Controllers Council recently held it’s annual outlook panel discussion, the 2022 Corporate Finance Outlook. Panelists included Dan North, Chief Economist at Euler Hermes, North America Division Alliance, and Jerry Clancy, National Tax Practice Lead of Top 20 accounting firm, Armanino. The webcast was moderated by Controllers Council Board Chair Lindy Antonelli. Following are highlights of the both the 2022 economic and tax compliance outlook.

2022 Economy Outlook

DAN NORTH: What’s going to make 2022 good year?

1. Stimulus Benefit

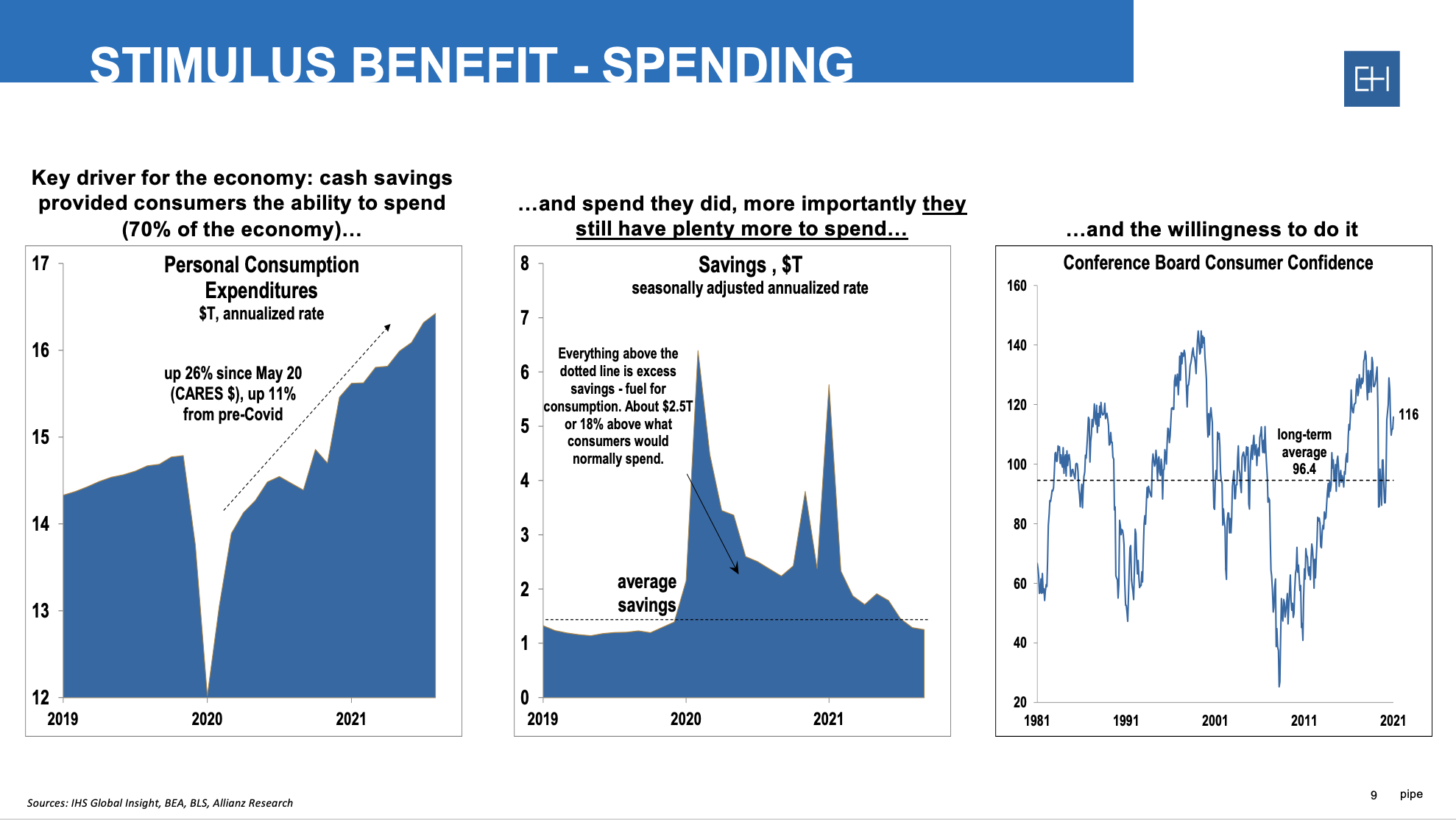

Well, first, we have the stimulus benefit that provided a lot of money that provided a lot of spending. 70% of the economy is personal consumption (which is the first chart below). You can see that it’s up 26% since the CARES Act. It drives 70% of the economy. That was allowed to be done because fiscal policies put a lot of money into people’s pockets. That chart in the middle shows the excess savings. Everything above that dotted line is extra savings and it’s an about two and a half trillion dollars or 18% more than consumers normally would spend. They still have a fair amount of that to go. So, they can continue spending and the willingness, which is the last chart on the right that’s consumer confidence. So, this is a good outlook for the consumer. Consumers helped us and will be helping us going forward.

