Controllers Council recently held a webinar panel discussion on Cash Flow Forecasting: Tips for Turbulent Times, sponsored by Centage.

Centage is the leading cloud FP&A platform for advanced reporting, detailed budgeting, and accurate forecasting. With more than 10,000 users, Centage is quick to set up and easy to use.

Our panelist, John Murdock, is president and CEO of Centage, with twenty years of technology experience, including Juniper Networks, Kaspersky Labs, and QuickPivot. He earned a BS Engineering from Northeastern University and an MBA from Boston University. Next, Mike Matthews is director of sales enablement at Centage with over ten years of FP&A experience. Mike earned a BA in finance and a BS in economics from Westfield State University.

Following are key highlights to this discussion. If you are interested in learning more, view the full webinar archive video here.

Reality of Running a Business

Challenges are presented to business leaders and finance teams, like yourself, as we go. You’ll look at the last several years, we’ve had, certainly, our fair share of challenges to face as business leaders to navigate. Here we are again, on potentially the beginning of what could be a recession starting to emerge. There’s a lot of challenges out there that we’ve had to navigate.

Maybe we’re still navigating some of these, like supply chain shortages. Those have been around for a while. They may be affecting your business in different ways. Inflation has started to really creep in over the last several quarters. We’ve all been, I think, dealing with remote work, and trying to navigate that appropriately and support it well. There’s certainly a tight labor market.

All of this was really brought on by the pandemic. However, we were really at the end of, really, a ten or a twelve-year bull market and growth wave. I think, as everyone here appreciates, there is a business cycle. You go through a contraction, through recession and then you go through growth phases. A ten to twelve-year growth phase is typically a long time, so I think we’re now going into a business cycle where there might be some contraction. How long that lasts, we don’t know. Certainly no one can tell the future, but I think our jobs as business leaders and as finance leaders is to really navigate our businesses through that and keep our businesses healthy.

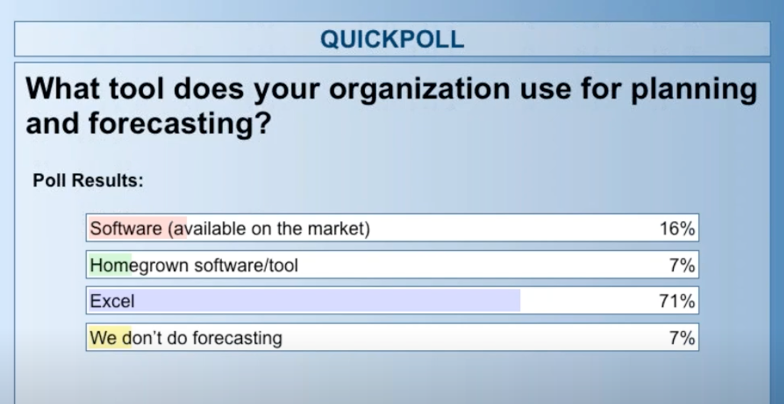

Interesting answers on the first poll question. 71% of you said you’re still using Excel to manage your business. Excel is a great tool. We still use it. It has its purpose, and certainly has served the business world very well over the last 30 plus years.

Our point of view here at Centage clearly is that the tools of the last 30 years have really become outdated. If you think about formulas, and formular logic, and broken links, and lookup tables, and security issues with data living in spreadsheets, and that getting emailed around your organization … Your users are trying to find the right version of the truth, they find there’s an error in it, and, of course, your data information is not secure.

Although Excel and spreadsheets have served us well, there’s a new wave of technology adoption and potential to really help businesses.

How Can Finance Teams Can Really Navigate the Uncertainty?

Here we are again on the beginning of an uncertain period. Are we in a recession? Are we not in a recession? How long will it last? There’s a lot of uncertainty for businesses, but strong FP&A processes, strong budgeting, strong forecasting, and rigor there can really help your organization and really should be, and we advocate it to really be, the lifeblood of your business. It can be, if used well, a differentiator as well for you in your markets.

