Controllers Council recently held a webinar on the 2022 State of Automation in the Finance Office: Survey Results Webcast and Panel Discussion, sponsored by Auditoria.

Auditoria integrates with industry leading ERP and financial applications, including bill.com, Conga, Coupa, Oracle ERP Cloud Oracle NetSuite, Sage Intacct, Workday and collaboration tools such as Microsoft 365 and Google Workspace.

Webcast panelists include Elaine Nowack, director of product marketing at Auditoria,/ and Nick Esso, VP of marketing net, or Auditoria.AI.

Following are key highlights to this discussion. If you are interested in learning more, view the full webinar archive video here.

Survey Results

Over the last three years, we’ve conducted a survey of finance professionals across the globe. In 2020, we surveyed 200 people. In 2021, we surveyed around 450 people. And this year, we topped out at about 650 respondents

Key Findings of the 2022 Survey

- Most respondents don’t feel that their finance back office is sufficiently automated.

- Accounts payable and receivable were ranked as having the most manual work for the third year running.

- Tine spent on manual and repetitive tasks is the biggest challenge in the finance office, followed closely by time spent checking and updating date.

- One fifth of the respondents say they will implement advanced levels of analytics and reporting in the next year.

Corporate finance is beginning to step up and embrace automation or getting left behind or even worse becoming overwhelmed and overworked because of the burnout turnover and the greater risk in the organization.

Finance and Automation

Question 1: Which of the following best describes the level of automation in your finance back office?

Answer 1: 11% of those with us today said, no automation, 32% said basic levels. 43% said some automation and 11% said fairly-advanced, very small percentage said advance or an autonomous automation.

Nick’s takeaway is that a good percentage of the respondents are not being well served by automation.

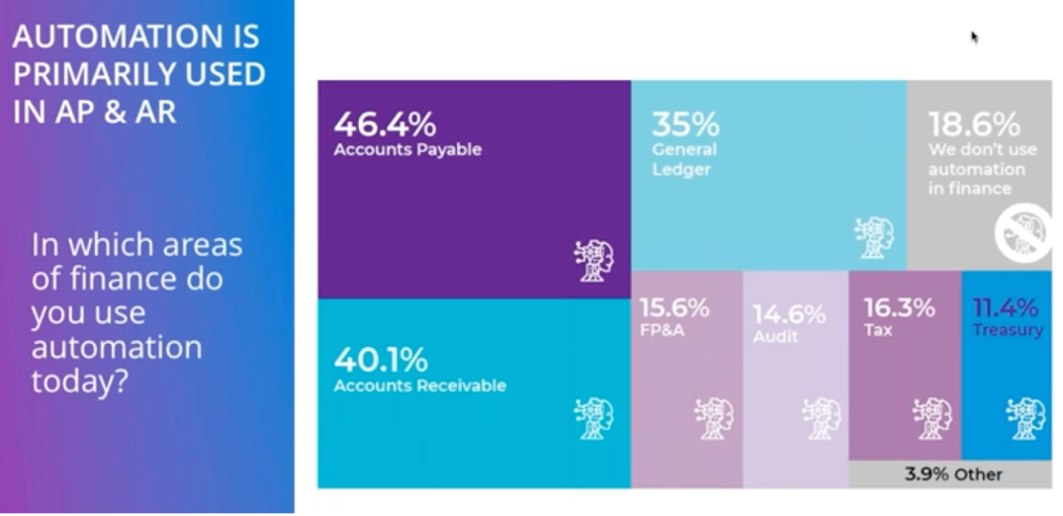

Question 2: In which areas of finance do you use automation?

Answer 2:

It’s interesting to note that even though the respondents said that the AP and AR were reported as being the most manual functional areas, there were also the areas that respondents said had the most automation.

Question 3: Which finance functions do you have automation in place?

Answer 3: it’s interesting to note that the area that had the most automation in the finance function was creating reports or performing analysis about 17.6% said that that’s where they had their finance automation. And that was followed closely by processing invoices and payments.

Nick’s thought is that controllers, CFOs, CAOs, they care a lot about reporting analysis to use the nautical analogy. If you’re on a ship, you really want to know what your heading is. What’s your course and speed? Are you headed in the right direction? And so, I think a lot of the work that’s happened up till now in terms of automation has been to provide the CFO with information for her to do her job better.

Question 4: On a daily basis, what are your pain points?

Answer 4:

It’s surprising to me that in 2022, with all the technology we have available today, people are still entering data manually, which is super-efficient, super slow. And then we’ve talked to firms like Gartner, Forrester, Constellation, and they’re basically saying, in the next few years, data extraction will be a completely automated exercise that, having a person sitting down and back in the day, accounting folks used to love, hey, used to brag about it, my 10 key skills, I can answer so much data per minute or whatever. And 10 key skills are great, I’m not dissing that at all. But even Gartner, Forrester and Constellation are saying that by 2025 or 2020, 2030, that the need for sitting down with an invoice and either copying and pasting or re-keying data from a PDF or a paper invoice will be definitely a thing of the past. That is low hanging fruit and it’s not going to be a thing anymore.

To discover how automation can help your pain points, view the full discussion here.

ABOUT THE SPONSOR:

Auditoria is an AI-driven SaaS automation company for corporate finance that automates back-office business processes involving tasks, analytics, and responses in Vendor Management, Accounts Receivables, Planning and Audit. By leveraging natural language processing, artificial intelligence, and machine learning, Auditoria’s platform removes friction and repetition from mundane tasks while also automating complex functions, such as predictive analytical forecasting. Corporate finance and accounting teams use Auditoria to accelerate business value while minimizing heavy IT involvement, improving business resilience, lowering attrition, and accelerating business insights. Give your finance teams superpowers at Auditoria.ai.