Controllers Council recently held a webcast panel discussion on the 2025 CFO/Controller Outlook & Sentiment Study Results.

Our host was Lindy Antonelli, partner in our technology practice at Armanino, a top 20 accounting and tech consulting firm, also board chair of the Controllers Council. Our panelist was Neil Brown, Controllers Council Executive Director.

During this discussion, Neil discussed several key predictions for changes in financial metrics, spending, talent and more in 2025. If you are interested in learning more, view the full webinar archive video here.

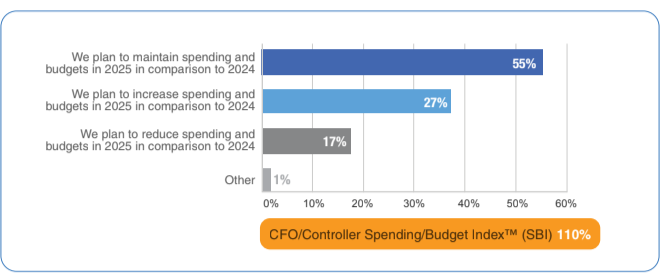

Key Takeaway 1: CFOs and Controllers are bullish about spending with the 2025 CFO/Controller Spending/Budget Index (SBI) rising to 110%

Neil: This is just bullish sentiment all over the place. My thoughts are that, well, the pandemic is certainly well behind us. Interest rates lowered throughout 2024, so that’s no longer an issue. Inflation is in check from where it was a couple of years ago, but we’ll see if that is still problematic this year. So just globally, there’s extraordinary optimism here.

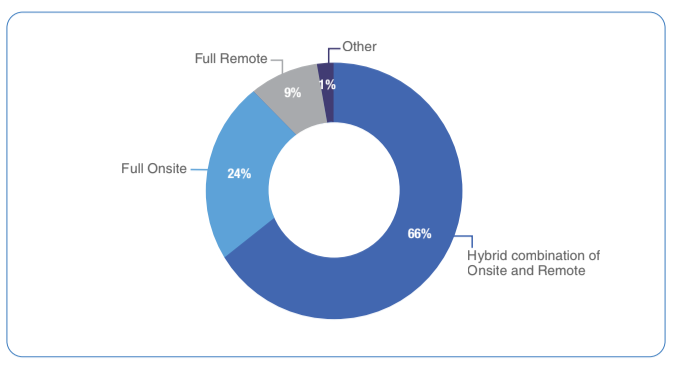

Key Takeaway 2: Hybrid work continues to gain traction with 68% adopting this model, an 8% YoY increase, while Fully Remote work fell to 9%

Neil: It’s changing modestly over time. In 2024, we had a 60% hybrid and a higher 29% on-site and a slightly higher 11% remote. So, it is changing. We are starting to hear about all these return to office (RTO) initiatives. So that’s interesting that full on-site is not growing more rapidly. I think on-site by industry, by function and by company size, for example, retail manufacturing, construction workers, laborers, they must be on-site. Whereas professional service staff can often work remotely, accounting has experienced a shortage, so that likely impacts allowing more remote versus on-site. But no question, employers prefer onsite, and employees prefer hybrid or remote. All I can do is predict that there’s going to be an employer-employee tug of war over this topic.

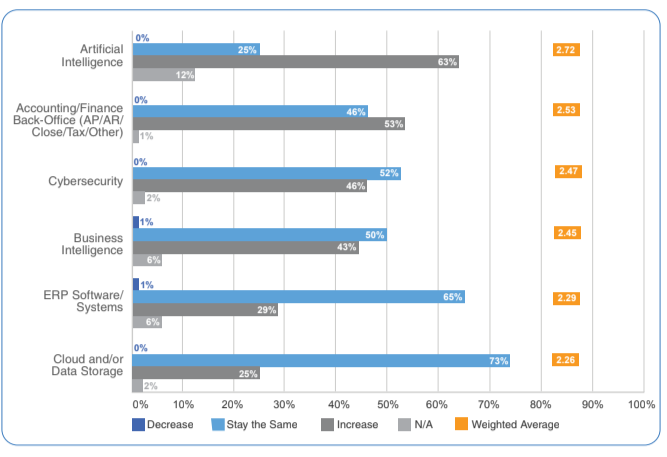

Key Takeaway 3: AI adoption plans for finance and accounting (F&A) surge to 63% in 2025, leading all technology increases including F&A back-office (53%), Cybersecurity (46%), and Business Intelligence (43%)

