Change is the new norm in many organizations – particularly within the finance function. Yet, because of this rapid evolution, there isn’t a composite picture of the finance function of the future. Below you will learn the future of the finance function.

As reported by AICPA & CIMA on June 2nd, 2018.

The changing shape of the finance function

When an interviewee from the Indian banking sector shared this insight, it reflected the prevailing sentiment of respondents and demonstrated the radically changing nature of the finance function. Our research reveals that an expanding mandate for finance, digital technologies and new sources of data are combining to change the shape of the finance function.

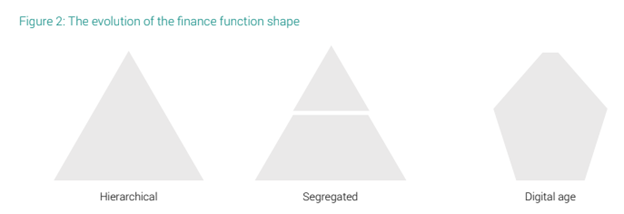

As expectations and skills evolve, that shape is migrating from a traditional hierarchical triangle (where broader populations of workers report directly upwards to a series of ever-narrower management bands) to a hexagonal structure (where expert teams collaborate as equals to achieve shared corporate objectives).

The evolving shape has implications for finance professionals. It will impact:

- career paths and succession planning upwards through the structure, as the lower tier career ladders erode

- the skills needed to remain relevant. These will change and go far beyond the traditional accountant’s skills set

- the conventional mindset where finance works in isolation. This will shift instead to a strategically- and commercially-aware mindset.

We will continue to monitor the evolving shape of the finance function as it informs the practical experience requirements for CGMA designation holders, lifelong learning and continuous professional development needs.

How the shape of the finance function is changing

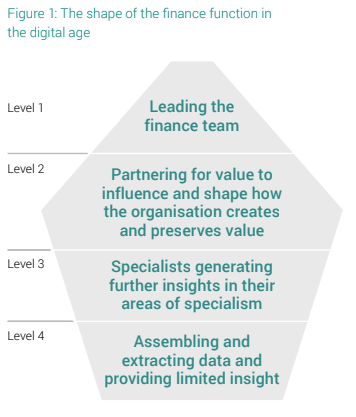

In the digital age, our research shows that the finance function’s shape has evolved into a hexagonal structure.

Traditionally, the shape was a hierarchical triangle with a broad base and fewer roles at senior levels. Over the past two decades, the shape then evolved to a segregated triangle, which was driven by globalization and advances in information and communications technology. This change allowed routine processes to be migrated to shared service centers – the bottom section of the segregated triangle represents the finance function activity carried out within shared service centers.

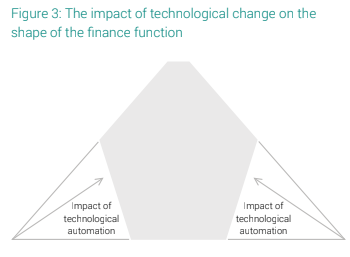

The hexagonal shape of the digital age shows the impact of technological automation as it continues to erode the traditional triangular base (Figure 2). This erosion has implications for succession planning; those basic finance activities, which are now automated, had provided the traditional training ground for finance professionals.

Many of the lower-level tasks involved in ‘assembling and extracting data and providing limited insight’ and ‘specialists generating further insights in their areas of specialism’ have been, and will continue to be, automated (Figure 3).

Most of these tasks are likely to be clerical in nature, rather than tasks performed by professional accountants. Professional-level tasks will still exist in the management and continuous improvement of processes. Indeed, this understanding and the use of new technologies will be increasingly important in process improvement.

Higher-value services, present within ‘specialists generating further insights in their areas of specialism’ (including financial planning and analysis) are now offered from shared service centers or centers of excellence, causing the central bulge in the hexagonal shape. Here, finance professionals will increasingly work in multidisciplinary teams, assembled in skills combinations that support the business. The flat top to the structure shows a move to a collaborative finance leadership approach.

