Controllers Council recently held a webcast panel discussion on the 2024 CFO/Controller Sentiment Study Results, sponsored by Blackline.

Our expert panelists include Richard Brady, Barbara Salazar, and Michael Gilmartin. Rich Brady is board chair for the Institute of Management Accountants, IMA, and CEO of the American Society of Military Controllers (ASMC). Rich earned several certifications and degrees, including a Certified Management Accountant, CGMA, CDFM, he earned a master’s MS in finance, and was a CFO of the Marine Corps Installation Command. Next is Barbara Salazar. She is a CFO of 7X, a holding company in construction, property management, and real estate. She has more than 25 years of F&A experience. Prior roles included CFO, VP of Finance, controller, SEC reporting, SOX compliance, and audit at PwC. Barbara is a CPA and earned an MBA from Stanford. And finally, Michael Gilmartin is a 12-year veteran of BlackLine and currently a Vice President of Close Solutions and has been many other roles at Black Line. Michael earned a bachelor’s degree in accounting from Moravian University.

During this discussion, Richard, Barbara, and Michael discussed several key predictions for changes in financial metrics, spending, talent and more in 2024. If you are interested in learning more, view the full webinar archive video here.

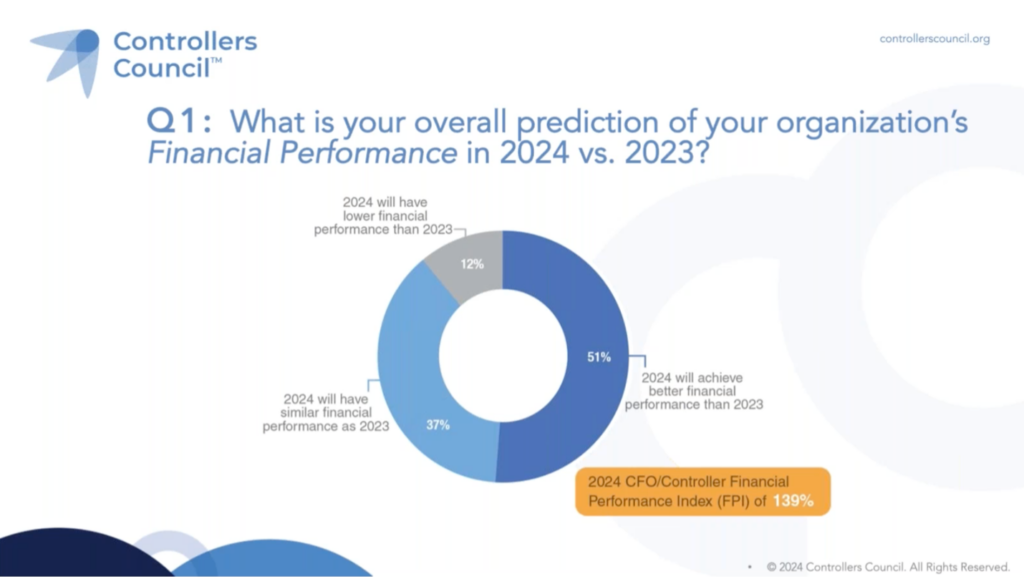

Takeaway 1: 2024 CFO/Controllers Financial Performance witnessed a “bullish” 139% Index with 51% increasing and only 12% decreasing

Neil/Moderator: What is your overall prediction of your organization’s financial performance in 2024 versus 2023? A majority, 51% are predicting better or increased performance, followed by 37% with similar or maintaining performance and only 12% decreasing. So, this compares to 2023 where we had 44% increase and 17% decrease and so much more robust than 2023. The 139%, financial performance index, is calculated by the percentage increases minus the percentage decreases added to (or subtracted from) the 100% base. Last year in 2023, the CFO/Controller financial performance index was 127%. So, a full 12 points lower than this year. So, lots of optimism, but not more optimism than our sister council, Chief Executives Council, and their 2024 CEO FPI index of 155%.

Richard: So overall, I think this is realistic. It’s a bit optimistic, but I think that, as we look at 2024… Most companies, most controllers, CFOs are beginning to gain a little bit more clarity in both the market and economic situations. It’s also, I think, a reflection of actions that have already been taken internally. Some investments in technology and skills, some anticipated payoffs in generative AI, and some cost cutting as well that has been done. You know, outsourcing, downsizing, getting rid of some commercial real estate. So, I think it’s, I would say it’s a bit optimistic. There’s some hedging there, because there’s still some, while there are several tailwinds for companies right now, there are still a few headwinds out there.