2. Plenty of Work in the Pipeline

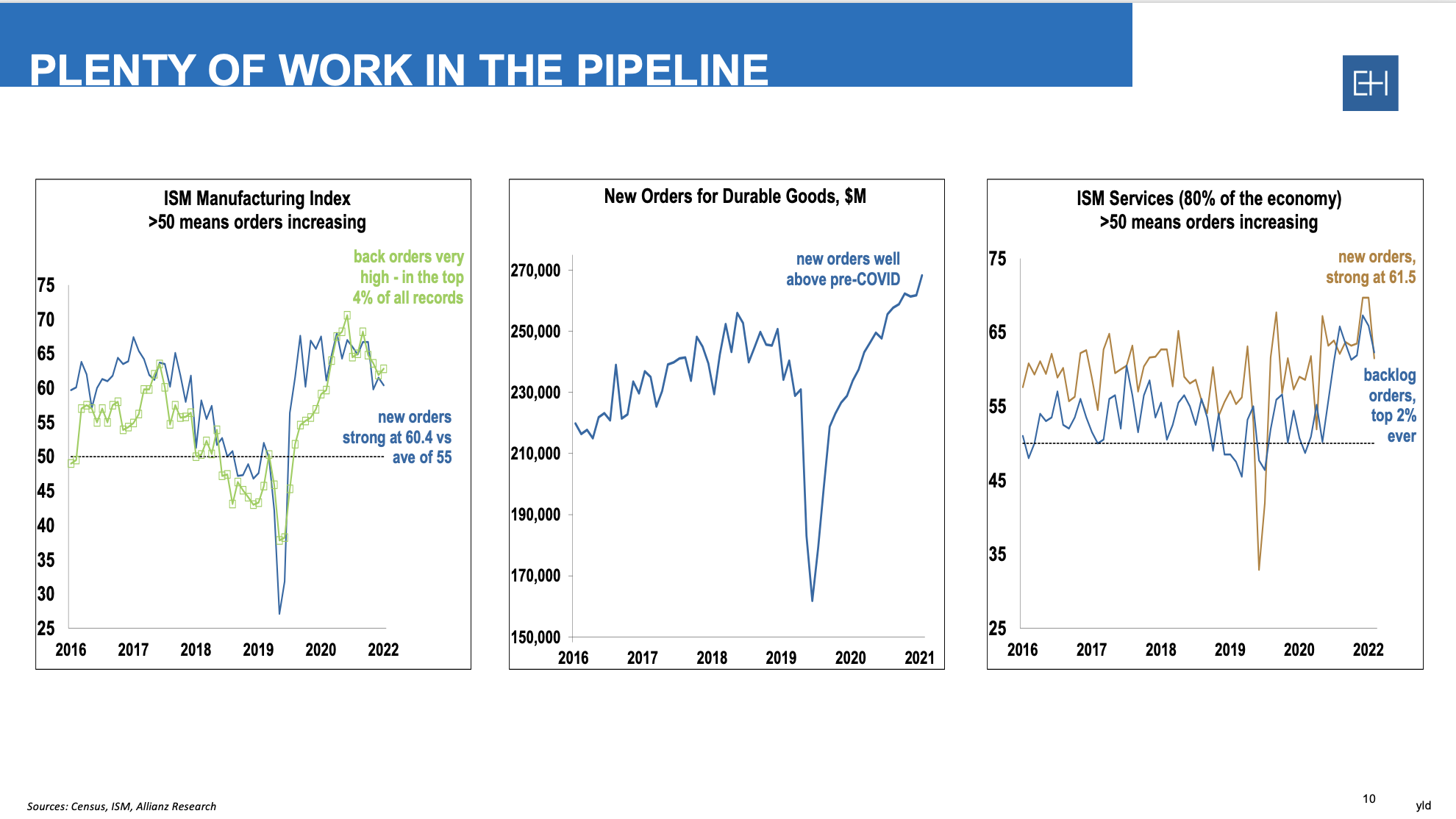

There is plenty of work in the pipeline. Right now, in the manufacturing, you can see new orders there. The blue line is at 60.4 versus 55 on average.

