Controllers Council recently held our annual expert panel discussion, the 2025 Economic Outlook.

Our expert speaker, Curtis DuBay, chief economist of the U.S. Chamber of Commerce. Mr. DuBay has researched and published frequently on a wide range of tax and economic issues and is regularly quoted by the press and has appeared often in media, including CNBC, Fox Business, Fox News, and C-SPAN. He testified beforeCongress several times and has been cited in newspapers, including the Wall Street Journal, the New York Times, the Washington Post, USA Today, Politico. His current role is to track the condition of the economy, analyze the impact of public policy on economic growth, and runs the Chamber’s Chief Economist Committee.

The economy has been doing well for a couple of years now, and it’s going to continue to do well for the foreseeable future. In fact, it might even pick up strength in 2025, as you will see with these key takeaways to this discussion. If you are interested in learning more, view the full webinar archive video here.

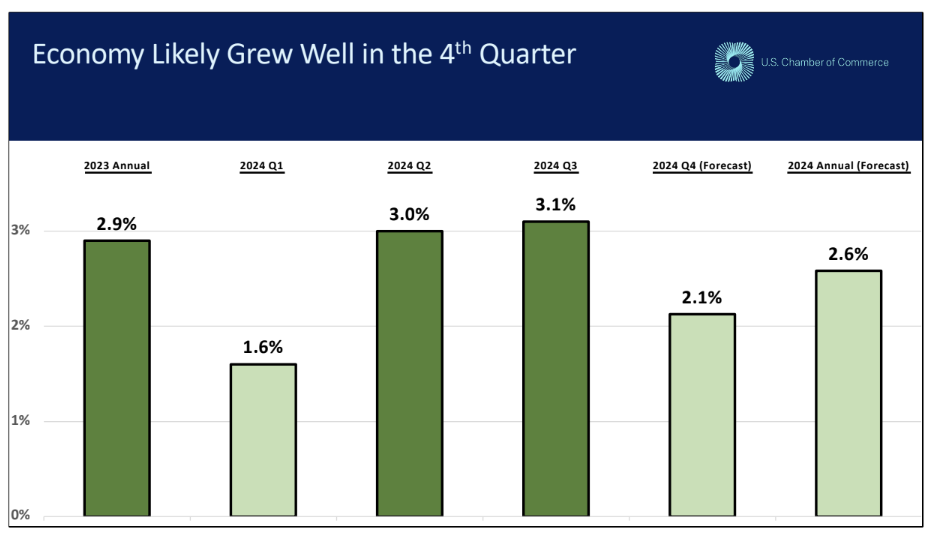

Economy Likely Grew Well in the 4th Quarter

In 2023, we grew right at 3%. The last two quarters in 2024, we were a bit above 3%. For the fourth quarter, we’re tracking closer to 3%. When all is said and done for 2024, expect the economy to have grown between 2.5 and 3% for the year. That is really strong.

Here’s the thing to remember I said that the economy is going to continue to be good. The reason I say that is that the US economy, doesn’t change trajectory very quickly. It’s like a great big aircraft carrier. It takes a lot to turn around. It can speed up and slow down, but it doesn’t change direction. The economy is going to continue to grow until something fundamentally changes its trajectory.

