Controllers Council recently held a webcast panel discussion on the 2024 Corporate Finance & Account Talent Study Results.

Our expert panelists include Brandt Kucharski and Joy Mbanugo. Brandt is CAO at Ethos Life, and former CAO at Grubhub. Joy is CFO at ServiceRocket, and former Controller at Google. Our moderator was Lindy Antonelli, Partner, Armanino Technology Practice and Controllers Council Board Chair.

During this discussion, Brandt and Joy discussed several key predictions for corporate finance & accounting talent in 2024. If you are interested in learning more, view the full webinar archive video here. Following are some of the study and panel highlights.

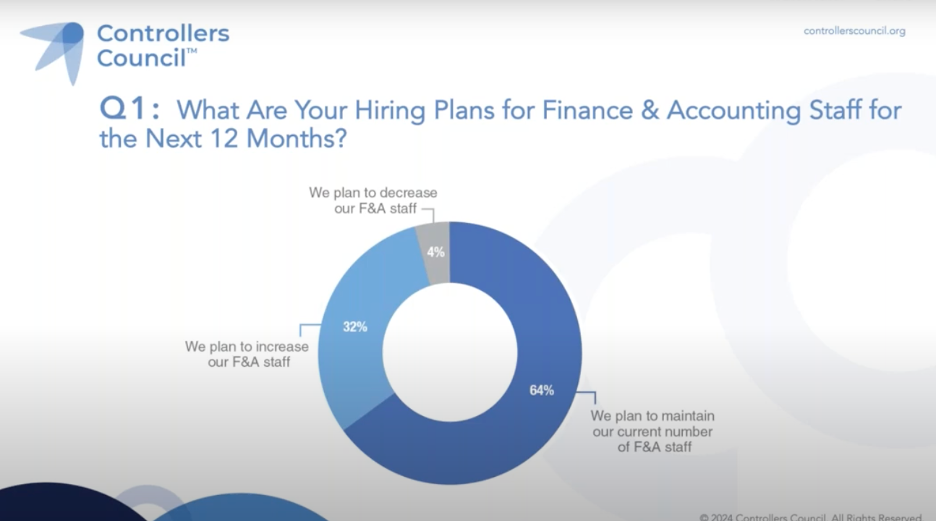

What are your hiring plans for finance & accounting staff for the next 12 months?

Lindy: In 2024, 32% of survey respondents plan to increase F&A hiring, with only 4% decreasing. This is slightly less than with 2023 when 37% planned hiring increases, and only 2% decreasing.

Joy: I can probably speak better to the next six months, because we plan out for the year, but we currently have an open rec. I think it’s outside of the US, but for someone more of an AP/Procurement type person. We have a large big F&A team, probably too big for our company size. So, we’re kind of looking to right-size that department. Right now, AP is like 10% of everybody’s job and not 100 % of anyone’s job. So, we’ll definitely be hiring for that role, and maybe a bit more in the future, but right now that’s like a pressing role that we have open.

Brandt: I think for us, you know, we’re a venture -backed company. We raised $5 million from Sequoia, Excel, Google Ventures, SoftBank. And I think what you saw is 2023 and 2022, companies were either cutting some staff as a company overall or being very cautious on hiring. I think we’re seeing that flip now; there’s a lot of optimism that the worst is behind us in terms of that realm. Interest rates may be cut. And I think for us, there’s been a real focus on “bullet proofing” our company on the finance and accounting side. We’re aggressively growing revenue as a company, we’re even now positive. And is there a next step of the company, which may or may not take place in 2025? We’re thinking about what does that look like right now as company? Is there a potential to hit the market? And what does that look like? I think right now, we’re looking at our staff, we’re trying to bulletproof ourselves and get ready. And hiring is kind of coming back. We’re adding key staff for certain positions that may have been a little bit like a year or two ago.