3. Positive Yield Curve

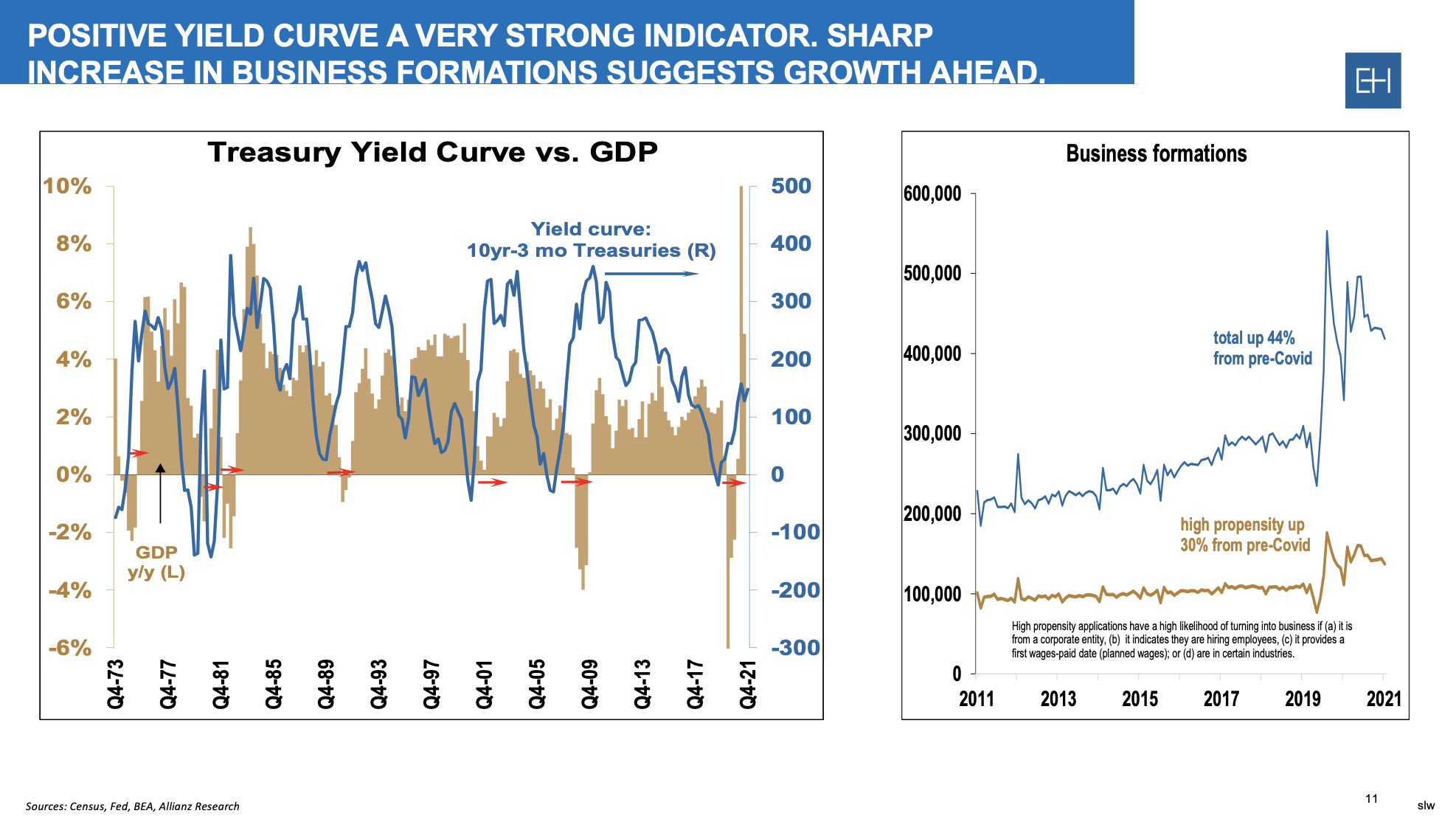

The point of the chart below is every time the blue line goes positive, it’s followed by recovery. You can start all the way over on the left. 1973, ’74, the blue line went positive and was followed by a recovery there, that is GDP went positive. It’s a little bit harder to see the next two because it’s kind of a tiny chart. Let’s go out to the great recession in ’08, ’09 and you can see that after the recession, blue line went positive, the economy recovered. Now look where the blue line is. It’s positive. That suggests with a great deal of confidence, more growth coming.

We can now see that we had very good consumer activity, working the pipeline, yield curve is positive, but there’s been a little bit of slow down. So, that stimulus spending there helps bring the economy back to life, but now COVID is a problem. 2021 was the green year; we just went through trying to recover from 2020. The economy is still growing, it’s going to be a good year, but we’re just seeing a little bit of a slowdown because of this Omicron risk, COVID is still with us.