Barbara: I think it’s clearly optimistic and I would totally agree with that. I mean, we were not so much optimistic in 2023 and actually, yeah, came out very positive. I mean, in real estate construction, there are a lot of business opportunities, so revenue is growing. We’ve impressive growth for my company this year, almost like twice. So, we are optimistic about next year. And I think, I mean, when I speak to similar CFOs, controllers, a situation is very similar. We do have a lot of growth. We try to apply as much technology as possible. We are a little bit conservative on gross margin with overinflation. It is hard to keep gross margin up, especially when your business is growing. But I kind of tend to agree with majority. I am very optimistic about revenue and growth.

Michael: I guess now officially I’ve been in technology twice as long as I was in accounting and finance, which is hard to imagine. But I do, you know, work with several controllers and CFOs and, you know, I obviously I want to be excited about the positive outlook. I think some companies have good reason to be optimistic for all the reasons that they’ve mentioned, depending on their industry and some of the adjustments that they’ve made over the last couple of years in terms of rationalizing their headcount resources and implementing technology and getting smarter around that. Do I think there could be a little optimism bias in here as well? Obviously, coming from a technology perspective, one of the important things to achieve these results, to drive more revenue with less cost, technology has to come into play somewhere.

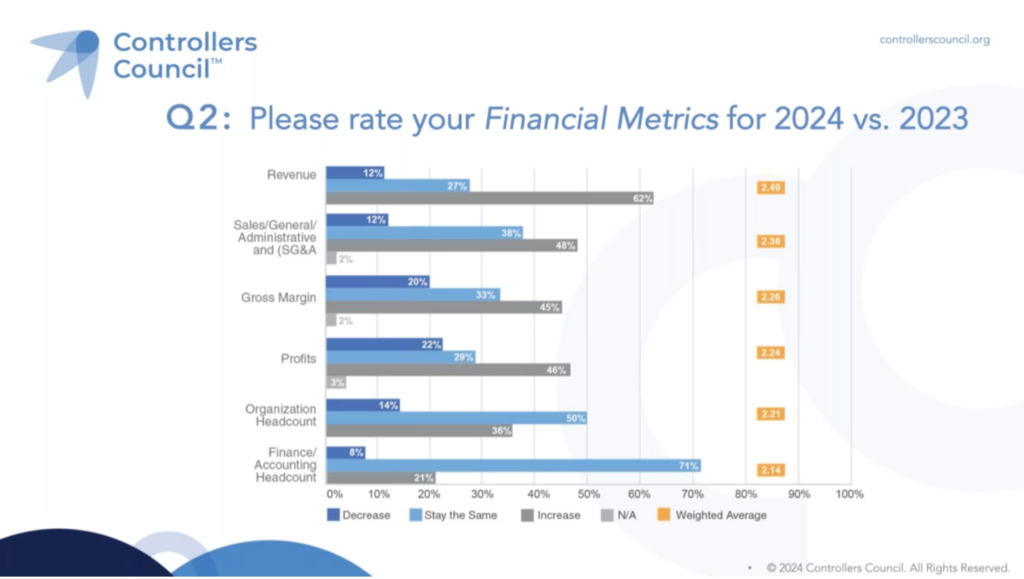

Takeaway 2: increases predicted for Revenue by 61%, Profits by 46%, GM by 45%; with cost increases for SG&A by 48%, Org Head Count by 46%, Accounting and Finance Headcount by 21%; lower Profit led decreases by 22%

Neil/Moderator: Individual financial metrics like revenue, SG&A, gross margin profits, all arrayed by weighted average. So, revenue, a whopping 62%, as I mentioned in the key takeaways, leads all increases. So, these are presented by weighted average. But the next, they’re closely. So, if we just look at the increases, revenue 62%, SG&A 48%, increase gross margin 45%, profits 46%. This is the gray bar. Organizational headcount 36%. So those kind of reinforce the prior FP&I.

Michael: I guess not necessarily surprised. Certainly, the plan, probably for everyone coming into the year, is to grow revenue and keep headcount in the back office flat, right? And again, probably leveraging technology to enable that. I think in terms of the margins, probably several companies are accepting the fact that they’re still catching up with their ability to adapt with the increases in cost of providing their service or building their product and being able to improve margins, knowing that they’re going to have to continue to work to do that.