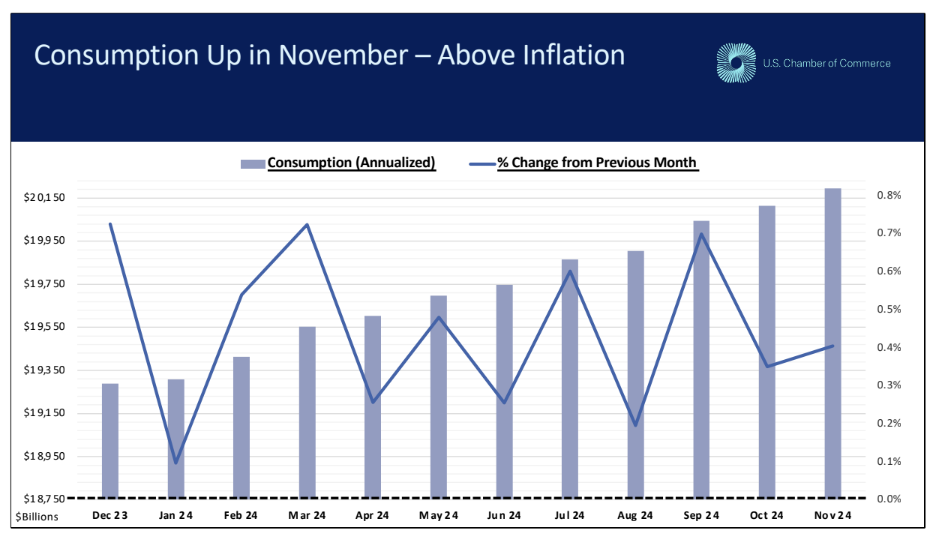

Consumption Up in November

Now I get this question a lot, which is how long can the US remain the global reserve currency? And my answer to that is only for the rest of my lifetime, my children’s lifetimes, their children’s lifetimes, and probably their children’s lifetimes, which means for a very, very, very long time. No other country can compare to us when it comes to things like we have the strongest economy, we have the biggest, deepest, most actively traded financial markets, we have the most established judicial system to adjudicate disputes, and then we have all of us, the country of the most stable political system. No country can hold the candle to us on any of those four things. So, the US is going to remain the global reserve currency for a very, very long time. And as again, is always the case, you’re the envy of the world. Okay, so with all that, no one really buys that. So it kind of leads to the question of the economy has been growing really strongly. How has that been the case? And the answer is consumers.

Consumers have been spending more and more month after month ever since COVID. And you can see here, this is just the last year. Don’t look so much at the line. The line is the month-to-month percent change. Look at the bars, month after month after month after month. And that’s above inflation. I think almost every one of those months, the growth rate for spending was higher than inflation. So, consumers are spending above the rate of inflation. And that’s what’s driving economic growth.

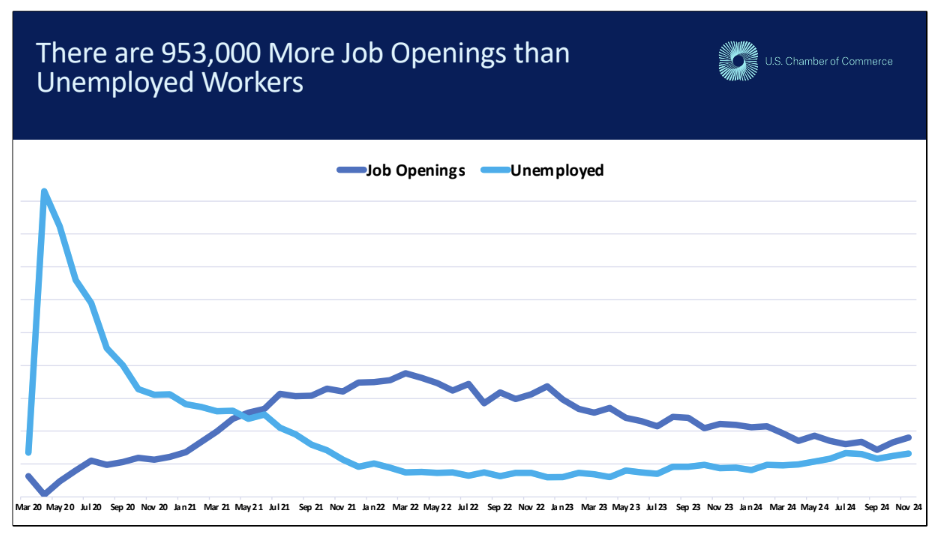

There are 953,000 More Job Openings than Unemployed Workers

Consumer strength has been incredibly strong, and they’ve been consumers in the spending at just an incredible clip. So that leads to the next question: How everyone kind of feels that economy isn’t doing well, people are stressed. How are they able to do that? And the answer is that in United States of America today, if you want a job, you can have one. As you can see there are 953,000 more job openings than there are unemployed workers to fill them. That is an enormous gap. But the thing to keep in mind is that this is a whole new world we’re in. It used to be that the number of unemployed workers vastly outpaced the number of job openings. That’s why we were, and we’re still concerned about things like unemployment, but it’s why we focus on the unemployment rate and the number of unemployed and the jobs created each month. Those things matter a great deal, but they had a huge amount of attention because there weren’t enough jobs in the economy for the number of workers. That has totally flipped around. It is now reversed. There are not enough workers to fill the number of available jobs.

