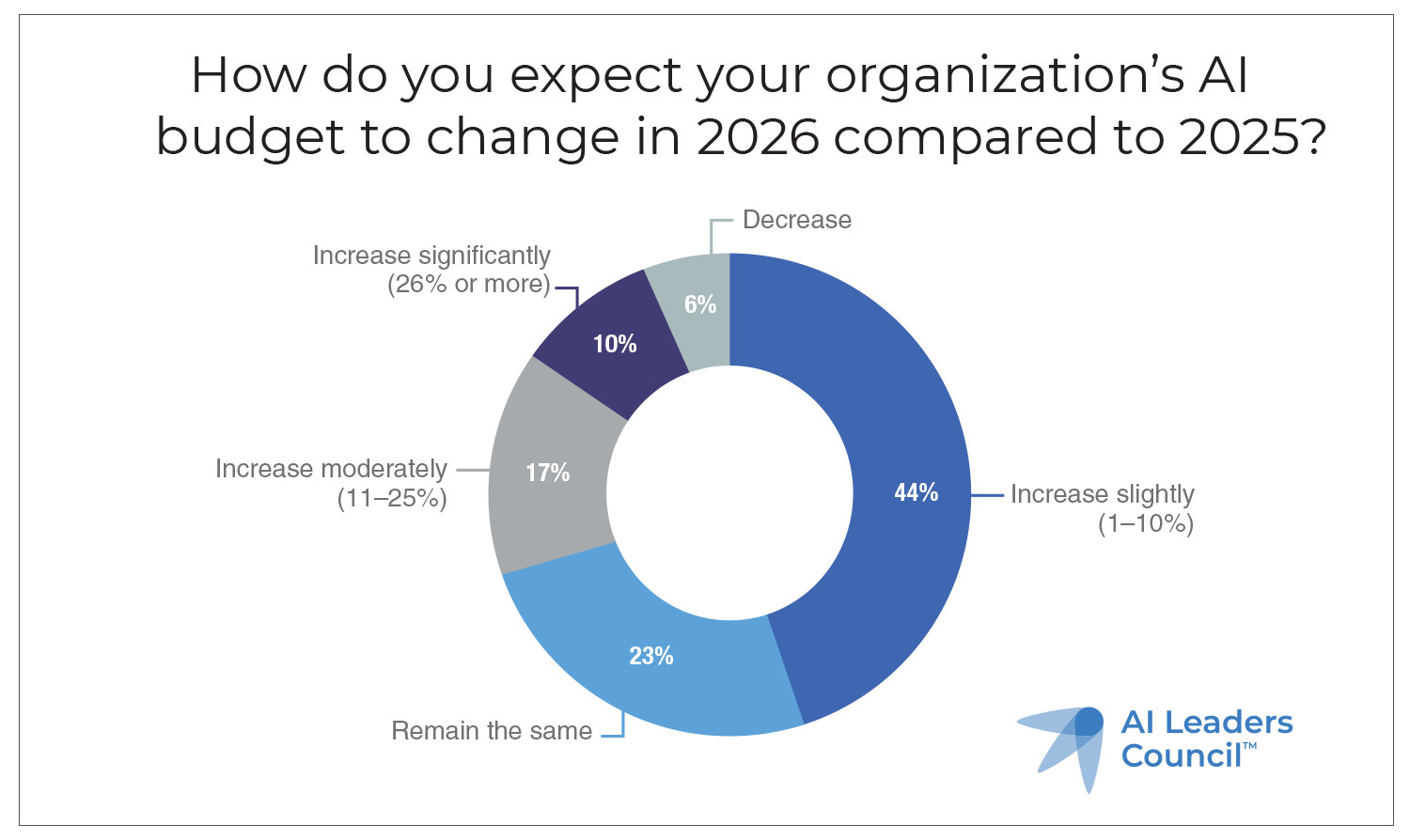

Budget growth brings accountability

Most organizations surveyed expect AI budgets to increase in 2026, although growth is measured rather than aggressive. This trend suggests that AI spending is becoming a normalized part of technology and operations budgets.

With this shift comes increased scrutiny. Finance leaders are often responsible for approving AI investments, tracking performance, and ensuring that initiatives produce measurable value. As AI funding moves from discretionary innovation to operational spend, expectations around transparency and financial discipline increase.