Barbara: I’m not surprised about that at all because as I mentioned, I think majority of companies would be able to drive revenue. And revenue is already growing. We have a lot of backlogs, but there is also opportunity. I mean, there is limited opportunity to hire to grow the talent. So, you can’t accept all possible projects. On margin, it is already like I’m looking at the margin and it is challenging in percentage terms, right, because there is high inflation, high cost, revenue is growing, so it is a lot of pressure on chief financial officer and corporate controllers to increase profitability. And the only way to do it is with automation.

Richard: I’ll approach this first from kind of the macroeconomic level. I think we’re seeing a fair amount of resilience in the economy, which is good. Some consistent moves toward lower inflation. So, we’re seeing slowing growth, getting down to the 2% Fed target in growth. But we’re still seeing increasing prices, which is kind of creating this squeeze, there’s a push to increase revenues, but hold costs steady. And so, how can you resolve that? It’s really through more automation and technology. And where we see people hiring, it tends to be in those areas where there’s a greater return on investment, people who understand.

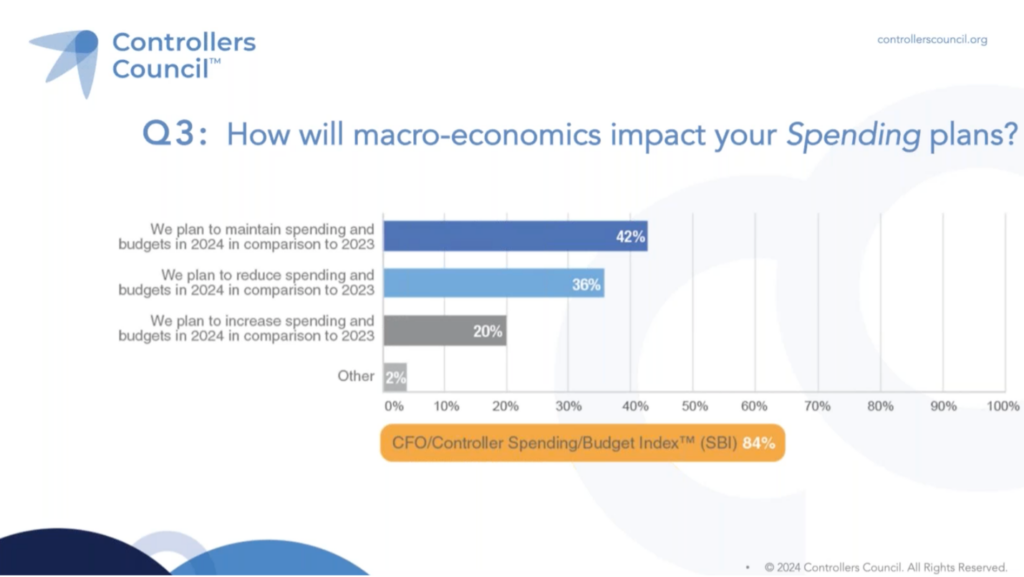

Takeaway 3: Reduced budgets are anticipated by 36%, with only 20% increasing for a Spending/Budget Index of 84%

Neil/Moderator: Regarding spending and budget predictions for 2024, 42% maintaining, 36% reducing and 20% increasing. So again, that decrease minus increase, 36% minus 20% creates the CFO/Controller Spending Budget Index of 84%. I’m going to reference our CEO spending budget index that is 105%. So, 21 points lower than the CEO and we’ve got reduced spending with increased financial metrics—so very conservative. What’s your perspective this?

Richard: I think this reflects some of the uncertainty and, again, some of the headwinds that are still out there. For any organizations, companies that have international operations, we’re still seeing slower growth in China and in parts of Europe. They just haven’t rebounded. In some other areas where we’ve done some work in India and the Middle East, things are improving, but not quick enough to make up for some of the declines in other areas. You know, the labor market is still tight also, and labor costs are generally high. So that’s another one of those uncertainties. I don’t want to dismiss U.S. sovereign debt as well as some debt servicing concerns and the ability of the government to continue to support programs over the long term.

Michael: I mean it’s hard right now to be all in on some uncertainty and I’ve worked for a company that was high growth company and I’ve worked for other companies that were not in those stages. It’s quite different. One thing I do want to comment on is the difference between the CEO and the CFO perspective. We at BlackLine, we do our own surveys and studies around things like this, and we do see those disconnects. The level of optimism always seems to increase as we go up the ladder. We do surveys around things like, you know, trusting the data and trusting your financials and you know, the CFOs always have a lot more faith in the financials than the people who are providing the financials and that kind of thing. It’s just closer to the details, the less optimistic you get.