In our interviews, we asked individuals to describe the number of hierarchical reporting levels within their finance functions. This research allowed us to create a composite picture of the reporting levels that sculpt the shape of the finance function within the digital age. We found it consists of four levels. From the top downwards these are:

- Level 1: Leading the finance team

- Level 2: Partnering for value to influence and shape how the organization creates and preserves value

- Level 3: Specialists generating further insights in their areas of specialism

- Level 4: Assembling and extracting data and providing limited insight.

When overlaid with the Global Management Accounting Principles’ definition of management accounting, we can start to understand the different responsibilities of these levels. The principles define management accounting as ‘the sourcing, analysis, communication and use of decision-relevant financial and non-financial information to generate and preserve value for organizations’. In this context, the responsibilities of each level are as follows:

- Level 1: To enable and shape the generation and preservation of value for organizations

- Level 2: To communicate the insight and moral of the story

- Level 3: To shape the story through the analysis and use of decision-relevant financial and non-financial information

- Level 4: To source the information for the story.

Why the shape of the finance function is changing

Our interviews indicate there are three main reasons why the shape of the finance function is changing. These reasons are: the changing mandate for finance, technology, and finance function capability.

1. The changing mandate for finance

The role of the finance function continues to shift in emphasis towards management rather than accounting. This emerging mandate is based on twin beliefs: firstly, that the finance function has a unique end-to-end view of an organization; and secondly, that the Chief Financial Officer (CFO) has the business understanding to work alongside the Chief Executive Officer (CEO) as a co-pilot – explaining the increasing focus on business partnering. This recognizes the important role of management accountants who, as guardians of the business model, apply the discipline of commercial finance to decision-making and value creation.

The shape of the finance function, and those within it, are evolving to better enable ‘partnering for value to influence and shape how the organization creates and preserves value’. This role is increasingly central to the finance function – and explains why the hexagon bulges outwards at the Level 2 tier.

2. Technology

Organizations are using technologies to improve the efficiency of the finance function and build new capabilities for it. An example of this is how organizations are embracing technology to support the automation of management information processes, and provide reporting to the rest of the business on a self-service basis. In turn, this is contributing to the narrowing of ‘assembling and extracting data and providing limited insight’ (Level 4). However, it’s also heightening the need for skills and talent in two other levels: ‘specialists generating further insights in their areas of specialism’ (Level 3) and ‘partnering for value to influence and shape how the organization creates and preserves value’ (Level 2).

a. New data sources and analysis methods

The availability of a wide range of new data sources and the means to conduct advanced analytics are providing opportunities to better inform decision-making. By contrast, in the past, these decisions had to be based on personal judgement. Now, for example, predictive analytics improves forecasting and it is likely that analytics will extend the financial planning and analysis (FP&A) area of the finance function. This is pulling demand for talent into the higher echelons of Level 3 – ‘specialists generating further insights in their areas of specialism’.

Our interviews revealed examples where digital centers of excellence are providing new insights into customers’ behavior and experiences, derived from data. These insights are enabling management teams to deal with important intangibles in a better, more informed way.

b. Automation and cognitive computing

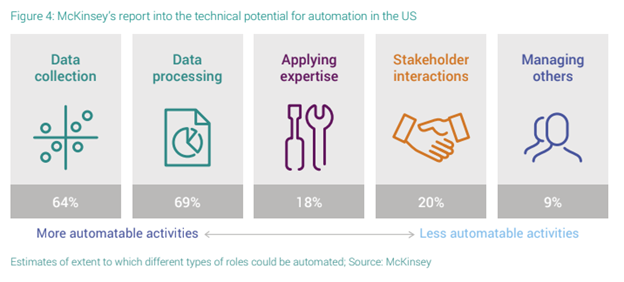

A 2016 McKinsey report studied which functions could be automated by advancing technology.