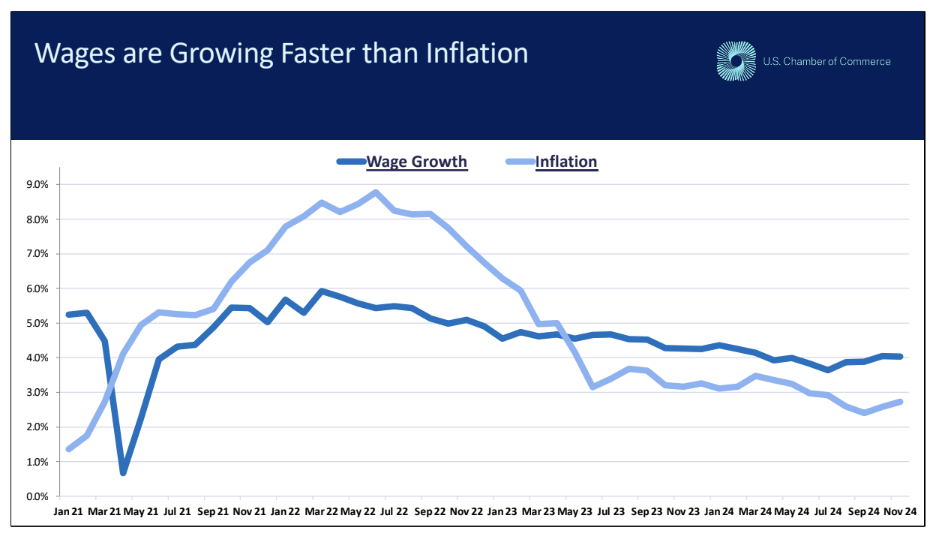

Wages are Growing Faster than Inflation

This is probably the most important economic issue we have for the rest of our lifetimes. If you want a job, you can have one. You get a job; it pays really well. Wages have been growing about 4% on an annual basis for a long time now. You see how steady that dark blue line is? That’s really strong wage growth, 4% on an annual basis for a very long time now, going back almost four years at this point. We’ve had strong wage growth and it’s been really, really steady. So, consumers have been getting those strong wages year after year. And that has really allowed them to keep their spending up. So, for two years almost now, wages have surpassed the rate of inflation. There’s a major caveat here though, and this explains a lot why people might not think the economy is doing so hot. In aggregate, in total, since inflation took off in March of 2021, prices are up over 19%. Wages are up a little over 18%. So, inflation prices have still risen more in aggregate than wages have.