Barbara: I think I see for we tend to be conservative, but they are more positive. But maybe people in our finance team are right because we look at financial statements in all material respects. And that clearly because of all the controls that we are having before. There is a safe for them, more conservative. So, we plan to maintain spending until there is more clarity, right? And there is a lot of risk right now, although we are growing revenue. We hope to maintain spending through automation, right? Through AI, we hope to spend the same, but achieve more, again, through all those amazing technologies, solutions, AI. But I mean, as CFOs, we, and CEOs right now are positive about economy. They’ve always wanted to spend, right? It is a kind of CFO job to be more conservative and try to be careful, a kind of chief risk officer. So, I’m not surprised with the results as well. And it is positive that CFOs are positive about business they want to spend. But our jobs at CFO, it’s kind of a risk manager to make sure that we just plan to maintain spending, right, until there is more clarity on the economy.

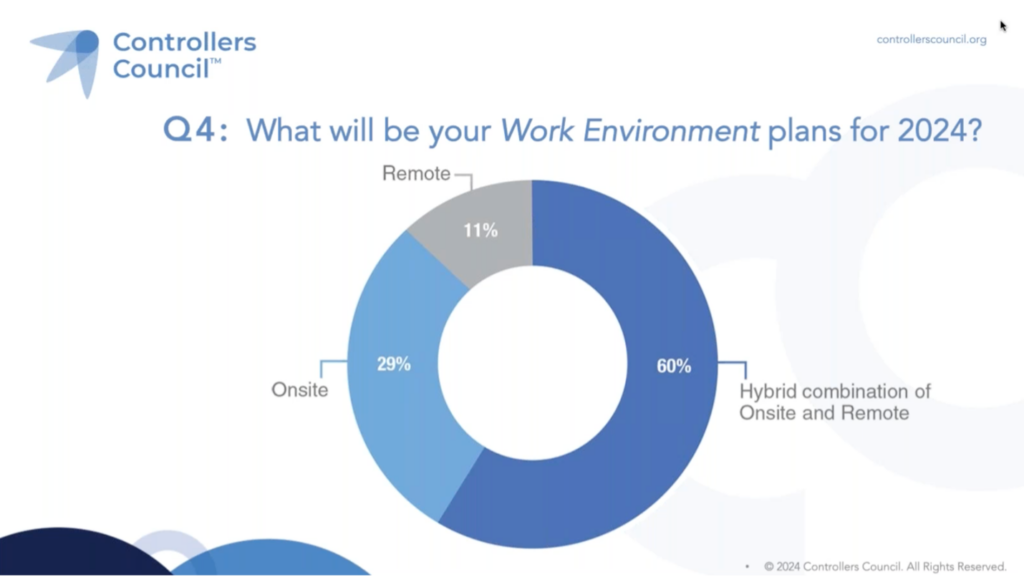

Takeaway 4: A majority 60% of organizations planning a Hybrid combination of Onsite and Remote work environment, followed by a significant 29% fully Onsite, and only 11% fully Remote

Neil/Moderator: What is your org work environment and what’s your perspective on these percentages?

Richard: Our organizational work environment is we’re hybrid here at the American Society of Military Comptrollers and the Institute of Management Accountants is as well. Most of the organizations we work with are operating in a hybrid environment. In my space, you know, I work very closely with the federal government here in Washington, D.C. There are efforts to bring the federal workforce back full-time, but I don’t know that they’ll be able to do that. And most of the companies that we work with in the defense sector, the defense contractors, the audit advisory, and consulting firms, most of them are hybrid. I think that, you know, it’s rare to find organizations that are requiring five days a week in the office. Like I think UPS just announced about two weeks ago that they’re bringing everybody back.

Michael: I travel a lot and I get around to all these different companies all over the country. I think mostly everyone is working towards a hybrid environment of some kind, but to various degrees in the degree to which they’re doing it. I think there’s a geopolitical slant to it too, in terms of where they are at in the country and some areas, they might be more aggressively pushing the onsite and come to work and other areas not. But obviously industry has a lot to do with it as well as company size. I think what’s interesting though because I’m curious about it and when I’m out at the customer’s site, I’m often asking them about their plans for this. And a lot of companies are doing things to try to encourage folks to come back to the office to make it easier providing convenience and services that were so convenient about working from home, such as laundry services and childcare. They’re enhancing their facilities to have, you know, break areas and, you know, have it been a more welcoming environment. So, I think that’s a real positive change, you know, as far as I’m concerned. So, but it’s just, it’s interesting to watch. I think everybody’s working towards that, you know, real sort of balance between the remote and the on-site work.