Risks

1. Cost of Stimulus

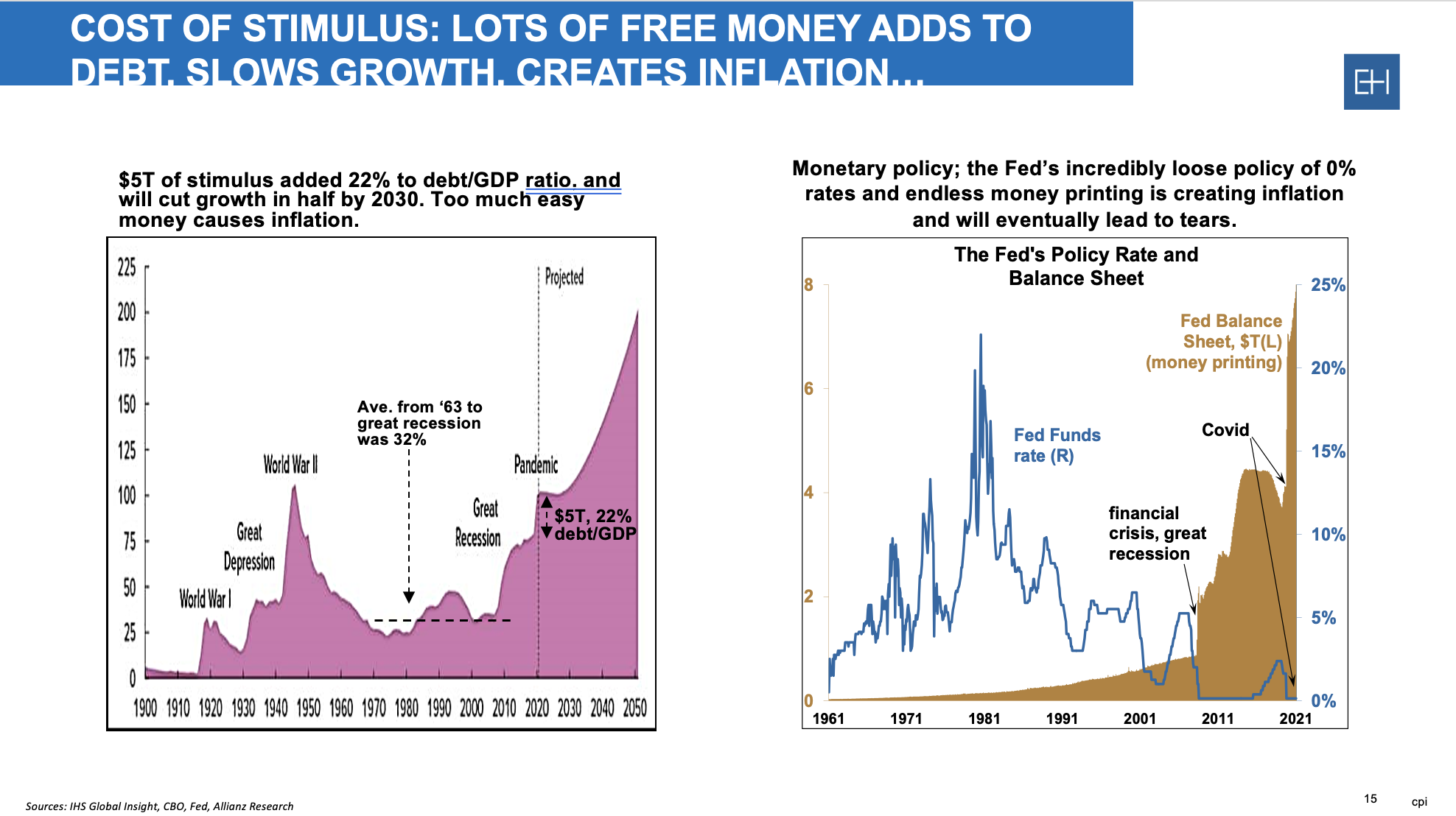

Let’s look at the cost of stimulus across the top there. It’s been basically lots of free money. It adds to debt which slows growth and creates inflation.

The purple chart on the left goes to debt to GDP ratio. Now we have something like $23 trillion of debt, and that’s hard to understand how much that is, but if you compare it to the size of the economy, then you have a measure that’s like the size of your mortgage compared to your income. That’s what that purple chart shows. And basically, what it shows is we added five trillion dollars of stimulus, added 22% to the GDP ratio, taking it from the 70s and in fact to 100%, and it’s going to cut growth in half by 2030. It was an enormous amount of money pumped in the economy surely helping cause inflation, but the chart on the right is even worse.

This is too much easy money for too long at 0% interest rates. It is the classic formula for inflation. It’s creating inflation now and eventually will lead to tiers.

2. Labor Shortage

Back when COVID started in March of 2020, a lot of those non-essential businesses which were supposed to have been shut down temporarily became shut down permanently and so those jobs were gone. And if you were thinking about retiring the next couple of years, your job is gone. Some studies show that two to three million people retired out early. We’re still four million jobs short than before the pandemic. Maybe, that was a lot a part of it. And certainly, fear of COVID in the workplace.

3. Supply Chain Issues

Prices are still raising for manufacturing. Supply Chain is filling very slowly. Capacity is limited due to the global chip shortage. Labor is still tight. There are still battles of labor, material, and transportation pressures. All in all, supply chain challenges are staffing needs and the price increase.