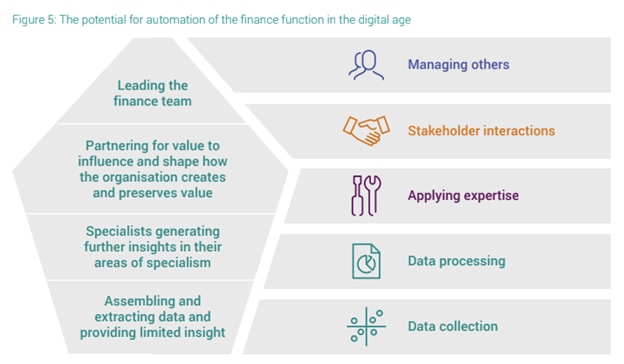

McKinsey’s research examined groups of occupational activities and ranked them according to their susceptibility to automation (Figure 4). Work activities at risk of automation include: data collection, data processing and predictable physical work. Less automatable activities include: managing others, applying expertise, stakeholder interactions and unpredictable physical work.

What’s interesting about the McKinsey infographic is how it sits when overlaid across the digital age’s hexagonal-shaped finance function (Figure 5), below.

It confirms what our interviews are exploring – that advances in technology, and particularly in robotic process automation, are providing opportunities to automate many routine, clerical activities. Cognitive computing, such as artificial intelligence, machine learning and natural language programming, are also providing opportunities to automate advanced data analytics, report writing and even conversations. Higher up the hexagon, new technologies will augment what humans can do and support roles that require personal interaction and the ability to manage others – which are areas less likely to be automated.

3. Finance function capability

Historically, the finance function has had a mandate to focus on organizational efficiencies and reduce operational costs. In many organizations, this focus has heralded lean operational processes, and now there is no more fat to trim. Technology is also at a point where machines can be left to monitor process costing and highlight patterns of efficiency. This shift has refocused the finance function towards revenue and value creation which, in turn, has impacted the function’s shape. Level 2 – ‘partnering for value to influence and shape how the organization creates and preserves value’ – becomes the focal point for these activities and is another reason for the bulge in the finance function shape at this point. There are also implications for the competencies required by finance professionals in Level 2 and these are explored in our briefing paper, ‘Emerging theme 4: Changing competencies and mindsets’.

Together, these developments are radically altering the delivery model for the finance function. As the delivery model evolves, its shape adapts into the emerging hexagonal structure present in our research.

How service areas within the finance function are fusing and evolving

This is the prediction of a banking sector interviewee. The changing mandate for the finance function and the impact of new technology puts more emphasis on finance as a discipline across the business, rather than as an overhead function. This fusion process, evident from our research, is bringing together different internal areas of the finance function, as well as fusing finance with the rest of the business.

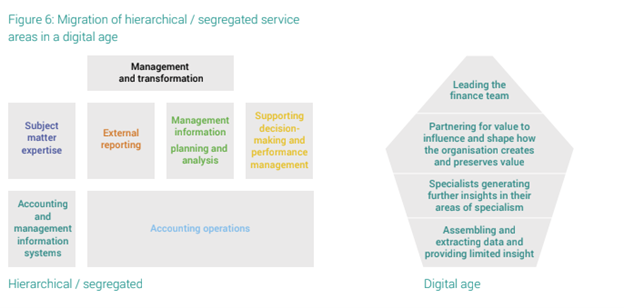

The following section reflects on the interview research, to explore the changing role of finance as a discipline in the business, based on the interviews we conducted. Here, we consider how the digital age is impacting on the different service areas within finance, and compare this with the traditional hierarchical or segregated structures (Figure 6). The left side of the table presents an overview of services provided within the finance function, and the right side indicates where they are migrating.

Management and transformation

Many finance transformation projects have stalled. Most accountants are so busy working with legacy systems they don’t have the capacity to take on a broader role. Some also lack the analytical and commercial skills needed. In addition, management accountants’ potential to contribute isn’t always recognized.

Leading the finance team

A new shared vision for finance’s role provides a mandate for further change. Change will be constant, so an ability to adapt and manage change will foster the agility needed to survive and prosper.

Change management and project management are already important disciplines in finance.

Changes to structure, systems and skills must be aligned, and progress in transformation must be measured and managed. Change is the new normal for businesses.

Supporting decision making and performance management

The CFO usually works closely with the CEO to support him or her in running the organization. Many businesses develop and deploy finance professionals as business partners to cascade the CFO’s influence through the business.

Partnering for value, to influence how the organization creates and preserves value

Business partnering services may be provided by: individuals deployed to work alongside business unit managers; a multi-disciplinary team in a center of expertise; or a hybrid model, where some support is provided locally, but an expert team is deployed to tackle a problem or guide a major initiative.