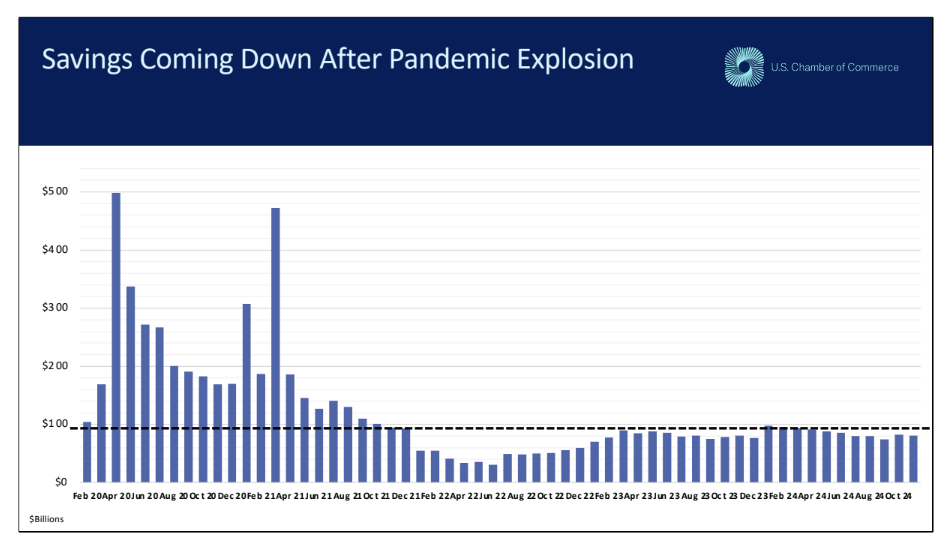

Savings Coming Down After Pandemic Explosion

We had a tremendous amount of savings during COVID. Excess savings, so savings above what we would have saved. The dotted line is what we were saving on average before COVID, and every bar above that is excess savings. It added up to $3 trillion of excess savings during that period when those bars are above the dotted line. Now, I used to say that, and people would say, well, that’s just rich people. I would say, yeah, Warren Buffett, Bill Gates, and Elon Musk, they saved a whole lot of money during COVID, but $3 trillion is such a gargantuan sum. For this audience, I think you probably have a sense of what $3 trillion is, but not everyone gets that. It’s so enormous. Even the three richest men in the world can’t save that much money. It turns out we eventually got out of that.

It was middle and low-income savings accounts that saw a big bump up during COVID as well. Now they spent that down. You can see ever since January or early 2022, the bars have been below the dotted line. So, we’ve been spending down our savings balance. It’s about $1.5 trillion of excess savings remaining, but that probably is in the pockets of those and the savings accounts of those who didn’t need their savings to buttress their spending. So, the savings has probably gone for those who need it.

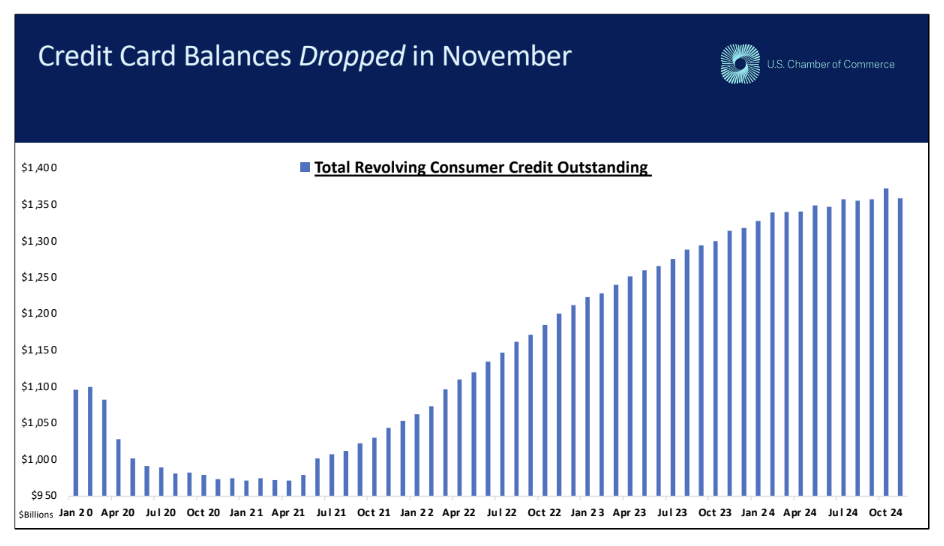

Credit Card Balances Dropped in November

We paid our credit card balances down enormously during COVID. And then we sent them back up. And those who needed their credit cards, those balances that breathing room in their credit cards to spend at higher levels, they’ve spent that capacity down. So that’s probably gone to spending at higher levels. It looks like we’ve got a major problem. It’s not that big of an issue. As a percentage of income, we’re still well below the average over last 20 years. The average as a percent of income is 7.3%. We’re at 6.2 % of income. So, we have more to go to let credit rise, credit card debt owed. But those who really needed it probably have exhausted their balances.