Barbara: I mean, a lot of organizations and especially like in construction, real estate, I think in manufacturing as well, health care, they are trying to bring them place on site. But in current environment, it’s almost impossible task, right? So, it’s coming to be hybrid. We did make an announcement when I was here for my prior company to try to keep people on site, but we were not successful. So, hybrid is a kind of new reality right now. With remote, I only saw very, very few companies who could achieve that because technically, if ideally, we could implement all those technologies in place. We potentially might be able to do more working from home. But we are still in the process of technology implementation. And that’s why we are currently actually focusing on automation in my company in absolutely every area, but it takes time.

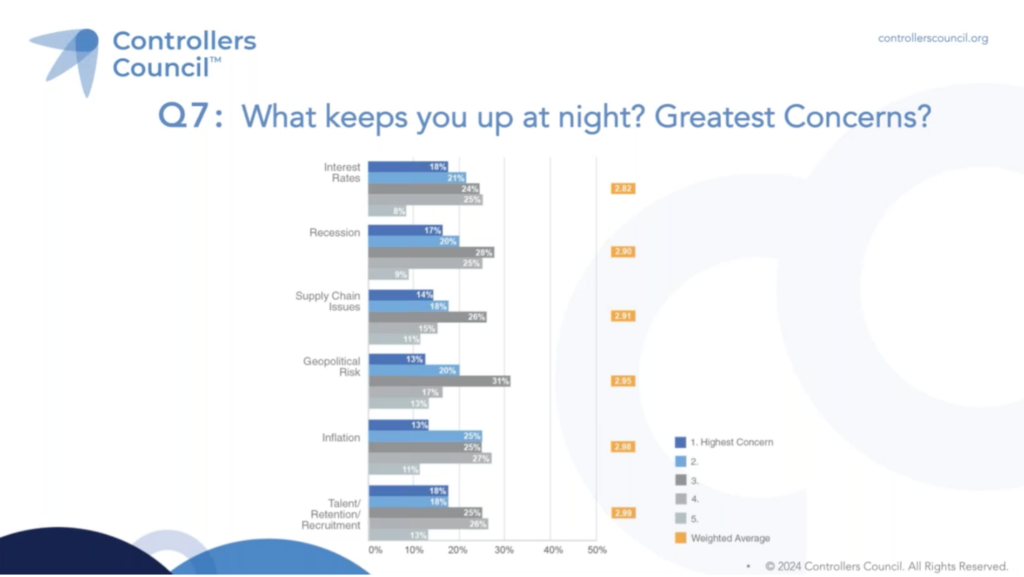

Takeaway 5: Greatest concerns include Interest Rates, Recession, Supply Chain, Geopolitical Risk, Inflation, and Talent

Neil/Moderator: We’ve got several concerns here, but they’re all really tightly impact and weighted average. So, I’m not getting too carried away with interest rates, cost to capital being ranked number one versus recession, which is debatable because it might be industry specific. But I do want to point out that the two highest increases or the most concerns are interest rates in that first row. But talent is weighted average number five here, but it does have the same highest concern of 18% rated there. What keeps you up at night? What are your greatest concerns?

Michael: I worry about talent retention the most internally. I guess the thing that I feel like I can control the most or, you know, implement the most solutions around. So that’s generally where I’d spend my time.

Barbara: It’s talent to implement all those amazing technology to fight that inflation cost increase, you need automation and top accountants in the risk shortage of talent.

Richard: Well probably by virtue of me being here the Washington DC area so close to government I would say it’s probably geopolitical risk and some of those things that are going on outside of our borders here that we don’t have a lot of control over but will certainly affect us if they get worse.

To view the complete webcast panel discussion, click here.

To download/read/print the 2024 CFO/Controller Sentiment Study Results Report, click here.

ABOUT THE SPONSOR:

Companies come to BlackLine (Nasdaq: BL) because their traditional manual accounting processes are not sustainable. BlackLine’s cloud-based financial operations management platform and market-leading customer service help companies move to modern accounting by unifying their data and processes, automating repetitive work, and driving accountability through visibility. BlackLine provides solutions to manage and automate financial close, accounts receivable and intercompany accounting processes, helping large enterprises and midsize companies across all industries do accounting work better, faster and with more control.