Fiscal monetary policy gave us plenty of money to savings to fuel consumption still in the 2022. There are other harbingers of strength. Work in the pipeline, consumer confidence, positive yield curve, business formations, improvements in the labor market. Euler Hermes thinks the economy is going to grow by 4% almost this year, much higher than the 2.2% rate over the past 20 years, but there are those risks of inflation, supply chain, and wages, and COVID.

GERRY CLANCY: 2022 Key Tax Issues

1. Net Operating Loss

During the years 2018 through 2020, any NOLs generated in those years, you can obtain a five-year carryback. Prior to this legislation and the CARES Act, there was no carryback available for those years. So, if any of you are in circumstances where you may have had a loss, just be aware that you have the ability to carry back five years. The 80% taxable income limitation associated with any NOL carryover is suspended for those years. So, it’s 100% in those cases. Post 2020 NOLs may not be carried back. So, in 2021, we’re kind of back to the old rules, which are sort of the new rules because the rules changed about four or five years ago and are subject to an 80% taxable income limitation

2. Employee Retention Credit

Employee Retention Credit is under the CARES Act and then also under the Appropriations Act. There is a tax credit associated with retaining employees. So, basically if there was a partial shutdown or operations due to a government order, and generally based upon your business type, there are various companies that could still qualify for the credit.

3. Research and Development Tax Credit

Probably one of the biggest is the change to the research and development credit. Prior to this year on Section 174, you were allowed to elect either amortize or deduct research and development expenditures, but beginning in 2022, you will be required to capitalize those. And you have a selection of basically a five-year amortization period. And so just keep in mind that the ability to just deduct those expenses currently is no longer available.

One thing to keep in mind is that the change in the 174 research and development expenditures does not affect the interplay between those expenditures and the R&D credit.

4. Wayfair

States now can pass laws to adopt economic nexus provisions which make sellers outside the state responsible for collecting and remitting sales tax on sales to customers in the state, even if the seller has no physical presence in the state