Management information, including FP&A and data analytics

Accountants tend to focus on financial analysis. Data usually ‘belongs’ to whoever owns the process that generates that data. This means their analysis is not subject to the same rigor that the finance professional applies. There is a need for finance to act as a broker of information, that can assemble and validate the analysis presented to decision-makers.

Specialists generating further insights in their areas of specialism

The production of routine management information is already being automated.

Managers have dashboards on their desks so they can monitor current performance.

Self-service tools allow interrogation, so managers can identify the root causes of performance. Problems or opportunities can be addressed promptly as they emerge.

Advanced data visualization and analytics can provide insights to enable more accurate driver-based forecasting and predictive modelling.

Finance professionals can increase their focus on providing ad hoc expert support for bigger decisions or strategic projects.

They can question and investigate, to constantly improve the shared understanding of how the business generates value.

They can also scan the horizon, and develop and help to formulate strategies, so the business can be agile in how it continually adapts its business model.

Subject matter expertise

Expertise in accounting and financial matters has, for a long time, provided accountants with security of employment and good career prospects.

This expertise can be leveraged and developed where teams work together. Teams allow specialization and collegiate working shares expertise. Lower value work can be delegated and supervised, providing learning opportunities for tomorrow’s experts.

Specialists generating further insights in their areas of specialism

Concentrating subject matter expertise within teams can improve efficiency. Teams may work in shared service centers (SSCs) or in centers of excellence closer to the business. Experts from different disciplines (for example, logistics, data analytics or computing), can work together on the same team to better support the business.

New technologies, especially the use of cognitive computing, already offer the potential to enable greater efficiency.

In the near future, blockchain will bring greater transparency and enable sharing of trusted information.

Accounting operations

SSCs, whether in-house (captive) or operated by a service provider (outsourced), have industrialized the management of accounting processes.

Rules-based processes are delegated to improve efficiency. The expertise needed most in SSCs is process management and change management, especially managing teams and migrating processes to SSCs.

Assembling and extracting data and providing limited insight

SSCs are expanding laterally to handle processes end to end, across professional disciplines.

They are also expanding vertically to offer higher value services, for example to FP&A, management reporting or business partnering.

Robotic process automation is already here; embedded controls and cognitive computing are coming soon. Blockchain is not far off.

Labor arbitrage has supported the business case for offshoring. Automation limits that benefit. The quality of service or level of expertise, and the value they can contribute has become more important than being low cost.

Accounting and management information systems

Information systems are shown as a box to the side that isn’t sufficiently integrated within the finance function. Although finance professionals still use terms such as ledger, journal or chart of accounts, accounting is already dependent on technology. However, assembling information from legacy systems and the widespread use of Excel keeps many expensive professionals busy. There are also risks of error due to human intervention.

Integral rather than auxiliary

IT will be fully integrated.

Cloud computing provides scalability.

Blockchain could provide transparency.

Accountants are still responsible for the integrity of the information produced.

Greater expertise in data governance, data planning and data architecture is needed.

New risks must be managed. These include back-up policies and contingency plans to mitigate the risk of downtime. Addressing cybersecurity risks is a growing concern.

Understanding and managing what happens within information systems requires combined accounting and systems expertise, whether individually or, more likely, in multi-disciplinary teams.

The skills needed to use new technologies, such as when automating a process, will become as important as people management skills are today.

In this evolved finance function of the future, we will see accounting operations, subject matter expertise, management information production and FP&A (now with data analytics) becoming more closely combined with decision support and performance management. This is a fusion of accounting expertise within the finance function, which will enable greater integration with the business and reflect the clear focus on decision support and performance management.

The shape of the finance function will continue to evolve, with increasing emphasis on professional-level roles that offer these support and management skills. However, the level of specialist expertise that’s required will lead to the formation of multi-disciplinary teams, so that experts in data analytics, logistics and other increasingly important areas will become members of the finance team. Finance will no longer be just for pure accountants.

Additional Resources

Corporate Finance Organization Structures

Optimizing Your Accounting Department Structure: Key Tips and Real-World Examples