Neil: No question that AI is in the mainstream now. CFOs, controllers, finance and accounting departments are embracing AI, moving from the initial personal use and experimentation to being early adopters for automation. In addition, new finance and accounting software often in or offers embedded AI workflows. So, I’m seeing more and more of that. So that’s very, very interesting.

Lindy: At our firm, Armanino, we started using Microsoft Copilot and I’ve been in the first round, so I’m already an expert at AI and use it in my daily tasks in every piece of software I use. So, every Microsoft software from Outlook to OneNote to our CRM to Word, Excel, PowerPoint, all the tool and Teams as well. So, it’s saving me a lot of time every day on tasks.

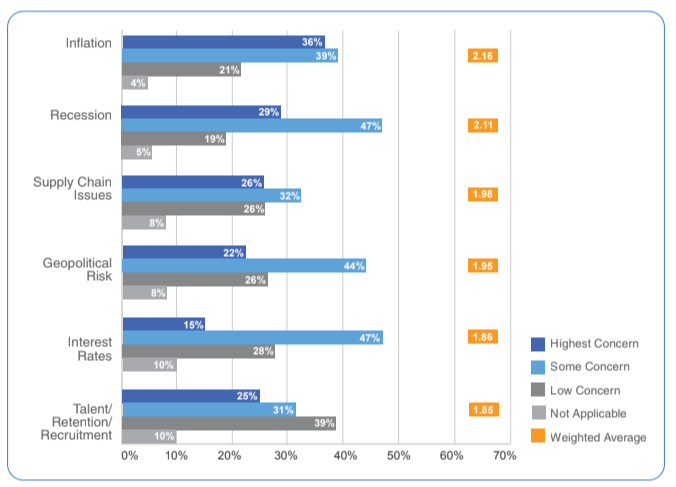

Key Takeaway 4: Answers to the 2025 “what keeps you up at night” question showed significantly less overall concerns than 2024 with inflation, recession, supply chain issues and geopolitical risk ranking highest

Neil: The greatest concern in our survey was inflation, followed by a recession, supply chain geopolitical was 1.95, interest rates 1.06, and talent was the lowest at 1.85. In 2024, interest rates were the highest concern and that makes sense, because that would have been at the end of 2023 when we took the survey. But the other concerns were similar.

But inflation, surprisingly, ranked number one when we didn’t have that extraordinarily high inflation from the last two years. I was on a 2025 Economic Webcast with Curtis Dubay, Chief Economist at the U.S. Chamber of Commerce, where he said that everyone still feels it in their daily lives, such as when you go grocery shopping and groceries are twice as much as they were a couple of years ago. Everyone’s adjusting around that. And then from the business standpoint, I know I did some construction and noticed the building materials changed rapidly from one year to the next, like doubling for lumber. From the business standpoint, that could be your cost of goods sold (COGS). You might be able to manage revenue, but COGS are going higher, so your gross margins are lower, etc. Now supply chain, might think that is in one of the top three because there’s these threats of tariffs that potentially are going to cut imports off from trading partners like China. I know the supply chain isn’t relevant to every business, certainly not professional services, more manufacturing and retail, but that could be the reason. And geopolitically, I’m surprised that might not even be highest, because the world is in two wars right now.

To view the complete webcast panel discussion, click here.

To download/read/print the 2025 CFO/Controller Outlook & Sentiment Study Results Report, click here.