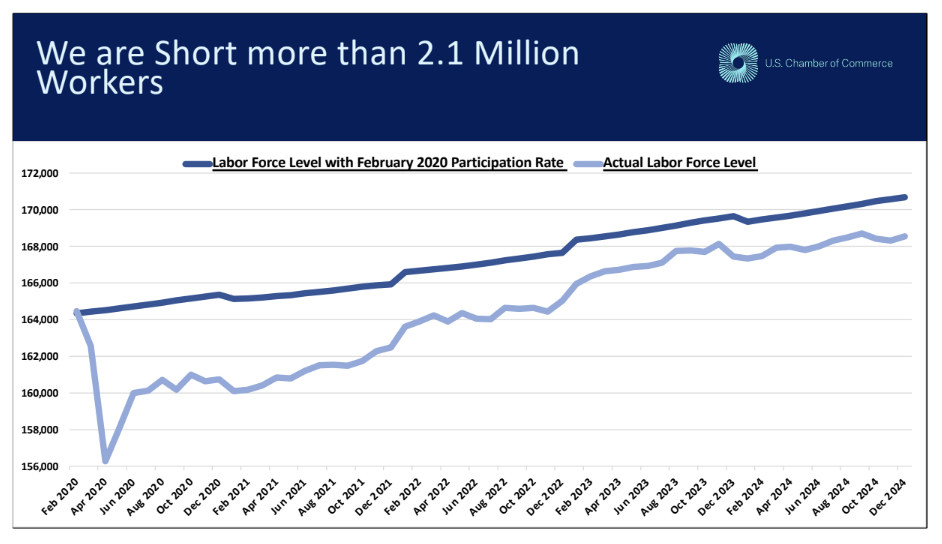

We are Short more than 2.1 million Workers

Here’s the thing, the situation we’re in where we have too few workers is going to persist. It’s a kind of a virtuous cycle where businesses need workers. They keep hiring and keep paying higher strong wages will continue because we’re going to remain and then consumers continue to spend because they have jobs that pay well. It’s going to continue because we’re going to be shorter workers for the rest of our lifetimes. This is not going to change. Right now, we have an aging workforce. Our participation rate has fallen. Just if you compare the participation rate to pre-COVID to where it is today, based on population growth, we’d have 2.1 million more workers in the economy if we only had the same participation rate. That means that those million job openings would have workers to fill them. And then we’d have a million more workers that couldn’t find work. So, we’d be where we were pre-COVID, but we’re not. We’re short of these workers, and the reason is the aging of the population.

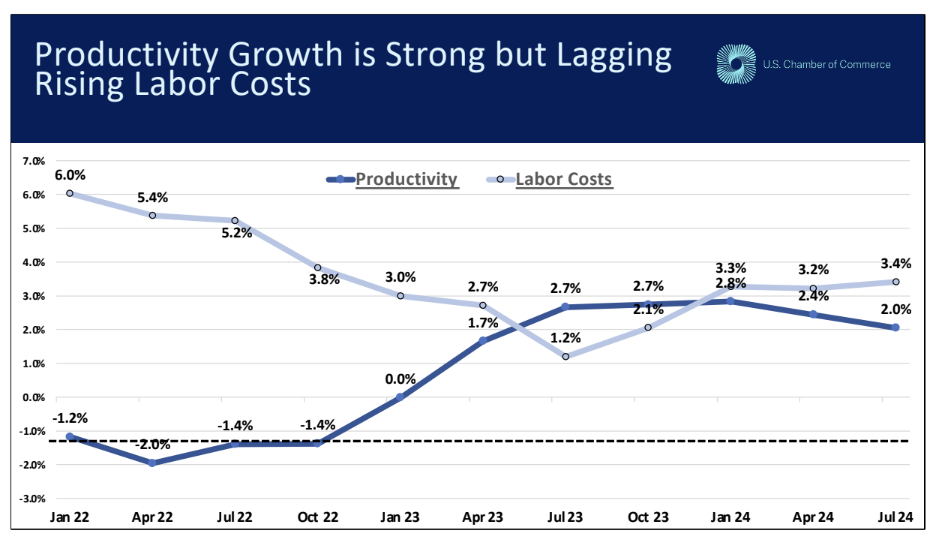

Productivity Growth is Strong but Lagging Rising Labor Costs

Now, there’s a big kind of missing element to this, which is that businesses would kind of push back and say, well, how much longer can I keep paying higher and higher wages? is, it’s end of the day. You know, it just puts too much stress on my bottom line and maybe it makes me, puts me in a loss position. And the answer is that this has been able to continue and hopefully will continue because of productivity. Productivity is probably one of the most important single data point you could have for an economy. A strong rising productivity rate is a sign of a dynamic economy, one that is growing strongly and one that has a bright future. And productivity in the US has been growing incredibly strong for the last couple of years.

