GDP readings have been down for two consecutive quarters. Inflation is at a 40-year high. And although experts like those at the National Bureau of Economic Research (NBER) have yet to make the official call, many signs are pointing toward a potential recession.

During times of economic uncertainty, businesses that successfully navigate turbulent times are those that are more proactive and strategic. Now, more than ever, the future of an organization’s fiscal health depends on improved spend transparency, actionable analytics, and smart automation that frees up finance teams to focus on work that moves the needle.

So, how can finance leaders take this opportunity to ensure their teams strategically position their organization to win and get the praise they deserve? How can you assure your company’s continued growth despite economic turbulence? By not just managing spend but optimizing it.

Here are four reasons a spend optimization strategy positions your finance team as the strategic lever your organization needs to weather any storm.

1. Spend Automation ≠ Spend Optimization

Long before the current bear market, most companies had a spend management strategy. These strategies helped to

- Mitigate financial risk

- Improve operational efficiency

- Secure cost savings

- Improve supplier relationships

Fast forward, and today’s finance teams are data-driven decision-makers with a significant impact on business outcomes. Finance has transformed into a strategic business partner, leveraging spend insights to improve every facet of a business.

It is no longer enough for businesses to simply manage their spend. They must be able to use data and insights to identify trends within their organization that signal where to pull back investments and where to double down. But what exactly is the difference between spend management, spend automation, and spend optimization?

While spend management and spend automation focus on process efficiencies and keeping spend under control, spend optimization creates a strategic view of an organization’s finances. It uses technology to gain insight and control over all aspects of a company’s financials. In other words, spend optimization picks up where spend management ends.

A spend optimization strategy can help you stay ahead of the curve—and remain agile enough to pivot for unforeseen challenges such as an economic downturn.

2. Spend Management is Reactive and Time-consuming

Consider the bigger picture of spend at your organization. How many of your processes are proactive? What about reactive?

Do you have automated tools and workflows that help your organization plan for costs, budget accordingly, gather expense data effortlessly, and pay all your vendors on time? Or is your team still burdened with spreadsheet and email-based accounting, budgeting, and reporting?