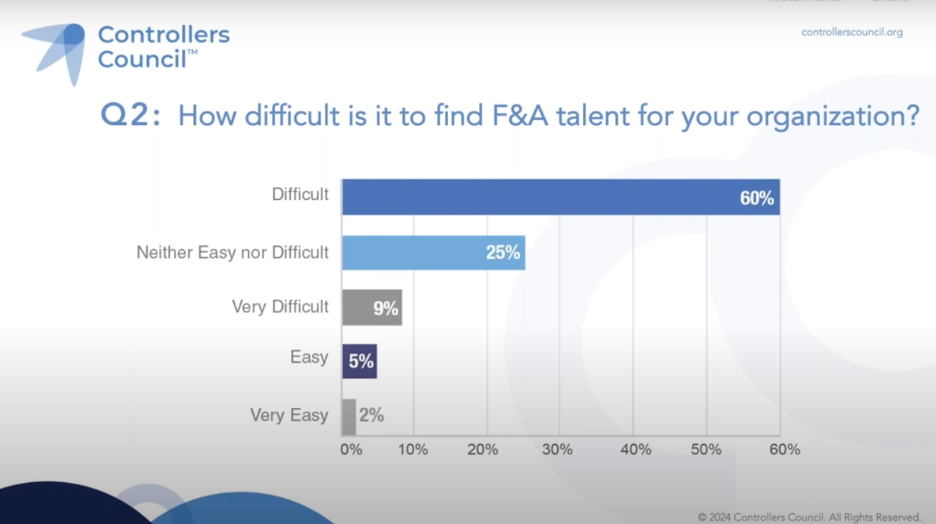

How difficult is it to find F&A talent for your organization?

Brandt: I’ve been in company for three years. In 2021, we were a very hot company. We raised a bunch of funding and didn’t have as much challenges finding talent. Then in 2022 and 2023, you found a lot of folks flocking to larger companies like Google, Facebook, Uber, etc. I think getting new talent was a little bit more challenging back then because people were flocking to safety versus a venture-backed company. Now I think it’s back the other way and I think people are starting to realize, hey, things are looking better for venture-backed companies, funding is coming back, investors are opening up the pocketbook. If a company is well positioned with aggressive growing revenue and cash flow positive, it’s a nice time to look at those companies. I think what you’re seeing is that Facebook, Amazon, and big companies aren’t immune to layoffs and they’re having some of the big layoffs around.

Joy: Competing against the bigger companies for hiring is really challenging just when you’re a smaller company and you have a different comp structure. I used to work at Google in finance. I’m aware of what their comp structure is and so trying to explain to someone, VC-backed companies have very different comp structure than you…getting your regular flow of restricted stock units that are highly valued. And then I think Google just paid like historic dividends. That can be challenging. I will say for the most part though, there are a lot of people who are interested in smaller to mid-sized companies because there’s room to grow. You get to know people quickly. You can work directly like with the CEO. So, there’s some different benefits that you can offer that you may not get out of Google.

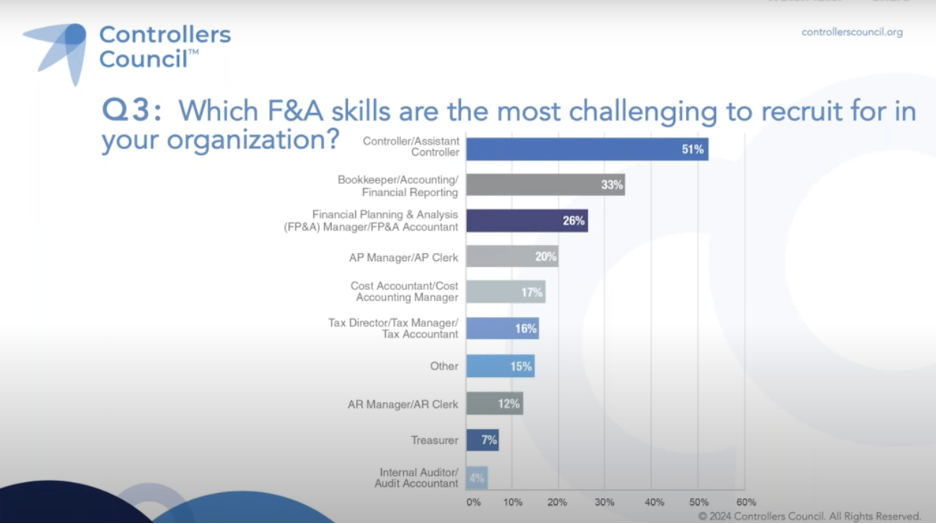

Which F&A skills are the most challenging to recruit for in your organization?