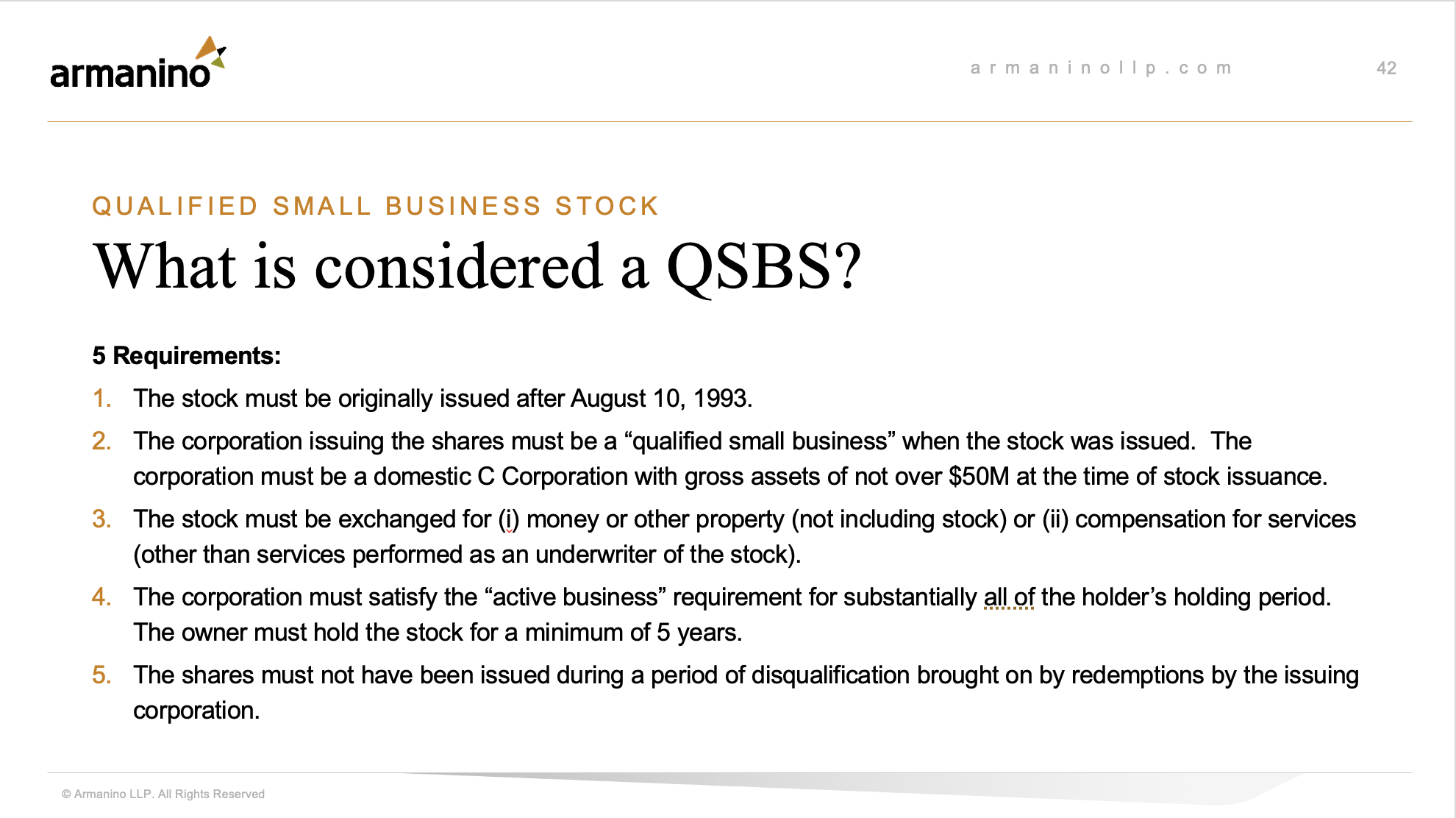

5. Qualified Small Business Stock

The Build Back Better (BBB) Act would only allow a 50% exclusion for taxpayers whose adjusted gross income (AGI) is over $400,000. Taxpayers with AGI below $400k are eligible for the 75% and 100% exclusion. There is uncertainty on whether the effective date would be moved to a future date or retroactive to September 13, 2021.

6. Sale of Business

This is an area where we’re just seeing a tremendous amount of M&A activity. Essentially, you have three SE types of entities out there. You have C corporations, S corporations, and partnerships. With respect to flow-through entities like partnerships and S corporations, which represent more than 90% of business entity types, the structuring of the transaction between whether you are structuring as an asset sale, a stock sale, membership inter sale, or partnership inter sale is important.

People often think that if I own a flow-through entity, it doesn’t matter whether I sell the stock or the assets because it’s a tax-free entity, but there’s so many circumstances that could not be the case.

7. State Elective Tax

22 states have thus far enacted provisions to permit pass-through entities (S Corporation or Partnership) to pay the state tax on behalf of the owners. These deductions become a Schedule K-1 deduction and will not be limited by the $10,000 federal personal itemized state tax deduction cap.

Most states allow taxpayers that want to elect to pay the PTE tax for the 2021 tax year to elect and pay on or before 03/15/2022. The federal tax deduction for state tax payments may only be taken in the tax year to which the payment was made. You may reduce the 2021 or 2022 federal estimated tax payments.