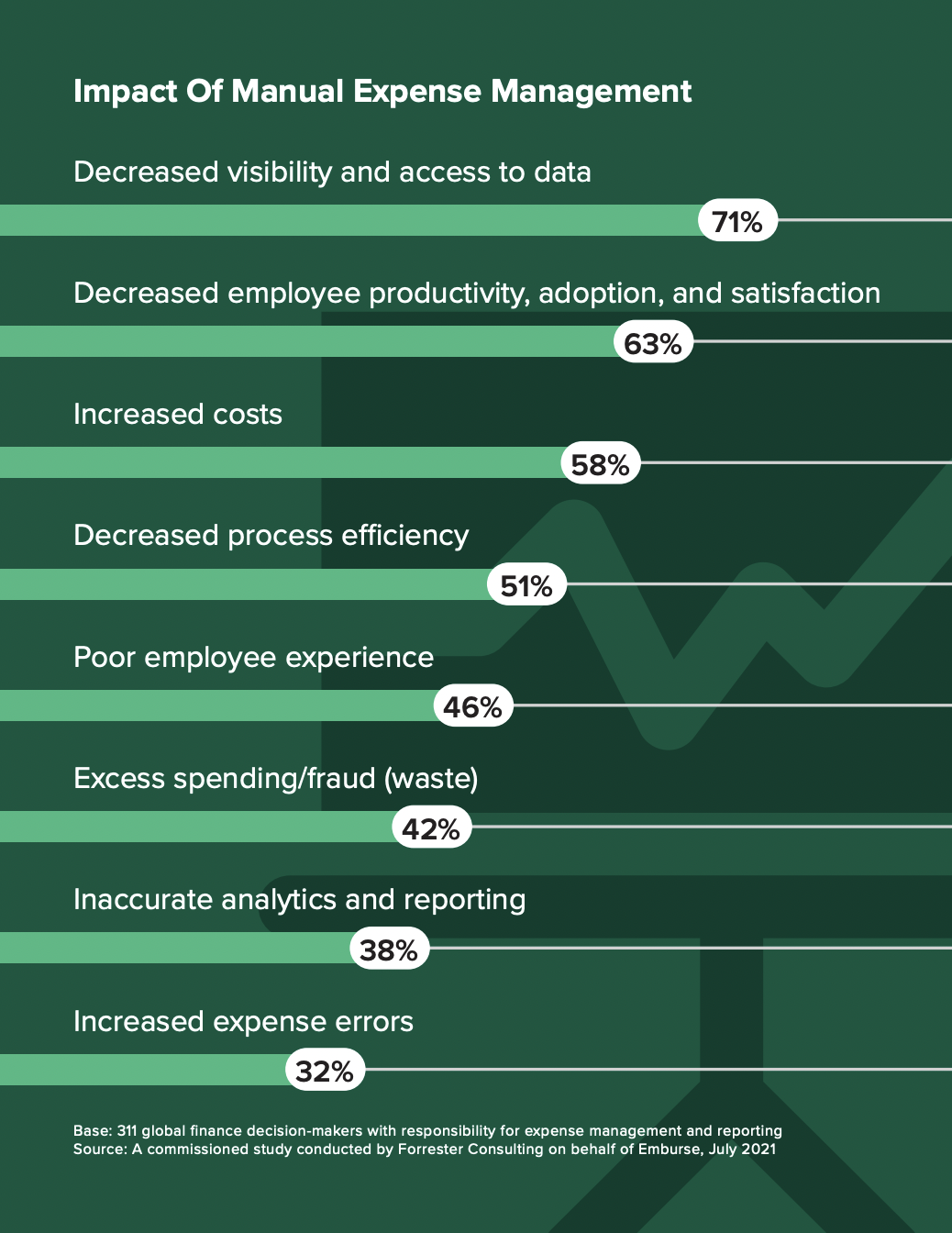

If you’re leaning toward the latter, consider these findings from Forrester, which surveyed more than 300 global finance leaders. The report found that organizations with legacy expense management systems had one thing in common: tedious, time-consuming manual processes.

Forrester reported that finance teams relying on outdated expense management systems faced many operational inefficiencies that significantly impacted their bottom lines. For instance, more than half (51%) of respondents reported being held back by decreased process efficiencies that led to bottlenecks in their organizations.

Case in point: the average AP clerk processes around five invoices per hour by hand. Even worse, large companies can take more than 11 days to process a single invoice.

Today’s organizations simply can’t afford to waste valuable hours or days on tasks that can be easily automated. Digitizing and streamlining AP and finance teams’ work ensures that everyone is on the same page (and that no one is burdened with time-consuming manual tasks).

3. Inadequate Data Can’t Give You Actionable Insights

According to Ardent Partners, 88% of finance professionals and 97% of “best-in-class“ AP teams believe accurate data and business intelligence are critical to business success. And McKinsey reported 43% of CFOs believe streamlining budgeting with data automation is key to long-term organizational success.

Without reliable spend data and business intelligence, organizations are left flying blind. Decision-makers are making million-dollar (even billion-dollar) business decisions with financial reports that don’t show the full picture.

The aforementioned Forrester survey found 71% of finance teams with outdated spend management platforms reported decreased visibility and access to data. In another report, Forrester reports that 56% of financial decision-makers agreed that their CFOs lacked the granular insights necessary to optimize spend.

When lacking a singular, data-driven view of their organizations’ spend, finance leaders and decision-makers only possess partial insights. Forcing them to fill in the blanks, chase down different employees or departments for more complete data, and retroactively address potential risk.

4. Complete Insight Means Complete Spend Control

Spend automation ensures that an organization’s financial data and insights are accurate, reliable, and dependable. Without deep insights, spend data is often delayed, no one is aware of what’s happening when it occurs, and non-compliant spending goes unchecked.

As noted by Forrester, only about half of financial decision-makers report possessing the oversight and control necessary to identify fraudulent or wasteful spend. Perhaps more concerning, more than half (59%) of respondents are only aware of whether their orgainzations’ spend complies with company policy and government regulations after the money has already been spent.

As is the case with outdated, manual spend management, a lack of complete spend control leaves organizations vulnerable to challenges and risks they simply cannot afford in (what may prove to be) a turbulent economy.

Optimizing Spend is Essential to Financial Resilience

In today’s market, you can’t afford to let your organization fly blind when it comes to spend and financial transparency. This means going beyond managing spend—but optimizing it so you can see and understand the full picture.

Download the eBook 5 Reasons Why You Need a Spend Optimization Strategy to learn how going beyond spend management is key to navigating a turbulent economy.