Lindy: Controller was identified as the most challenging to recruit at 51%, followed by Accountant/Bookkeeper/Financial Reporting at 26%, and FP&A at 26%.

Joy: The one role I will say that I think is challenging to fill is a controller role, and I only know this because my husband is a controller, and finding a really good controller can be challenging.

Brandt: The role that’s challenging to hire for is that senior account level. A lot of folks want the same type of person where they want them to work at a big firm with two to four years experience and you must go find that person at an accounting firm, get them to leave that firm or you put something out there or you work with recruiter and try and find someone who fits that. There’s a lot of opportunity because public audits or public accounting and the audit side, 90 % of the work is done by the senior accountant. It’s just competition for demand, and there’s a lot of good companies and they’re making good money. So, how do you get them to leave and go corporate?

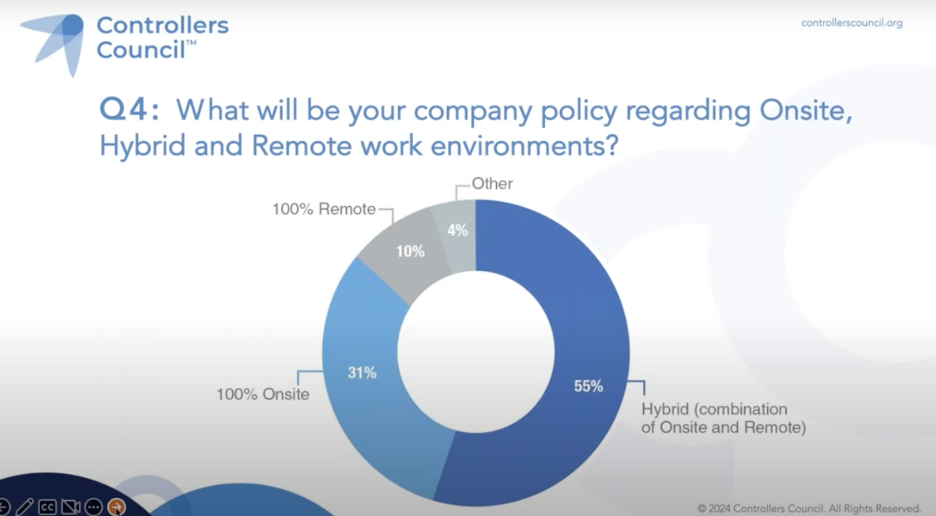

What will be your company policy regarding Onsite, Hybrid and Remote work environments?

Lindy: Remember, on the job training in the office as a new accounting person, you’d be sitting there with a team of the manager, senior manager, and the partner, and what better way to learn was from sitting there listening to what the questions they were asking the clients and the work they were doing.

Brandt: I echo what you’re saying where in public accounting, I learned more in the first four years of my career because I sat in the audit room with the audit partner, looking at review notes and comments and all that. We’re 100 % remote, but we do a lot of one or two day trips and off sites. So, I’m still a big believer in quality over quantity. And I love getting together. I think we get a lot from hanging out all day together. Some folks will spend an hour each day, but definitely things are turning towards hybrid at a minimum.

Joy: I’m definitely seeing an upward trend in hybrid. I would say 100% remote is rarity. I hate to repeat it, but I was just thinking back to my time at EY, every single office I worked in, I learned so much. And even now, when I’m in the office. Like as a CFO, you don’t even think about, you just have to continue learning and developing – you learn a lot from your CEO. Right now, I learn a lot from our head of sales, therefore being in the office, no matter what level you are, there’s some learnings from that. Quality over quantity doesn’t necessarily need to be in the office every day, but that connection point with my CEO is important and understanding how he’s thinking about running the business is also helpful for me.

To view the complete webcast panel discussion and see questions 5-11, click here.

To download the full study report, click here.