Controllers Council recently held a webinar on Aligning Payables with Procurement: Getting it right, sponsored by Bill.com.

Bill.com (NYSE: BILL) is a leading provider of cloud-based software that simplifies, digitizes, and automates financial operations for small and medium size businesses or SMBs. Additional solutions include expense management platform divvy and mobile invoicing product invoice to go. SMBs worldwide, use bill.com solutions to manage end-to-end financial workflows flows, payments, and to manage their cash inflows and outflows.

Our expert speaker and panelist Aaron Berson. Aaron is a CPA and Founder/CEO of Fringe Advisory, a New York based fractional controller and CFO service, among other things.

Following are key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

What are the clearest indications that a growing company should establish a dedicated procurement function?

Why are you looking at procurement? Is it because you have inventory that you’re buying or other physical items that you’re buying that you need to do through a matching and reconcile to make sure that, as those goods come in, you’re not paying invoices prior to ensuring that those have been delivered to you? Or is it more around spending control and accuracy of the information? I think when evaluating this, you really need to first step back and say, “Why do I need this?”

As you continue to grow, and obviously the company size plays into this as well, that a lot of times multi-location enterprises with large teams that have… whether it be physical goods or purchase requisitions coming from all the different offices, that’s usually one trigger also that would indicate that maybe we need a procurement function.

One of the other big reasons why you might need procurement is if you’re having accuracy issues in shipments being received of physical goods or just issues with accurate bills being entered into the system.

The most common reason I see people starting with procurement is spend control of just trying to get a reign on all the various spending going on within an organization, especially as it begins to grow, and finance becomes less involved in day-to-day operations.

Significant challenges mid-size organizations encounter as they strive to coordinate both

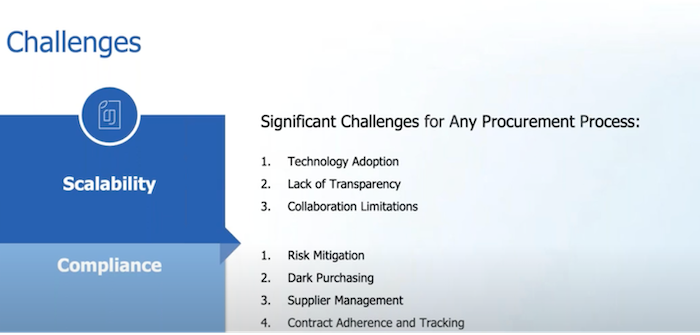

The historical and typical reason is compliance stream. You’re doing risk mitigation, you’re trying to dark purchasing, supplier management, contract adherence and tracking, and all these things, which honestly are more a concern of the finance division, for the most part, with the exception of dark purchasing, which is essentially people purchasing products without formal approved POs or getting POs and approvals after the fact, exposing companies to risks of being liable for something that was never approved in the first place.

And as we see people start to make that move away from compliance in those areas, we start seeing the opportunity to scale whether that be scale with technology adoption or removing the lack of transparency that they typically were as well as increasing and expanding the opportunities and possibility for collaboration of your workforce beyond the divisions that they’re in.

I think that’s a lot of the opportunities, but then when you think about the issues that happen, the converse is true. When you start to scale, you can easily have trouble with technology adoption, which is what really enables this to move beyond the compliance and beyond the typical of what you would have in these functions. And especially in today’s world being virtual, technology is more important than ever.

How can you facilitate collaboration between finance and procurement

I think some of the best practices are actually… In the question there, it’s collaboration. But the enterprises and the companies that do this well really tend to have a culture of collaboration. And that best practice of facilitating that culture, I think, really helps in this process of setting up procurement and finance, but also across the rest of the organization.

To go beyond that, because that’s a generic answer, but with that collaboration, the best practice of actually diligently planning before running and implementing is also one of those things that really sets up procurement and finance for a successful integration and ultimately a successful operation of these systems and these processes into the future because you bring all the key stakeholders together today, bring all their concerns to the table, and then address them one by one, whether that be by certain checks and balances in the process, certain system features that need to be vetted when selecting which systems to be using, or potentially just making your team feel heard in this process so that they, again, feel heard, understand where they fit in the process, and then feel good about implementing and actioning that process and they’re not wasting their time.

But all that comes back to collaboration, of bringing people along that journey of why are we now introducing procurement when we’ve never had it before?

To view the complete webcast panel discussion, link to the video archive here.

ABOUT THE SPONSOR:

Bill.com, the intelligent business payments platform, helps automate your PO-to-payment process and save 50% of your time on accounts payable. With Bill.com, you can turn your finance organization into an efficient, paperless environment with automated approval workflows, digital document capture and management, and built-in team collaboration. It centralizes your payments process for both domestic and international vendors, integrating with your accounting software and tools in your tech stack to keep information up-to-date. Getting up and running with Bill.com is fast and easy, and personalized support ensures your company can gain efficiencies right away.