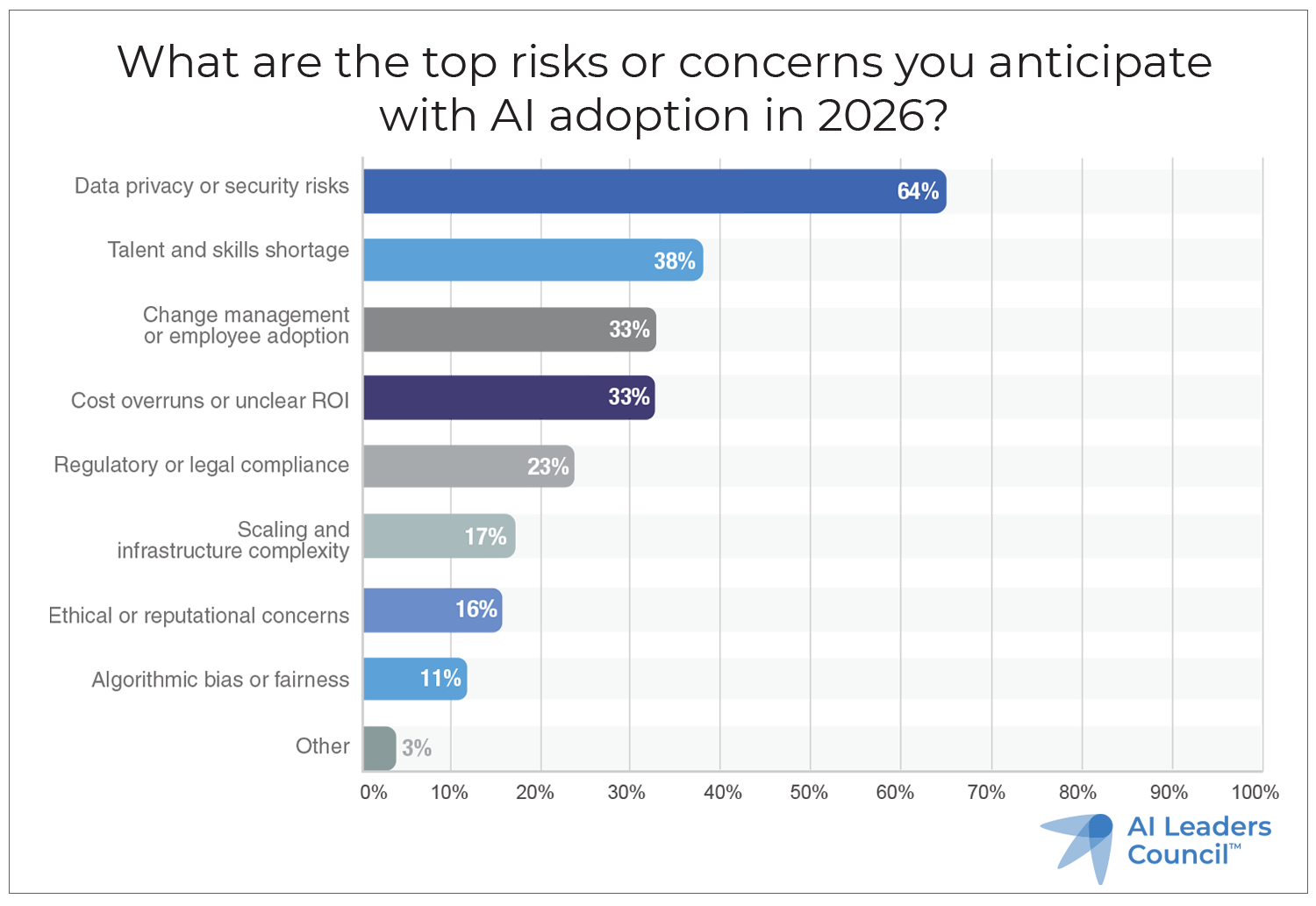

Governance and risk management are finance priorities

The study highlights data privacy, security, regulatory compliance, and ROI uncertainty as leading concerns associated with AI adoption. These risks intersect directly with financial oversight responsibilities.

CFOs and Controllers play a central role in establishing governance frameworks that define acceptable use, ensure auditability, and support compliance requirements. As AI becomes embedded in financial and operational workflows, the importance of strong internal controls and documentation will continue to grow.

Preparing finance teams for AI-enabled operations

AI adoption is not limited to technology teams. Finance organizations must prepare for changes in how forecasting, reporting, and analysis are performed. This includes training staff, updating workflows, and integrating AI outputs into existing review and approval processes.

The 2026 Corporate AI Outlook Study from the AI Leaders Council provides deeper insight into how organizations are funding AI initiatives and managing accountability. Download the full report to understand how finance leaders are positioning their organizations for disciplined AI adoption in 2026.