Productivity in the United States of America is growing at a rate 10 times than other industrialized developed countries. That is just stunning and remarkable. And you can really see it here in the chart. The dark blue line, productivity taking off. Really once COVID came to an end, productivity takes off and has remained really, really strong.

Businesses can continue to hire and pay if productivity exceeds or is at least close to in labor costs and that’s where we are. They’re very close, and this has allowed us to continue with the hiring and the paying higher wages. I anticipate that this will soon exceed labor costs growth because it’s going to have to otherwise businesses won’t keep hiring.

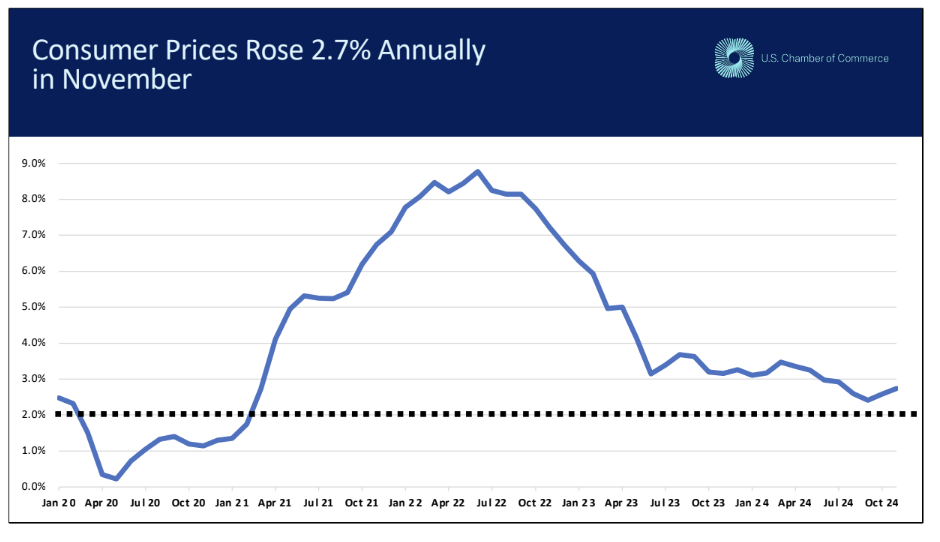

Consumer Prices Rose 2.7% Annually in November

Consumer confidence remains low. Consumers tell us the economy isn’t very strong. I think the answer is straightforward – It’s inflation. It’s really the elephant in the room. Inflation remains a problem. It is still well above the Fed’s 2 % target. It’s at 2.7% as of last data. Even when you look at, so this is broad range of consumer prices. If you look at the number that the Fed looks at specifically, it’s called core PCE. That’s at the same range. So no matter how you look at it, the inflation remains too high. It’s going to remain there for the rest of the year. The Fed itself says that inflation won’t be down to 2% until 2026. We have a year still before inflation gets down to its target. Now, the big problem is that, when inflation took off, when it really peaked in the middle of 2022 at about 9%, all prices were rising. The main things would have been airfares, car rentals, hotels, things like that. They got super expensive.

The problem right now is that inflation is really hitting hard on things like food, housing, and energy. You can’t opt out of those things. You must pay them. I think that has a lot to do with why people feel the economy isn’t doing as well as the data shows. Another thing to remember is that the accumulation of inflation matters.

Inflation ends with prices rising at a slower rate, rising only at 2%. We don’t want deflation. We don’t want prices falling. Deflation is probably more destructive and disruptive than inflation. When prices fall, means that no businesses, workers take lower wages, suppliers don’t take lower prices with inputs. They’d really be in a bad situation if prices fall.

To view the complete webcast, download full webinar here.