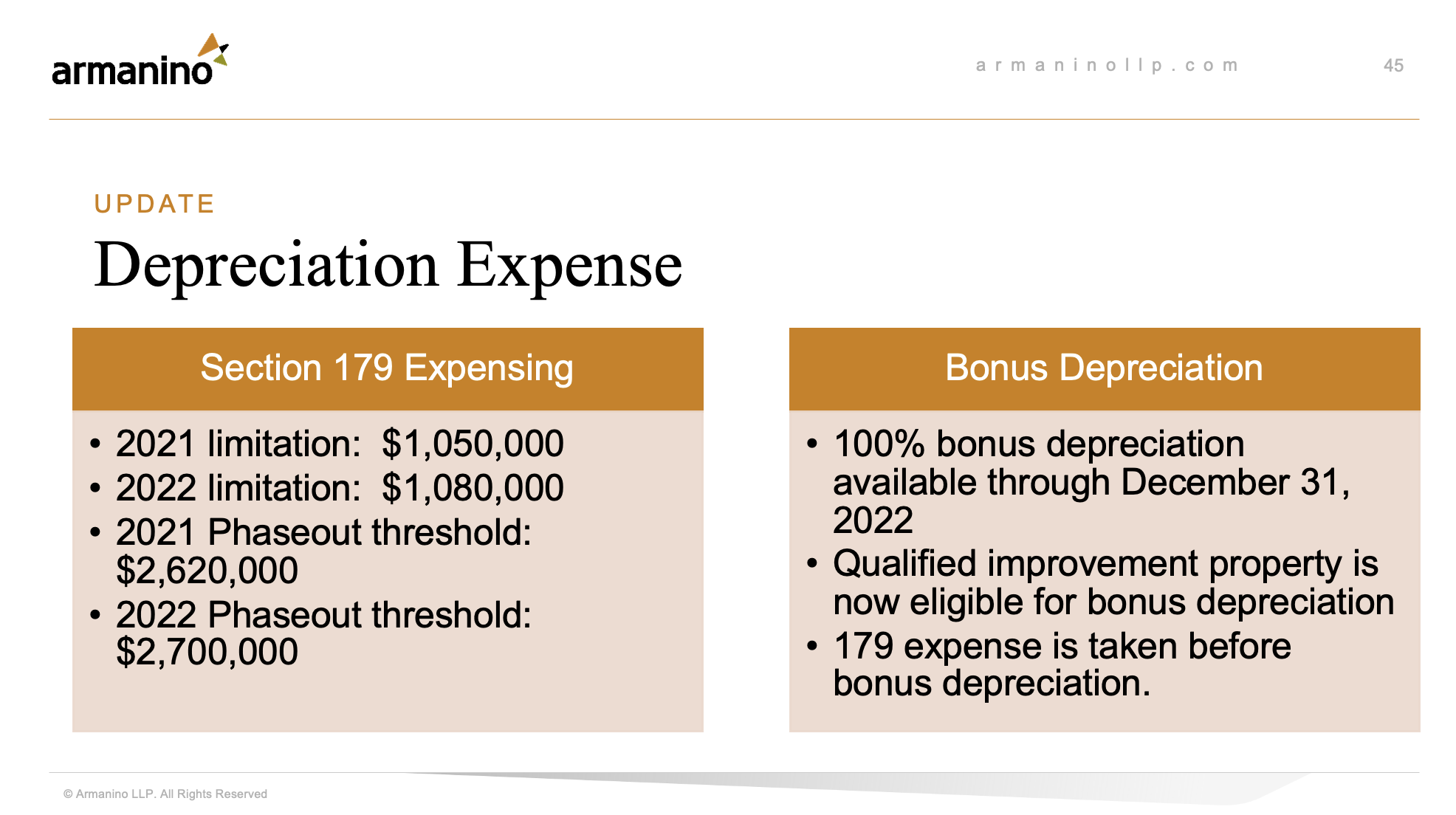

8. Depreciation Expense – 179 and 100% Bonus

They drew the new limitations for section 179, which is a special expensing election and then bonus depreciate which is 100% still in 2022, but it is going to drop down in 2023 to 80%. So if you’re contemplating acquiring fixed assets, you may want to do that a little sooner, 22 rather than 23.

To view the complete 2022 Corporate Finance Outlook, link here.