As we think about priorities for finance teams, and where we really advise our customers, we’re lucky to work with a lot of different industries. We really start by really putting some focus on improving reporting. Looking at your financial analytics, the metrics that you’re tracking, the KPIs that you surface for your organization, and challenging you to ensure that your team has access to that. Your stakeholders have access to that in an agile, quick, and, if you can get there, a self-service way, so that you’re empowering your teams.

To do that, there’s technology and automation. It doesn’t have to be expensive. There are tools, Centage one of them, that’s not expensive to automate some of these steps and to automate some of these workflows to help your team, to really augment your team and to help add some muscle and some scale to how you support your organization.

As you’re putting in that technology, and you’re pushing for more and more information, you want to really look at your process and look for opportunities for efficiency and cycle time improvements. One of the most common challenges is turnaround time for companies. There is an opportunity to look at process, to look at technology and automate things that are repeatable tasks that can be done by software. That will free up finance for you and your teams to work closer with your business teams.

We certainly advocate for as real time as you can get. Even if you’re not adjusting your forecast, or you’re not adjusting your budget, being able to provide that near-real-time, or, if you can’t get there, daily, weekly reporting to your users is very, very important. At a very minimum, we do advocate weekly and monthly reforecasting. Revisit your assumptions.

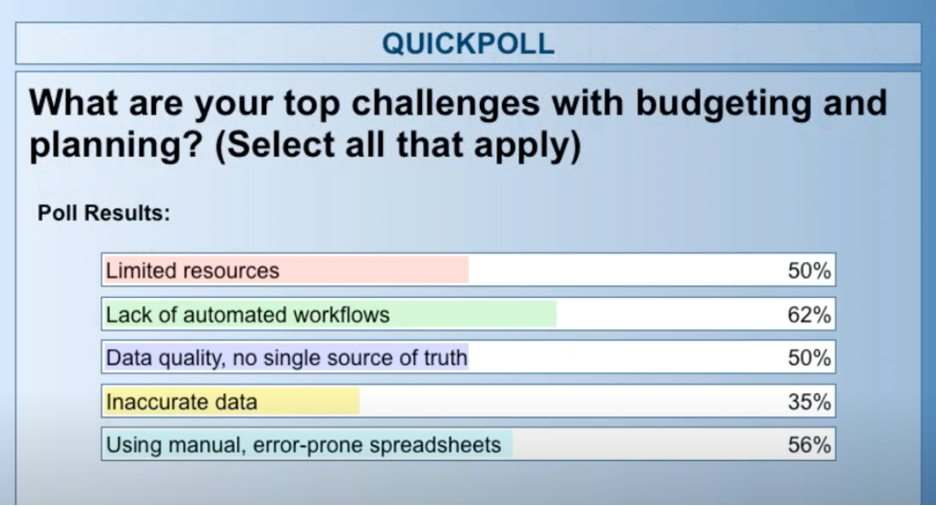

What are Your Top Challenges with Budgeting and Planning?

The second poll, 62% site lack of automation in the workflows. What’s the flip side of that? It means there’s a lot of manual steps, a lot of manual work to pull everything together. I would argue, we would argue, a lot of those are repeatable steps. Pulling down data, pulling them through the same set of spreadsheets, and pivot tables, and lookups, and formulas, all of that’s manual today, and you can really automate a lot of that.

It looks like 62% say automation is the biggest challenge. Then, interestingly, a tie with limited resources, and no single source of truth.

To learn more, view the full discussion here.

ABOUT THE SPONSOR:

Here at Centage, we believe that CFOs, Controllers, FP&A experts and others are critical to the success of any business. That’s why we’ve created the leading cloud FP&A platform that equips finance teams with the tools they need to confidently provide strategic recommendations, propose action plans backed up by data, and accurately report on progress and results.

In short, Centage’s Planning Maestro helps finance teams make a measurable contribution to the success of their business. Planning Maestro was designed to take advantage of modern technologies and advances in cloud computing and is optimized for performance, scale, integration and automation. To learn more, please visit www.centage.com